Shareholders Should Be Pleased With Air Products and Chemicals, Inc.'s (NYSE:APD) Price

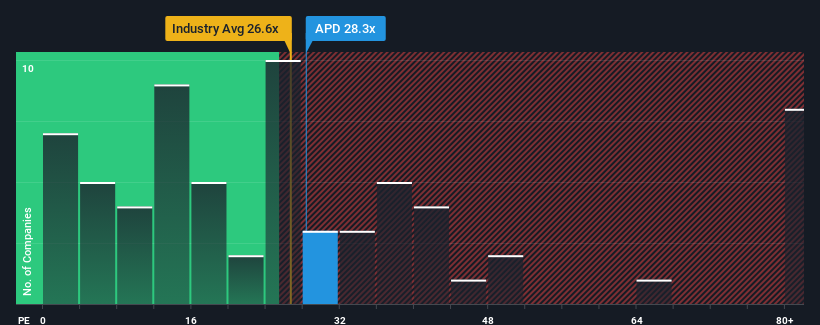

When close to half the companies in the United States have price-to-earnings ratios (or "P/E's") below 18x, you may consider Air Products and Chemicals, Inc. (NYSE:APD) as a stock to avoid entirely with its 28.3x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Air Products and Chemicals has been doing quite well of late. It seems that many are expecting the company to continue defying the broader market adversity, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

Check out our latest analysis for Air Products and Chemicals

Is There Enough Growth For Air Products and Chemicals?

In order to justify its P/E ratio, Air Products and Chemicals would need to produce outstanding growth well in excess of the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 18% last year. Pleasingly, EPS has also lifted 31% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 13% each year during the coming three years according to the analysts following the company. Meanwhile, the rest of the market is forecast to only expand by 10% each year, which is noticeably less attractive.

With this information, we can see why Air Products and Chemicals is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Air Products and Chemicals maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Air Products and Chemicals you should know about.

If these risks are making you reconsider your opinion on Air Products and Chemicals, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal