Uncovering Hong Kong's Undiscovered Gems This October 2024

As global markets experience varied economic shifts, the Hong Kong market has captured attention amid broader concerns about China's economic stimulus and a notable decline in the Hang Seng Index. Despite these challenges, opportunities may exist within small-cap stocks that demonstrate resilience and potential for growth in uncertain times. Identifying such undiscovered gems requires focusing on companies with strong fundamentals and innovative strategies that can navigate and thrive despite current market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Hong Kong

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| E-Commodities Holdings | 21.33% | 9.04% | 28.46% | ★★★★★★ |

| C&D Property Management Group | 1.32% | 37.15% | 41.55% | ★★★★★★ |

| Changjiu Holdings | NA | 11.84% | 2.46% | ★★★★★★ |

| ManpowerGroup Greater China | NA | 14.56% | 1.58% | ★★★★★★ |

| Sundart Holdings | 0.92% | -2.32% | -3.94% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Xin Point Holdings | 1.77% | 10.88% | 22.83% | ★★★★★☆ |

| S.A.S. Dragon Holdings | 60.96% | 4.62% | 10.02% | ★★★★★☆ |

| Carote | 2.36% | 85.09% | 92.12% | ★★★★★☆ |

| Billion Industrial Holdings | 3.63% | 18.00% | -11.38% | ★★★★★☆ |

Let's uncover some gems from our specialized screener.

Kinetic Development Group (SEHK:1277)

Simply Wall St Value Rating: ★★★★★☆

Overview: Kinetic Development Group Limited is an investment holding company focused on the extraction and sale of coal products in the People's Republic of China, with a market capitalization of HK$14.16 billion.

Operations: Kinetic Development Group generates revenue primarily through the extraction and sale of coal products in China. The company's financial performance is influenced by its ability to manage costs associated with coal production and market fluctuations affecting coal prices.

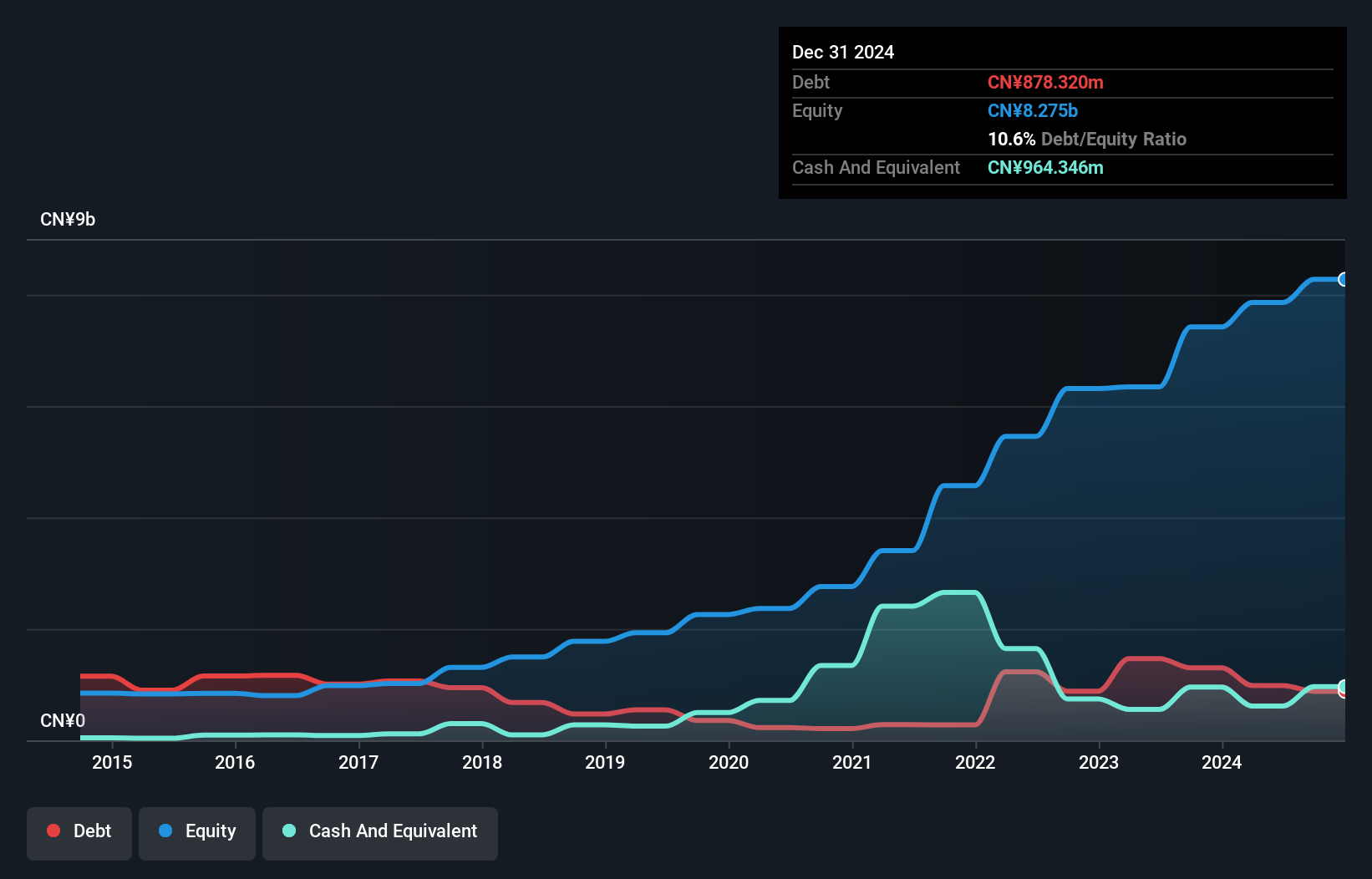

Kinetic Development Group, a dynamic player in Hong Kong's market, is trading at 56% below its estimated fair value, suggesting potential undervaluation. Over the past year, earnings surged by 39%, outpacing the Oil and Gas industry growth of 4.6%. The company's debt-to-equity ratio has impressively reduced from 28.4% to 12.5% over five years, reflecting prudent financial management. Recent announcements include a special dividend of HKD 0.04 per share and interim sales reaching CNY 2.53 billion from CNY 1.49 billion last year.

Sprocomm Intelligence (SEHK:1401)

Simply Wall St Value Rating: ★★★★★☆

Overview: Sprocomm Intelligence Limited is an investment holding company involved in the research and development, design, manufacture, and sale of mobile phones across China, India, Algeria, Bangladesh, and other international markets with a market capitalization of HK$5.53 billion.

Operations: Sprocomm Intelligence generates revenue primarily from the sale of wireless communications equipment, amounting to CN¥3.27 billion.

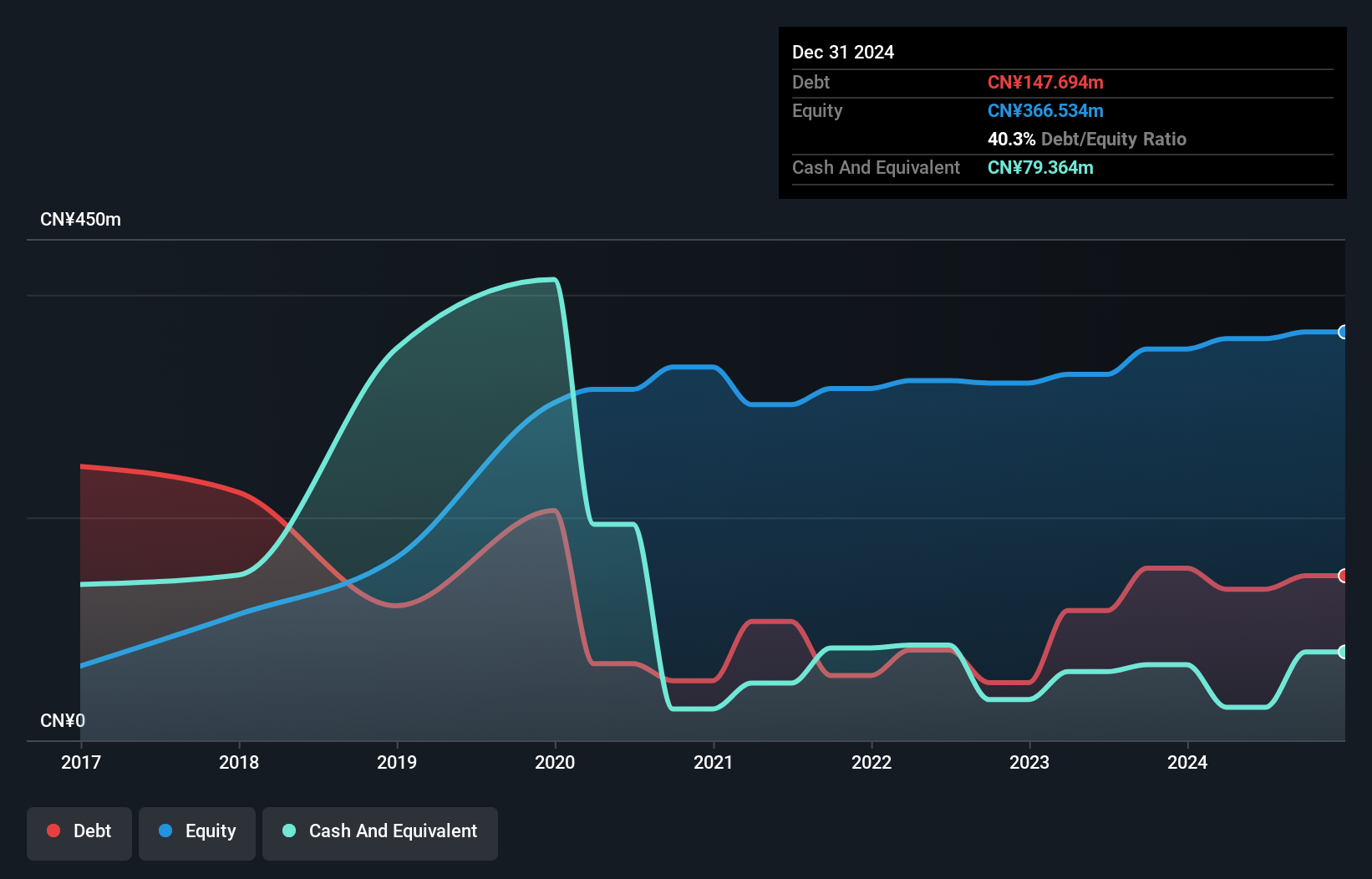

Sprocomm Intelligence, a tech player in Hong Kong, has seen its earnings grow by 301% over the past year, outpacing the broader industry's -0.6%. Despite a satisfactory net debt to equity ratio of 29.4%, interest payments are not well covered with an EBIT coverage of just 1.8 times. Recent M&A activity saw a 16.5% stake change hands twice in September for HK$200 million each time, reflecting potential investor interest in this company trading below estimated fair value.

- Click here and access our complete health analysis report to understand the dynamics of Sprocomm Intelligence.

Understand Sprocomm Intelligence's track record by examining our Past report.

Sinopec Kantons Holdings (SEHK:934)

Simply Wall St Value Rating: ★★★★★★

Overview: Sinopec Kantons Holdings Limited is an investment holding company that offers crude oil jetty services, with a market capitalization of HK$11.78 billion.

Operations: The company generates revenue primarily from its crude oil jetty and storage services, amounting to HK$632.38 million.

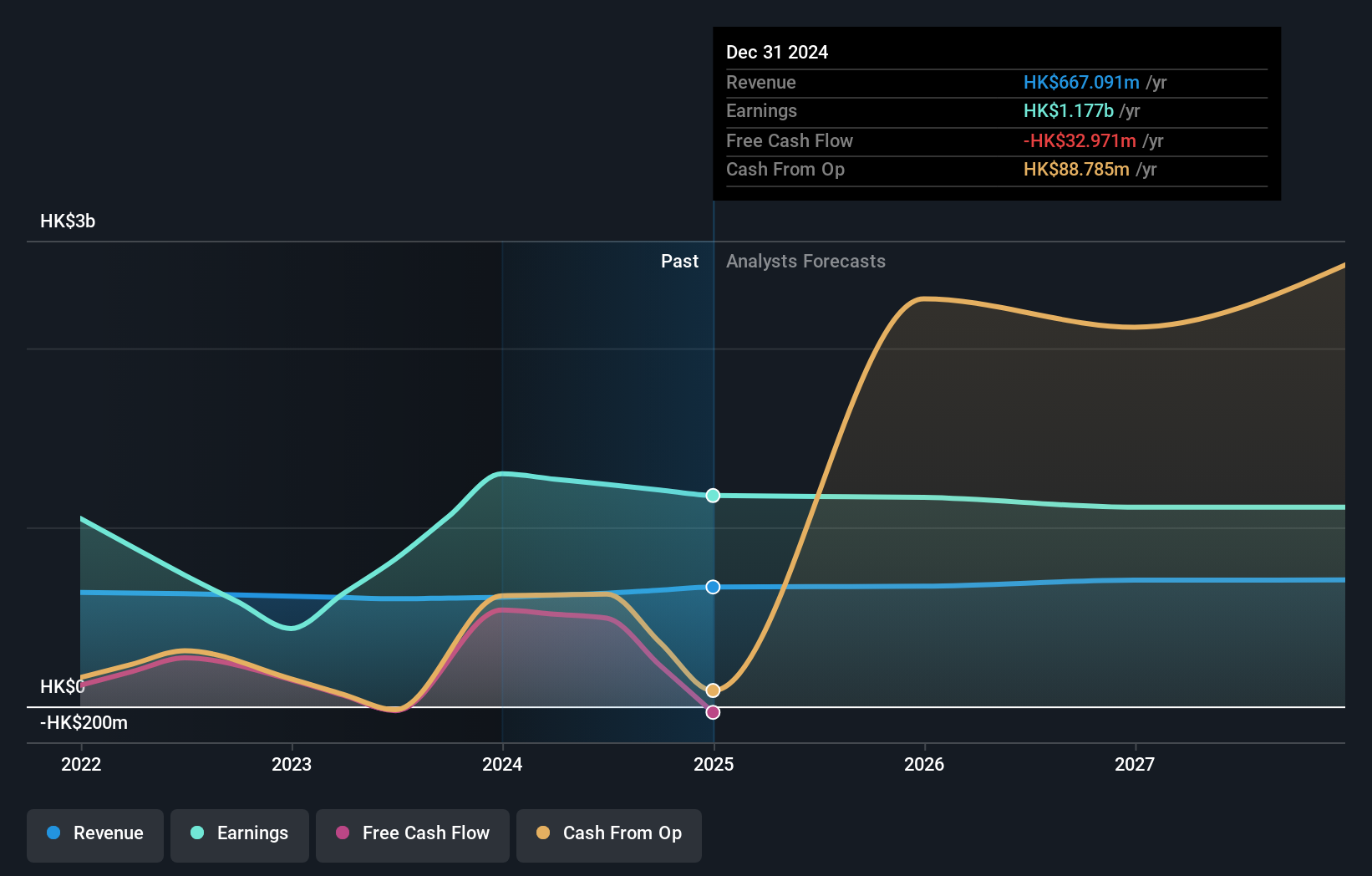

Sinopec Kantons Holdings, a Hong Kong-listed company, is trading at 59% below its estimated fair value and boasts high-quality earnings. The firm reported sales of HK$331 million for the first half of 2024, up from HK$309 million the previous year. Despite a net income dip to HK$685 million from HK$744 million, it remains debt-free with a strong cash flow position. Recent leadership changes may influence its strategic direction moving forward.

Key Takeaways

- Gain an insight into the universe of 168 SEHK Undiscovered Gems With Strong Fundamentals by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal