Exploring Canadian Undervalued Small Caps With Insider Action

Over the last 7 days, the Canadian market has risen by 1.4%, contributing to a notable 24% increase over the past year, with earnings projected to grow by 15% annually in the coming years. In this thriving environment, identifying small-cap stocks that are perceived as undervalued and exhibit insider activity can present intriguing opportunities for investors seeking potential growth.

Top 10 Undervalued Small Caps With Insider Buying In Canada

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| First National Financial | 10.5x | 3.4x | 49.58% | ★★★★★☆ |

| Trican Well Service | 7.2x | 0.9x | 18.95% | ★★★★★☆ |

| AutoCanada | NA | 0.1x | 39.47% | ★★★★★☆ |

| Nexus Industrial REIT | 3.7x | 3.7x | 16.90% | ★★★★☆☆ |

| Rogers Sugar | 15.6x | 0.6x | 47.63% | ★★★★☆☆ |

| Goodfellow | 9.7x | 0.2x | 20.28% | ★★★★☆☆ |

| Primaris Real Estate Investment Trust | 13.0x | 3.5x | 44.04% | ★★★★☆☆ |

| Sagicor Financial | 1.4x | 0.3x | -48.27% | ★★★★☆☆ |

| Calfrac Well Services | 2.5x | 0.2x | 18.09% | ★★★★☆☆ |

| Vermilion Energy | NA | 1.1x | -4.79% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Badger Infrastructure Solutions (TSX:BDGI)

Simply Wall St Value Rating: ★★★★☆☆

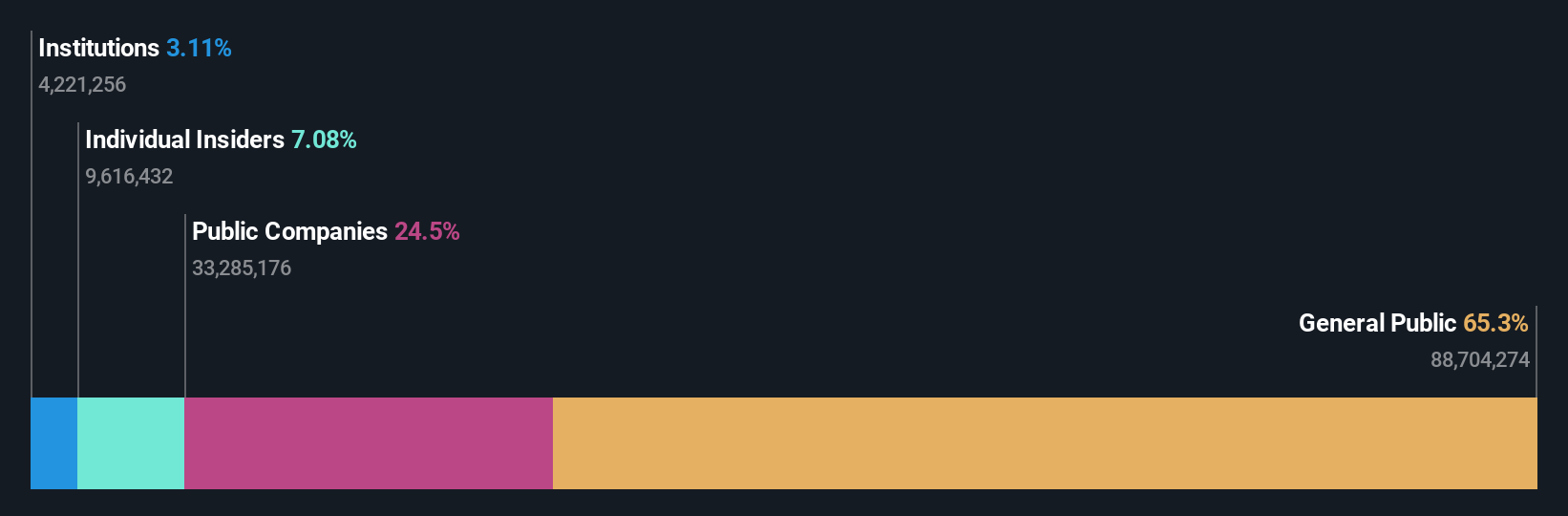

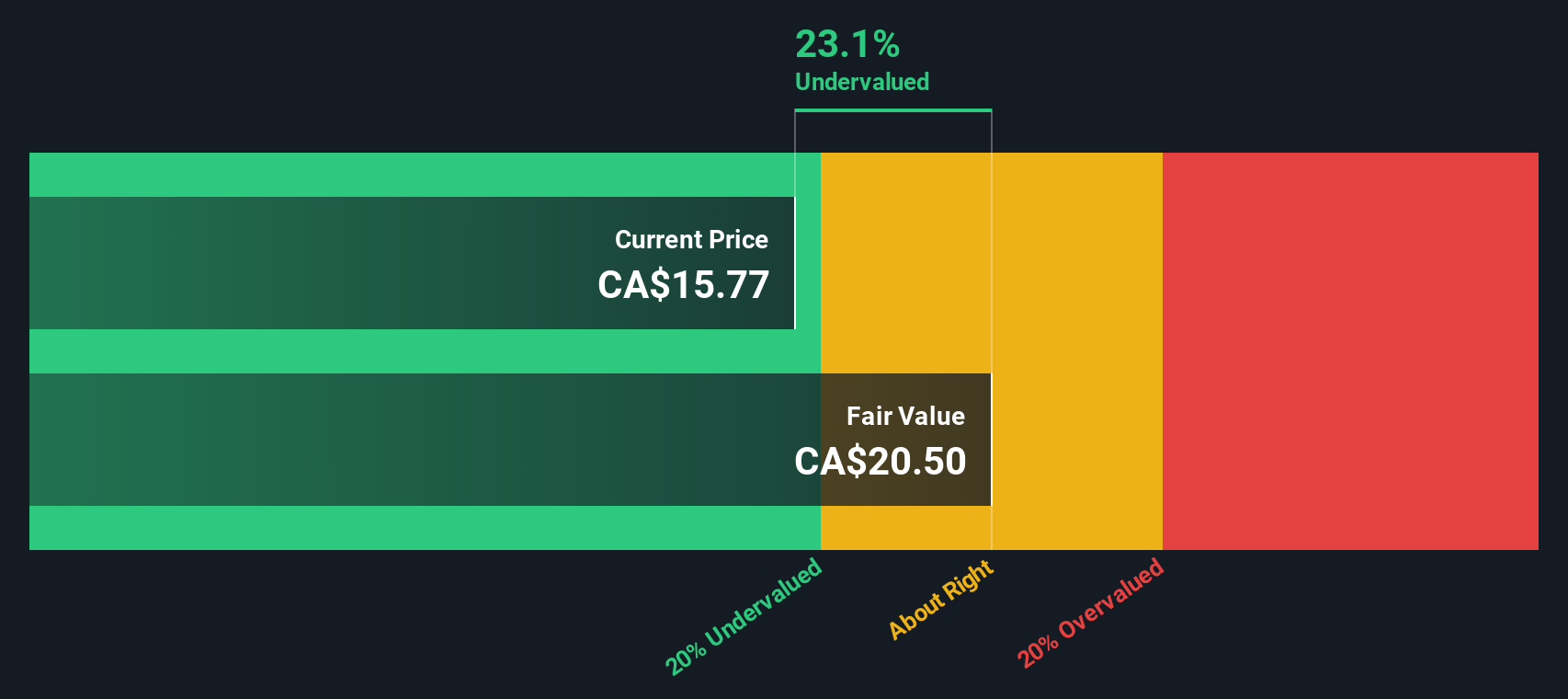

Overview: Badger Infrastructure Solutions focuses on providing non-destructive excavating services, with a market cap of approximately CAD $1.19 billion.

Operations: The company's revenue primarily comes from its Non-Destructive Excavating Services, amounting to $717.10 million. Over recent periods, the gross profit margin has shown an upward trend, reaching 28.29% by the latest quarter in 2024.

PE: 24.6x

Badger Infrastructure Solutions, a Canadian small-cap, reported increased second-quarter sales of US$186.84 million and net income of US$11.91 million, reflecting steady growth from the previous year. Despite high debt levels and reliance on external borrowing, insider confidence is evident with recent share purchases in 2024. The company has maintained its dividend at C$0.18 per share for Q3 2024 and is considering a share repurchase program, indicating potential strategic moves to enhance shareholder value.

Sagicor Financial (TSX:SFC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Sagicor Financial operates in the insurance and financial services industry, providing life insurance and related products through its segments Sagicor Life, Sagicor Jamaica, and Sagicor Life USA, with a market capitalization of approximately $1.82 billion.

Operations: Sagicor Financial generates revenue primarily from its segments: Sagicor Jamaica, Sagicor Life, and Sagicor Life USA. The company reported a gross profit margin of 48.19% as of June 30, 2023. Operating expenses and non-operating expenses significantly impact net income, with recent figures showing a net income margin of 13.33% for the period ending September 30, 2023.

PE: 1.4x

Sagicor Financial, a Canadian small-cap stock, is experiencing significant insider confidence as Gilbert Palter purchased 225,000 shares for US$1.26 million in 2024. The company reported a net loss of US$40.24 million for Q2 2024, contrasting with last year's profit of US$48.84 million, indicating financial challenges ahead with earnings forecasted to decline by 72% annually over the next three years. Despite these hurdles, Sagicor continues its tradition of dividend payments and share repurchases totaling $9.79 million since June 2023.

VersaBank (TSX:VBNK)

Simply Wall St Value Rating: ★★★★☆☆

Overview: VersaBank operates as a digital bank offering financial services and cybersecurity solutions, with a market cap of CA$0.42 billion.

Operations: VersaBank generates revenue primarily from its Digital Banking segment, contributing CA$105.16 million, and its DRTC division, which focuses on cybersecurity services and financial technology development, adding CA$10.75 million. The company consistently achieves a gross profit margin of 100%, with net income margins showing an upward trend from 6.43% in October 2013 to over 40% by July 2024. Operating expenses are largely driven by general and administrative costs, reaching CA$50.18 million in the latest period reported.

PE: 11.9x

VersaBank, a Canadian financial institution, showcases potential as an undervalued stock with forecasted earnings growth of 30.36% annually. Despite a slight dip in quarterly net income to C$9.71 million from C$10 million the previous year, nine-month figures reveal improvement with net income rising to C$34.23 million from C$29.68 million last year. Insider confidence is evident through recent share purchases, suggesting belief in future prospects amidst consistent dividend declarations and strategic presentations at key financial forums this summer.

- Get an in-depth perspective on VersaBank's performance by reading our valuation report here.

Understand VersaBank's track record by examining our Past report.

Next Steps

- Delve into our full catalog of 22 Undervalued TSX Small Caps With Insider Buying here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal