Shareholders in BATM Advanced Communications (LON:BVC) have lost 78%, as stock drops 11% this past week

As an investor, mistakes are inevitable. But really bad investments should be rare. So consider, for a moment, the misfortune of BATM Advanced Communications Ltd. (LON:BVC) investors who have held the stock for three years as it declined a whopping 78%. That might cause some serious doubts about the merits of the initial decision to buy the stock, to put it mildly. Even worse, it's down 12% in about a month, which isn't fun at all.

After losing 11% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

View our latest analysis for BATM Advanced Communications

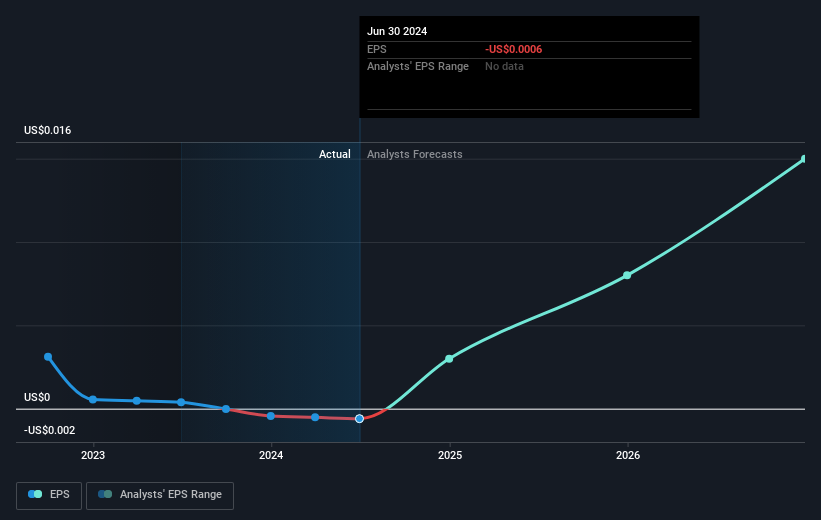

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Over the three years that the share price declined, BATM Advanced Communications' earnings per share (EPS) dropped significantly, falling to a loss. Due to the loss, it's not easy to use EPS as a reliable guide to the business. However, we can say we'd expect to see a falling share price in this scenario.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

This free interactive report on BATM Advanced Communications' earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

BATM Advanced Communications shareholders are down 16% for the year, but the market itself is up 14%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 9% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. You could get a better understanding of BATM Advanced Communications' growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on British exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal