Insider-Favored Growth Companies To Watch In October 2024

As global markets continue to navigate a complex economic landscape, U.S. stocks have reached new highs, driven by positive earnings surprises despite inflationary pressures and rising jobless claims. In this environment, growth companies with high insider ownership can offer unique insights into potential market opportunities, as insiders often have a deep understanding of their company's prospects and are willing to invest their own capital accordingly.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 11.9% | 21.1% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 41.9% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 27.4% |

| Medley (TSE:4480) | 34% | 30.4% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.8% | 49.1% |

| KebNi (OM:KEBNI B) | 36.3% | 86.1% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.0% | 95% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Underneath we present a selection of stocks filtered out by our screen.

Raia Drogasil (BOVESPA:RADL3)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Raia Drogasil S.A. operates in Brazil as a retail seller of medicines, personal care and beauty products, cosmetics, dermocosmetics, and specialty medicines with a market cap of R$43.89 billion.

Operations: The company's revenue primarily comes from its retail operations in medicine, cosmetics, and hygiene products, totaling R$36.39 billion.

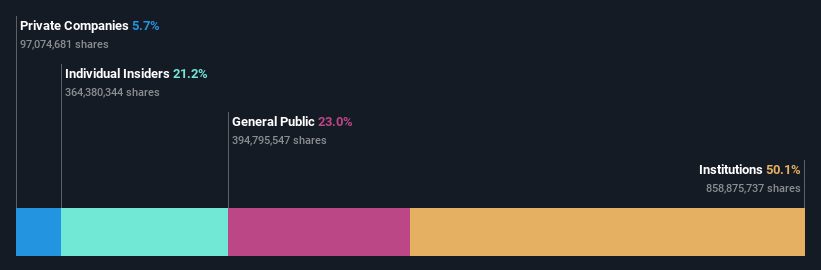

Insider Ownership: 21.2%

Revenue Growth Forecast: 12.3% p.a.

Raia Drogasil's earnings are forecast to grow significantly at 24.62% annually, outpacing the Brazilian market's 13.9% growth rate. Despite high debt levels, its revenue is expected to increase by 12.3% per year, surpassing the market average of 7.8%. Analysts anticipate a stock price rise of 20.5%. Recent financials show sales growth but a decline in net income and earnings per share compared to last year, indicating potential challenges ahead.

- Unlock comprehensive insights into our analysis of Raia Drogasil stock in this growth report.

- Our valuation report here indicates Raia Drogasil may be overvalued.

Quectel Wireless Solutions (SHSE:603236)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Quectel Wireless Solutions Co., Ltd. focuses on the research, development, design, production, and sales of wireless communication modules and solutions globally, with a market cap of CN¥12.93 billion.

Operations: Quectel Wireless Solutions Co., Ltd. generates revenue through its global operations in the research, development, design, production, and sales of wireless communication modules and solutions.

Insider Ownership: 24.4%

Revenue Growth Forecast: 19.3% p.a.

Quectel Wireless Solutions is poised for strong growth, with earnings forecast to rise significantly at 32.5% annually, surpassing the Chinese market's average. Its revenue is expected to grow by 19.3% per year, faster than the market rate of 13.2%. The company trades below its estimated fair value and offers competitive pricing relative to peers. Recent product launches, including advanced antennas and IoT modules, highlight its innovative edge in expanding global connectivity solutions.

- Dive into the specifics of Quectel Wireless Solutions here with our thorough growth forecast report.

- According our valuation report, there's an indication that Quectel Wireless Solutions' share price might be on the cheaper side.

Gold Circuit Electronics (TWSE:2368)

Simply Wall St Growth Rating: ★★★★☆☆

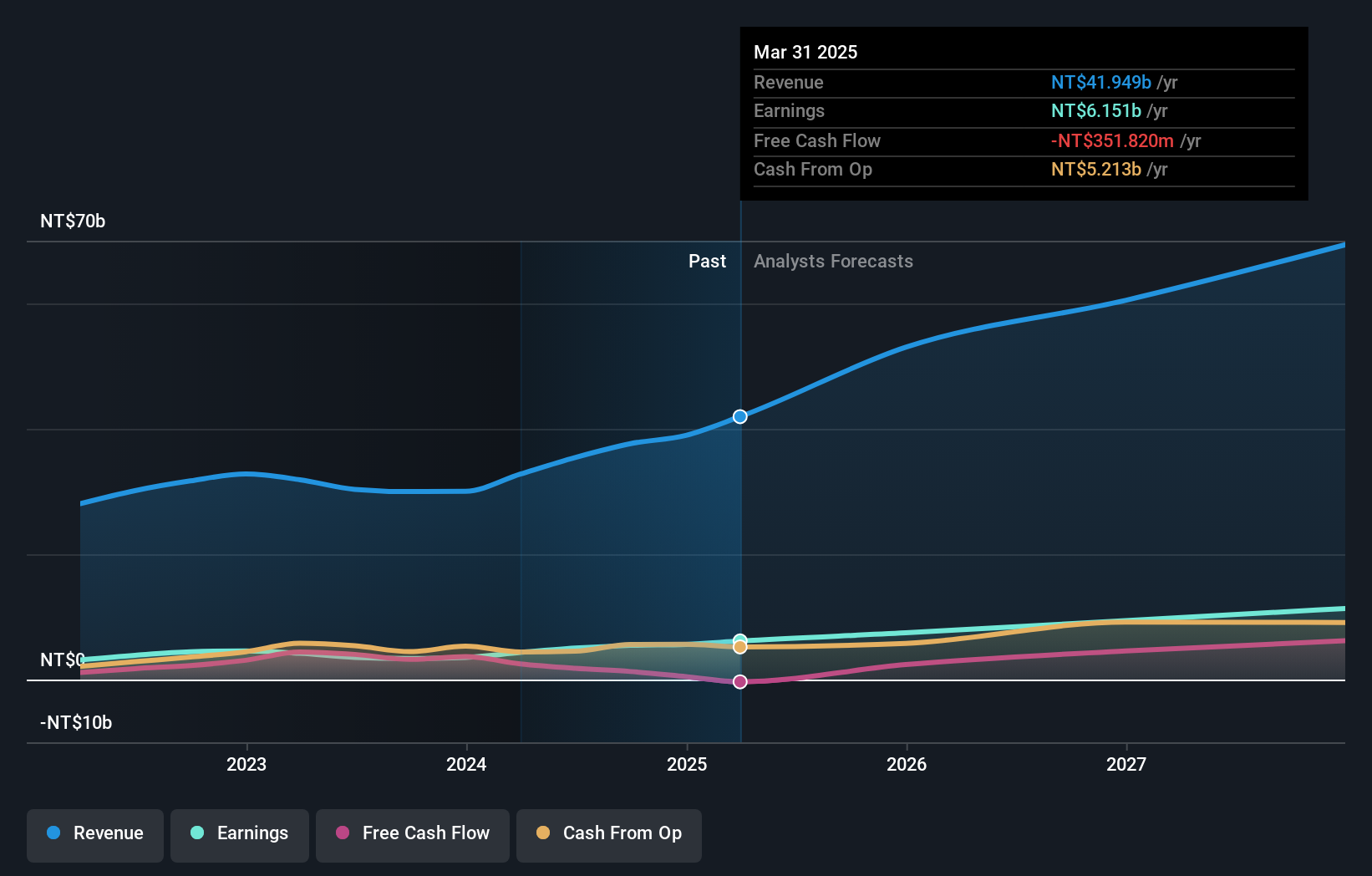

Overview: Gold Circuit Electronics Ltd. is a Taiwan-based company that designs, manufactures, processes, and distributes multilayer printed circuit boards with a market cap of NT$92.23 billion.

Operations: The company's revenue from manufacturing and sales of printed circuit boards amounts to NT$35.42 billion.

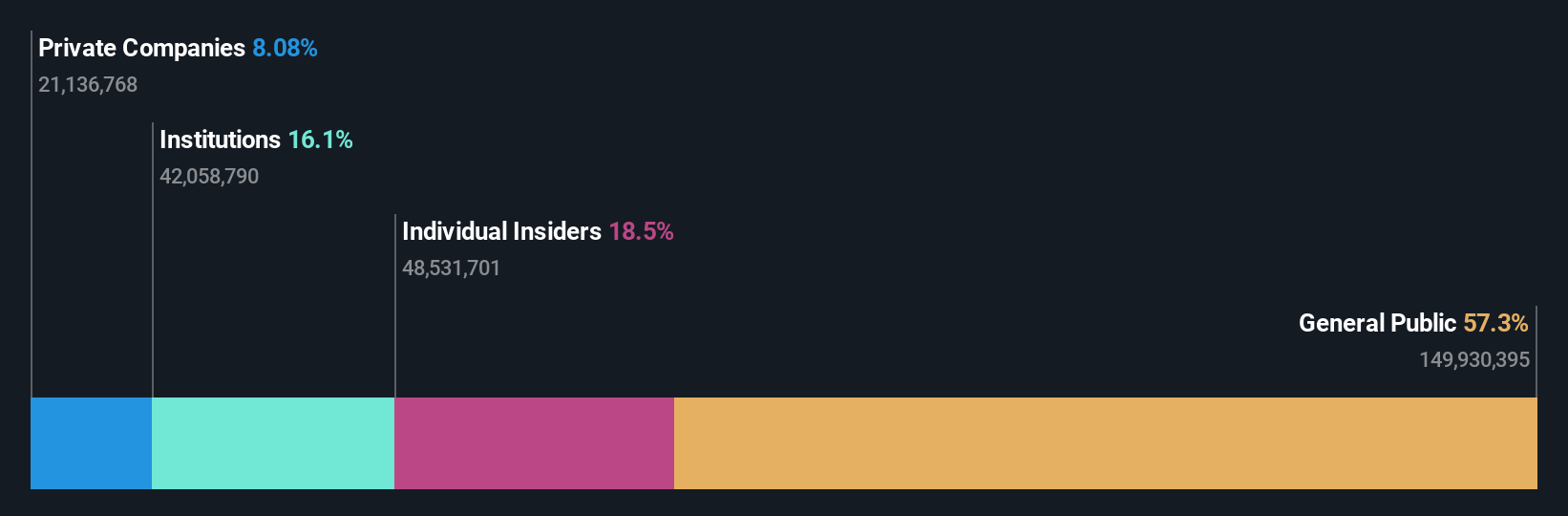

Insider Ownership: 31.4%

Revenue Growth Forecast: 15.1% p.a.

Gold Circuit Electronics demonstrates robust growth potential, with earnings having grown 41.6% over the past year and forecasted to increase by 19.61% annually, outpacing the Taiwanese market average. Recent earnings reports show significant improvements in sales and net income compared to last year. The company's price-to-earnings ratio of 18.7x is attractive relative to the broader market, though its dividend yield of 1.82% lacks coverage from free cash flows.

- Delve into the full analysis future growth report here for a deeper understanding of Gold Circuit Electronics.

- Upon reviewing our latest valuation report, Gold Circuit Electronics' share price might be too pessimistic.

Seize The Opportunity

- Dive into all 1486 of the Fast Growing Companies With High Insider Ownership we have identified here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal