Undiscovered Gems in the United States for October 2024

The United States market has shown robust performance, with a 1.2% increase over the last week and a remarkable 35% climb in the past year, while earnings are anticipated to grow by 15% annually in the coming years. In this thriving environment, identifying stocks that remain underappreciated yet possess strong fundamentals can offer unique opportunities for investors seeking to capitalize on potential growth.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| River Financial | 122.41% | 16.43% | 18.50% | ★★★★★★ |

| Mission Bancorp | 25.37% | 16.23% | 20.16% | ★★★★★★ |

| Teekay | NA | -6.48% | 55.79% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.12% | 10.04% | ★★★★★★ |

| Omega Flex | NA | 1.31% | 3.88% | ★★★★★★ |

| Banco Latinoamericano de Comercio Exterior S. A | 311.64% | 21.07% | 24.77% | ★★★★★☆ |

| Valhi | 38.71% | 2.57% | -19.76% | ★★★★★☆ |

| Chain Bridge Bancorp | 10.64% | 41.34% | 18.53% | ★★★★☆☆ |

| FRMO | 0.13% | 19.43% | 29.70% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Sezzle (NasdaqCM:SEZL)

Simply Wall St Value Rating: ★★★★★☆

Overview: Sezzle Inc. is a technology-enabled payments company operating mainly in the United States and Canada, with a market cap of $1.12 billion.

Operations: Sezzle generates revenue primarily through lending to end-customers, amounting to $192.69 million. The company operates with a market cap of approximately $1.12 billion.

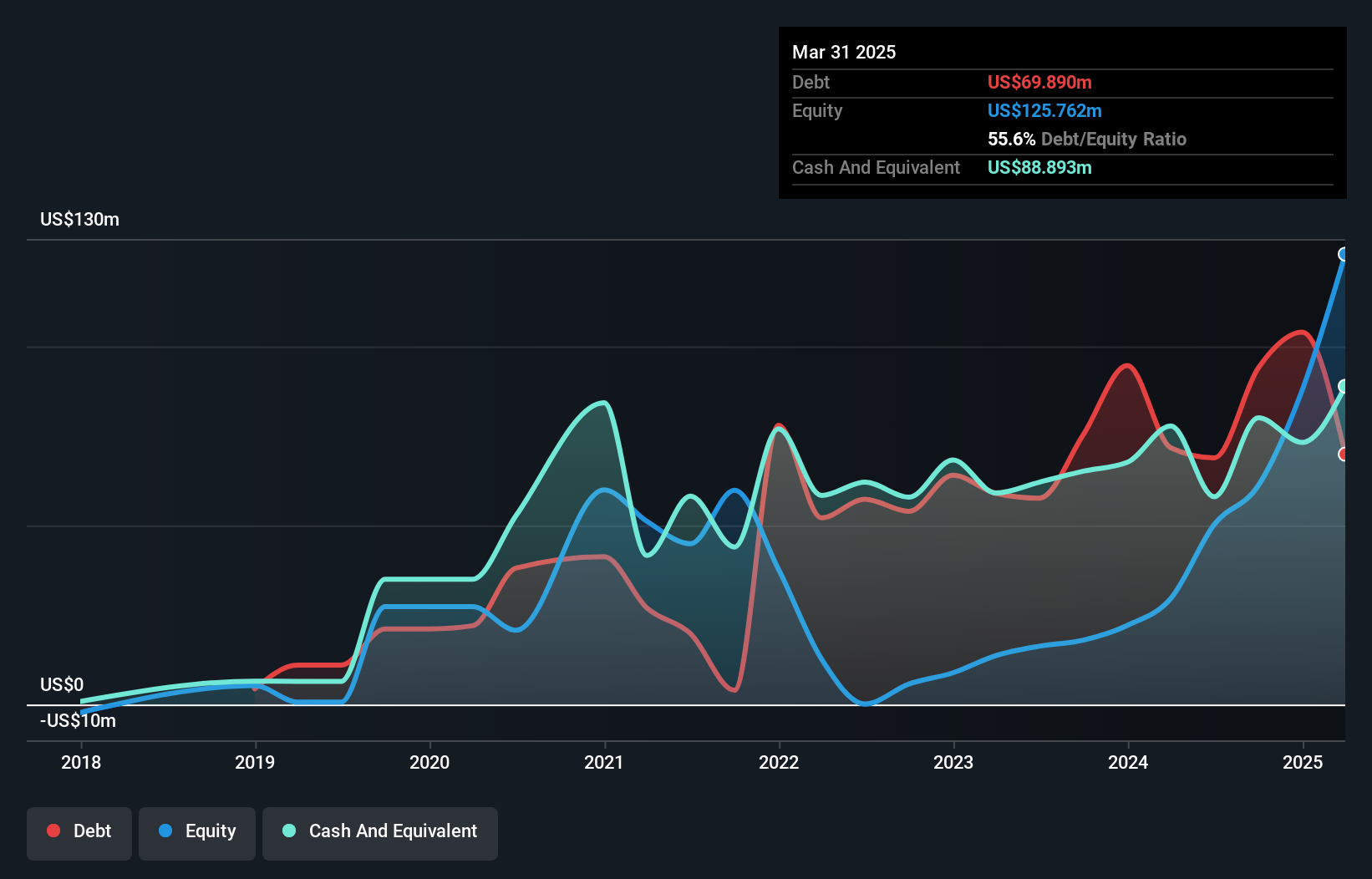

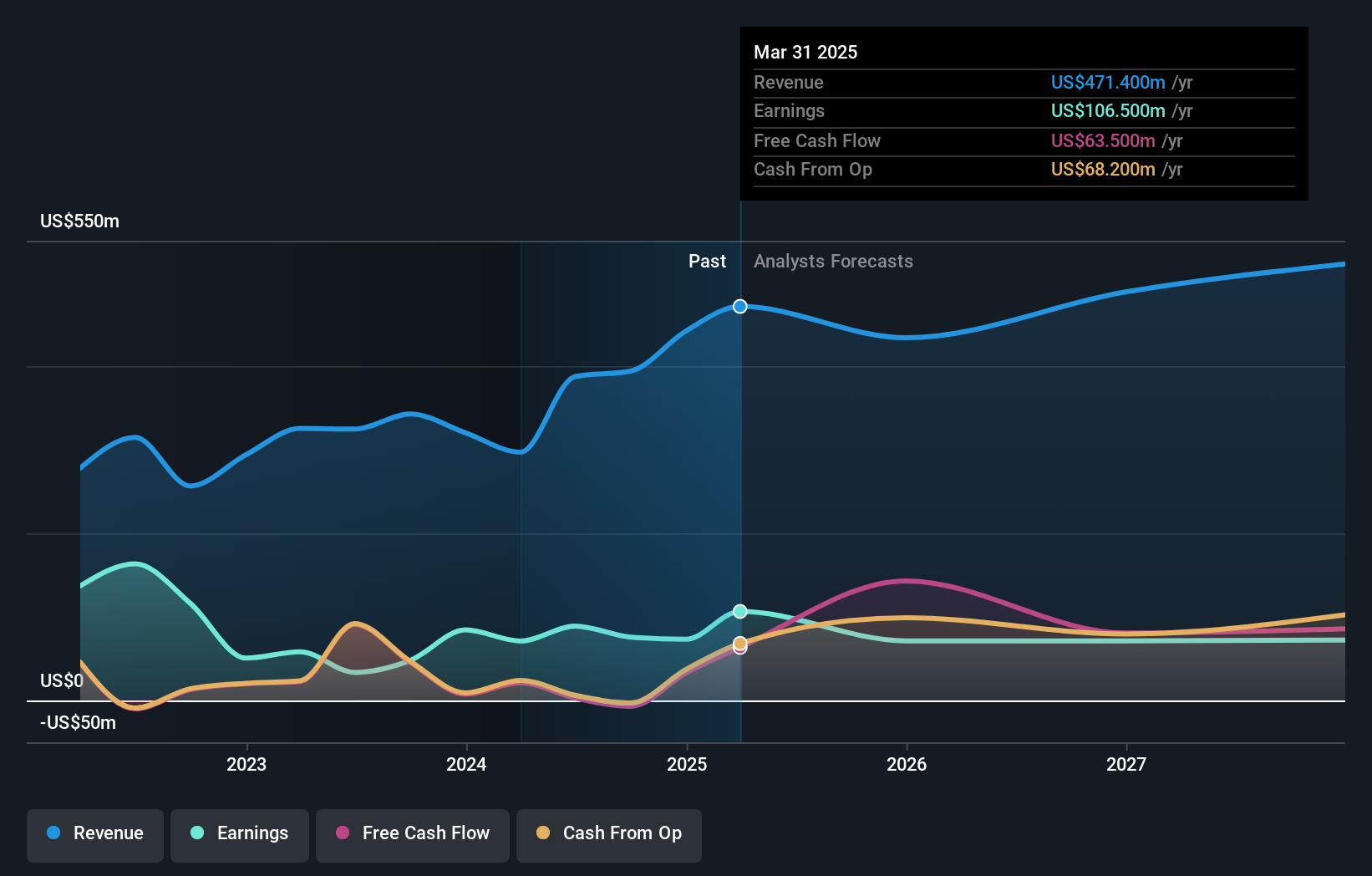

Sezzle, a growing player in the financial sector, has shown impressive earnings growth of 434.8% over the past year, outpacing its industry significantly. The company has reduced its debt to equity ratio from 1676.6% to a more manageable 137% over five years, while maintaining satisfactory net debt levels at 21.6%. Recent strategic moves include a partnership with WebBank and a multi-year deal with the Minnesota Timberwolves, reinforcing Sezzle's expanding market presence and potential for future growth.

- Click here to discover the nuances of Sezzle with our detailed analytical health report.

Assess Sezzle's past performance with our detailed historical performance reports.

Centrus Energy (NYSEAM:LEU)

Simply Wall St Value Rating: ★★★★★☆

Overview: Centrus Energy Corp. is a company that supplies nuclear fuel components and services to the nuclear power industry across various countries, with a market cap of approximately $1.26 billion.

Operations: The company generates revenue primarily from its Low-Enriched Uranium (LEU) segment, accounting for $320.80 million, and Technical Solutions segment, contributing $71.80 million.

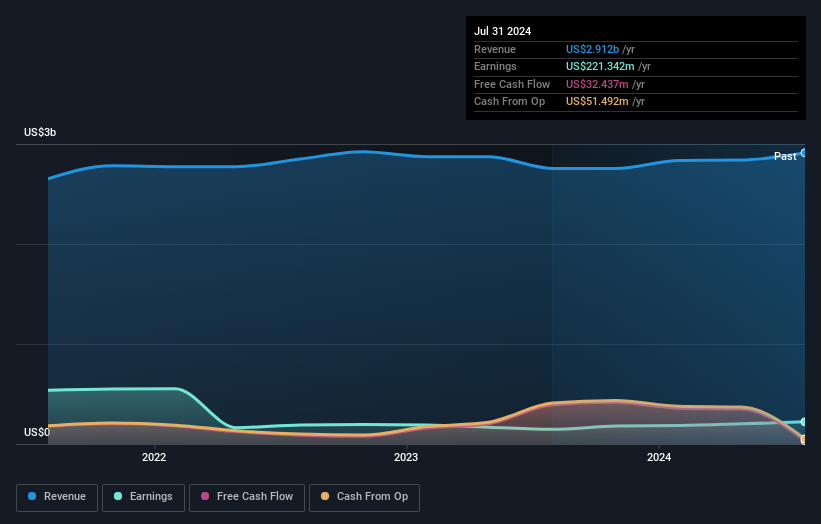

Centrus Energy, a notable player in the nuclear fuel industry, has shown remarkable growth with earnings surging 164.9% over the past year, outpacing its industry peers. Trading at 53.8% below estimated fair value, it presents an intriguing opportunity despite recent insider selling and shareholder dilution concerns. With positive free cash flow and more cash than debt, Centrus seems financially robust. Recent board appointments could further bolster its strategic direction amidst a volatile share price environment.

- Dive into the specifics of Centrus Energy here with our thorough health report.

Gain insights into Centrus Energy's historical performance by reviewing our past performance report.

Hovnanian Enterprises (NYSE:HOV)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Hovnanian Enterprises, Inc. is a company that designs, constructs, markets, and sells residential homes in the United States with a market capitalization of approximately $1.26 billion.

Operations: Hovnanian Enterprises generates revenue primarily from its homebuilding operations, with the West region contributing $1.37 billion, the Northeast $989.39 million, and the Southeast $474.97 million. The financial services segment adds an additional $70.40 million in revenue.

Hovnanian Enterprises, a US-based homebuilder, has seen impressive earnings growth of 51.3% over the past year, outpacing the Consumer Durables industry. The company reported Q3 revenue at US$722.7 million and net income of US$72.92 million, showing solid profitability with free cash flow positive status. Despite a high net debt to equity ratio of 145.9%, interest payments are well covered by EBIT at 7.6x, indicating strong financial management amidst ongoing share repurchases totaling US$48.31 million since September 2022.

Summing It All Up

- Get an in-depth perspective on all 221 US Undiscovered Gems With Strong Fundamentals by using our screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal