US Exchange: Discovering 3 Stocks That Might Be Trading Below Estimated Value

As the United States stock market experiences a resurgence with banks surging after earnings and major indices like the Dow Jones hitting new record highs, investors are keenly observing opportunities that may arise from these fluctuations. In this environment, identifying stocks that might be trading below their estimated value can offer potential for growth, particularly as companies release strong earnings and economic indicators suggest stability.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Molina Healthcare (NYSE:MOH) | $331.00 | $657.44 | 49.7% |

| MidWestOne Financial Group (NasdaqGS:MOFG) | $29.60 | $57.34 | 48.4% |

| California Resources (NYSE:CRC) | $51.90 | $103.73 | 50% |

| Atlanticus Holdings (NasdaqGS:ATLC) | $36.28 | $72.49 | 50% |

| Avidbank Holdings (OTCPK:AVBH) | $19.60 | $37.87 | 48.2% |

| EverQuote (NasdaqGM:EVER) | $20.17 | $39.69 | 49.2% |

| ChromaDex (NasdaqCM:CDXC) | $3.56 | $7.11 | 50% |

| EVERTEC (NYSE:EVTC) | $33.47 | $65.77 | 49.1% |

| Vitesse Energy (NYSE:VTS) | $25.14 | $49.19 | 48.9% |

| Cytek Biosciences (NasdaqGS:CTKB) | $5.36 | $10.63 | 49.6% |

Let's explore several standout options from the results in the screener.

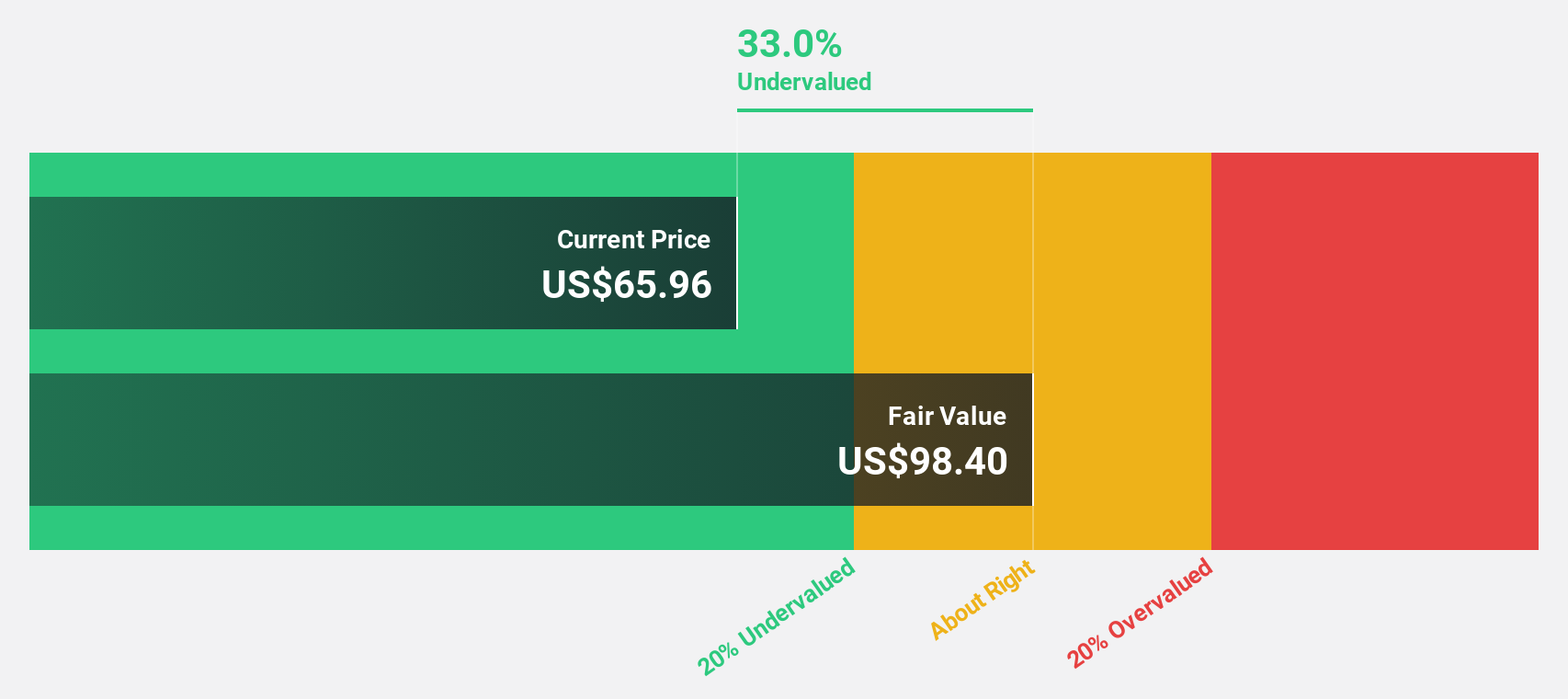

Western Digital (NasdaqGS:WDC)

Overview: Western Digital Corporation is engaged in the development, manufacturing, and sale of data storage devices and solutions across various regions globally, with a market cap of approximately $22.99 billion.

Operations: The company's revenue is primarily derived from two segments: Hard Disk Drives (HDD) at $6.32 billion and Flash-Based Products at $6.69 billion.

Estimated Discount To Fair Value: 24.7%

Western Digital is trading at US$67.79, significantly below its estimated fair value of US$90.05, suggesting undervaluation based on cash flows. The company anticipates above-market revenue growth and profitability within three years, despite low forecasted return on equity and insufficient earnings to cover interest payments. Recent product innovations in high-capacity HDDs for AI-driven data demands highlight Western Digital's strategic positioning in the storage market, potentially enhancing future cash flow prospects.

- The growth report we've compiled suggests that Western Digital's future prospects could be on the up.

- Navigate through the intricacies of Western Digital with our comprehensive financial health report here.

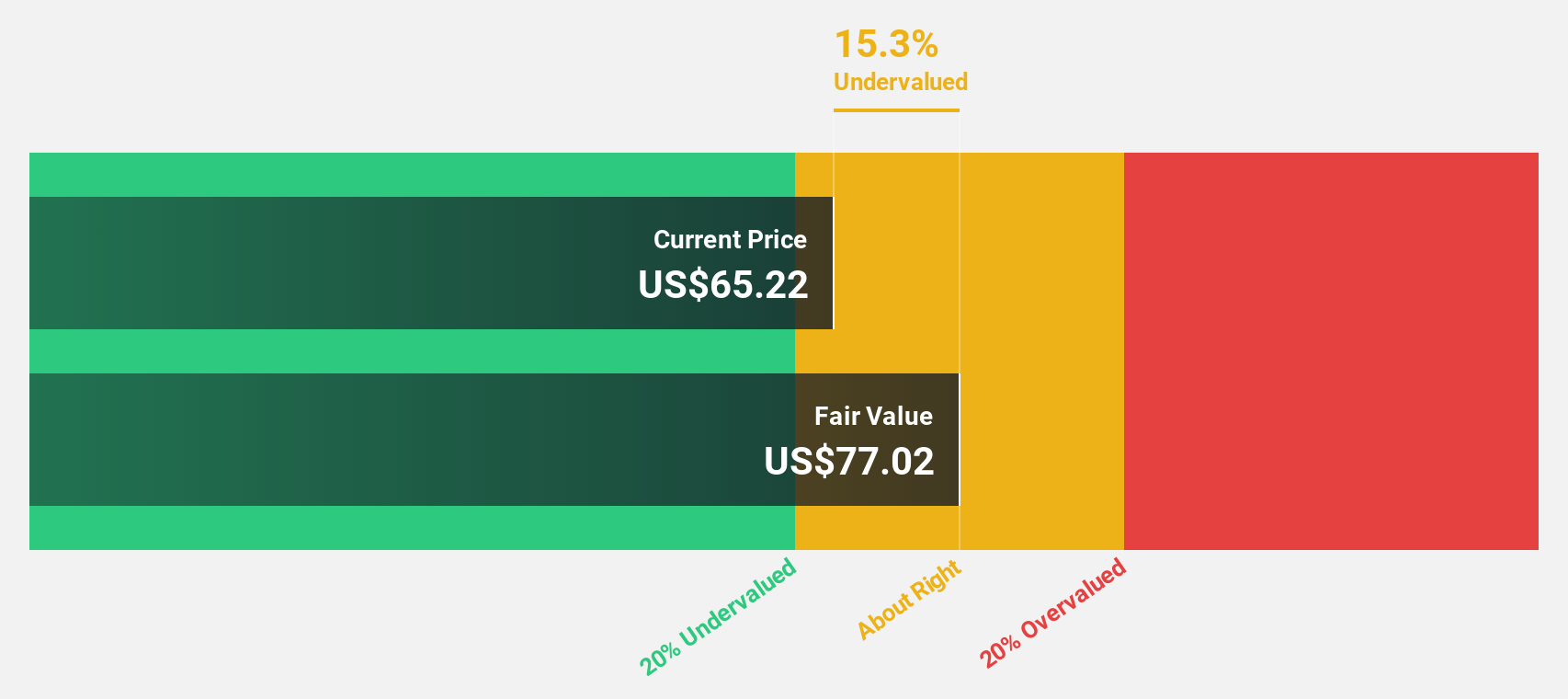

Zillow Group (NasdaqGS:ZG)

Overview: Zillow Group, Inc. operates real estate brands through mobile applications and websites in the United States, with a market cap of approximately $14.55 billion.

Operations: Zillow Group generates revenue through its real estate brands primarily via mobile applications and websites in the U.S.

Estimated Discount To Fair Value: 40.8%

Zillow Group, trading at US$61.68, is significantly undervalued with a fair value estimate of US$104.24 based on cash flows. The company anticipates revenue growth of 11.5% annually, outpacing the broader market, and aims for profitability within three years despite a modest return on equity forecast. Recent leadership changes and strategic focus on real estate technology innovation may bolster Zillow's operational efficiency and long-term cash flow potential amidst its ongoing share buyback program.

- Our comprehensive growth report raises the possibility that Zillow Group is poised for substantial financial growth.

- Dive into the specifics of Zillow Group here with our thorough financial health report.

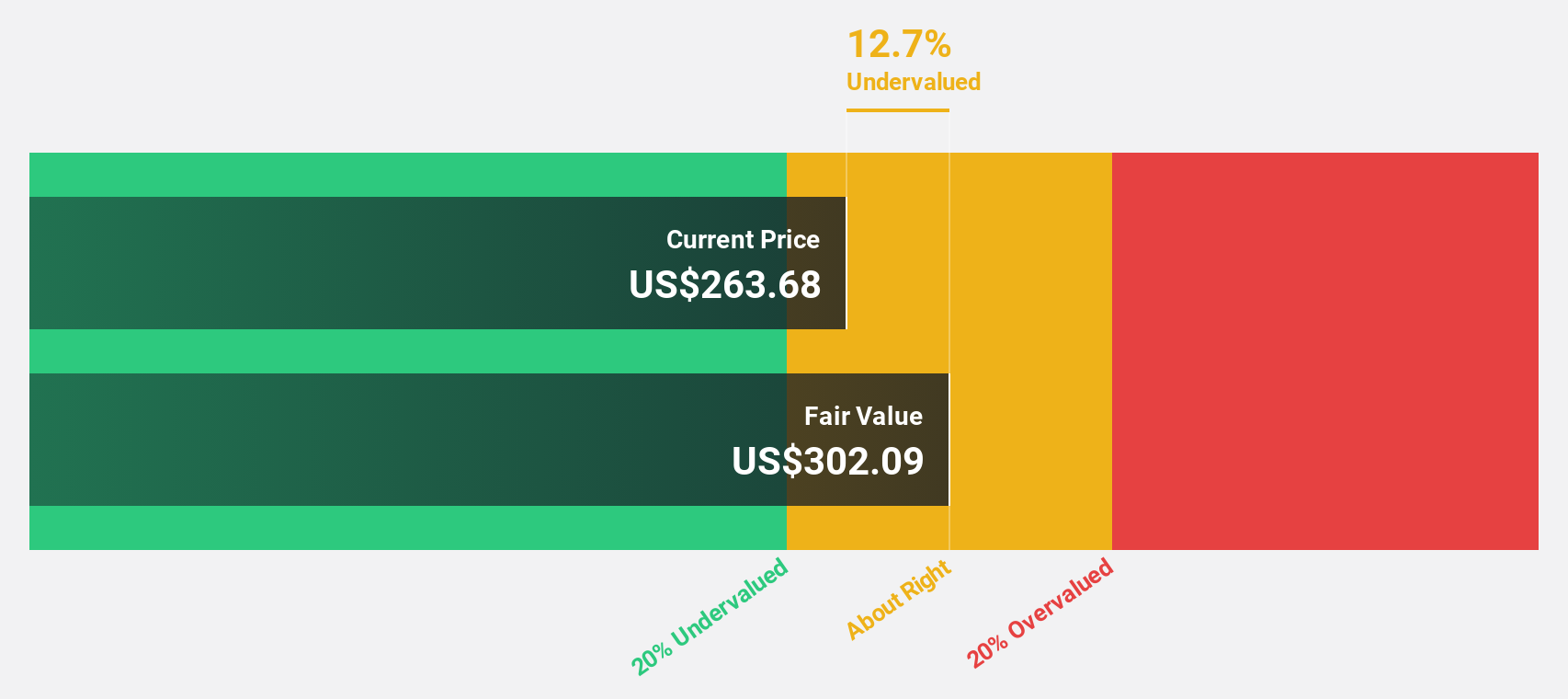

Burlington Stores (NYSE:BURL)

Overview: Burlington Stores, Inc. operates as a retailer of branded merchandise in the United States and has a market cap of approximately $16.32 billion.

Operations: The company's revenue is primarily generated from its retail segment, specifically in apparel, amounting to $10.23 billion.

Estimated Discount To Fair Value: 13.2%

Burlington Stores is trading at US$259.11, below its estimated fair value of US$298.61, indicating undervaluation based on cash flows. The company has demonstrated strong earnings growth, with net income increasing to US$73.76 million in the recent quarter from US$30.89 million a year ago. Despite high debt levels and significant insider selling recently, Burlington's projected earnings growth rate of 17.8% annually surpasses the broader market expectations.

- Our expertly prepared growth report on Burlington Stores implies its future financial outlook may be stronger than recent results.

- Delve into the full analysis health report here for a deeper understanding of Burlington Stores.

Next Steps

- Click through to start exploring the rest of the 192 Undervalued US Stocks Based On Cash Flows now.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal