Is A.P.N. Promise (WSE:PRO) Using Too Much Debt?

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that A.P.N. Promise S.A. (WSE:PRO) does have debt on its balance sheet. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for A.P.N. Promise

What Is A.P.N. Promise's Debt?

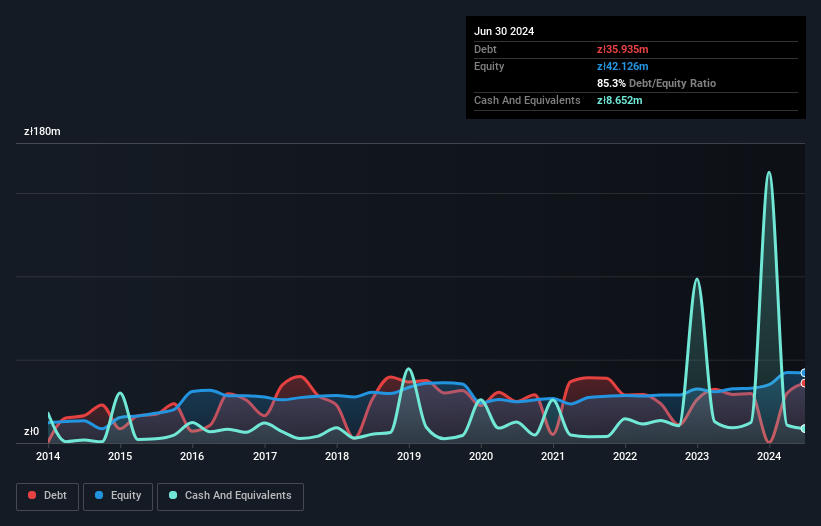

The image below, which you can click on for greater detail, shows that at June 2024 A.P.N. Promise had debt of zł35.9m, up from zł29.1m in one year. However, because it has a cash reserve of zł8.65m, its net debt is less, at about zł27.3m.

How Strong Is A.P.N. Promise's Balance Sheet?

The latest balance sheet data shows that A.P.N. Promise had liabilities of zł294.5m due within a year, and liabilities of zł4.39m falling due after that. On the other hand, it had cash of zł8.65m and zł302.8m worth of receivables due within a year. So it can boast zł12.5m more liquid assets than total liabilities.

It's good to see that A.P.N. Promise has plenty of liquidity on its balance sheet, suggesting conservative management of liabilities. Given it has easily adequate short term liquidity, we don't think it will have any issues with its lenders.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

We'd say that A.P.N. Promise's moderate net debt to EBITDA ratio ( being 2.5), indicates prudence when it comes to debt. And its strong interest cover of 1k times, makes us even more comfortable. Notably, A.P.N. Promise's EBIT launched higher than Elon Musk, gaining a whopping 108% on last year. The balance sheet is clearly the area to focus on when you are analysing debt. But it is A.P.N. Promise's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we always check how much of that EBIT is translated into free cash flow. During the last three years, A.P.N. Promise produced sturdy free cash flow equating to 80% of its EBIT, about what we'd expect. This cold hard cash means it can reduce its debt when it wants to.

Our View

A.P.N. Promise's interest cover suggests it can handle its debt as easily as Cristiano Ronaldo could score a goal against an under 14's goalkeeper. But truth be told we feel its net debt to EBITDA does undermine this impression a bit. It looks A.P.N. Promise has no trouble standing on its own two feet, and it has no reason to fear its lenders. For investing nerds like us its balance sheet is almost charming. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 4 warning signs for A.P.N. Promise (3 are a bit unpleasant!) that you should be aware of before investing here.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal