3 KRX Growth Companies With High Insider Ownership

The South Korean stock market recently experienced a slight downturn, with the KOSPI index dipping by 0.88 percent to settle at just above the 2,610-point mark, amidst mixed performances across global markets. In such fluctuating conditions, growth companies with high insider ownership can offer unique insights and potential stability, as these firms often reflect strong internal confidence and alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In South Korea

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.8% | 49.1% |

| ALTEOGEN (KOSDAQ:A196170) | 26.6% | 99.5% |

| Bioneer (KOSDAQ:A064550) | 15.8% | 97.6% |

| Oscotec (KOSDAQ:A039200) | 26.1% | 122% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 105.8% |

| Vuno (KOSDAQ:A338220) | 19.4% | 110.9% |

| Park Systems (KOSDAQ:A140860) | 33% | 34.6% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

| Techwing (KOSDAQ:A089030) | 18.7% | 83.6% |

Below we spotlight a couple of our favorites from our exclusive screener.

HANA Micron (KOSDAQ:A067310)

Simply Wall St Growth Rating: ★★★★★★

Overview: HANA Micron Inc. offers semiconductor back-end process packaging solutions in South Korea with a market cap of ₩696.34 billion.

Operations: The company's revenue is primarily derived from its Semiconductor Manufacturing segment, contributing ₩1.41 billion, followed by the Semiconductor Material segment at ₩217.79 million.

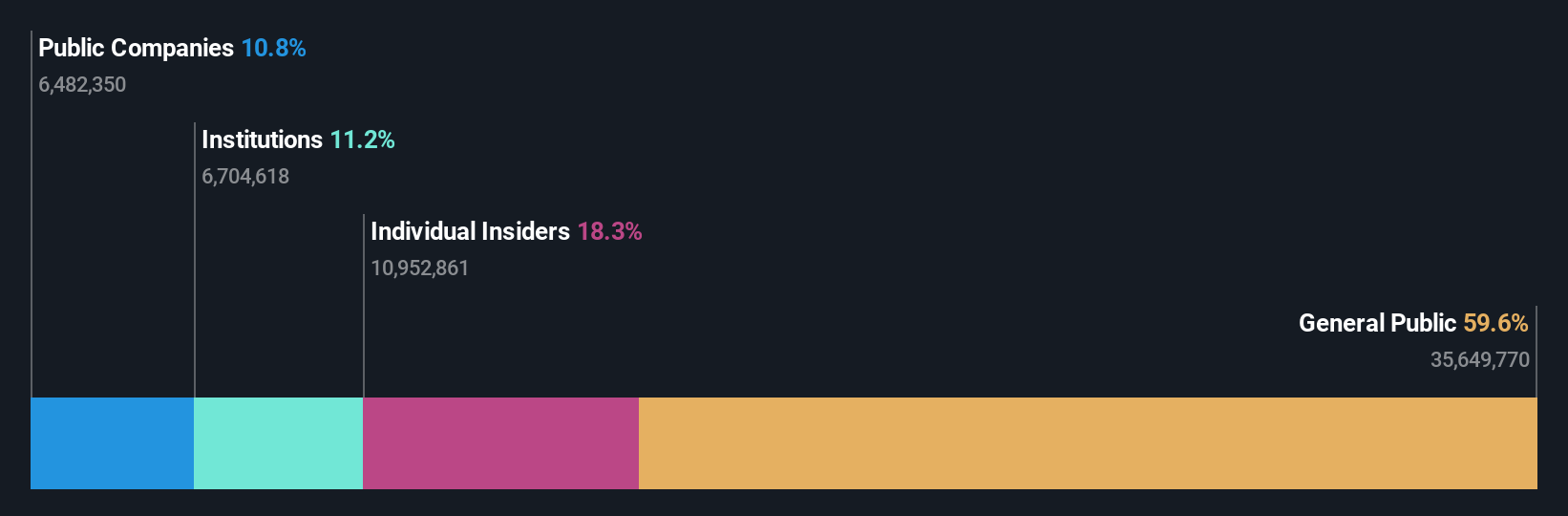

Insider Ownership: 18.3%

HANA Micron, despite recent financial challenges with a net loss in the second quarter of 2024, shows promising growth potential. Its revenue is forecasted to grow significantly faster than the market average at 24.5% annually. The company completed an equity offering raising KRW 82.4 billion, which could support expansion efforts. Trading well below its estimated fair value and with expected profitability within three years, HANA Micron remains attractive for growth-focused investors seeking high insider ownership dynamics in South Korea.

- Unlock comprehensive insights into our analysis of HANA Micron stock in this growth report.

- Our comprehensive valuation report raises the possibility that HANA Micron is priced lower than what may be justified by its financials.

Eugene TechnologyLtd (KOSDAQ:A084370)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Eugene Technology Co., Ltd. manufactures and sells semiconductor equipment and parts both in South Korea and internationally, with a market cap of ₩795.95 billion.

Operations: The company's revenue primarily comes from semiconductor equipment, generating ₩256.56 billion, and industrial gas for semiconductors, contributing ₩10.49 billion.

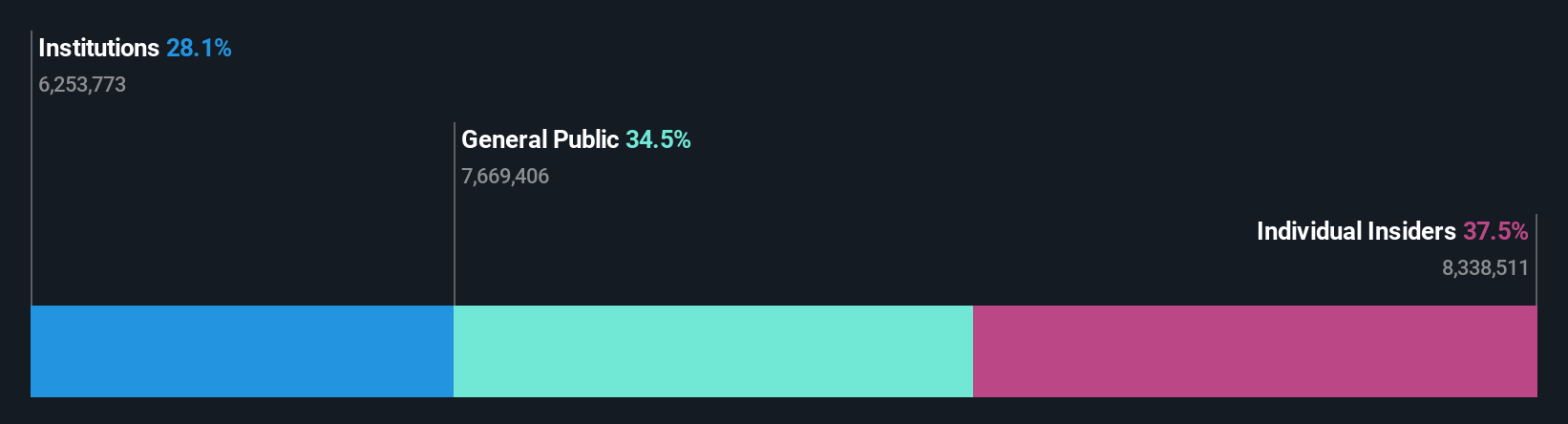

Insider Ownership: 37.5%

Eugene Technology Ltd. demonstrates strong growth prospects with earnings forecasted to grow significantly at 36.4% annually, outpacing the South Korean market average. Revenue is expected to increase by 19.3% per year, though slightly below the high-growth threshold of 20%. Despite recent volatility in share price, analysts agree on a potential 60.6% stock price rise. Recent financials show improved net income for Q2 2024, indicating robust performance amidst competitive pressures in South Korea's tech sector.

- Click here and access our complete growth analysis report to understand the dynamics of Eugene TechnologyLtd.

- In light of our recent valuation report, it seems possible that Eugene TechnologyLtd is trading beyond its estimated value.

Devsisters (KOSDAQ:A194480)

Simply Wall St Growth Rating: ★★★★★★

Overview: Devsisters Corporation is a South Korean company that develops mobile games both domestically and internationally, with a market cap of ₩394.09 billion.

Operations: The company generates revenue from its computer graphics segment, amounting to ₩186.57 million.

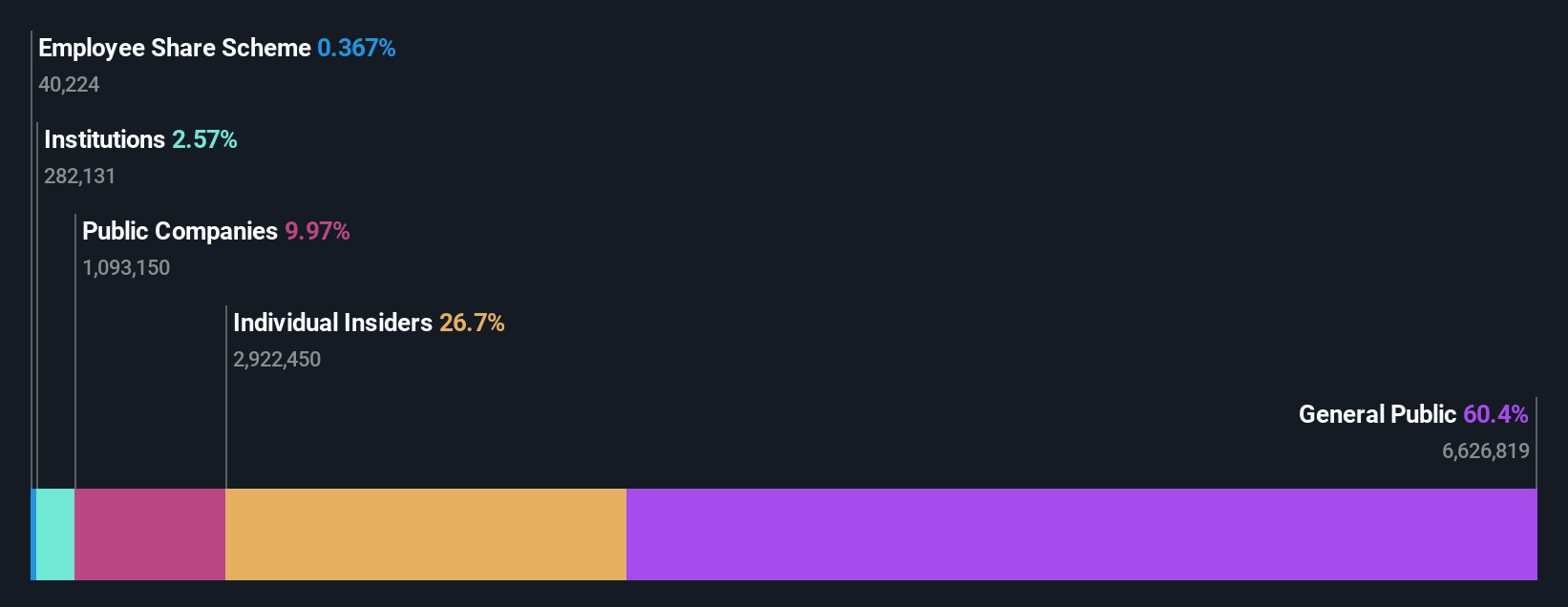

Insider Ownership: 26.2%

Devsisters shows promising growth potential with earnings forecasted to grow 63.02% annually, significantly above the market average. Recent financials highlight a strong turnaround, with Q2 2024 net income at KRW 6.27 billion compared to a loss last year, and revenue increasing to KRW 51.82 billion from KRW 36.46 billion. The company trades at a substantial discount to its estimated fair value, while revenue is expected to grow faster than the South Korean market rate of 10.4%.

- Take a closer look at Devsisters' potential here in our earnings growth report.

- The analysis detailed in our Devsisters valuation report hints at an deflated share price compared to its estimated value.

Key Takeaways

- Unlock our comprehensive list of 86 Fast Growing KRX Companies With High Insider Ownership by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal