Take Care Before Jumping Onto Digital Value S.p.A. (BIT:DGV) Even Though It's 75% Cheaper

Digital Value S.p.A. (BIT:DGV) shareholders that were waiting for something to happen have been dealt a blow with a 75% share price drop in the last month. For any long-term shareholders, the last month ends a year to forget by locking in a 71% share price decline.

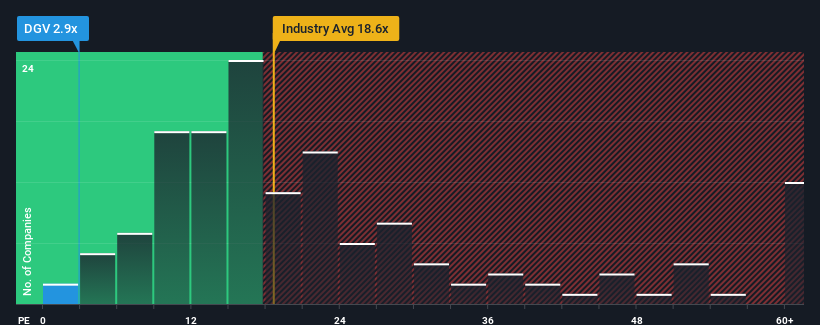

After such a large drop in price, given about half the companies in Italy have price-to-earnings ratios (or "P/E's") above 15x, you may consider Digital Value as a highly attractive investment with its 2.9x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

Recent times have been advantageous for Digital Value as its earnings have been rising faster than most other companies. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for Digital Value

How Is Digital Value's Growth Trending?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Digital Value's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 27% gain to the company's bottom line. The strong recent performance means it was also able to grow EPS by 60% in total over the last three years. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 14% per annum as estimated by the three analysts watching the company. With the market predicted to deliver 12% growth each year, the company is positioned for a comparable earnings result.

With this information, we find it odd that Digital Value is trading at a P/E lower than the market. It may be that most investors are not convinced the company can achieve future growth expectations.

The Bottom Line On Digital Value's P/E

Having almost fallen off a cliff, Digital Value's share price has pulled its P/E way down as well. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Digital Value currently trades on a lower than expected P/E since its forecast growth is in line with the wider market. There could be some unobserved threats to earnings preventing the P/E ratio from matching the outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Digital Value (1 is concerning) you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal