Unveiling 3 Undiscovered Gems in India with Strong Potential

In the last week, the Indian market has stayed flat, yet it boasts a remarkable 40% rise over the past year with earnings forecast to grow by 17% annually. In this promising environment, identifying stocks with strong potential often involves looking for companies that are poised to benefit from robust earnings growth and have not yet captured widespread attention.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| All E Technologies | NA | 40.78% | 31.63% | ★★★★★★ |

| Goldiam International | 0.74% | 10.81% | 15.85% | ★★★★★★ |

| Suraj | 27.47% | 17.95% | 67.29% | ★★★★★★ |

| Le Travenues Technology | 10.32% | 26.39% | 67.32% | ★★★★★★ |

| ELANTAS Beck India | NA | 14.89% | 24.83% | ★★★★★★ |

| Om Infra | 13.99% | 43.36% | 27.66% | ★★★★★☆ |

| Macpower CNC Machines | 0.40% | 22.04% | 31.09% | ★★★★★☆ |

| Ingersoll-Rand (India) | 1.05% | 14.88% | 27.54% | ★★★★★☆ |

| SG Mart | 16.77% | 98.09% | 96.54% | ★★★★☆☆ |

| Abans Holdings | 91.77% | 13.13% | 18.72% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

IFB Industries (NSEI:IFBIND)

Simply Wall St Value Rating: ★★★★★☆

Overview: IFB Industries Limited, along with its subsidiaries, is engaged in the manufacturing and trading of home appliances both in India and globally, with a market capitalization of ₹87.48 billion.

Operations: IFB Industries generates revenue primarily from its Home Appliances segment, contributing ₹36.32 billion, followed by the Engineering segment at ₹8.55 billion. The company also derives income from its Steel and Motor segments, with revenues of ₹1.65 billion and ₹670.70 million, respectively.

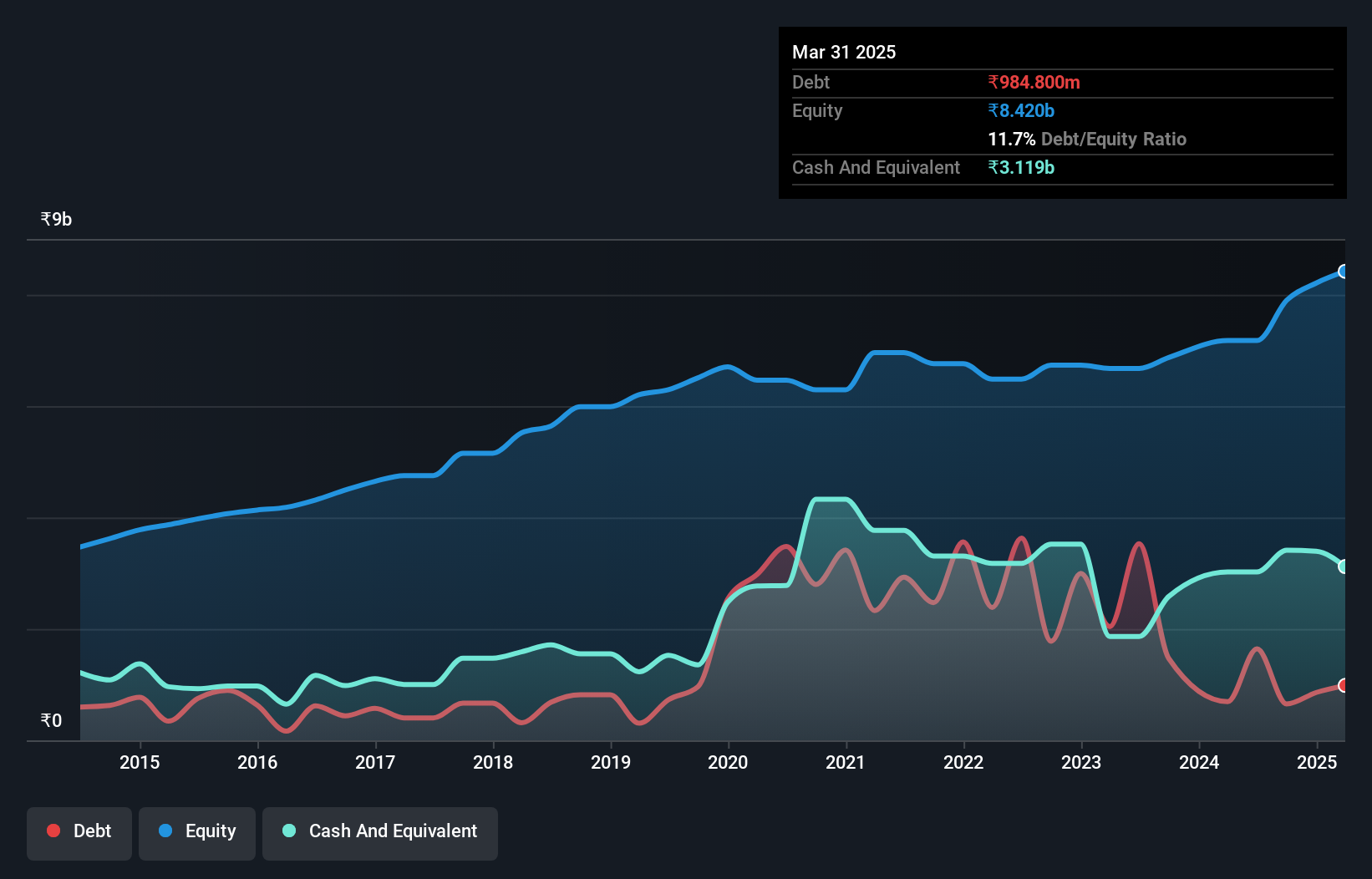

IFB Industries, a small player in the consumer durables sector, has seen its earnings skyrocket by 612.7% over the past year, outpacing industry growth of 16.6%. The company reported a net income of ₹375.4 million for Q1 2025, bouncing back from a loss of ₹6.2 million the previous year. With more cash than total debt and interest payments well covered at 7.5x EBIT, IFB's financial health appears robust despite an increased debt-to-equity ratio from 11.6% to 22.9% over five years.

- Take a closer look at IFB Industries' potential here in our health report.

Review our historical performance report to gain insights into IFB Industries''s past performance.

Ingersoll-Rand (India) (NSEI:INGERRAND)

Simply Wall St Value Rating: ★★★★★☆

Overview: Ingersoll-Rand (India) Limited is a company that focuses on manufacturing and selling industrial air compressors in India, with a market capitalization of ₹145.19 billion.

Operations: The primary revenue stream for Ingersoll-Rand (India) Limited is its Air Solutions segment, generating ₹12.27 billion. The company's market capitalization stands at ₹145.19 billion.

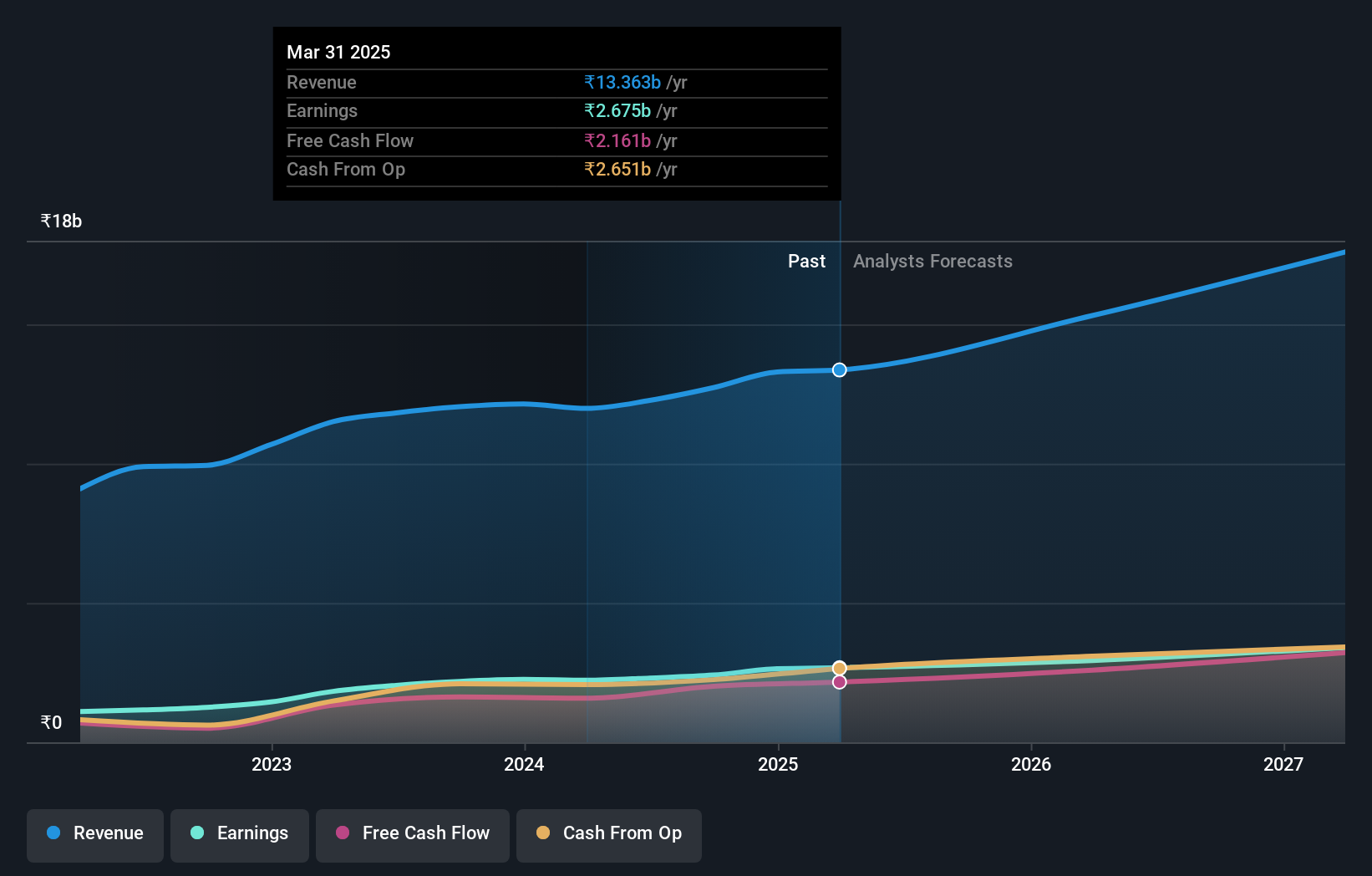

Ingersoll-Rand (India) stands out with its robust financial health, boasting more cash than total debt and a positive free cash flow of INR 1.58 billion as of March 2024. Despite earnings growth lagging behind the machinery industry at 12.9% over the past year, it has achieved a solid annual growth rate of 27.5% over five years. Recent earnings show revenue increased to INR 3,229 million with net income rising to INR 618 million, reflecting strong performance amidst executive changes and dividend affirmations.

- Navigate through the intricacies of Ingersoll-Rand (India) with our comprehensive health report here.

Evaluate Ingersoll-Rand (India)'s historical performance by accessing our past performance report.

Time Technoplast (NSEI:TIMETECHNO)

Simply Wall St Value Rating: ★★★★★★

Overview: Time Technoplast Limited is involved in the manufacture and sale of polymer and composite products both in India and internationally, with a market capitalization of ₹104.73 billion.

Operations: The company generates revenue primarily from two segments: Polymer Products, contributing ₹33.43 billion, and Composite Products, adding ₹18 billion.

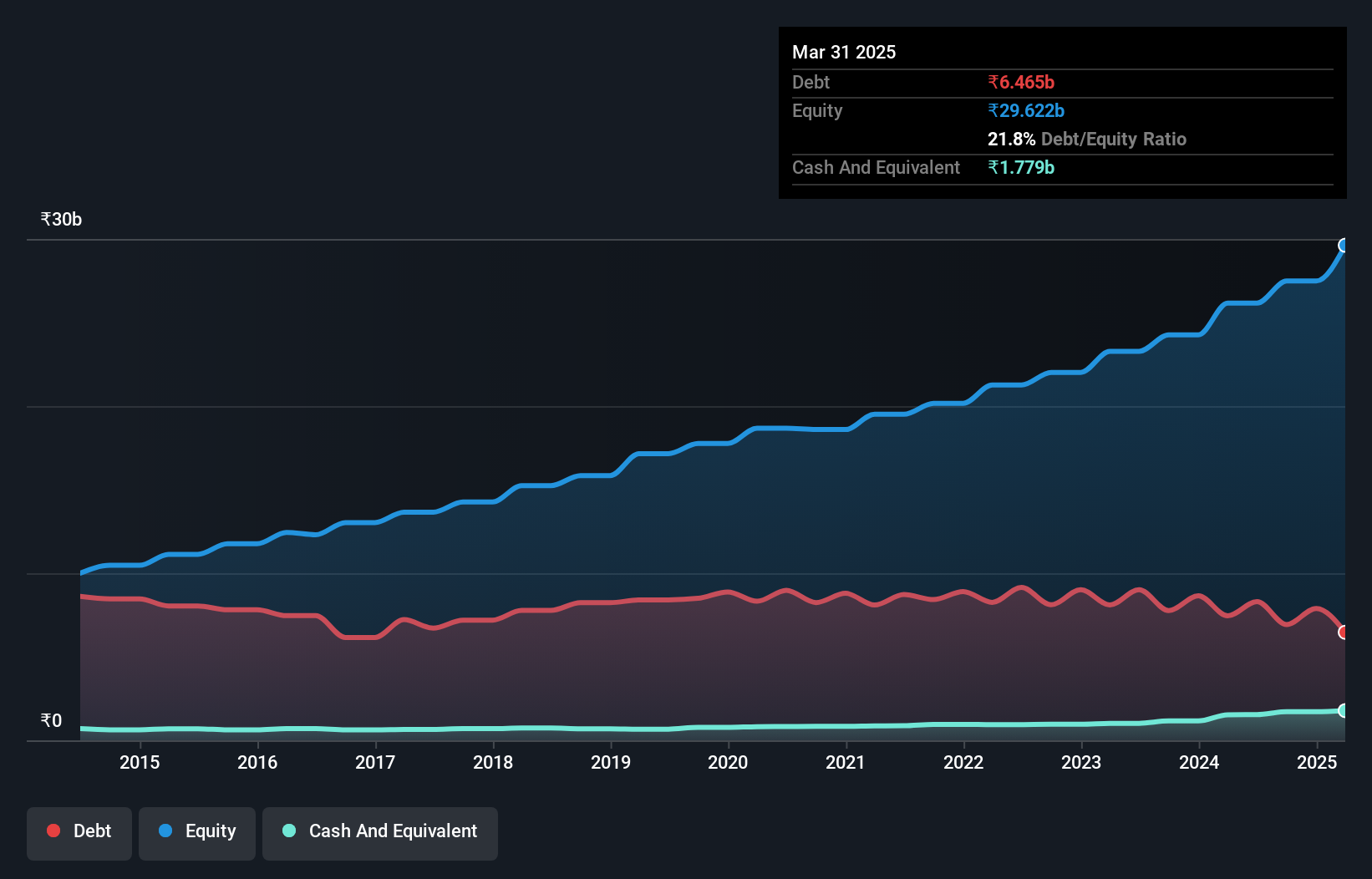

Time Technoplast, a notable player in the packaging industry, showcases impressive figures with earnings growth of 44.6% over the past year, outpacing the sector's 8.7%. The company's net debt to equity ratio stands at a satisfactory 25.9%, reflecting sound financial health as it reduced from 49% to 31.7% over five years. Recent developments include a dividend increase to INR 2 per share and securing an INR 672 million contract for CNG storage solutions, highlighting robust operational performance and strategic expansions.

Next Steps

- Dive into all 469 of the Indian Undiscovered Gems With Strong Fundamentals we have identified here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal