With A 30% Price Drop For Tronic's Microsystems SA (EPA:ALTRO) You'll Still Get What You Pay For

Tronic's Microsystems SA (EPA:ALTRO) shares have retraced a considerable 30% in the last month, reversing a fair amount of their solid recent performance. The last month has meant the stock is now only up 8.6% during the last year.

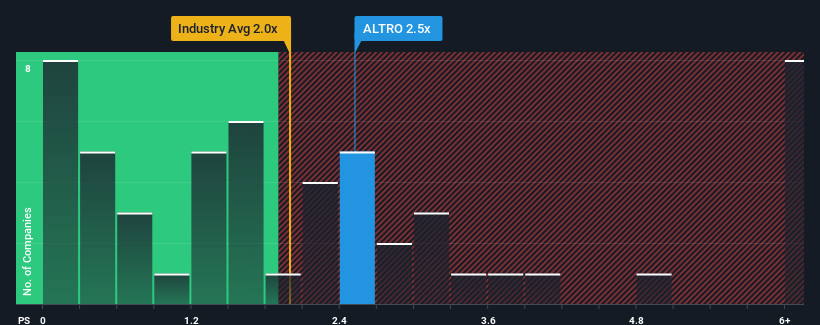

Although its price has dipped substantially, when almost half of the companies in France's Semiconductor industry have price-to-sales ratios (or "P/S") below 1.5x, you may still consider Tronic's Microsystems as a stock probably not worth researching with its 2.5x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

View our latest analysis for Tronic's Microsystems

How Tronic's Microsystems Has Been Performing

Tronic's Microsystems has been doing a decent job lately as it's been growing revenue at a reasonable pace. Perhaps the market believes the recent revenue performance is strong enough to outperform the industry, which has inflated the P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Tronic's Microsystems will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Tronic's Microsystems would need to produce impressive growth in excess of the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 6.1% last year. Pleasingly, revenue has also lifted 57% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenues over that time.

Weighing the recent medium-term upward revenue trajectory against the broader industry's one-year forecast for contraction of 8.0% shows it's a great look while it lasts.

With this information, we can see why Tronic's Microsystems is trading at a high P/S compared to the industry. Investors are willing to pay more for a stock they hope will buck the trend of the broader industry going backwards. Nonetheless, with most other businesses facing an uphill battle, staying on its current revenue path is no certainty.

The Final Word

Tronic's Microsystems' P/S remain high even after its stock plunged. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We see that Tronic's Microsystems justifiably maintains its high P/S on the merits of its recentthree-year revenue growth beating forecasts amidst struggling industry. Right now shareholders are comfortable with the P/S as they are quite confident revenues aren't under threat. However, it'd be fair to raise concerns over whether this level of revenue performance will continue given the harsh conditions facing the industry. Otherwise, it's hard to see the share price falling strongly in the near future if its revenue performance persists.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Tronic's Microsystems (at least 1 which makes us a bit uncomfortable), and understanding them should be part of your investment process.

If these risks are making you reconsider your opinion on Tronic's Microsystems, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal