Exploring Three Undiscovered Gems In The Canadian Market

The Canadian market has shown impressive momentum, climbing 1.4% in the last week and up 24% over the past year, with earnings projected to grow by 15% annually. In such a dynamic environment, identifying stocks that combine strong fundamentals with growth potential can be key to uncovering hidden opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| TWC Enterprises | 6.74% | 10.99% | 25.68% | ★★★★★★ |

| Reconnaissance Energy Africa | NA | 15.28% | 7.58% | ★★★★★★ |

| Taiga Building Products | NA | 6.05% | 10.50% | ★★★★★★ |

| Lithium Chile | NA | nan | 30.02% | ★★★★★★ |

| Tornado Global Hydrovacs | 14.62% | 24.52% | 64.90% | ★★★★★☆ |

| Firan Technology Group | 15.52% | 6.50% | 32.07% | ★★★★★☆ |

| Grown Rogue International | 24.92% | 43.35% | 67.95% | ★★★★★☆ |

| Mako Mining | 22.90% | 38.12% | 54.79% | ★★★★★☆ |

| Queen's Road Capital Investment | 7.20% | 22.14% | 22.20% | ★★★★☆☆ |

| Genesis Land Development | 53.32% | 25.58% | 47.05% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Dundee Precious Metals (TSX:DPM)

Simply Wall St Value Rating: ★★★★★★

Overview: Dundee Precious Metals Inc. is a gold mining company involved in the acquisition, exploration, development, mining, and processing of precious metals with a market cap of approximately CA$2.53 billion.

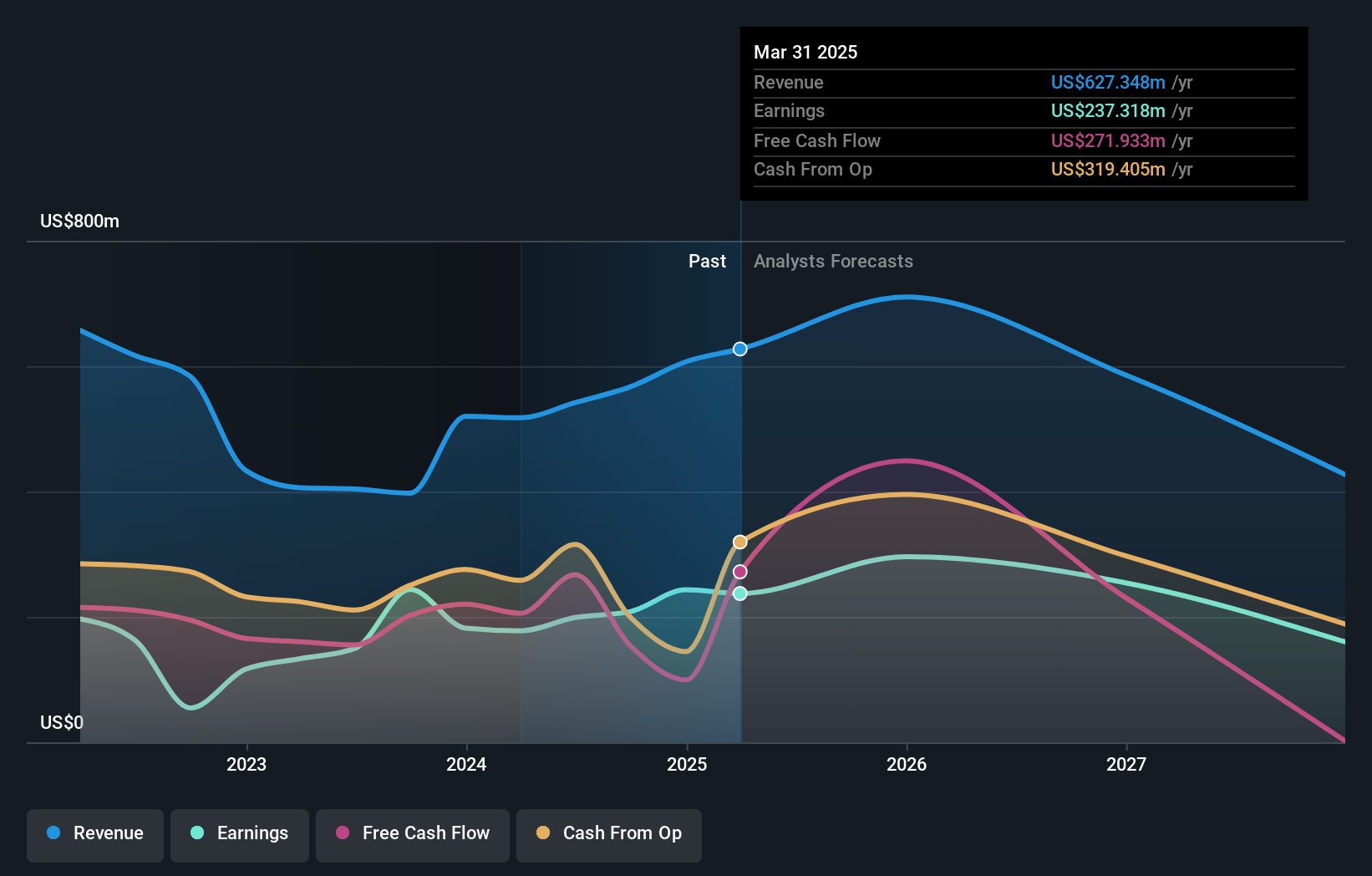

Operations: Dundee Precious Metals generates revenue primarily from its Ada Tepe and Chelopech segments, contributing $237.16 million and $304.68 million, respectively.

Dundee Precious Metals, a nimble player in the mining sector, has shown impressive earnings growth of 33.1% over the past year, outpacing the industry average of 2.8%. The company operates debt-free and trades at nearly 25% below its estimated fair value. Recent production results highlight substantial output with gold reaching 60.1 K oz and copper at 7.3 Mlbs for Q3 2024, while share buybacks totaled $26.4 million this year, reflecting confidence in its valuation strategy.

TerraVest Industries (TSX:TVK)

Simply Wall St Value Rating: ★★★★★☆

Overview: TerraVest Industries Inc. is a Canadian company that manufactures and sells goods and services to various sectors, including energy, agriculture, mining, and transportation in Canada and the United States, with a market cap of approximately CA$1.98 billion.

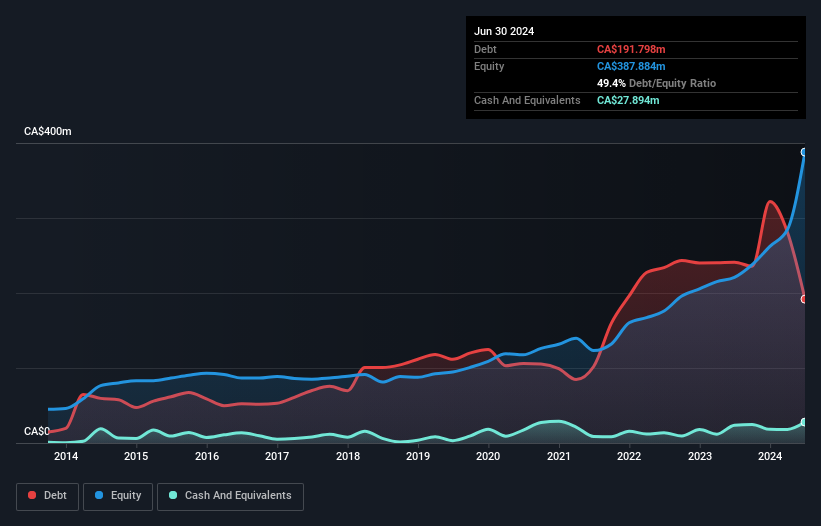

Operations: TerraVest Industries generates revenue primarily from its HVAC and Containment Equipment segment (CA$292.90 million), followed by Compressed Gas Equipment (CA$243.77 million) and Service (CA$201.78 million). The company also earns from Processing Equipment, contributing CA$117.58 million to its revenue stream.

TerraVest Industries, a smaller player in the energy services sector, has demonstrated impressive earnings growth of 43.6% over the past year, outpacing its industry significantly. The company's debt-to-equity ratio improved from 117.9% to 49.4% over five years, indicating better financial health despite a high net debt to equity ratio of 42.3%. Trading at a discount of 22.3% below estimated fair value and maintaining positive free cash flow signals potential investment appeal amidst recent insider selling activities.

- Click here to discover the nuances of TerraVest Industries with our detailed analytical health report.

Evaluate TerraVest Industries' historical performance by accessing our past performance report.

Standard Lithium (TSXV:SLI)

Simply Wall St Value Rating: ★★★★★★

Overview: Standard Lithium Ltd. is engaged in the exploration, development, and processing of lithium brine properties in the United States, with a market cap of CA$470.68 million.

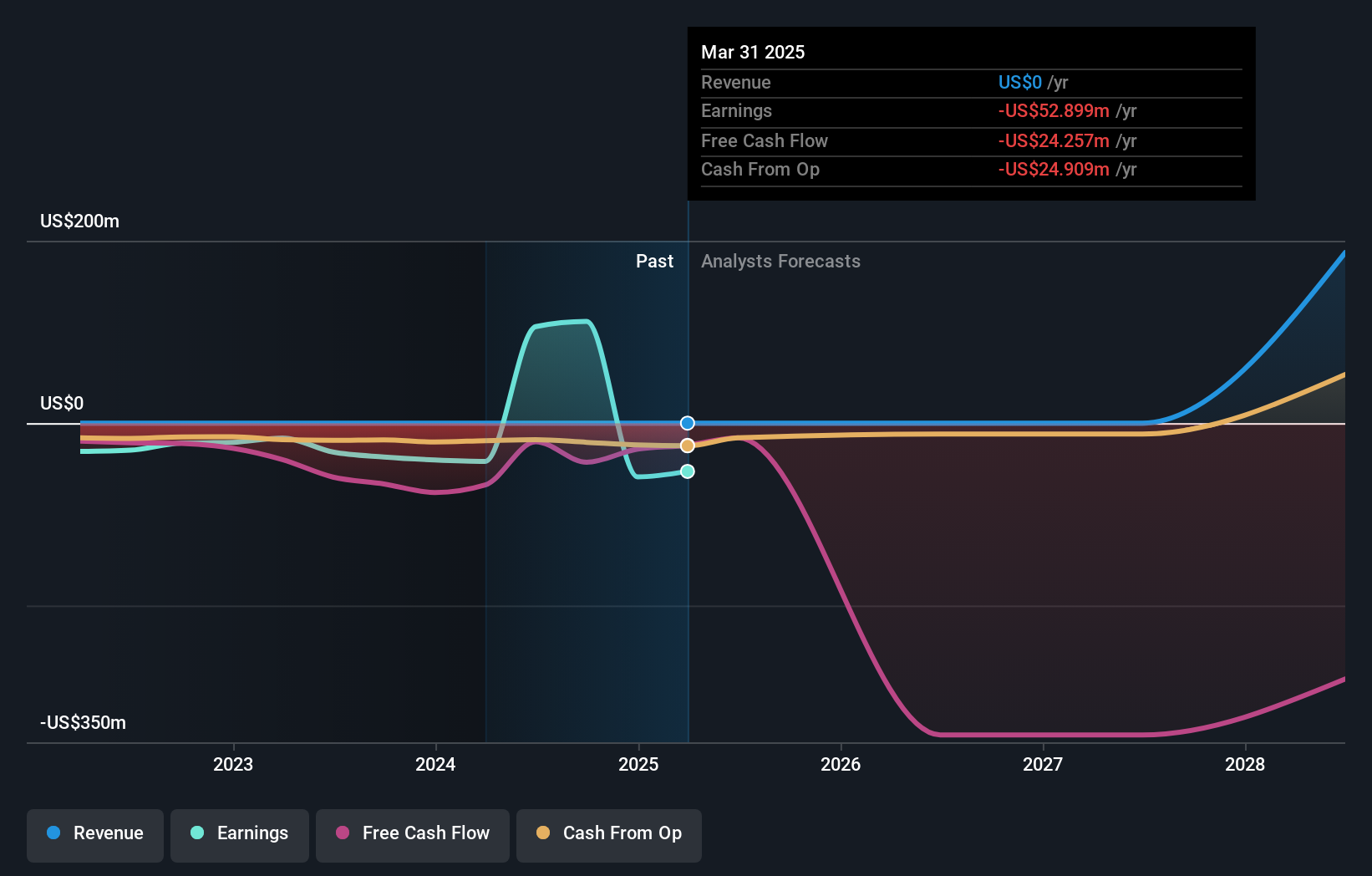

Operations: Standard Lithium Ltd. currently does not report any revenue segments, indicating that it may still be in the pre-revenue stage of its business operations.

Standard Lithium has turned a corner, reporting a net income of CAD 147 million for the year ending June 2024, contrasting sharply with the previous year's loss. The company is debt-free and boasts a low price-to-earnings ratio of 3.6x, well below the Canadian market average. Despite high volatility in share prices recently, their strategic partnership with Equinor and potential USD 225 million DOE funding could bolster its lithium projects significantly.

- Navigate through the intricacies of Standard Lithium with our comprehensive health report here.

Explore historical data to track Standard Lithium's performance over time in our Past section.

Summing It All Up

- Discover the full array of 48 TSX Undiscovered Gems With Strong Fundamentals right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal