S.C. Industria Sarmei Campia Turzii SA's (BVB:INSI) Shares Leap 37% Yet They're Still Not Telling The Full Story

S.C. Industria Sarmei Campia Turzii SA (BVB:INSI) shares have had a really impressive month, gaining 37% after a shaky period beforehand. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

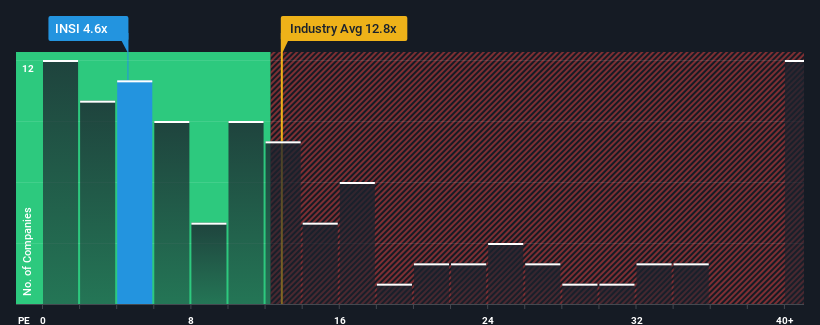

In spite of the firm bounce in price, S.C. Industria Sarmei Campia Turzii's price-to-earnings (or "P/E") ratio of 4.6x might still make it look like a strong buy right now compared to the market in Romania, where around half of the companies have P/E ratios above 15x and even P/E's above 36x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

With earnings growth that's exceedingly strong of late, S.C. Industria Sarmei Campia Turzii has been doing very well. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for S.C. Industria Sarmei Campia Turzii

Is There Any Growth For S.C. Industria Sarmei Campia Turzii?

The only time you'd be truly comfortable seeing a P/E as depressed as S.C. Industria Sarmei Campia Turzii's is when the company's growth is on track to lag the market decidedly.

Retrospectively, the last year delivered an exceptional 363% gain to the company's bottom line. Although, its longer-term performance hasn't been as strong with three-year EPS growth being relatively non-existent overall. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

In contrast to the company, the rest of the market is expected to decline by 3.8% over the next year, which puts the company's recent medium-term positive growth rates in a good light for now.

With this information, we find it very odd that S.C. Industria Sarmei Campia Turzii is trading at a P/E lower than the market. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Bottom Line On S.C. Industria Sarmei Campia Turzii's P/E

S.C. Industria Sarmei Campia Turzii's recent share price jump still sees its P/E sitting firmly flat on the ground. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that S.C. Industria Sarmei Campia Turzii currently trades on a much lower than expected P/E since its recent three-year earnings growth is beating forecasts for a struggling market. We think potential risks might be placing significant pressure on the P/E ratio and share price. Perhaps there is some hesitation about the company's ability to stay its recent course and swim against the current of the broader market turmoil. It appears many are indeed anticipating earnings instability, because this relative performance should normally provide a boost to the share price.

We don't want to rain on the parade too much, but we did also find 2 warning signs for S.C. Industria Sarmei Campia Turzii (1 doesn't sit too well with us!) that you need to be mindful of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal