High Growth Tech And 2 Other Exciting Stocks with Potential Expansion

As global markets navigate a complex landscape marked by record highs in key U.S. indices and mixed economic signals, investors are keenly observing sectors with potential for robust growth. In this environment, identifying promising stocks involves considering companies that demonstrate resilience and adaptability, particularly those in high-growth tech sectors poised to leverage current market dynamics for expansion.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Clinuvel Pharmaceuticals | 22.32% | 27.42% | ★★★★★★ |

| Sarepta Therapeutics | 23.67% | 43.83% | ★★★★★★ |

| TG Therapeutics | 28.39% | 43.54% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| KebNi | 34.75% | 86.11% | ★★★★★★ |

| Travere Therapeutics | 27.74% | 70.00% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1274 stocks from our High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

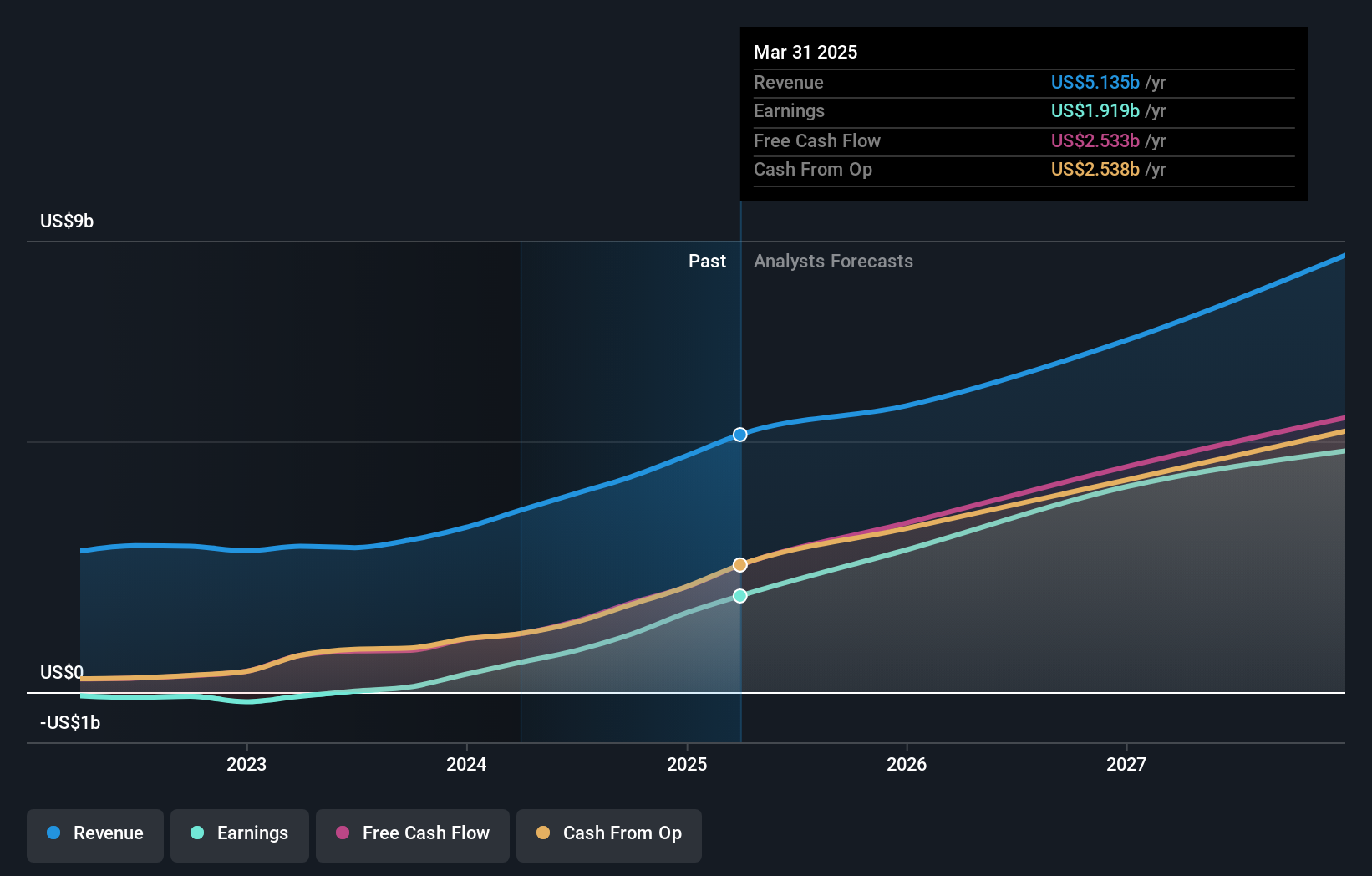

AppLovin (NasdaqGS:APP)

Simply Wall St Growth Rating: ★★★★★☆

Overview: AppLovin Corporation operates a software-based platform designed to help advertisers improve the marketing and monetization of their content globally, with a market capitalization of approximately $48.07 billion.

Operations: AppLovin generates revenue primarily through its Software Platform and Apps segments, with the Software Platform contributing $2.47 billion. The company's focus on enhancing advertising effectiveness is central to its operations, serving clients both in the United States and internationally.

AppLovin has demonstrated robust growth with a 4060.8% increase in earnings over the past year, significantly outpacing the software industry's average of 23.3%. This surge is underpinned by a strategic focus on R&D, which is evident from its substantial investment in innovation; however, specific figures on R&D spending were not disclosed. The company's recent inclusion in the FTSE All-World Index underscores its expanding market presence and investor confidence. Looking ahead, AppLovin expects to maintain momentum with projected earnings growth of 24.9% annually, outstripping the US market forecast of 15.2%, while also anticipating third-quarter revenues between $1,115 million and $1,135 million.

- Click to explore a detailed breakdown of our findings in AppLovin's health report.

Explore historical data to track AppLovin's performance over time in our Past section.

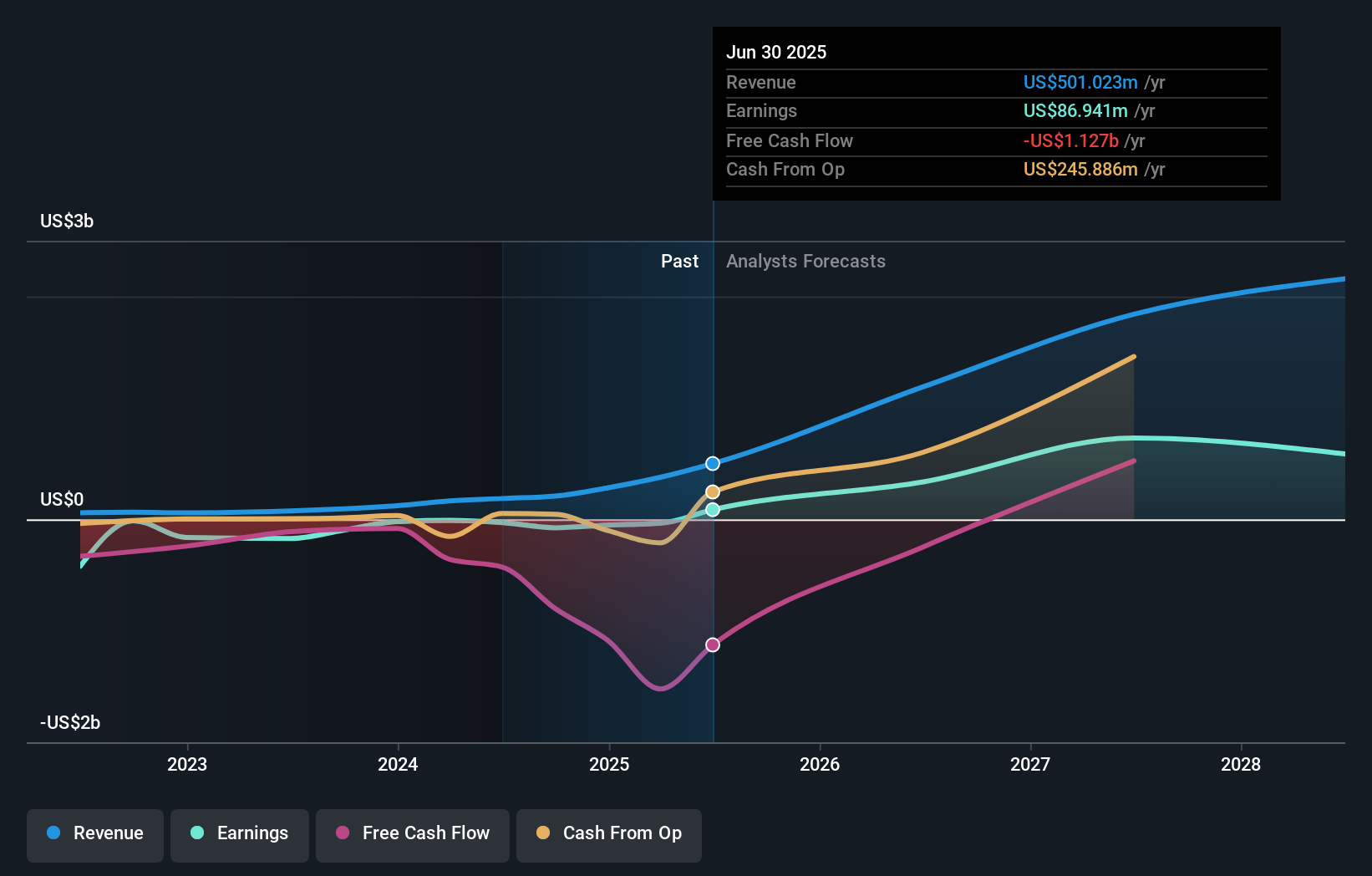

Iris Energy (NasdaqGS:IREN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Iris Energy Limited owns and operates bitcoin mining data centers, with a market capitalization of $1.77 billion.

Operations: The company generates revenue primarily from building and operating data center sites for bitcoin mining, with reported revenues of $188.76 million.

Despite facing a challenging landscape marked by a recent shareholder lawsuit, Iris Energy's commitment to growth is evident in its aggressive revenue forecasts, with an expected annual increase of 37.4%. This figure significantly outpaces the broader U.S. market's growth rate of 8.8%, showcasing the company's ambition in the high-performance computing sector. Furthermore, earnings are anticipated to surge by 68.6% annually, positioning Iris Energy for a potential turnaround from its current unprofitable status within three years. The firm has also strategically increased its operational capacity for Bitcoin mining and AI cloud services, leveraging advancements in technology and infrastructure to meet rising demand efficiently.

- Take a closer look at Iris Energy's potential here in our health report.

Gain insights into Iris Energy's historical performance by reviewing our past performance report.

Zscaler (NasdaqGS:ZS)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zscaler, Inc. is a global cloud security company with a market capitalization of approximately $29.76 billion.

Operations: The company generates revenue primarily through the sale of subscription services to its cloud platform and related support services, amounting to $2.17 billion. As a cloud security provider, it focuses on delivering scalable security solutions globally.

Zscaler's strategic alliances, such as the recent integration with Okta announced at Oktane2024, underscore its commitment to enhancing cybersecurity through zero trust architectures. This collaboration aims to streamline access and security protocols, vital in today's dispersed IT environments. The company’s R&D focus is evident from its substantial investment in innovation, with a notable 16.3% revenue growth anticipated annually. Additionally, Zscaler’s approach to merging advanced threat protection with network connectivity in partnerships like that with Airtel India positions it well amidst escalating cyber threats globally. These initiatives are part of why Zscaler is expected to pivot into profitability with earnings forecasted to surge by 40.2% per year, reflecting robust operational enhancements and market adaptation.

- Get an in-depth perspective on Zscaler's performance by reading our health report here.

Assess Zscaler's past performance with our detailed historical performance reports.

Where To Now?

- Unlock more gems! Our High Growth Tech and AI Stocks screener has unearthed 1271 more companies for you to explore.Click here to unveil our expertly curated list of 1274 High Growth Tech and AI Stocks.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal