Undervalued Small Caps With Insider Action In United States For October 2024

Over the last 7 days, the United States market has risen by 1.2%, contributing to a remarkable 35% increase over the past year, with earnings forecasted to grow by 15% annually. In this thriving environment, identifying small-cap stocks that are potentially undervalued and experiencing insider activity can present intriguing opportunities for investors seeking to diversify their portfolios.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Columbus McKinnon | 21.9x | 1.0x | 40.43% | ★★★★★☆ |

| Hanover Bancorp | 10.4x | 2.4x | 42.53% | ★★★★☆☆ |

| Franklin Financial Services | 9.7x | 1.9x | 37.63% | ★★★★☆☆ |

| HighPeak Energy | 11.9x | 1.5x | 35.79% | ★★★★☆☆ |

| German American Bancorp | 14.7x | 4.9x | 44.37% | ★★★☆☆☆ |

| Citizens & Northern | 13.4x | 3.0x | 40.87% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Orion Group Holdings | NA | 0.3x | -99.10% | ★★★☆☆☆ |

| Sabre | NA | 0.5x | -42.31% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -58.58% | ★★★☆☆☆ |

Let's uncover some gems from our specialized screener.

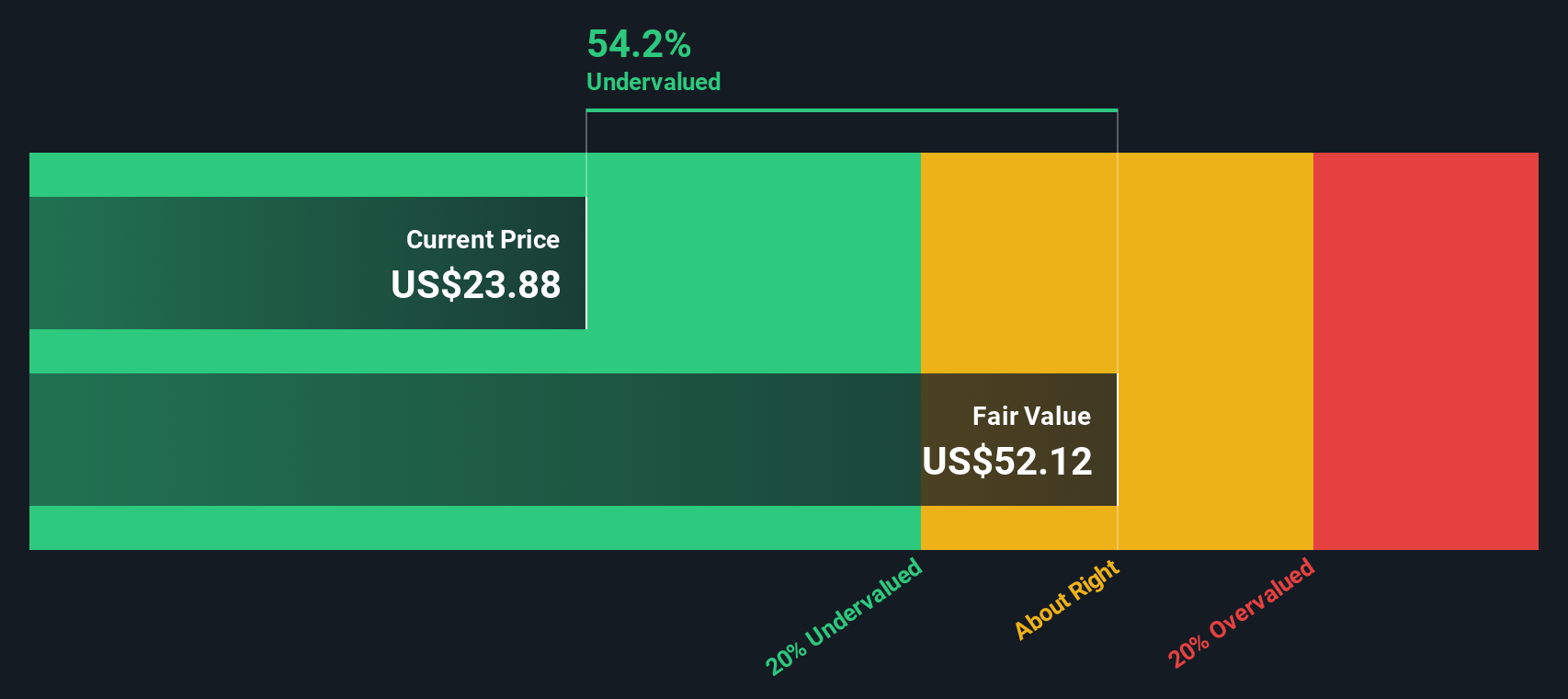

Phibro Animal Health (NasdaqGM:PAHC)

Simply Wall St Value Rating: ★★★★★☆

Overview: Phibro Animal Health is a company focused on providing animal health products, mineral nutrition solutions, and performance products, with a market cap of approximately $0.54 billion.

Operations: Phibro Animal Health generates revenue primarily from its Animal Health, Mineral Nutrition, and Performance Products segments. The company's cost of goods sold (COGS) has been increasing alongside revenue, impacting net income margins. Notably, the gross profit margin showed a varied trend over time, reaching 30.82% by June 2024. Operating expenses have also seen an upward trajectory with significant allocations towards general and administrative costs.

PE: 416.4x

Phibro Animal Health, a small company in the U.S., is drawing attention for its potential value. Despite recent financial challenges, including a drop in net income to US$2.42 million for fiscal 2024 from US$32.61 million the previous year, insider confidence is evident with share purchases observed recently. The company forecasts sales between US$1.04 billion and US$1.09 billion for fiscal 2025, driven by growth in animal health and recovery in other segments, indicating potential future prospects despite current hurdles.

- Navigate through the intricacies of Phibro Animal Health with our comprehensive valuation report here.

Understand Phibro Animal Health's track record by examining our Past report.

Sabre (NasdaqGS:SABR)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Sabre is a technology company that provides software and services to the travel industry, with operations primarily focused on its Travel Solutions and Hospitality Solutions segments, and it has a market capitalization of approximately $2.86 billion.

Operations: The company's revenue primarily derives from Travel Solutions and Hospitality Solutions, totaling $2.70 billion and $315.74 million respectively. The gross profit margin has shown significant fluctuations, reaching as high as 81.41% in 2020 before stabilizing around the mid-50s to low-60s in recent periods. Operating expenses are substantial, with research and development being a notable component of these costs.

PE: -3.0x

Sabre, a tech-focused travel solutions provider, is gaining traction with strategic partnerships and innovative technologies. Recent collaborations with Riyadh Air and Arajet highlight its role in transforming airline retailing through AI-driven platforms like SabreMosaic. Despite financial challenges, including a net loss of US$141 million for the first half of 2024, insider confidence is evident as insiders recently increased their shareholdings. The addition of Eric L. Kelly to the board further strengthens its strategic direction in technology advancements.

- Click to explore a detailed breakdown of our findings in Sabre's valuation report.

Evaluate Sabre's historical performance by accessing our past performance report.

Centuri Holdings (NYSE:CTRI)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Centuri Holdings operates in various segments with a focus on infrastructure services, and its market capitalization is $2.61 billion.

Operations: Centuri Holdings generates revenue primarily through its operations, with a significant portion of costs attributed to COGS. The company experienced fluctuations in its net income margin, reaching -7.87% as of the latest period. Gross profit margin varied over time, recorded at 8.15% in the most recent data point.

PE: -7.9x

Centuri Holdings, a smaller U.S. company, is making waves with its recent addition to the S&P Global BMI Index and strategic involvement in New York's Sunrise Wind project. This initiative not only advances the state's renewable energy goals but also supports local job creation. Despite a dip in earnings—with second-quarter sales at US$672 million versus US$806 million last year—the company projects annual revenues between US$2.5 billion and US$2.7 billion for 2024. Insider confidence is evident through share purchases, signaling potential growth prospects despite current financial challenges linked to external borrowing risks.

Seize The Opportunity

- Embark on your investment journey to our 50 Undervalued US Small Caps With Insider Buying selection here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal