Should You Buy, Sell, or Hold PulteGroup Before Q3 Earnings?

PulteGroup Inc. PHM is scheduled to report third-quarter 2024 results on Oct. 22, before the opening bell.

Stay up-to-date with all quarterly releases: See Zacks Earnings Calendar.

In the second quarter of 2024, earnings and revenues handily beat the Zacks Consensus Estimate by 11.5% and 2.7%, respectively. PulteGroup’s balanced operating model resulted in increases in closings, average sales price, and gross margin, which collectively led to a 19.3% increase in earnings per share (EPS).

Strong cash flows provided the flexibility to invest in business growth, return funds to shareholders, and strengthen the overall capital structure. Effective management of sales price, pace, and starts on a community-by-community basis enabled the company to achieve high returns on invested capital and equity, showed by a 27.1% return on equity over the past 12 months.

PulteGroup has an impressive track record of surpassing earnings expectations, exceeding the consensus mark in each of the last four quarters. The average surprise over this period is 10%.

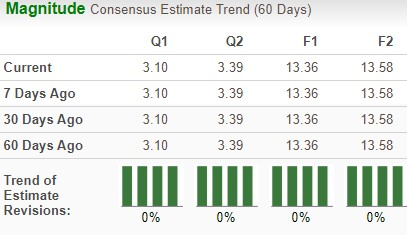

How Are Estimates Placed for PHM?

The Zacks Consensus Estimate for the third-quarter EPS has remained unchanged at $3.10 over the past 60 days. The estimated figure indicates a 6.9% increase from the year-ago EPS of $2.90. Also, the consensus mark for revenues is $4.26 billion, indicating 6.4% year-over-year growth.

Image Source: Zacks Investment Research

What the Zacks Model Unveils for PHM

Our proven model does not predict an earnings beat for PulteGroup for the quarter to be reported. That is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. This is not the case here, as you will see below.

Earnings ESP: PHM has an Earnings ESP of 0.00%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: The company currently carries a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Factors Influencing PulteGroup’s Q3 Performance

Low-existing homes for sale have been driving demand for new homes in the market. Along with this market tailwind, PulteGroup’s cyclically resilient operating model, effective pricing strategy and mortgage rate buydown program are expected to have positively impacted the company’s top line in the third quarter.

Notably, PulteGroup is effectively managing a balance between spec (speculative) and build-to-order approaches to drive growth by maintaining a strategic mix and responding to market conditions. Also, its mortgage rate buydown program is expected to have enhanced PulteGroup's market appeal and sales performance in the to-be-reported quarter amid the challenging higher mortgage rate environment. Meanwhile, the company has been effectively increasing prices, thereby helping to boost its revenues.

PulteGroup’s land management and flexibility strategy also plays a critical role in its financial success, operational efficiency, and resilience within the homebuilding industry. While using land options through third-party bankers may result in a trade-off in gross margins, the increased flexibility and reduced capital risk more than compensate for this through improved returns. Given the strength of its land pipeline, PHM continues to expect community count growth of 3% to 5% in the third and fourth quarters of 2024 from the year-ago perspective.

PulteGroup expects home deliveries to be approximately 7,400-7,800 units compared with 7,076 homes delivered a year ago. Our model predicts deliveries to grow 7.4% year over year to 7,596 units.

PHM expects a higher average selling price or ASP for the quarter between $540,000 and $550,000 compared with the year-ago level of $549,000. Our model predicts the ASP of homes delivered to drop 0.8% year over year to $544,500.

We expect the Homebuilding revenues to grow 6.3% to $4.18 billion from $3.93 billion a year ago due to higher deliveries.

From the margin perspective, high costs associated with labor are expected to have weighed on margins to some extent. That said, prudent cost-saving efforts might have partly mitigated the risks. Management has been emphasizing balancing price, pace, and investment to maximize long-term returns. They reiterated their commitment to not being “margin proud,” indicating a willingness to adjust pricing and incentives to turn assets and maintain volume.

The company expects homebuilding gross margins of 29% for the quarter compared with 29.3% reported in the year-ago period. Our model also predicts homebuilding gross margins to be 29% for the quarter, down 30 basis points from the year-ago period.

We expect SG&A (as a percentage of home sales revenues) to be 10%, higher than 9.1% reported in the prior-year quarter.

Meanwhile, we expect the company’s new orders to drop marginally by 0.8% year over year to 7,009 units in the quarter. However, value of the net orders is likely to grow 3.7% year over year to $3.96 billion.

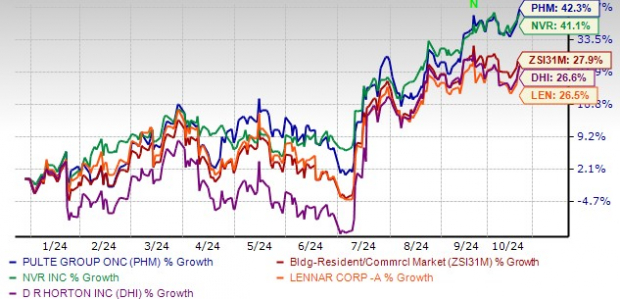

Price Performance & Valuation

PHM’s stock has exhibited an upward movement in the year-to-date period. The stock has gained 42.3% compared with the industry’s rise of 27.9% in the same time frame. PulteGroup has also performed better than other prominent players in the industry, like NVR, Inc. NVR, D.R. Horton DHI and Lennar LEN, over the same time frame.

YTD Price Performance

Image Source: Zacks Investment Research

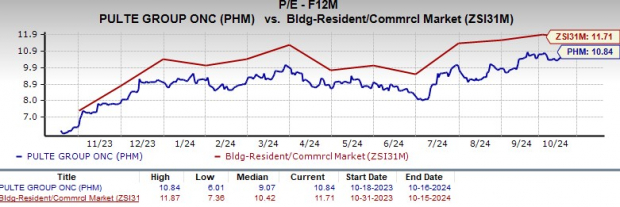

Let's assess the value PHM offers to investors at its current levels.

Presently, PHM is trading at a discount compared to the industry average as shown in the chart below.

Image Source: Zacks Investment Research

Investment Thoughts

This Atlanta, GA-based homebuilder has strategically capitalized on key tailwinds such as flexible land portfolio and investment strategies, enhanced production efficiency and improved construction cycle times. The company's cyclically resilient operating model, effective pricing strategy and mortgage rate buydown program further position it for continued success.

With a discounted valuation, PulteGroup's stock remains attractively priced relative to the market. The company has a strong track record of quarterly dividend payments spanning nearly four decades, reflecting its commitment to returning cash flows to shareholders while maintaining financial stability. Investors holding PulteGroup stock are advised to retain their positions.

However, rising costs, fluctuations in consumer sentiment, and margin pressures could pose challenges. Furthermore, the absence of positive EPS estimate revisions in the past 60 days indicates limited upside potential. Given these market uncertainties, prospective investors are advised to await a more opportune entry point into PulteGroup.

Only $1 to See All Zacks' Buys and Sells

We're not kidding.

Several years ago, we shocked our members by offering them 30-day access to all our picks for the total sum of only $1. No obligation to spend another cent.

Thousands have taken advantage of this opportunity. Thousands did not - they thought there must be a catch. Yes, we do have a reason. We want you to get acquainted with our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators,and more, that closed 228 positions with double- and triple-digit gains in 2023 alone.

See Stocks Now >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PulteGroup, Inc. (PHM): Free Stock Analysis Report

Lennar Corporation (LEN): Free Stock Analysis Report

D.R. Horton, Inc. (DHI): Free Stock Analysis Report

NVR, Inc. (NVR): Free Stock Analysis Report

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal