Undiscovered Gems In Japan Three Small Caps With Strong Fundamentals

Japan's stock markets have shown resilience, with the Nikkei 225 Index rising by 2.45% and the broader TOPIX Index up by 0.45%, buoyed by yen weakness that has improved profit outlooks for exporters. In this favorable environment, small-cap stocks with strong fundamentals stand out as potential opportunities for investors seeking to navigate these dynamic market conditions effectively.

Top 10 Undiscovered Gems With Strong Fundamentals In Japan

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| NJS | NA | 4.97% | 5.30% | ★★★★★★ |

| ITOCHU-SHOKUHIN | NA | -0.08% | 12.04% | ★★★★★★ |

| Ad-Sol Nissin | NA | 4.02% | 7.90% | ★★★★★★ |

| Maezawa Kasei Industries | 0.81% | 2.01% | 18.42% | ★★★★★★ |

| Nikko | 31.99% | 4.24% | -8.75% | ★★★★★☆ |

| AJIS | 0.69% | 0.07% | -12.44% | ★★★★★☆ |

| Pharma Foods International | 145.80% | 30.07% | 22.61% | ★★★★★☆ |

| Techno Ryowa | 1.77% | 2.06% | 5.32% | ★★★★★☆ |

| Kappa Create | 74.42% | -0.45% | 3.62% | ★★★★★☆ |

| Toyo Kanetsu K.K | 47.92% | 2.34% | 15.44% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

PAL GROUP Holdings (TSE:2726)

Simply Wall St Value Rating: ★★★★★★

Overview: PAL GROUP Holdings CO., LTD. operates in Japan, focusing on the planning, manufacturing, wholesale, and retail of men's and women's clothing and accessories, with a market capitalization of ¥262.21 billion.

Operations: PAL GROUP Holdings derives its revenue primarily from the clothing business, which generated ¥121.28 billion, and the miscellaneous goods/accessories segment, contributing ¥75.51 billion.

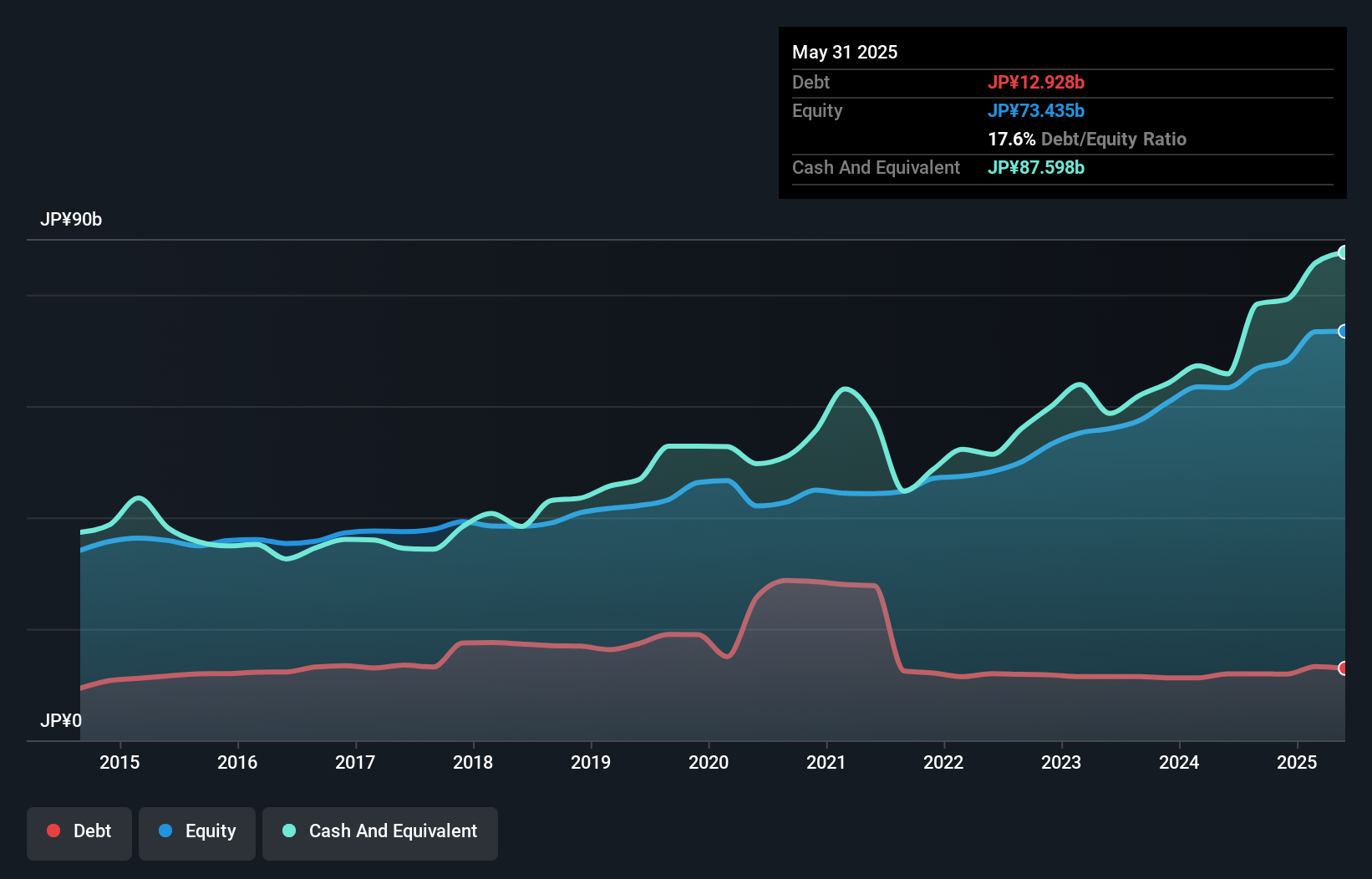

PAL GROUP Holdings, a smaller player in Japan's retail sector, has shown impressive earnings growth of 18.8% over the past year, outpacing the industry average of 5.3%. The company has successfully reduced its debt to equity ratio from 41.2% to 18.9% over five years, indicating improved financial health. Trading at a significant discount of 33.4% below estimated fair value suggests potential upside for investors seeking undervalued opportunities in this niche market segment.

- Delve into the full analysis health report here for a deeper understanding of PAL GROUP Holdings.

Explore historical data to track PAL GROUP Holdings' performance over time in our Past section.

Bic Camera (TSE:3048)

Simply Wall St Value Rating: ★★★★★☆

Overview: Bic Camera Inc., along with its subsidiaries, is involved in the manufacture and sale of audiovisual products in Japan, with a market capitalization of ¥294.78 billion.

Operations: Bic Camera generates revenue primarily through the sale of audiovisual products in Japan. The company's market capitalization stands at ¥294.78 billion.

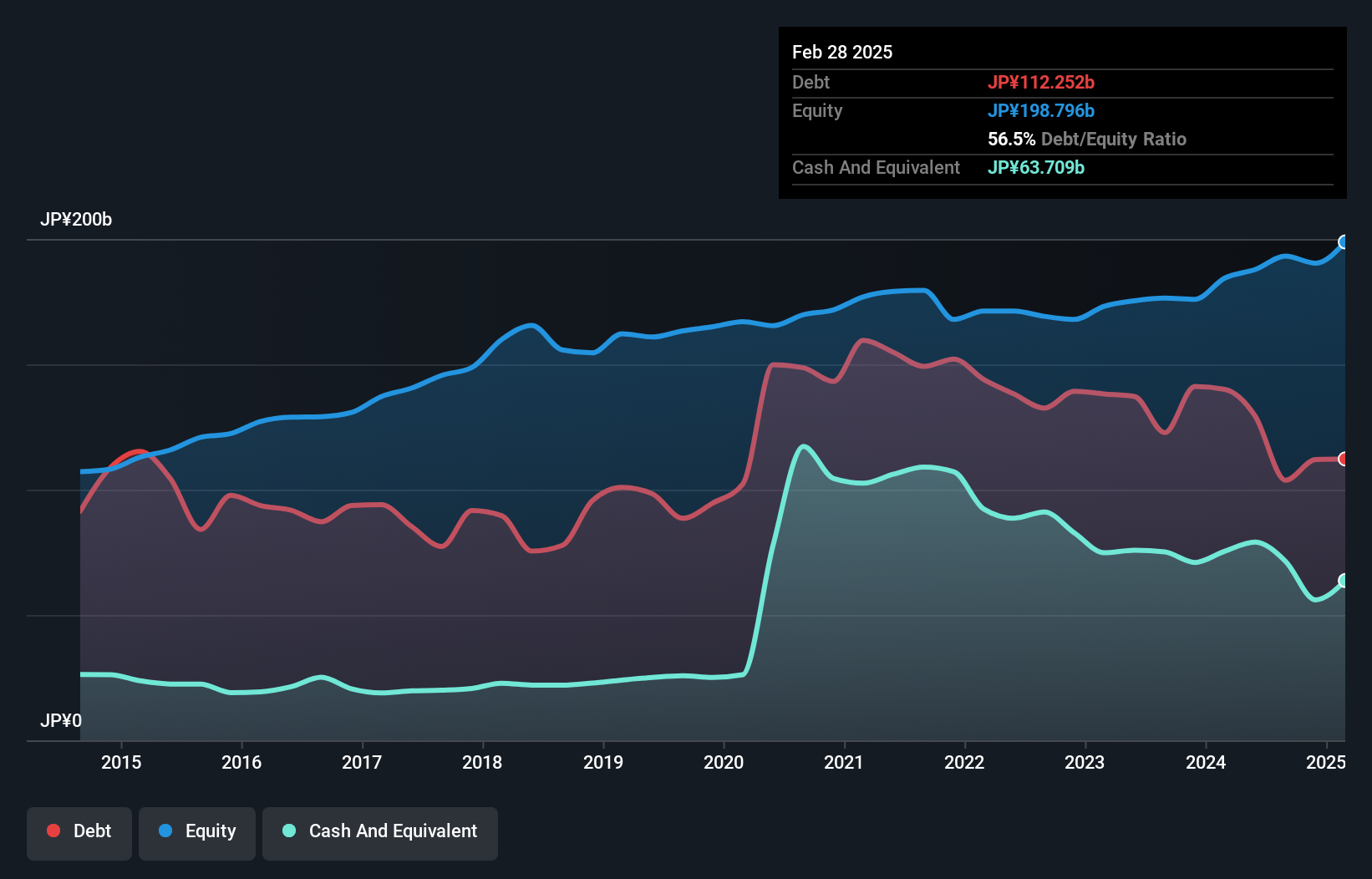

Bic Camera, a player in Japan's retail sector, has shown impressive earnings growth of 299% over the past year, outpacing the industry average of 5%. Despite a significant one-off loss of ¥5.4 billion impacting recent results, its net debt to equity ratio remains satisfactory at 26.7%. The company seems poised for future growth with earnings expected to rise by 13.74% annually, suggesting potential resilience and opportunity within this niche market segment.

- Unlock comprehensive insights into our analysis of Bic Camera stock in this health report.

Gain insights into Bic Camera's historical performance by reviewing our past performance report.

Furuno Electric (TSE:6814)

Simply Wall St Value Rating: ★★★★★☆

Overview: Furuno Electric Co., Ltd. manufactures and sells marine and industrial electronics equipment, wireless LAN systems, and handy terminals globally, with a market cap of ¥66.50 billion.

Operations: Furuno Electric's primary revenue stream is derived from its Marine Business, generating ¥102.10 billion, followed by the Industrial Business with ¥13.32 billion and the Wireless LAN Handy Terminal Business contributing ¥3.81 billion.

Furuno Electric, a smaller player in Japan's electronics scene, has caught attention with its impressive earnings growth of 218% over the past year, outpacing the industry's 7%. The company's price-to-earnings ratio stands at 10.4x, which is below the broader Japanese market average of 13.6x, suggesting potential value for investors. Despite a highly volatile share price recently, Furuno benefits from a satisfactory net debt to equity ratio of 10%, indicating sound financial health amidst industry challenges.

- Take a closer look at Furuno Electric's potential here in our health report.

Examine Furuno Electric's past performance report to understand how it has performed in the past.

Where To Now?

- Get an in-depth perspective on all 729 Japanese Undiscovered Gems With Strong Fundamentals by using our screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal