3 US Growth Companies With Significant Insider Ownership

As the United States stock market experiences a surge, with banking stocks leading the charge and major indices like the Dow Jones Industrial Average reaching new highs, investors are keenly observing growth opportunities amidst fluctuating economic indicators. In this vibrant market landscape, companies with significant insider ownership often attract attention for their potential alignment of interests between management and shareholders, making them noteworthy considerations in today's investment climate.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 41.9% |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 23.4% |

| GigaCloud Technology (NasdaqGM:GCT) | 25.7% | 26% |

| Victory Capital Holdings (NasdaqGS:VCTR) | 10.2% | 33.2% |

| Super Micro Computer (NasdaqGS:SMCI) | 25.7% | 28.0% |

| Hims & Hers Health (NYSE:HIMS) | 13.7% | 37.4% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.0% | 95% |

| Carlyle Group (NasdaqGS:CG) | 29.5% | 22% |

| BBB Foods (NYSE:TBBB) | 22.9% | 51.2% |

Here's a peek at a few of the choices from the screener.

TeraWulf (NasdaqCM:WULF)

Simply Wall St Growth Rating: ★★★★★☆

Overview: TeraWulf Inc. is a digital asset technology company operating in the United States with a market cap of approximately $1.76 billion.

Operations: The company's revenue is primarily generated from its digital currency mining segment, which amounts to $120.25 million.

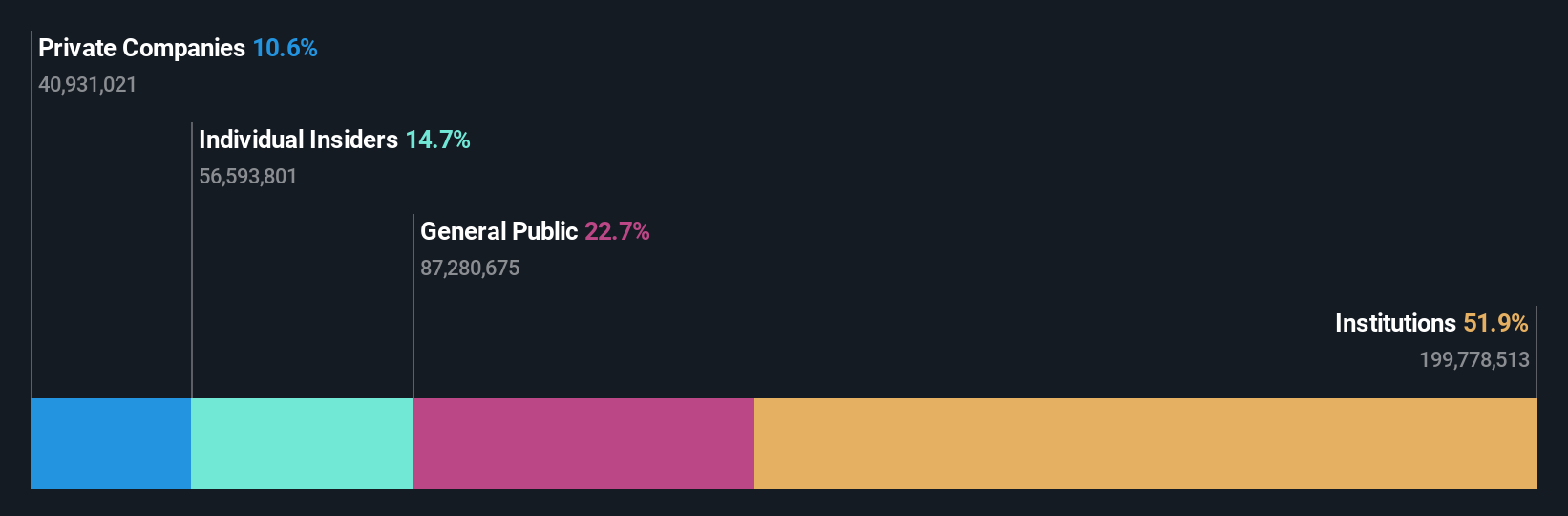

Insider Ownership: 14.7%

Earnings Growth Forecast: 108.5% p.a.

TeraWulf is experiencing significant growth, with revenue expected to increase by 53% annually, outpacing the US market. The company anticipates becoming profitable within three years. Recent strategic moves include a new 35-year ground lease at Lake Mariner for expansion into high-performance computing and AI data centers, aligning CEO interests through equity-based compensation. Despite substantial shareholder dilution in the past year and high share price volatility, these developments support its long-term growth trajectory.

- Click to explore a detailed breakdown of our findings in TeraWulf's earnings growth report.

- Our expertly prepared valuation report TeraWulf implies its share price may be too high.

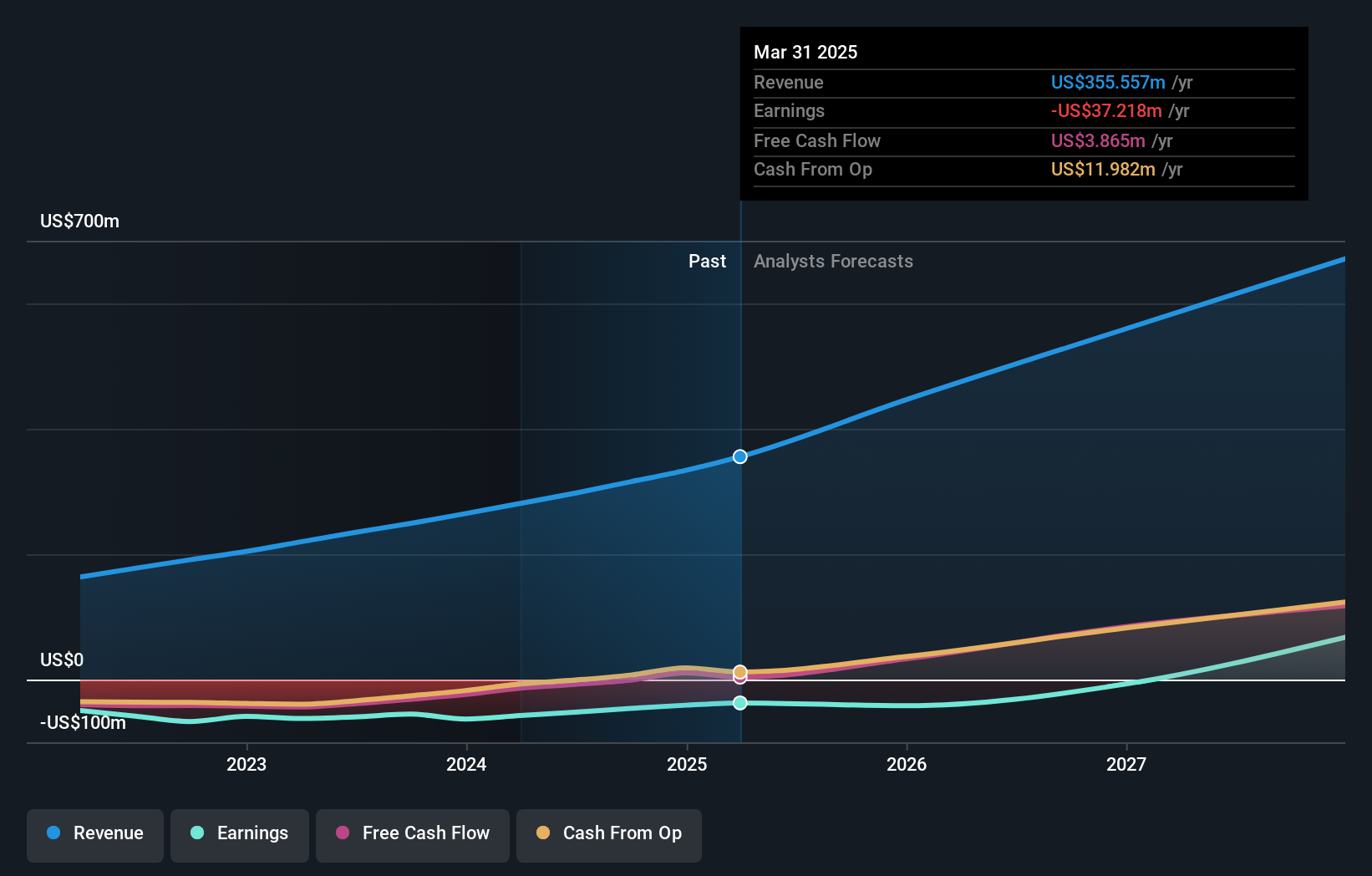

Alkami Technology (NasdaqGS:ALKT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Alkami Technology, Inc. provides cloud-based digital banking solutions in the United States and has a market cap of approximately $3.33 billion.

Operations: The company's revenue segment consists of Internet Software & Services, generating $297.36 million.

Insider Ownership: 11.3%

Earnings Growth Forecast: 98.5% p.a.

Alkami Technology is forecast to achieve a 21.4% annual revenue growth, surpassing the US market average. Although insider buying has been minimal recently, the company has seen more substantial insider selling in the past three months. Alkami's digital banking platform continues to expand through partnerships with credit unions like Nutmeg State and Intrepid, enhancing user experience and fraud protection. Despite recent shareholder dilution, its trading value remains below estimated fair value by 22.9%.

- Click here to discover the nuances of Alkami Technology with our detailed analytical future growth report.

- In light of our recent valuation report, it seems possible that Alkami Technology is trading beyond its estimated value.

Hims & Hers Health (NYSE:HIMS)

Simply Wall St Growth Rating: ★★★★★★

Overview: Hims & Hers Health, Inc. operates a telehealth platform that connects consumers to licensed healthcare professionals across the United States, the United Kingdom, and internationally, with a market cap of approximately $4.93 billion.

Operations: The company's revenue primarily comes from online retailers, totaling $1.07 billion.

Insider Ownership: 13.7%

Earnings Growth Forecast: 37.4% p.a.

Hims & Hers Health, recently added to multiple S&P indices, showcases strong growth potential with forecasted annual earnings growth of 37.4% and revenue growth of 22%, outpacing the US market. Despite past shareholder dilution and share price volatility, it became profitable this year with a net income of US$13.3 million in Q2 2024. Insider transactions have been balanced but not substantial recently, while its stock trades significantly below estimated fair value by 65.1%.

- Navigate through the intricacies of Hims & Hers Health with our comprehensive analyst estimates report here.

- Our expertly prepared valuation report Hims & Hers Health implies its share price may be lower than expected.

Seize The Opportunity

- Reveal the 188 hidden gems among our Fast Growing US Companies With High Insider Ownership screener with a single click here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal