Discover 3 Japanese Stocks Estimated To Be Trading Up To 42.6% Below Intrinsic Value

Japan's stock markets have experienced a positive trend recently, with the Nikkei 225 Index gaining 2.45% and the broader TOPIX Index rising by 0.45%, supported by a weaker yen which has enhanced the profit outlook for exporters. In this environment, identifying undervalued stocks can be particularly appealing as investors seek opportunities that may offer significant potential for appreciation when trading below their intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows In Japan

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Hagiwara Electric Holdings (TSE:7467) | ¥3430.00 | ¥6679.99 | 48.7% |

| Akatsuki (TSE:3932) | ¥2014.00 | ¥3735.74 | 46.1% |

| Eternal Hospitality GroupLtd (TSE:3193) | ¥4085.00 | ¥7754.28 | 47.3% |

| Pilot (TSE:7846) | ¥4627.00 | ¥8885.49 | 47.9% |

| Management SolutionsLtd (TSE:7033) | ¥1950.00 | ¥3835.42 | 49.2% |

| ServerworksLtd (TSE:4434) | ¥2373.00 | ¥4297.96 | 44.8% |

| S-Pool (TSE:2471) | ¥369.00 | ¥692.48 | 46.7% |

| Adventure (TSE:6030) | ¥4030.00 | ¥7361.84 | 45.3% |

| Gift Holdings (TSE:9279) | ¥3400.00 | ¥6545.88 | 48.1% |

| KeePer Technical Laboratory (TSE:6036) | ¥4215.00 | ¥7823.04 | 46.1% |

Here we highlight a subset of our preferred stocks from the screener.

Fujio Food Group (TSE:2752)

Overview: Fujio Food Group Inc. operates restaurants both in Japan and internationally, with a market cap of ¥61.60 billion.

Operations: The company's revenue segments include ¥1.60 billion from the FC Business and ¥28.77 billion from the Directly Managed Business.

Estimated Discount To Fair Value: 25.7%

Fujio Food Group is trading at ¥1,354, significantly below its estimated fair value of ¥1,821.71, indicating it may be undervalued based on cash flows. The company is expected to become profitable within three years and has a revenue growth forecast of 6.5% annually, outpacing the Japanese market's 4.3%. However, insufficient data prevents a clear assessment of future return on equity performance.

- Upon reviewing our latest growth report, Fujio Food Group's projected financial performance appears quite optimistic.

- Navigate through the intricacies of Fujio Food Group with our comprehensive financial health report here.

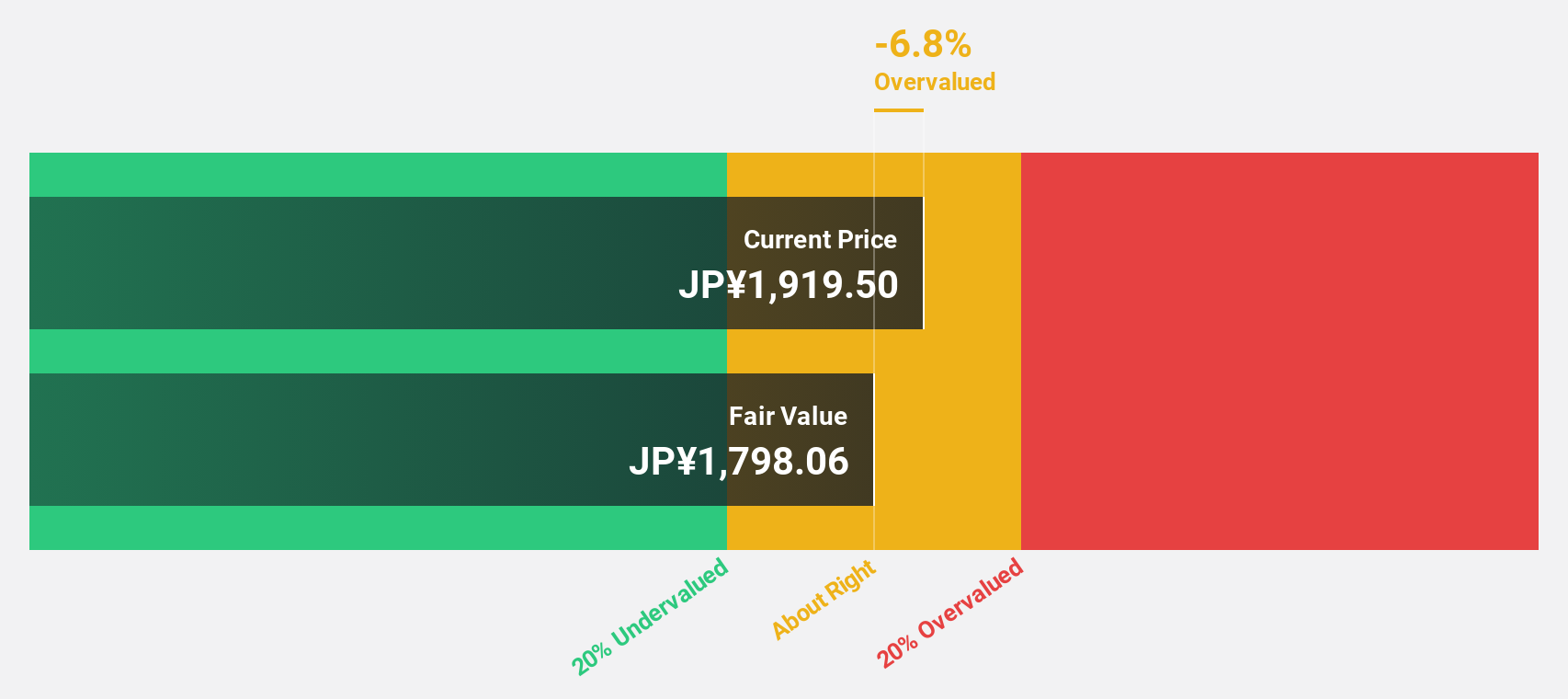

PARK24 (TSE:4666)

Overview: PARK24 Co., Ltd. operates and manages parking facilities both in Japan and internationally, with a market cap of ¥313.98 billion.

Operations: The company's revenue is derived from its Mobility Business, which contributes ¥107.36 million, the Parking Lot Business in Japan with ¥178.06 million, and the Parking Lot Business Overseas generating ¥79.23 million.

Estimated Discount To Fair Value: 26.6%

PARK24 is trading at ¥1,840.5, well below its estimated fair value of ¥2,506.19, highlighting potential undervaluation based on cash flows. Despite high debt levels, earnings are projected to grow 16.35% annually—faster than the Japanese market's 8.7%. Recent strategic moves include a pilot rideshare service with Uber Japan and Royal Limousine in Tokyo, potentially increasing vehicle utilization and revenue streams if successful in addressing operational challenges.

- Our earnings growth report unveils the potential for significant increases in PARK24's future results.

- Delve into the full analysis health report here for a deeper understanding of PARK24.

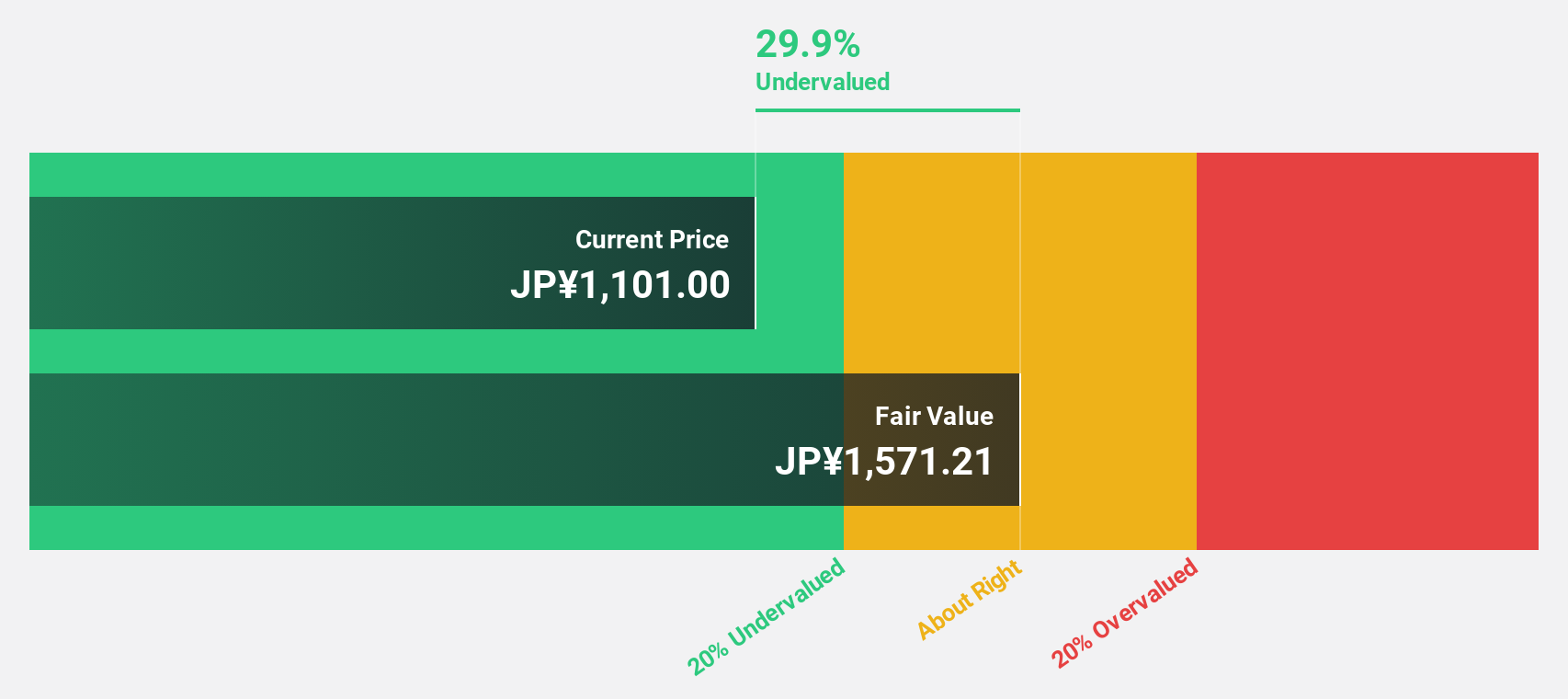

Japan Investment Adviser (TSE:7172)

Overview: Japan Investment Adviser Co., Ltd. offers a range of financial solutions in Japan and has a market cap of ¥63.57 billion.

Operations: The company generates revenue from its Finance Solution segment, amounting to ¥27.86 billion.

Estimated Discount To Fair Value: 42.6%

Japan Investment Adviser is trading at ¥1,051, significantly below its estimated fair value of ¥1,830.17, suggesting undervaluation based on cash flows. The company reported a substantial earnings growth of 710.7% over the past year and forecasts revenue growth at 25.8% annually—outpacing the Japanese market's average. Despite recent shareholder dilution and dividend reductions from ¥16 to ¥12 per share, its operating lease business remains robust amid yen depreciation benefits.

- Our comprehensive growth report raises the possibility that Japan Investment Adviser is poised for substantial financial growth.

- Get an in-depth perspective on Japan Investment Adviser's balance sheet by reading our health report here.

Taking Advantage

- Click here to access our complete index of 85 Undervalued Japanese Stocks Based On Cash Flows.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal