October 2024 Growth Stocks With High Insider Ownership On Indian Exchange

The Indian market has shown remarkable resilience, remaining flat over the past week while achieving a 40% increase over the last year, with earnings anticipated to grow by 17% annually in the coming years. In this context, growth companies with high insider ownership can be particularly appealing as they often indicate strong management confidence and alignment of interests with shareholders.

Top 10 Growth Companies With High Insider Ownership In India

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 34% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 30.1% |

| Jupiter Wagons (NSEI:JWL) | 10.8% | 27.4% |

| Dixon Technologies (India) (NSEI:DIXON) | 24.6% | 30.8% |

| Paisalo Digital (BSE:532900) | 16.3% | 24.8% |

| Apollo Hospitals Enterprise (NSEI:APOLLOHOSP) | 10.4% | 32.3% |

| Rajratan Global Wire (BSE:517522) | 18.3% | 35.8% |

| Pricol (NSEI:PRICOLLTD) | 25.5% | 24% |

| KEI Industries (BSE:517569) | 19.2% | 22.9% |

| Aether Industries (NSEI:AETHER) | 31.1% | 45.8% |

Let's dive into some prime choices out of the screener.

Dixon Technologies (India) (NSEI:DIXON)

Simply Wall St Growth Rating: ★★★★★★

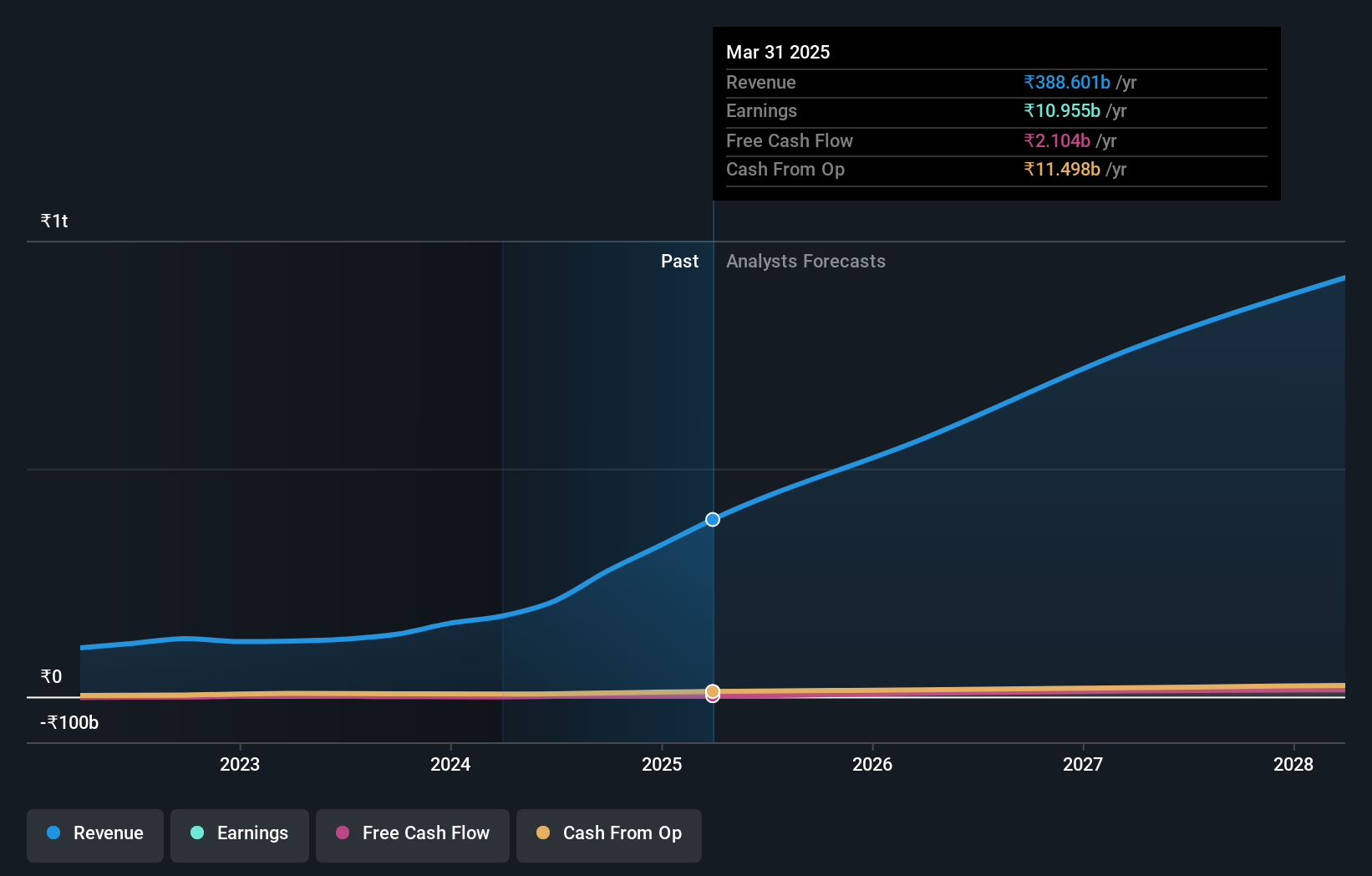

Overview: Dixon Technologies (India) Limited provides electronic manufacturing services both domestically and internationally, with a market cap of ₹921.75 billion.

Operations: The company's revenue segments include Home Appliances at ₹12.51 billion, Lighting Products at ₹7.92 billion, Mobile & EMS Division at ₹143.16 billion, and Consumer Electronics & Appliances at ₹41.21 billion.

Insider Ownership: 24.6%

Earnings Growth Forecast: 30.8% p.a.

Dixon Technologies (India) shows strong growth potential with earnings forecasted to grow significantly at 30.77% annually, outpacing the Indian market's 17.4%. Revenue is also expected to rise by 23.7% per year, surpassing the market's 10.2%. Recent financial results highlight robust performance, with first-quarter sales reaching ₹65.8 billion and net income of ₹1.34 billion, doubling from the previous year. High insider ownership aligns interests with shareholders, supporting long-term growth strategies amidst leadership changes and strategic meetings.

- Delve into the full analysis future growth report here for a deeper understanding of Dixon Technologies (India).

- Our valuation report here indicates Dixon Technologies (India) may be overvalued.

Five-Star Business Finance (NSEI:FIVESTAR)

Simply Wall St Growth Rating: ★★★★★☆

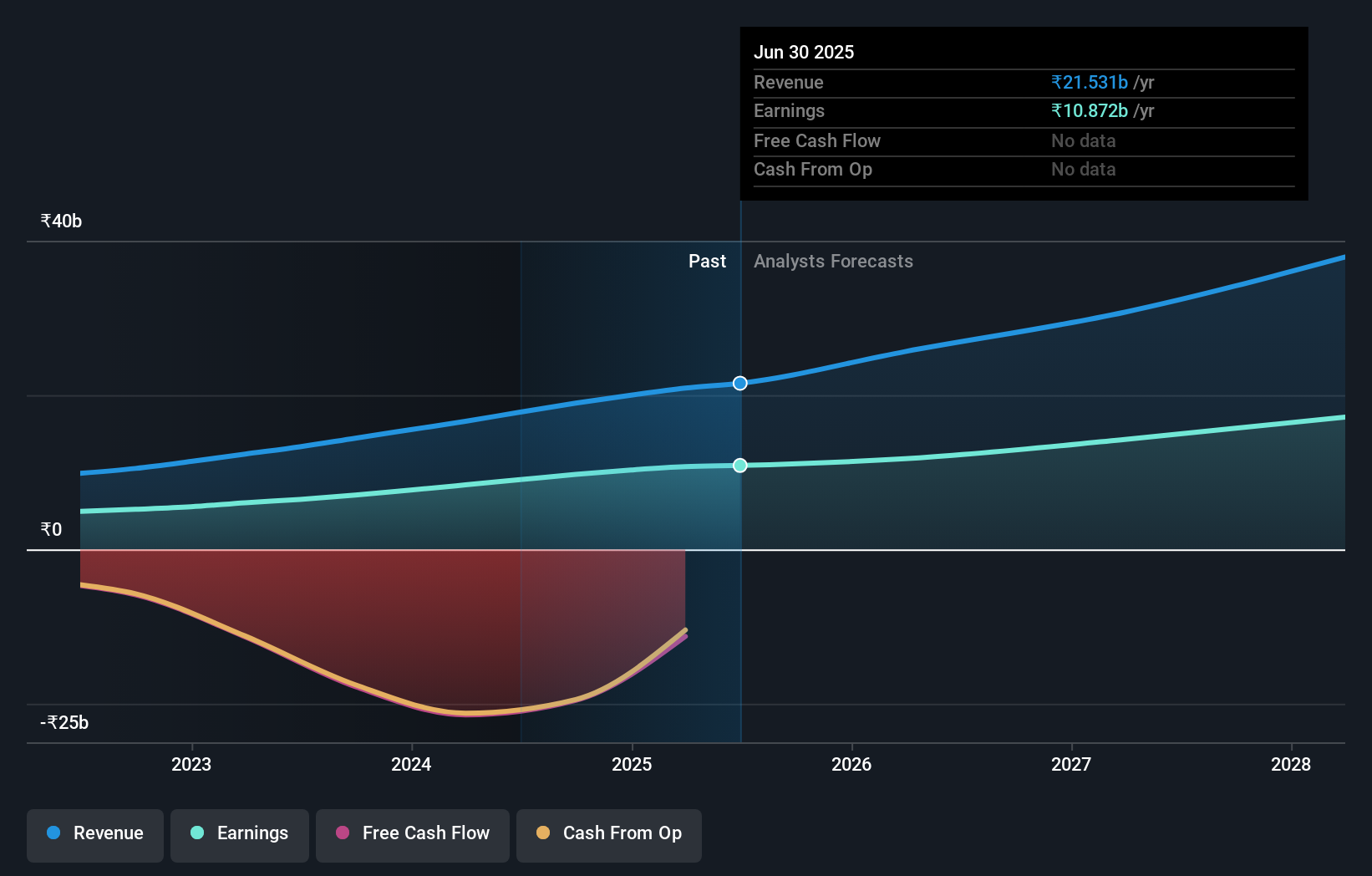

Overview: Five-Star Business Finance Limited is a non-banking financial company in India with a market capitalization of ₹263.35 billion.

Operations: The company's revenue primarily comes from MSME Loans, Housing Loans, and Property Loans, totaling ₹17.79 billion.

Insider Ownership: 18.7%

Earnings Growth Forecast: 20.5% p.a.

Five-Star Business Finance demonstrates strong growth prospects, with earnings and revenue forecasted to grow significantly at 20.5% and 21.9% annually, respectively, outpacing the Indian market averages. The company recently approved issuing non-convertible debentures totaling ₹25 billion to bolster financial strategies. Insider participation remains steady with no significant buying or selling activity reported in recent months. Leadership changes aim to sustain growth momentum following its successful IPO in November 2022.

- Click to explore a detailed breakdown of our findings in Five-Star Business Finance's earnings growth report.

- Insights from our recent valuation report point to the potential overvaluation of Five-Star Business Finance shares in the market.

Varun Beverages (NSEI:VBL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Varun Beverages Limited, along with its subsidiaries, operates as a franchisee for PepsiCo's carbonated soft drinks and non-carbonated beverages, with a market cap of ₹1.98 trillion.

Operations: The company's revenue primarily comes from the manufacturing and sale of beverages, amounting to ₹180.52 billion.

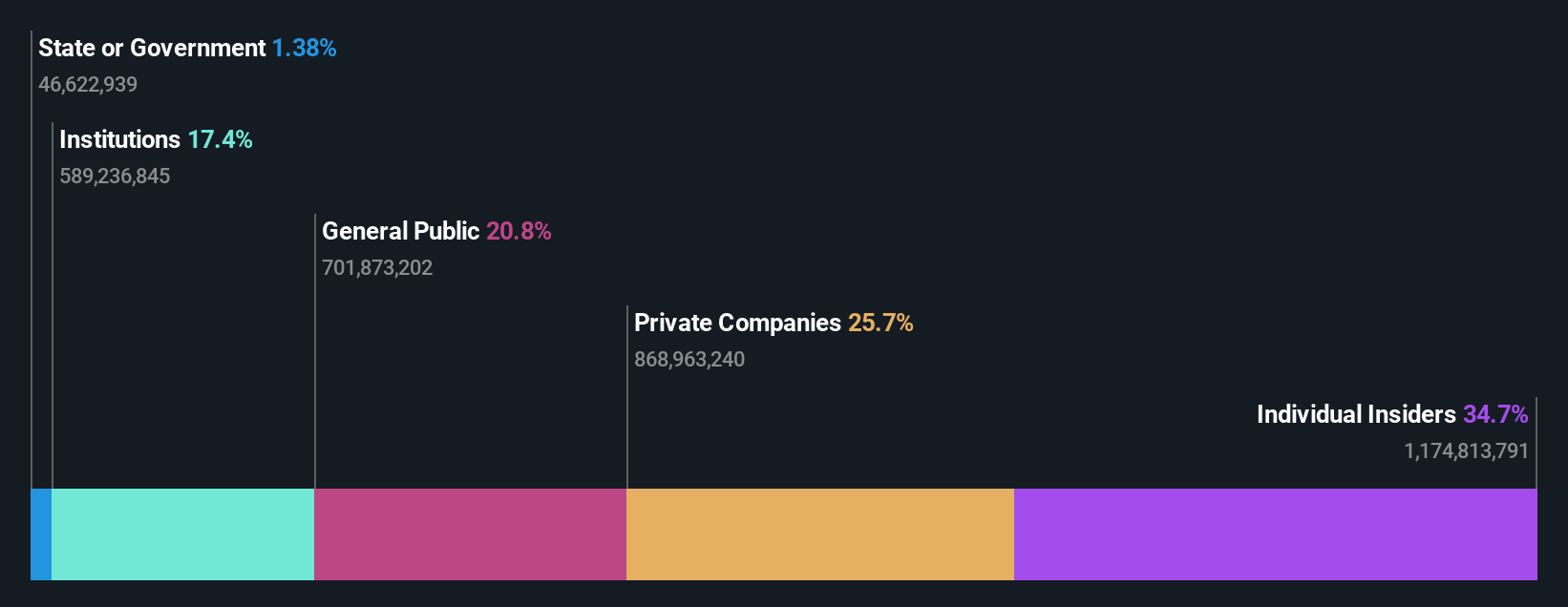

Insider Ownership: 36.2%

Earnings Growth Forecast: 22.4% p.a.

Varun Beverages is poised for robust growth, with earnings projected to rise significantly at 22.38% annually, surpassing the Indian market average. The company plans to raise ₹75 billion through a Qualified Institutional Placement to fund expansions and debt management. Recent investments include a $50 million Pepsi facility in the DRC, enhancing its strategic global presence. Despite high debt levels, Varun Beverages' substantial insider ownership aligns interests with shareholders, supporting long-term growth objectives.

- Dive into the specifics of Varun Beverages here with our thorough growth forecast report.

- Our comprehensive valuation report raises the possibility that Varun Beverages is priced higher than what may be justified by its financials.

Next Steps

- Get an in-depth perspective on all 87 Fast Growing Indian Companies With High Insider Ownership by using our screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal