Market Cool On Seco S.p.A.'s (BIT:IOT) Revenues Pushing Shares 25% Lower

To the annoyance of some shareholders, Seco S.p.A. (BIT:IOT) shares are down a considerable 25% in the last month, which continues a horrid run for the company. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 46% in that time.

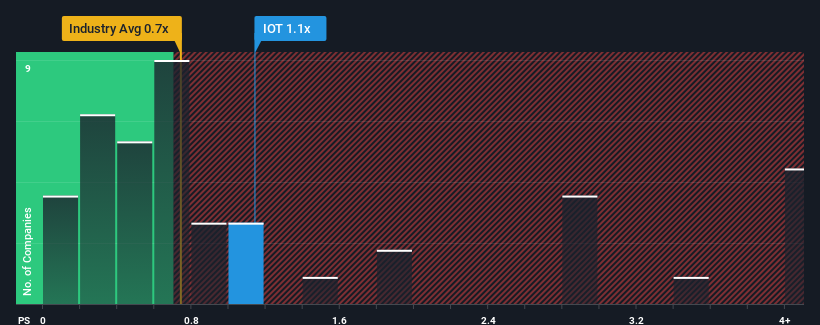

In spite of the heavy fall in price, you could still be forgiven for feeling indifferent about Seco's P/S ratio of 1.1x, since the median price-to-sales (or "P/S") ratio for the Tech industry in Italy is also close to 0.7x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Seco

How Has Seco Performed Recently?

While the industry has experienced revenue growth lately, Seco's revenue has gone into reverse gear, which is not great. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Seco will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, Seco would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a frustrating 13% decrease to the company's top line. Even so, admirably revenue has lifted 141% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Turning to the outlook, the next year should demonstrate some strength in company's business, generating growth of 0.9% as estimated by the three analysts watching the company. This isn't typically strong growth, but with the rest of the industry predicted to shrink by 1.2%, that would be a solid result.

Despite the marginal growth, we find it odd that Seco is trading at a fairly similar P/S to the industry. Apparently some shareholders are skeptical of the contrarian forecasts and have been accepting lower selling prices.

What We Can Learn From Seco's P/S?

Seco's plummeting stock price has brought its P/S back to a similar region as the rest of the industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Seco currently trades on a lower than expected P/S since its growth forecasts are potentially beating a struggling industry. Given the glowing revenue forecasts, we can only assume potential risks are what might be capping the P/S ratio at its current levels. Perhaps there is some hesitation about the company's ability to keep swimming against the current of the broader industry turmoil. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Seco that you should be aware of.

If you're unsure about the strength of Seco's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal