4 Discount Retail Stocks to Invest In Ahead of Holiday Season

With the holiday season just around the corner, bargain hunters are on the streets to grab the best deals on products. It is not a hidden fact that economic uncertainties and inflation have led many budget-conscious consumers to prioritize value-driven purchases, making discount retailers like Costco Wholesale Corporation COST, The TJX Companies, Inc. TJX, Ross Stores, Inc. ROST and Burlington Stores, Inc. BURL a go-to destination for shopping. This shift in consumer behavior creates a unique opportunity for investors to capitalize on the expected surge in holiday spending at discount retailers.

Discount retailers typically thrive during the holiday season as they offer a wide range of products at competitive prices, attracting value-conscious shoppers. Whether it is seasonal décor, gifts or everyday essentials, these retailers provide a variety of options that cater to diverse customer needs. Their ability to quickly adapt to market trends and consumer preferences makes them well-positioned to capture increased foot traffic and sales.

Moreover, many discount retailers have been investing in enhancing their digital presence to meet the growing demand for online shopping. As shoppers increasingly seek convenience, retailers that effectively blend in-store and online experiences are likely to see substantial growth. This strategic approach not only drives sales but also strengthens customer loyalty, providing an additional boost during the holiday rush.

According to the Mastercard Economics Institute, U.S. retail sales, excluding automotive, are anticipated to increase by 3.2% between Nov. 1 and Dec. 24. This forecast reflects a slight improvement over the 3.1% increase witnessed last season. Per the report, online spending is expected to rise 7.1% year over year. With a proactive approach and customer-centric offerings, retailers will try to seize every opportunity the season presents.

Here are four must-own discount retail stocks that are well-positioned for strong performance.

Past-Year Stock Price Performance of COST, TJX, ROST & BURL

Image Source: Zacks Investment Research

4 Top Retail Stocks

Costco: Leveraging Membership Model for Success

Costco has been navigating the market’s ups and downs pretty well. The discount retailer’s growth strategies, better price management and decent membership trends have been contributing to its performance. These factors have been aiding this Issaquah, WA-based company in registering decent sales numbers. The company's distinctive membership business model and pricing power set it apart from traditional players. We believe a favorable product mix, steady store traffic, pricing strength and strong liquidity should benefit Costco.

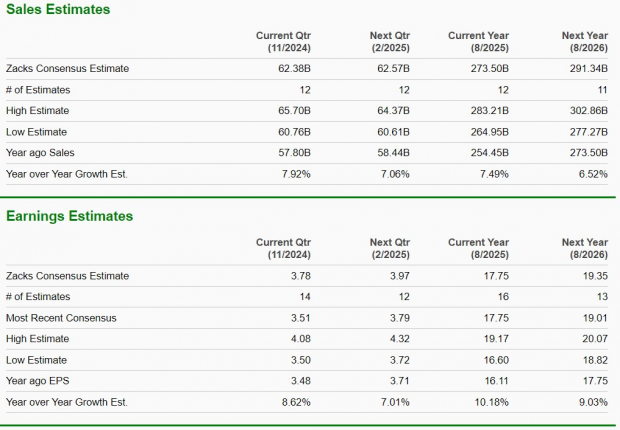

The Zacks Consensus Estimate for Costco’s current financial-year sales and earnings per share (EPS) implies growth of 7.5% and 10.2%, respectively, from the year-ago period’s actuals. This Zacks Rank #2 (Buy) company has a trailing four-quarter earnings surprise of 2%, on average. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Image Source: Zacks Investment Research

TJX Companies: Sourcing Premium Brands at Discounted Prices

TJX's business model thrives on flexibility, allowing it to swiftly adapt to shifting market trends and seize new opportunities. This agility sets TJX apart in the off-price retail space, where the ability to source and offer premium brands at discounted prices is crucial. By maintaining a nimble approach to inventory management, TJX can quickly respond to changes in consumer preferences, ensuring fresh and appealing merchandise across its stores. The company's strong relationships with vendors also enable it to secure high-quality products at a lower cost, which it passes on to value-driven shoppers. This operational efficiency not only keeps customer traffic high but also supports sustained financial growth.

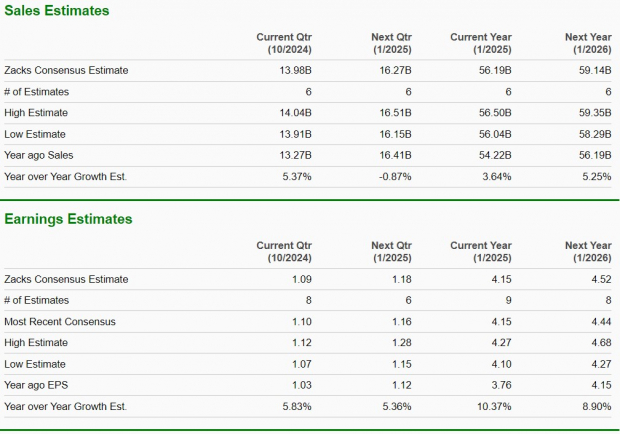

The Zacks Consensus Estimate for TJX Companies’ current financial-year revenues and EPS indicates growth of 3.6% and 10.4%, respectively, from the year-ago reported figure. This Zacks Rank #2 company has a trailing four-quarter earnings surprise of 4.4%, on average.

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

Image Source: Zacks Investment Research

Ross Stores: Strong Value Proposition & Strategic Expansion

Investors should consider investing in Ross Stores due to its strong positioning as a leading off-price retailer, which allows it to cater to cost-conscious consumers seeking value in today’s economic climate. The company's commitment to enhancing its value offerings has resonated with its customer base, driving increased foot traffic and higher average transaction sizes. Ross Stores' strategic expansion plans, including new store openings, showcase its confidence in capturing market share across various regions. The company's efficient inventory management ensures that it can adapt to changing consumer preferences while maintaining flexibility in its supply chain.

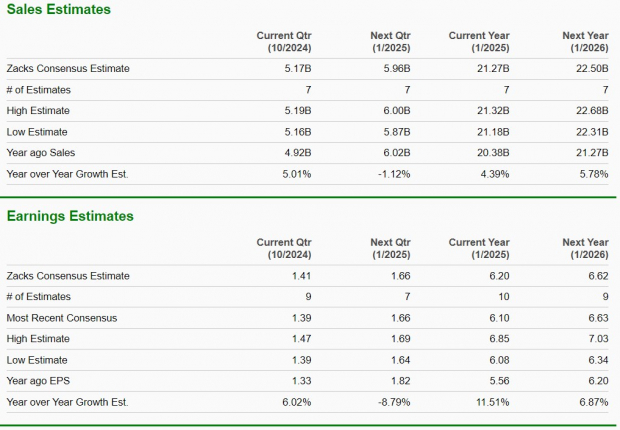

The Zacks Consensus Estimate for Ross Stores’ current financial-year sales and EPS suggests growth of 4.4% and 11.5%, respectively, from the year-ago reported figures. This Zacks Rank #2 company has a trailing four-quarter earnings surprise of 9.1%, on average.

Image Source: Zacks Investment Research

Burlington: Merchandising Enhancements & Store Productivity

Burlington Stores is a nationally recognized off-price retailer. The company has demonstrated a strong ability to adapt to consumer trends, which gives it a competitive edge. By staying in tune with customer preferences and adjusting its product offerings, Burlington Stores is well-positioned to capture market share. The company has balanced promotions with regular price sales, appealing to budget-conscious shoppers while protecting margins. Its strategic initiatives, including enhancing merchandising capabilities and optimizing store operations, have supported revenue growth. With targeted store openings, relocations and real-time inventory management, Burlington Stores has seized opportunities and improved store productivity.

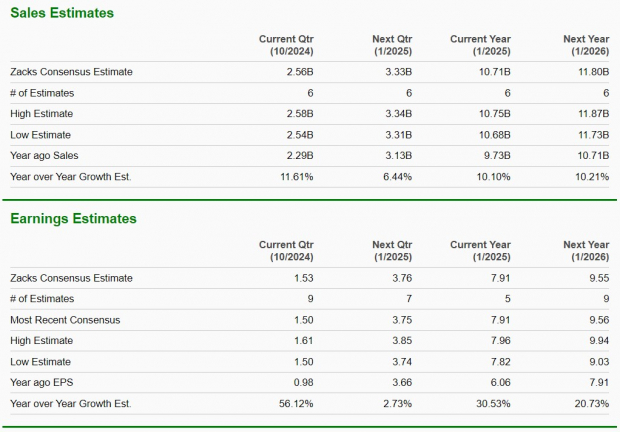

The Zacks Consensus Estimate for Burlington Stores’ current financial-year sales and EPS implies growth of 10.1% and 30.5%, respectively, from the year-ago reported figures. This Zacks Rank #2 company has a trailing four-quarter earnings surprise of 18.4%, on average.

Image Source: Zacks Investment Research

Only $1 to See All Zacks' Buys and Sells

We're not kidding.

Several years ago, we shocked our members by offering them 30-day access to all our picks for the total sum of only $1. No obligation to spend another cent.

Thousands have taken advantage of this opportunity. Thousands did not - they thought there must be a catch. Yes, we do have a reason. We want you to get acquainted with our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators,and more, that closed 228 positions with double- and triple-digit gains in 2023 alone.

See Stocks Now >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The TJX Companies, Inc. (TJX): Free Stock Analysis Report

Costco Wholesale Corporation (COST): Free Stock Analysis Report

Ross Stores, Inc. (ROST): Free Stock Analysis Report

Burlington Stores, Inc. (BURL): Free Stock Analysis Report

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal