Wall Street's Most Accurate Analysts Give Their Take On 3 Energy Stocks Delivering High-Dividend Yields

Benzinga · 10/17 11:42

During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting Analyst Stock Ratings page. Traders can sort through Benzinga's extensive database of analyst ratings, including by analyst accuracy.

Below are the ratings of the most accurate analysts for three high-yielding stocks in the energy sector.

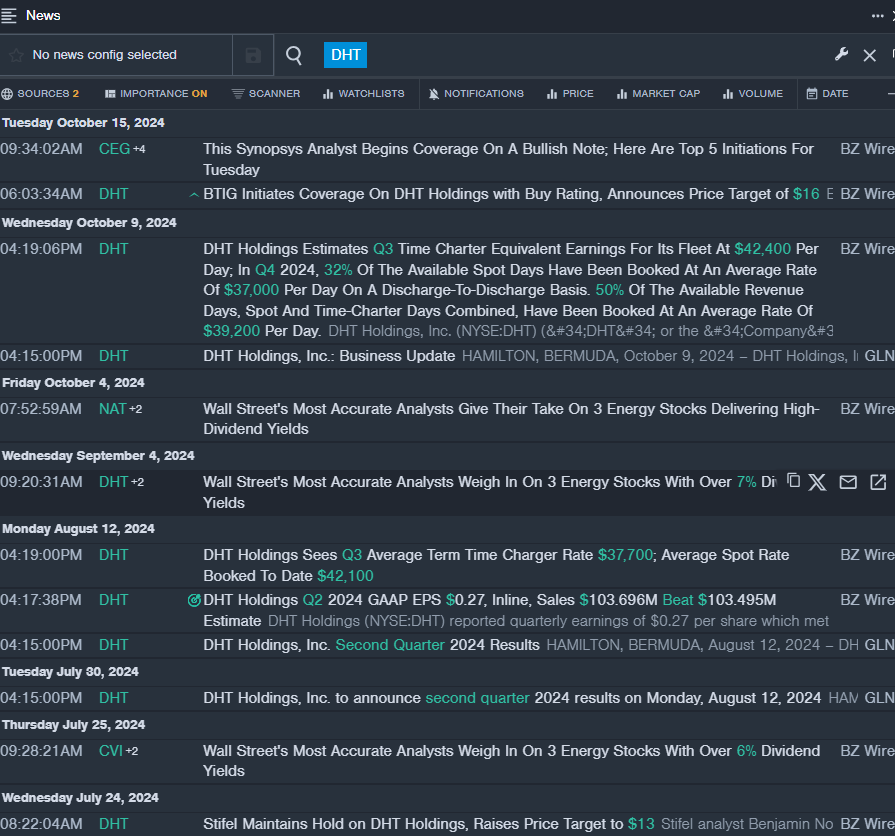

DHT Holdings, Inc. (NYSE:DHT)

- Dividend Yield: 9.64%

- BTIG analyst Gregory Lewis initiated coverage on the stock with a Buy rating and a price target of $16 on Oct. 15. This analyst has an accuracy rate of 74%.

- Stifel analyst Benjamin Nolan maintained a Hold rating and raised the price target from $12 to $13 on July 24. This analyst has an accuracy rate of 68%

- Recent News: On Oct 9, DHT Holdings said it estimates third-quarter time charter equivalent earnings for its fleet at $42,400 per day.

- Benzinga Pro's real-time newsfeed alerted to latest DHT news.

Vitesse Energy, Inc. (NYSE:VTS)

- Dividend Yield: 8.35%

- Alliance Global Partners analyst Jeff Grampp maintained a Buy rating and cut the price target from $28 to $26 on Aug. 7. This analyst has an accuracy rate of 63%.

- Roth MKM analyst John White initiated coverage on the stock with a Buy rating and a price target of $30.5 on Oct. 16, 2023. This analyst has an accuracy rate of 69%.

- Recent News: On Aug. 5, Vitesse Energy posted downbeat quarterly earnings.

- Benzinga Pro's real-time newsfeed alerted to latest VTS news.

Kinder Morgan, Inc. (NYSE:KMI)

- Dividend Yield: 4.61%

- Morgan Stanley analyst Devin McDermott upgraded the stock from Underweight to Equal-Weight with a price target of $24 on Sept. 16. This analyst has an accuracy rate of 80%.

- Barclays analyst Theresa Chen maintained an Equal-Weight rating and boosted the price target from $21 to $22 on Sept. 13. This analyst has an accuracy rate of 78%.

- Recent News: On Oct. 16, Kinder Morgan reported third-quarter revenue of $3.699 billion, missing the consensus estimate of $3.975 billion, according to Benzinga Pro.

- Benzinga Pro’s charting tool helped identify the trend in KMI stock.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal