Exploring 3 Undiscovered Gems in the United Kingdom Market

Over the last 7 days, the United Kingdom market has remained flat, yet it has shown a promising rise of 8.8% over the past year, with earnings projected to grow by 14% annually in the coming years. In this environment, identifying stocks that are not only poised for growth but also remain underappreciated can offer unique opportunities for investors seeking to capitalize on emerging prospects.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Livermore Investments Group | NA | 9.92% | 13.65% | ★★★★★★ |

| M&G Credit Income Investment Trust | NA | 17.28% | 15.80% | ★★★★★★ |

| Metals Exploration | NA | 12.92% | 73.62% | ★★★★★★ |

| London Security | 0.22% | 10.13% | 7.75% | ★★★★★★ |

| Globaltrans Investment | 15.40% | 2.68% | 16.51% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| VH Global Sustainable Energy Opportunities | NA | 18.30% | 20.03% | ★★★★★★ |

| Kodal Minerals | NA | nan | 72.74% | ★★★★★★ |

| BBGI Global Infrastructure | 0.02% | 3.08% | 6.85% | ★★★★★☆ |

| Goodwin | 52.21% | 9.26% | 13.12% | ★★★★★☆ |

Here's a peek at a few of the choices from the screener.

Fonix (AIM:FNX)

Simply Wall St Value Rating: ★★★★★★

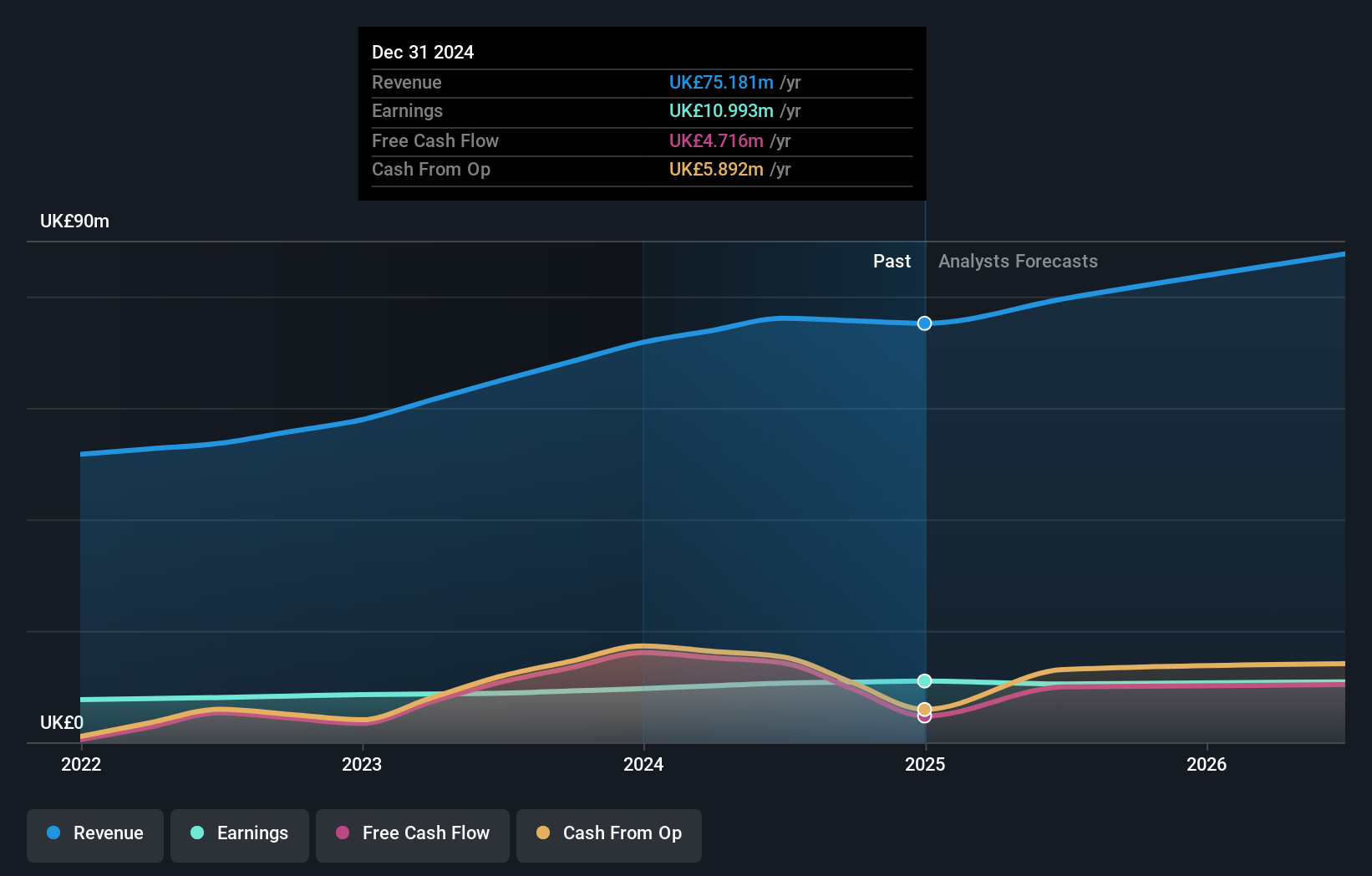

Overview: Fonix Plc is a UK-based company that offers mobile payments and messaging services, as well as managed services across sectors such as media, charity, gaming, ticketing, and mobility, with a market cap of £254.86 million.

Operations: Revenue from facilitating mobile payments and messaging services for Fonix Plc is £76.09 million.

Fonix, a nimble player in the UK market, has shown robust financial health with earnings surging 20.7% over the past year, outpacing industry growth of 2.8%. The company remains debt-free for five years and boasts high-quality earnings. Recent results highlight sales climbing to £76.09 million from £64.92 million last year, while net income rose to £10.62 million from £8.8 million. With dividends set at 77% of adjusted EPS, Fonix appears poised for continued stability and growth prospects fueled by recurring revenue streams and international expansion opportunities.

- Navigate through the intricacies of Fonix with our comprehensive health report here.

Evaluate Fonix's historical performance by accessing our past performance report.

Warpaint London (AIM:W7L)

Simply Wall St Value Rating: ★★★★★★

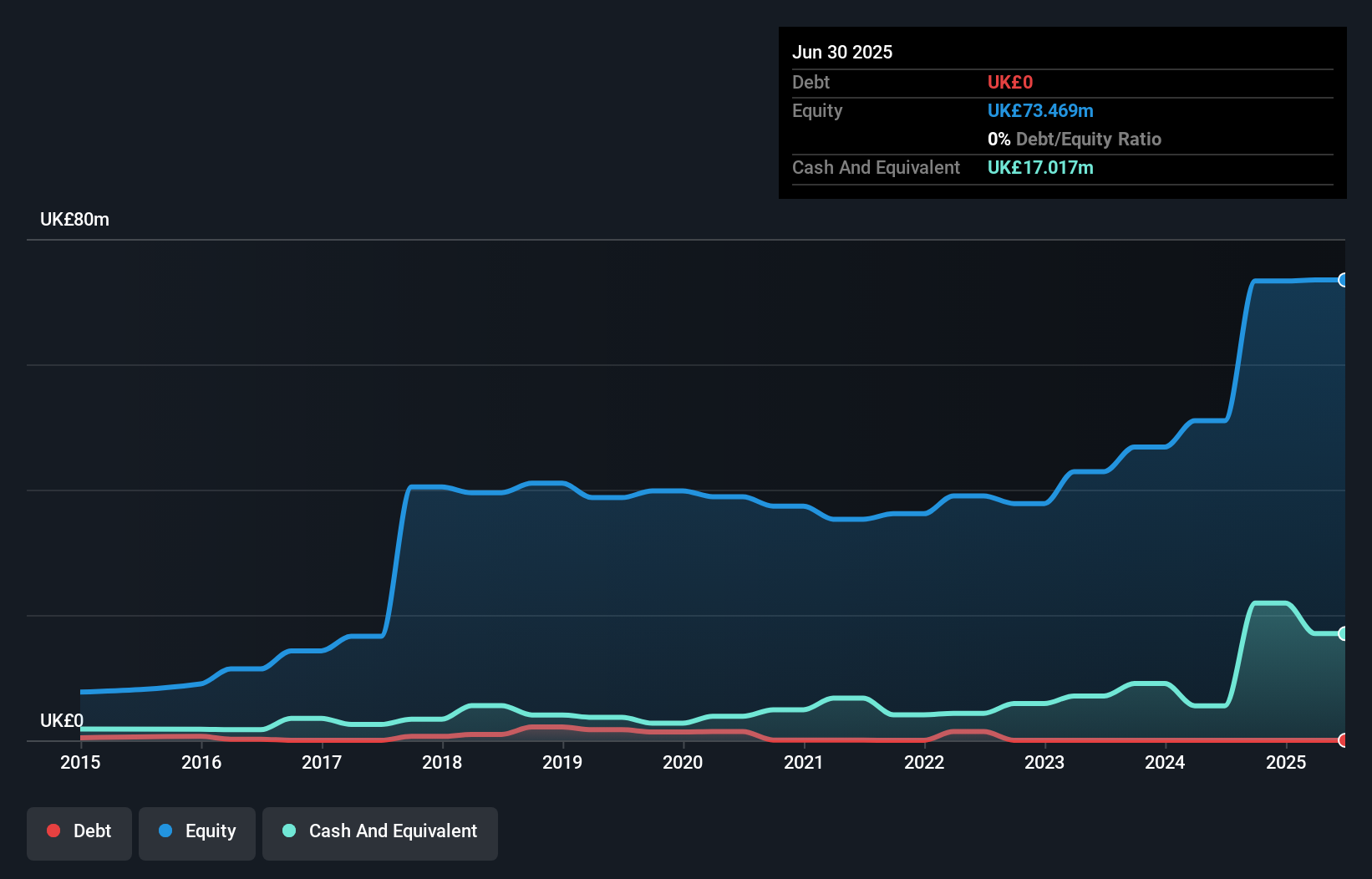

Overview: Warpaint London PLC, along with its subsidiaries, is engaged in the production and sale of cosmetics and has a market capitalization of approximately £435.36 million.

Operations: Warpaint London generates revenue primarily from its Own Brand segment, contributing £96.72 million, while the Close-Out segment adds £2.12 million.

Warpaint London, a vibrant player in the beauty sector, has captured attention with its impressive financial strides. Over the past year, earnings surged by 106%, outpacing industry growth of 7%. The company is debt-free, a significant shift from five years ago when its debt to equity ratio was 4.4%. Recent half-year results showcased sales of £45.85 million and net income of £8.02 million, reflecting robust growth compared to last year’s figures.

- Get an in-depth perspective on Warpaint London's performance by reading our health report here.

Understand Warpaint London's track record by examining our Past report.

Seplat Energy (LSE:SEPL)

Simply Wall St Value Rating: ★★★★☆☆

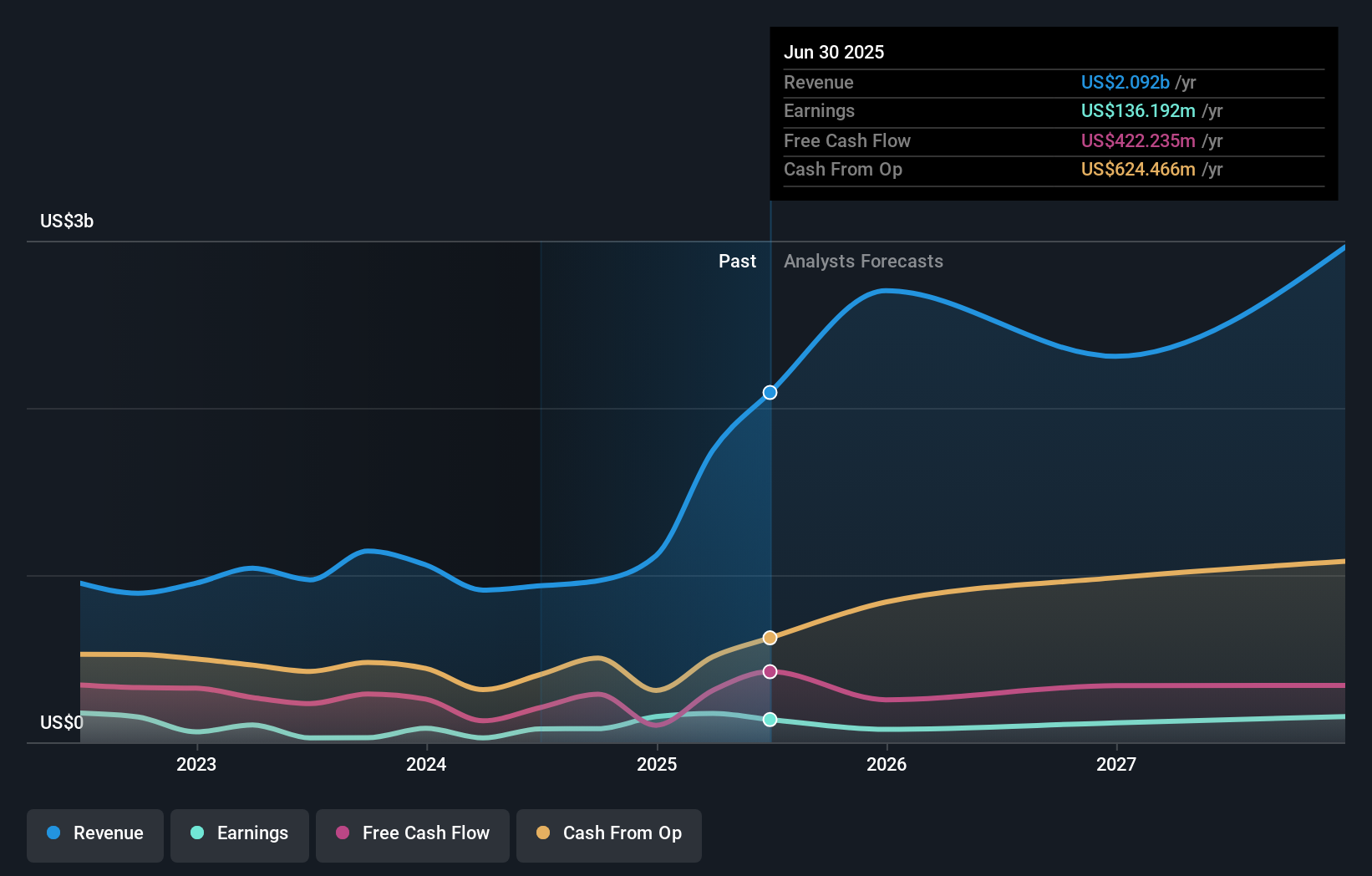

Overview: Seplat Energy Plc is involved in oil and gas exploration, production, and gas processing across Nigeria, the Bahamas, Italy, Switzerland, Barbados, and England with a market capitalization of £1.24 billion.

Operations: Seplat Energy generates revenue primarily from oil and gas, with oil contributing $815.03 million and gas $120.87 million.

Seplat Energy, a player in the oil and gas sector, experienced significant earnings growth of 207.6% last year, surpassing industry trends. While its debt to equity ratio rose from 20.6% to 41.5% over five years, the net debt to equity remains satisfactory at 20.6%. Interest payments are well-covered with EBIT at 5.8x coverage. Despite a slight dip in production from an average of 50,805 boepd to 48,407 boepd for H1 2024, Seplat reported Q2 sales of US$241 million and net income of US$39 million compared to a loss previously recorded.

- Delve into the full analysis health report here for a deeper understanding of Seplat Energy.

Gain insights into Seplat Energy's historical performance by reviewing our past performance report.

Key Takeaways

- Embark on your investment journey to our 82 UK Undiscovered Gems With Strong Fundamentals selection here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal