Discover 3 SEHK Growth Stocks With Strong Insider Ownership

As global markets navigate a complex landscape of economic shifts, the Hong Kong market has experienced its own set of challenges, with the Hang Seng Index recently witnessing a notable decline. Amidst this backdrop, growth companies with high insider ownership can offer unique insights into potential investment opportunities, as they often reflect a strong alignment between management and shareholder interests.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

| Name | Insider Ownership | Earnings Growth |

| Laopu Gold (SEHK:6181) | 36.4% | 33.2% |

| Akeso (SEHK:9926) | 20.5% | 53% |

| Fenbi (SEHK:2469) | 33.1% | 22.4% |

| Zylox-Tonbridge Medical Technology (SEHK:2190) | 18.8% | 69.8% |

| Pacific Textiles Holdings (SEHK:1382) | 11.2% | 37.7% |

| DPC Dash (SEHK:1405) | 38.1% | 106.5% |

| Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) | 13.9% | 109.2% |

| Beijing Airdoc Technology (SEHK:2251) | 29.4% | 93.4% |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15% | 69.7% |

| MicroTech Medical (Hangzhou) (SEHK:2235) | 25.8% | 105% |

Let's dive into some prime choices out of the screener.

Vobile Group (SEHK:3738)

Simply Wall St Growth Rating: ★★★★★☆

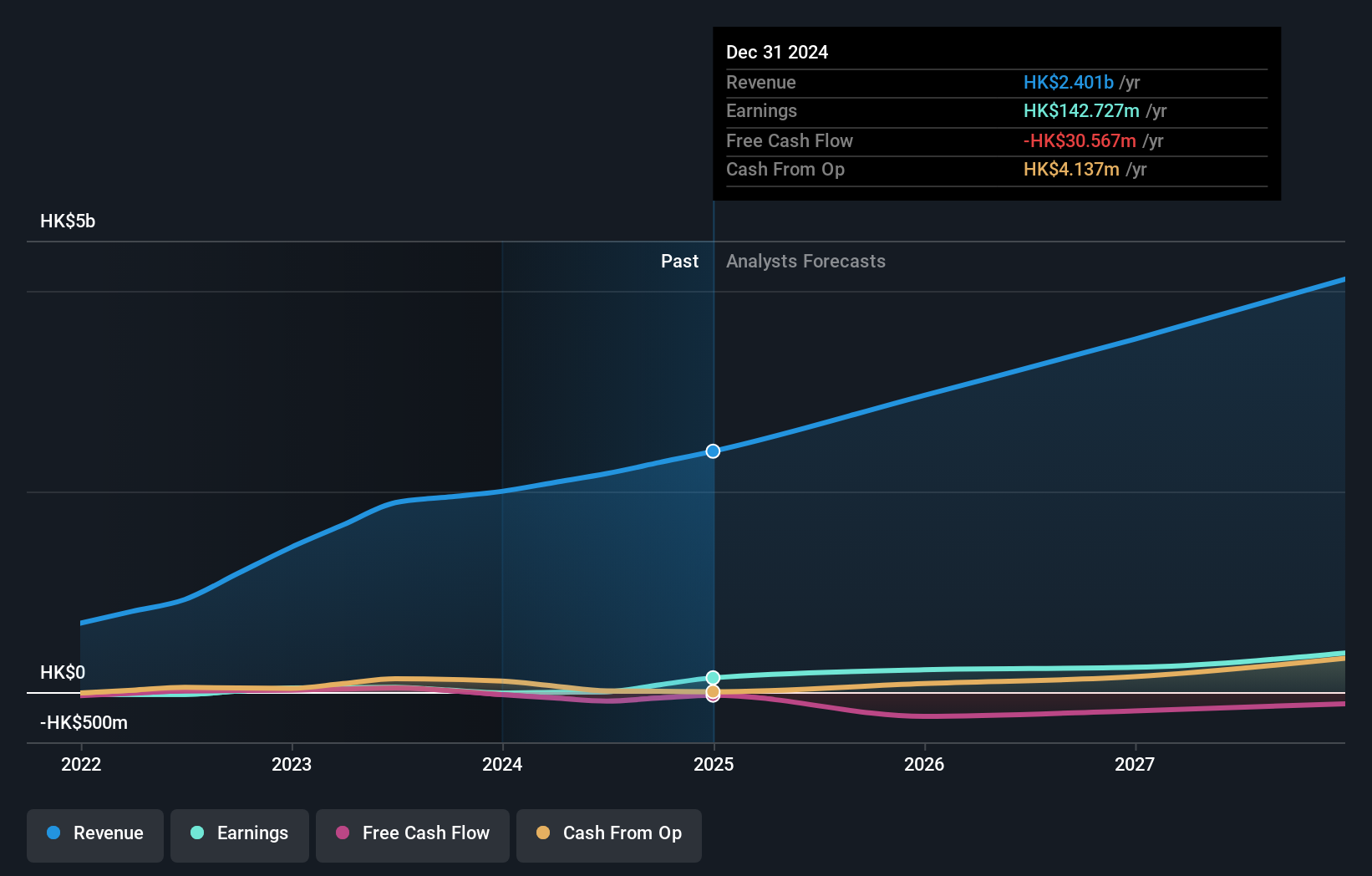

Overview: Vobile Group Limited is an investment holding company that offers software as a service for digital content asset protection and transactions across the United States, Japan, Mainland China, and internationally, with a market cap of HK$5.77 billion.

Operations: The company's revenue primarily comes from its software as a service offerings, generating HK$2.18 billion.

Insider Ownership: 23.1%

Earnings Growth Forecast: 68.5% p.a.

Vobile Group is experiencing significant earnings growth, forecasted at 68.5% annually, outpacing the Hong Kong market's average. Despite recent shareholder dilution and high share price volatility, revenue is expected to grow at 21.4% per year. The company has initiated a share buyback program authorized to repurchase up to 10% of its issued capital, potentially enhancing net asset value and earnings per share. Recent half-year results show improved sales and net income compared to last year.

- Dive into the specifics of Vobile Group here with our thorough growth forecast report.

- Our expertly prepared valuation report Vobile Group implies its share price may be too high.

Techtronic Industries (SEHK:669)

Simply Wall St Growth Rating: ★★★★☆☆

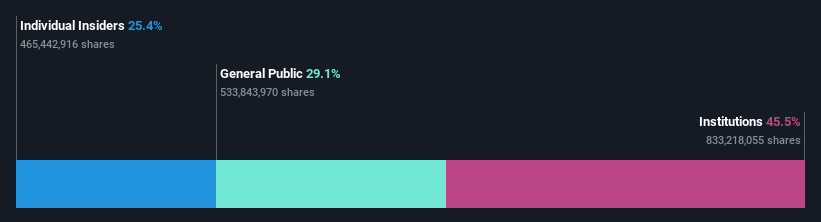

Overview: Techtronic Industries Company Limited designs, manufactures, and markets power tools, outdoor power equipment, and floorcare and cleaning products across North America, Europe, and internationally with a market cap of approximately HK$207.81 billion.

Operations: The company's revenue is primarily derived from its Power Equipment segment at $13.23 billion and the Floorcare & Cleaning segment at $965.09 million.

Insider Ownership: 25.4%

Earnings Growth Forecast: 15.3% p.a.

Techtronic Industries is trading at 23.4% below its estimated fair value, offering potential upside. The firm's earnings are projected to grow by 15.32% annually, surpassing the Hong Kong market's average growth rate of 12%. Recently appointed independent directors bring extensive financial expertise, potentially strengthening governance and strategic direction. The company reported half-year sales of US$7.31 billion and net income of US$550 million, reflecting solid performance with ongoing revenue growth outpacing the market average.

- Get an in-depth perspective on Techtronic Industries' performance by reading our analyst estimates report here.

- The valuation report we've compiled suggests that Techtronic Industries' current price could be inflated.

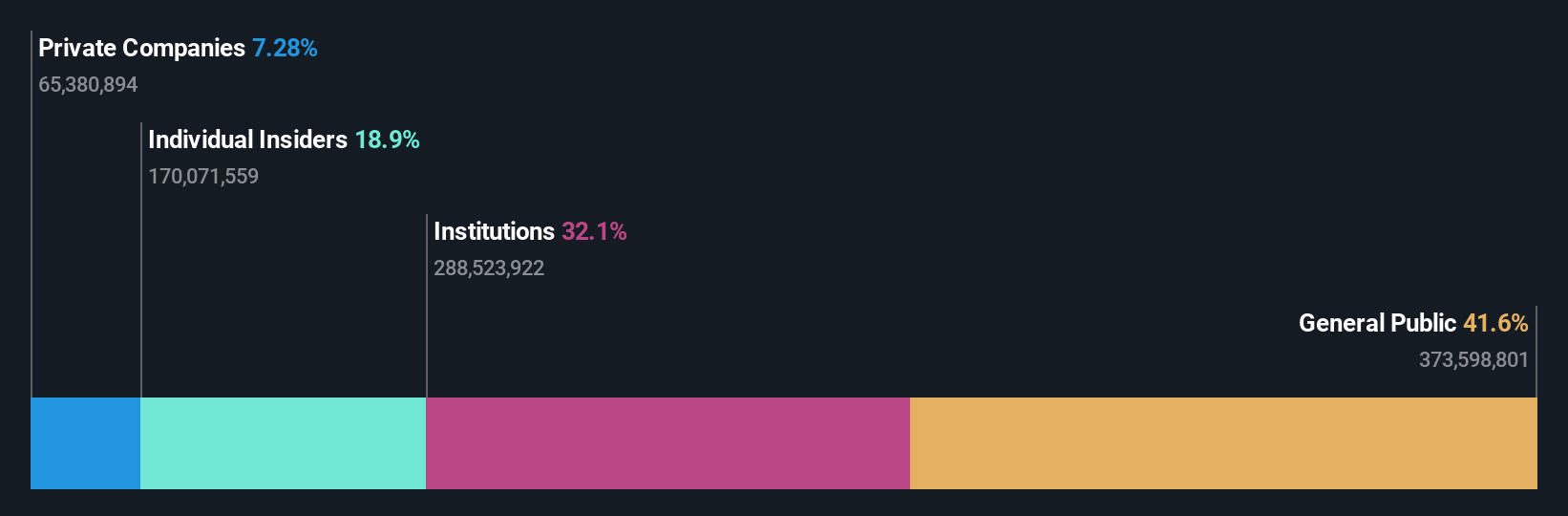

Akeso (SEHK:9926)

Simply Wall St Growth Rating: ★★★★★★

Overview: Akeso, Inc. is a biopharmaceutical company engaged in the research, development, manufacturing, and commercialization of antibody drugs with a market cap of HK$57.06 billion.

Operations: The company's revenue from the research, development, production, and sale of biopharmaceutical products amounts to CN¥1.87 billion.

Insider Ownership: 20.5%

Earnings Growth Forecast: 53% p.a.

Akeso is poised for significant growth, driven by its innovative pipeline and high insider ownership. The company recently announced promising results from its Phase 3 study on cadonilimab, enhancing treatment options for advanced cervical cancer. With a follow-on equity offering of HK$1.94 billion, Akeso aims to bolster its financial position. Despite recent revenue declines to CNY 1.02 billion and a net loss of CNY 238.59 million, forecasted annual earnings growth of 53% suggests future profitability potential.

- Delve into the full analysis future growth report here for a deeper understanding of Akeso.

- The analysis detailed in our Akeso valuation report hints at an inflated share price compared to its estimated value.

Key Takeaways

- Take a closer look at our Fast Growing SEHK Companies With High Insider Ownership list of 47 companies by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal