There's No Escaping Develop Global Limited's (ASX:DVP) Muted Revenues Despite A 33% Share Price Rise

Develop Global Limited (ASX:DVP) shareholders have had their patience rewarded with a 33% share price jump in the last month. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 14% in the last twelve months.

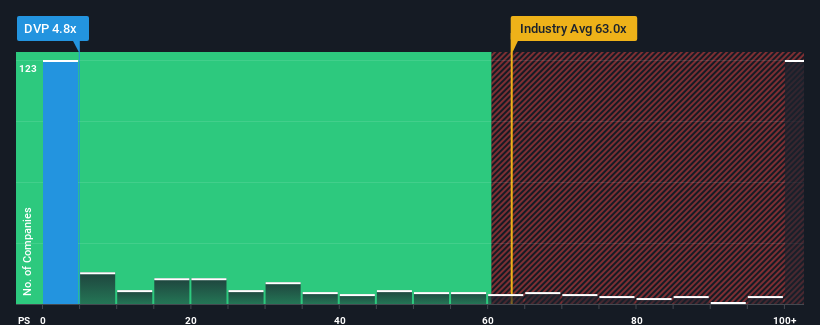

Even after such a large jump in price, Develop Global may still be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 4.8x, since almost half of all companies in the Metals and Mining industry in Australia have P/S ratios greater than 60.8x and even P/S higher than 290x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

Check out our latest analysis for Develop Global

What Does Develop Global's Recent Performance Look Like?

With revenue growth that's inferior to most other companies of late, Develop Global has been relatively sluggish. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Develop Global.Do Revenue Forecasts Match The Low P/S Ratio?

Develop Global's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Taking a look back first, we see that the company grew revenue by an impressive 117% last year. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 80% each year during the coming three years according to the two analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 559% per year, which is noticeably more attractive.

With this information, we can see why Develop Global is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What We Can Learn From Develop Global's P/S?

Shares in Develop Global have risen appreciably however, its P/S is still subdued. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Develop Global's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

It is also worth noting that we have found 1 warning sign for Develop Global that you need to take into consideration.

If these risks are making you reconsider your opinion on Develop Global, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal