Chinese Growth Stocks With High Insider Ownership And Up To 40% Revenue Growth

Amidst a backdrop of waning optimism about Beijing's stimulus measures, Chinese equities have experienced a decline, with key indices such as the Shanghai Composite and the blue-chip CSI 300 posting notable losses. In this environment, growth companies with high insider ownership stand out as potentially resilient options due to their alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In China

| Name | Insider Ownership | Earnings Growth |

| Jiayou International LogisticsLtd (SHSE:603871) | 20.6% | 24.6% |

| Western Regions Tourism DevelopmentLtd (SZSE:300859) | 13.9% | 39.2% |

| Arctech Solar Holding (SHSE:688408) | 37.8% | 29.8% |

| Cubic Sensor and InstrumentLtd (SHSE:688665) | 10.1% | 38.9% |

| Quick Intelligent EquipmentLtd (SHSE:603203) | 34.4% | 33.1% |

| Suzhou Sunmun Technology (SZSE:300522) | 36.5% | 67.5% |

| Sineng ElectricLtd (SZSE:300827) | 36.5% | 41.7% |

| UTour Group (SZSE:002707) | 22.8% | 28.7% |

| BIWIN Storage Technology (SHSE:688525) | 18.8% | 116.8% |

| Offcn Education Technology (SZSE:002607) | 25.1% | 75.7% |

Let's explore several standout options from the results in the screener.

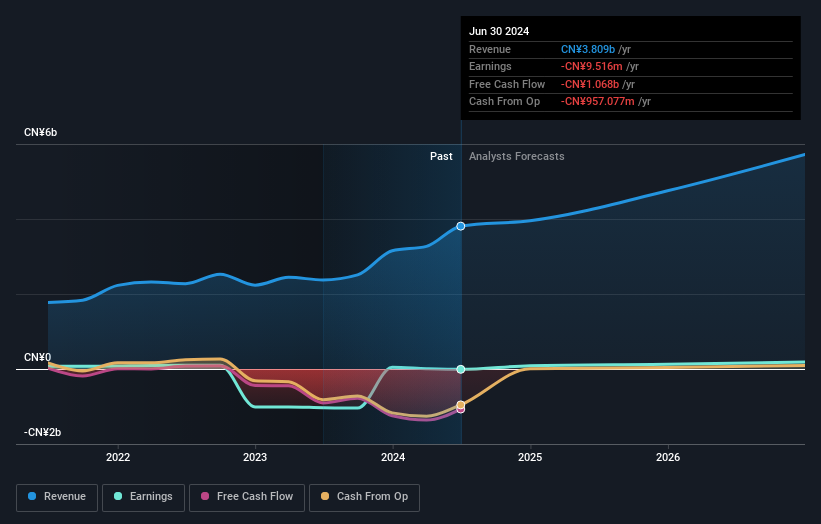

Talkweb Information SystemLtd (SZSE:002261)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Talkweb Information System Co., Ltd. operates in China, offering education services and mobile games, with a market cap of CN¥26.42 billion.

Operations: The company's revenue is derived from Information Technology Services and Software, which generated CN¥1.62 billion, and Computer, Communications, and Other Electronic Equipment Manufacturing, contributing CN¥2.19 billion.

Insider Ownership: 20.2%

Revenue Growth Forecast: 17.2% p.a.

Talkweb Information System Ltd. showcases significant growth potential with its revenue increasing to CNY 2.94 billion for the nine months ending September 2024, up from CNY 1.87 billion a year prior, though net income declined to CNY 11.01 million from CNY 72.71 million. While revenue is forecasted to grow at a rate of 17.2% annually, above the Chinese market average, its return on equity is projected to remain low at 5.5%.

- Click to explore a detailed breakdown of our findings in Talkweb Information SystemLtd's earnings growth report.

- According our valuation report, there's an indication that Talkweb Information SystemLtd's share price might be on the expensive side.

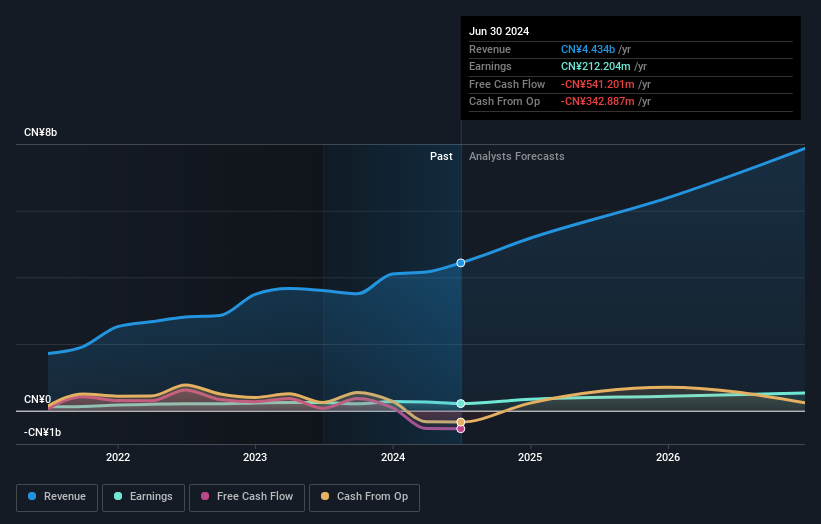

Winall Hi-tech Seed (SZSE:300087)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Winall Hi-tech Seed Co., Ltd. is involved in the research, development, breeding, promotion, and service of various crop seeds both in China and internationally, with a market cap of CN¥7.52 billion.

Operations: The company's revenue segments include the research and development, breeding, promotion, and service of various crop seeds both domestically and internationally.

Insider Ownership: 14.2%

Revenue Growth Forecast: 22.6% p.a.

Winall Hi-tech Seed is poised for robust growth, with revenue expected to increase by 22.6% annually, outpacing the Chinese market's average. Earnings are projected to grow significantly at 32.1%, also surpassing market expectations. Despite these positive forecasts, recent financial results show a net loss of CNY 22.24 million for the half-year ending June 2024, compared to a net income of CNY 39.42 million in the previous year, indicating potential challenges ahead.

- Unlock comprehensive insights into our analysis of Winall Hi-tech Seed stock in this growth report.

- Upon reviewing our latest valuation report, Winall Hi-tech Seed's share price might be too optimistic.

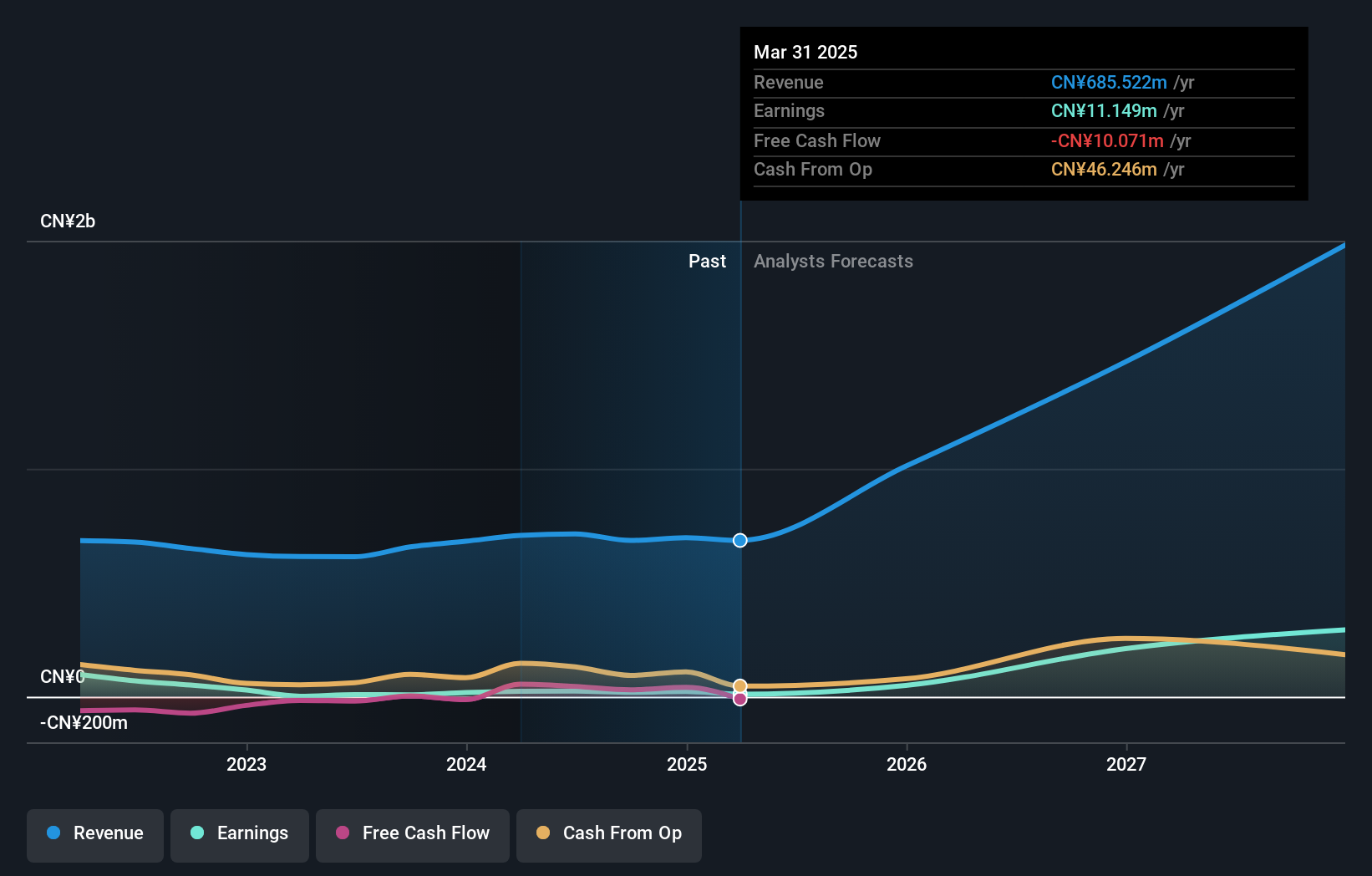

Suzhou Sunmun Technology (SZSE:300522)

Simply Wall St Growth Rating: ★★★★★★

Overview: Suzhou Sunmun Technology Co., Ltd. operates in China, focusing on the research, production, and sale of nano-coloring materials, functional nano-dispersions, special additives, intelligent color matching systems, and electronic chemicals with a market cap of CN¥4.09 billion.

Operations: The company's revenue segments include nano-coloring materials, functional nano-dispersions, special additives, intelligent color matching systems, and electronic chemicals.

Insider Ownership: 36.5%

Revenue Growth Forecast: 40.6% p.a.

Suzhou Sunmun Technology shows promising growth potential, with revenue forecasted to increase by 40.6% annually, significantly outpacing the Chinese market's average. Earnings are expected to grow at a robust 67.5% per year, well above market expectations. Recent financial results underscore this trajectory, with half-year sales rising to CNY 354.11 million from CNY 321.84 million and net income improving from CNY 20.7 million to CNY 27.6 million year-over-year, reflecting strong operational performance amid high insider ownership dynamics.

- Get an in-depth perspective on Suzhou Sunmun Technology's performance by reading our analyst estimates report here.

- Our valuation report here indicates Suzhou Sunmun Technology may be overvalued.

Summing It All Up

- Navigate through the entire inventory of 381 Fast Growing Chinese Companies With High Insider Ownership here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal