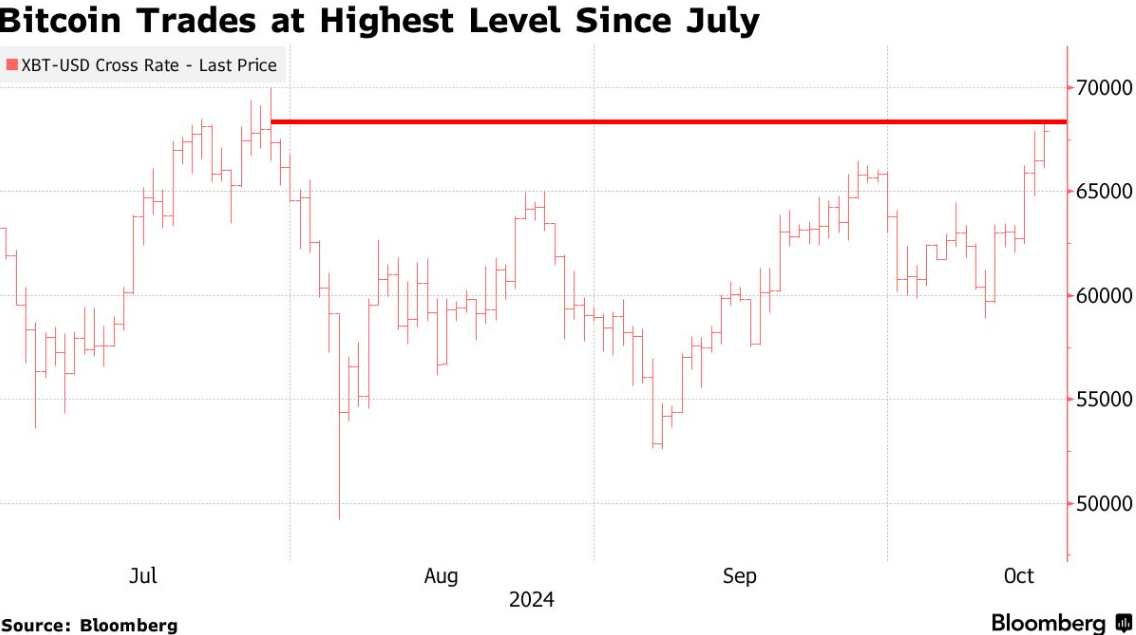

The perfect storm is coming! Bitcoin Approaches $70,000 Again

As optimism about risky assets heats up and the US election looms, Bitcoin bulls are once again setting their sights on the all-time high set in March.

Blockforce Capital's Brett Munster (Brett Munster) wrote: “After six months of price consolidation this year, a perfect storm favorable to Bitcoin and other crypto assets is on the horizon.”

He mentioned the increase in global liquidity, including China, which has recently been providing a range of stimulus measures.

Bitcoin rose 2.9% on Wednesday to reach $68,376 before falling to around $67,800. The last time Bitcoin traded at $70,000 was in July, and it reached an all-time high of nearly $74,000 in March. Other smaller coins also rose, with Dogecoin (Dogecoin) jumped about 10% and Ripple (XRP) increased by about 2%.

Munster wrote, “Global liquidity is rising again, and central banks are injecting cheap capital into their economies. In the past, when global liquidity exceeded its moving average, it often coincided with a sharp rise in the price of Bitcoin.”

This week, US Vice President Harris promised to support the cryptocurrency regulatory framework, which made people more optimistic. Previously, the cryptocurrency industry had been complaining for years that US officials chose the path of regulation through enforcement rather than increased transparency.

Former President Trump is actively seeking cryptocurrency voters in the current presidential campaign with Harris and is working on several crypto-related tasks.

Chris Newhouse (Chris Newhouse), director of research at Cumberland Labs (Cumberland Labs), said, “Various factors, from the market to politics, intertwined to form a powerful combination of short squeezing, speculative positions, and new capital inflows, driving Bitcoin to a new high since July.”

Fadi Aboualfa, head of research at cryptocurrency custodian Copper Technologies Ltd., said: “Overall, the market has been fluctuating sideways since cryptocurrencies hit a record high in March.” The industry's so-called “Fear and Greed Index” (Fear and Greed Index) tracks the accumulation and sentiment of Bitcoin traders, and the index will record 2024 as Bitcoin's greediest year. Aboualfa said, “So it's normal to expect some cooling down.”

According to data compiled by Bloomberg, as of this Thursday, Bitcoin has fluctuated less than 5% for 34 consecutive trading days. It also disappointed many in the cryptocurrency community, as the asset class has historically performed well in October and is therefore known as “Uptober.”

But volatility has begun to return. According to ETC Group data, Bitcoin futures and perpetual options saw a sharp rise in open positions last week, adding around 33,000 bitcoins (approximately $2.1 billion). The company said in a report on Tuesday that open futures contracts have reached a record high in US dollars.

“What we are seeing now is closely related to price trends and market structures a year ago, when CME activity accelerated in mid-October,” said Vetle Lunde, head of research at K33 Research. Lunde said that CME's futures premium has risen to a five-month high, which shows that institutions seeking to increase their exposure to cryptocurrency risk are in huge demand.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal