Lilly Loses Around $14B This Week: How to Play LLY Stock

The stock of Eli Lilly and Company LLY has declined 1.7% already this week, losing almost $14 billion of its market value. Earlier this month, the FDA removed Lilly’s popular GLP-1 drug tirzepatide from its shortage list after confirming with Lilly that it can meet the present and future demand with its manufacturing expansion. Lilly markets tirzepatide as Mounjaro for type II diabetes and Zepbound for obesity. Due to increased demand, tirzepatide was added to the FDA’s shortage list in 2022.

In the United States, when a drug is placed under the FDA’s shortage list, compounding pharmacies are allowed to produce copies of the approved drug to meet existing demand. Compounded drugs are, however, not approved by the FDA. Lilly has filed lawsuits against several compounding pharmacies, expressing concerns over the safety and use of the compounded versions.

However, last week, the FDA announced that it would review its decision to remove tirzepatide from the shortage list. This decision was announced in a court filing by the FDA in response to a lawsuit filed by the Outsourcing Facilities Association, a trade association representing compounding pharmacists and facilities. The lawsuit claimed that the FDA’s decision to remove Lilly’s tirzepatide from its shortage list was “reckless and arbitrary” as tirzepatide was still in short supply. During this review period, the FDA has agreed to allow compounding pharmacies to continue making tirzepatide.

Lilly’s shares have declined in response to this latest FDA decision. However, we feel this is only a temporary setback for a mighty drugmaker like Lilly. The drug giant has seen unparalleled success with its GLP-1 drugs, Mounjaro and Zepbound. In the past couple of years, it has received approvals for several new drugs like Kisunla, Omvoh and Jaypirca and witnessed pipeline and regulatory success. Its new drugs have been contributing significantly to its top-line growth in 2024. Lilly is also making rapid pipeline progress in areas like obesity, diabetes and Alzheimer’s.

Let’s understand the company’s strengths and weaknesses to better analyze how to play the stock amid the recent price decline.

Mounjaro & Zepbound: Key Top-Line Drivers for Lilly

Tirzepatide is a dual GIP and GLP-1 receptor agonist (GIP/GLP-1 RA). The GLP-1 segment is a very important class of drugs for multiple cardiometabolic diseases and is gaining significant popularity.

Mounjaro was approved in May 2022 for type II diabetes. Zepbound was launched in November 2023 to treat obesity. Despite a short time on the market, Mounjaro and Zepbound have become key top-line drivers for Lilly in 2024, with demand rising rapidly. Since 2020, Lilly has committed more than $18 billion to build, upgrade or acquire facilities in the United States and Europe, and the benefit of these investments is showing now as the supply of the drugs is increasing. Mounjaro and Zepbound generated sales of almost $6.7 billion in the first half of 2024, accounting for around 44% of the company’s total revenues.

Tirzepatide is also being developed for other indications like obstructive sleep apnea (OSA), heart failure with preserved ejection fraction (HFpEF), cardiovascular risks and metabolic dysfunction-associated steatohepatitis (MASH). Approval for these expanded indications and launch in additional geographies can further boost sales.

Lilly’s tirzepatide medicines face strong competition from Novo Nordisk’s NVO semaglutide. Semaglutide is approved as Ozempic pre-filled pen and Rybelsus oral tablet for type II diabetes and as Wegovy injection for weight management. Wegovy sales have also remained strong. Though Novo Nordisk is also making efforts to improve the supply of its semaglutide drugs, the product remains in short supply.

LLY’s New Drugs & Pipeline Success

Other than Mounjaro and Zepbound, Lilly has gained approvals for some other new drugs in the past year. These included Omvoh for ulcerative colitis and BTK inhibitor Jaypirca for mantle cell lymphoma and chronic lymphocytic leukemia. Lilly expects its new drugs Mounjaro, Omvoh, Zepbound, Ebglyss and Jaypirca to drive its top line in the second half of 2024.

In July, Lilly won a long-awaited FDA approval for Kisunla (donanemab) for treating early symptomatic Alzheimer's disease. Lilly believes Kisunla can generate blockbuster sales. Kisunla is only the second drug on the market to treat Alzheimer's disease after Biogen BIIB and its Japan-based partner Eisai’s Leqembi. Interestingly, Kisunla’s label mentions that physicians may consider stopping the dosing of Kisunla based on the reduction of amyloid plaques, which can prove to be a competitive advantage.

Lilly is investing broadly in obesity and has 11 new molecules currently in clinical development, including two late-stage candidates, orforglipron, an oral GLP-1 small molecule and retatrutide, a GGG tri-agonist. Several phase III data readouts are expected in 2025. While competitors like Amgen AMGN and Viking Therapeutics are making rapid progress in their GLP-1-based diabetes/obesity candidates, we believe they will take time to catch up.

LLY Stock Outperformance, Premium Valuation

Despite the occasional hiccups, Lilly’s stock has been rising consistently this year. Lilly’s stock has risen 57.3% so far this year compared with an increase of 20.6% for the Large Cap Pharmaceutical industry. The stock has also outperformed the sector as well as the S&P 500 as seen in the chart below.

LLY Stock Outperforms Industry, Sector & S&P 500

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

The stock is trading at a premium to the industry, as seen in the chart below.

LLY Stock Valuation

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

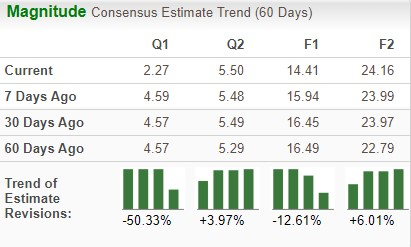

Estimates for Lilly’s 2024 earnings have declined from $16.49 to $14.41 per share over the past 60 days. The decline in estimates could be due to costs related to the acquisition of Morphic which closed in August and should be recorded as a charge against earnings in the third quarter. However, for 2025, earnings estimates have risen from $22.79 to $24.16 per share over the same timeframe.

Find the latest earnings estimates and surprises on Zacks Earnings Calendar.

LLY Earnings Estimate Movement

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Consider Buying LLY Stock Despite the Dip

One of the biggest names in healthcare, Lilly has consistently reported strong revenues and profits and dealt well with expiring patents and increasing competition. The stupendous success of Mounjaro and Zepbound has made it the largest drugmaker with a market cap of more than $825 billion. Lilly’s stock has gone up by 745% in the past five years, mainly due to its solid pipeline potential, particularly its obesity drugs.

Lilly’s revenue growth is being driven by higher demand for Mounjaro, Zepbound, Verzenio, and others, which will make up for the decline in sales from Trulicity. Incremental contribution for new drugs, rapid pipeline progress in areas like obesity, diabetes and Alzheimer’s and regular M&A activity will keep the stock afloat.

Lilly is a great stock to own based on its strong overall financial performance and robust drug pipeline. Though LLY currently trades at a premium to the industry, investors should still consider adding this Zacks Rank #2 (Buy) stock. The company has robust growth prospects, which make it a top stock to own.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

Only $1 to See All Zacks' Buys and Sells

We're not kidding.

Several years ago, we shocked our members by offering them 30-day access to all our picks for the total sum of only $1. No obligation to spend another cent.

Thousands have taken advantage of this opportunity. Thousands did not - they thought there must be a catch. Yes, we do have a reason. We want you to get acquainted with our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators,and more, that closed 228 positions with double- and triple-digit gains in 2023 alone.

See Stocks Now >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Biogen Inc. (BIIB): Free Stock Analysis Report

Novo Nordisk A/S (NVO): Free Stock Analysis Report

Eli Lilly and Company (LLY): Free Stock Analysis Report

Amgen Inc. (AMGN): Free Stock Analysis Report

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal