German Growth Companies With Insider Ownership For October 2024

As the German economy faces a forecasted contraction in 2024, the DAX index has managed to gain 1.32%, reflecting resilience amid broader economic challenges. In this environment, growth companies with high insider ownership are particularly noteworthy, as they often signal confidence from those closest to the business and may offer potential stability in uncertain times.

Top 10 Growth Companies With High Insider Ownership In Germany

| Name | Insider Ownership | Earnings Growth |

| Stemmer Imaging (XTRA:S9I) | 25.1% | 23.2% |

| Multitude (XTRA:E4I) | 31% | 20.7% |

| Exasol (XTRA:EXL) | 25.3% | 117.1% |

| Deutsche Beteiligungs (XTRA:DBAN) | 39.6% | 54.1% |

| adidas (XTRA:ADS) | 16.6% | 40.5% |

| pferdewetten.de (XTRA:EMH) | 20.6% | 97.9% |

| Alelion Energy Systems (DB:2FZ) | 37.4% | 106.6% |

| R. STAHL (XTRA:RSL2) | 37.9% | 59.3% |

| Friedrich Vorwerk Group (XTRA:VH2) | 18.8% | 24.6% |

| Redcare Pharmacy (XTRA:RDC) | 17.4% | 54.3% |

Let's dive into some prime choices out of the screener.

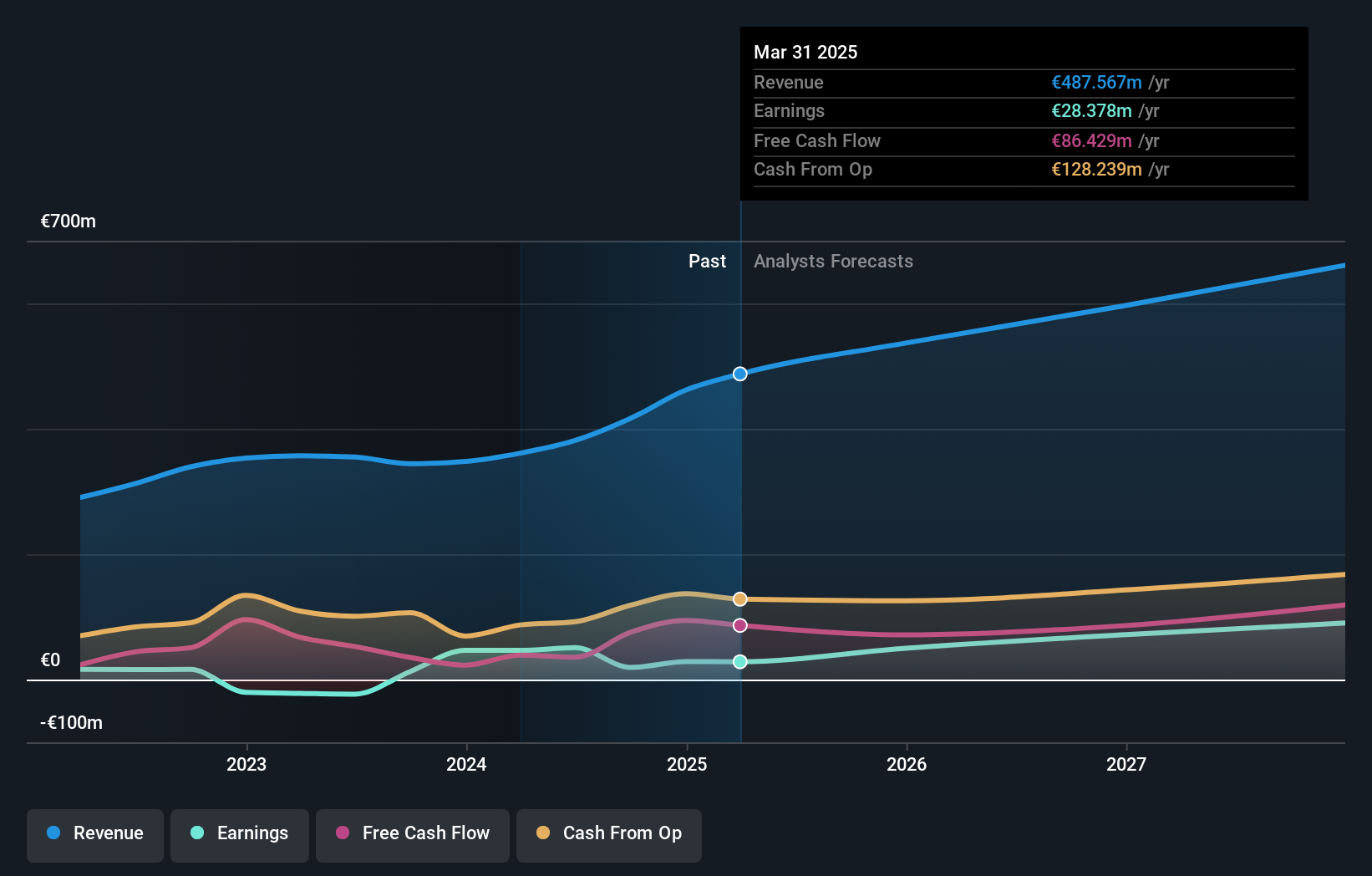

Verve Group (XTRA:M8G)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Verve Group SE operates a software platform facilitating the automated buying and selling of digital advertising space in North America and Europe, with a market cap of €597.28 million.

Operations: The company's revenue is primarily generated from its Supply Side Platforms (SSP) at €341.35 million and Demand Side Platforms (DSP) at €57.59 million.

Insider Ownership: 25.1%

Earnings Growth Forecast: 20.1% p.a.

Verve Group, a German company with substantial insider ownership, is experiencing significant earnings growth, forecasted at over 20% annually for the next three years. Despite recent volatility in its share price and past shareholder dilution, it trades at a good value compared to peers. The company recently raised its revenue guidance to €400 million - €420 million for 2024 and reported strong Q2 results with net income of €6.26 million, up from €1.74 million last year.

- Click to explore a detailed breakdown of our findings in Verve Group's earnings growth report.

- Our valuation report unveils the possibility Verve Group's shares may be trading at a discount.

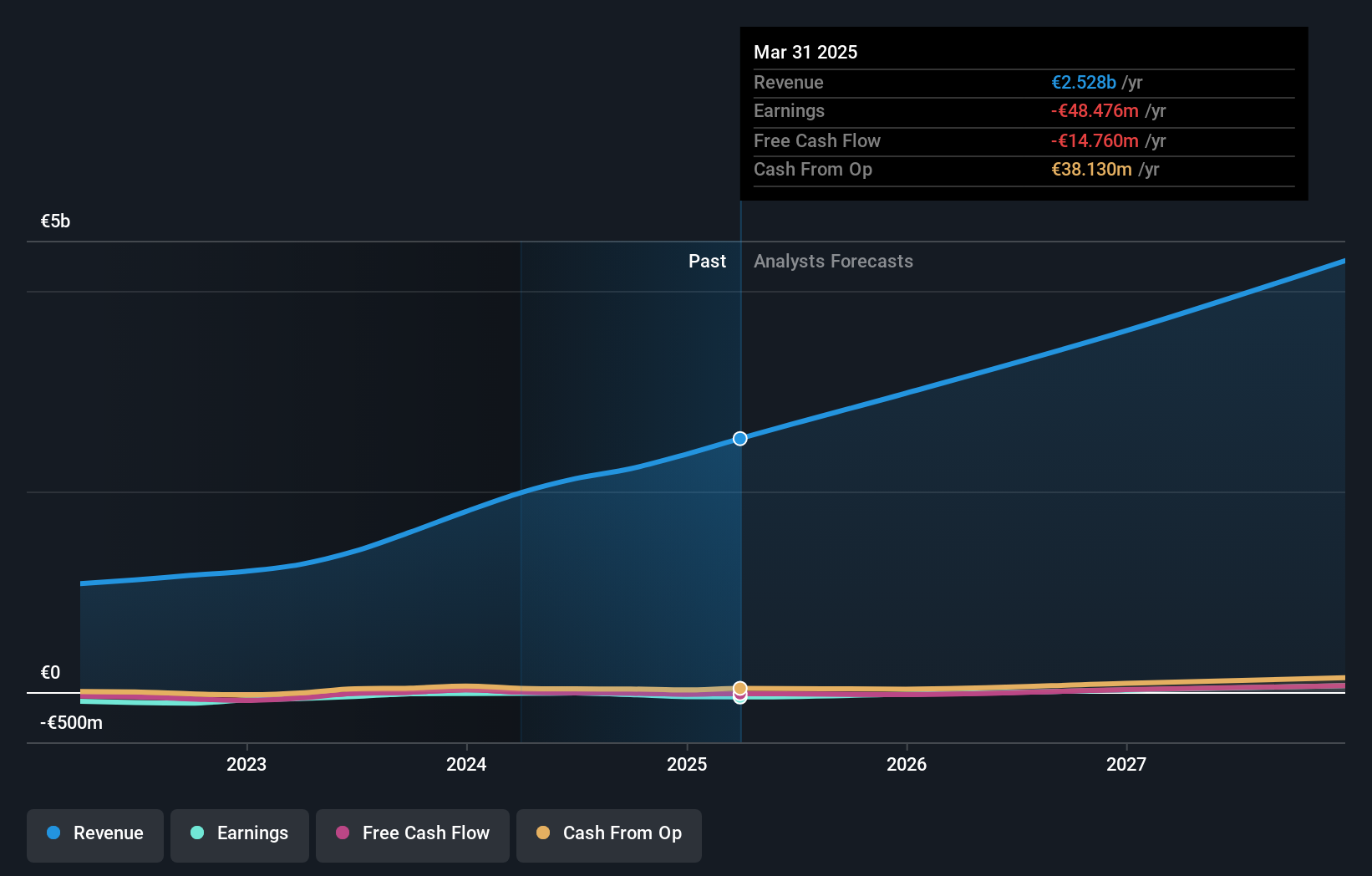

Redcare Pharmacy (XTRA:RDC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Redcare Pharmacy NV operates an online pharmacy business across the Netherlands, Germany, Italy, Belgium, Switzerland, Austria, and France with a market cap of €2.96 billion.

Operations: The company generates revenue from its DACH segment, totaling €1.74 billion, and an International segment amounting to €391 million.

Insider Ownership: 17.4%

Earnings Growth Forecast: 54.3% p.a.

Redcare Pharmacy, with significant insider ownership, recently raised its 2024 sales guidance to €2.35 billion - €2.5 billion, reflecting optimism despite a net loss of €12.07 million for the first half of 2024. The company is trading significantly below estimated fair value and is expected to achieve profitability within three years, with earnings projected to grow at over 50% annually. However, insider activity shows more selling than buying in recent months.

- Take a closer look at Redcare Pharmacy's potential here in our earnings growth report.

- Our valuation report unveils the possibility Redcare Pharmacy's shares may be trading at a premium.

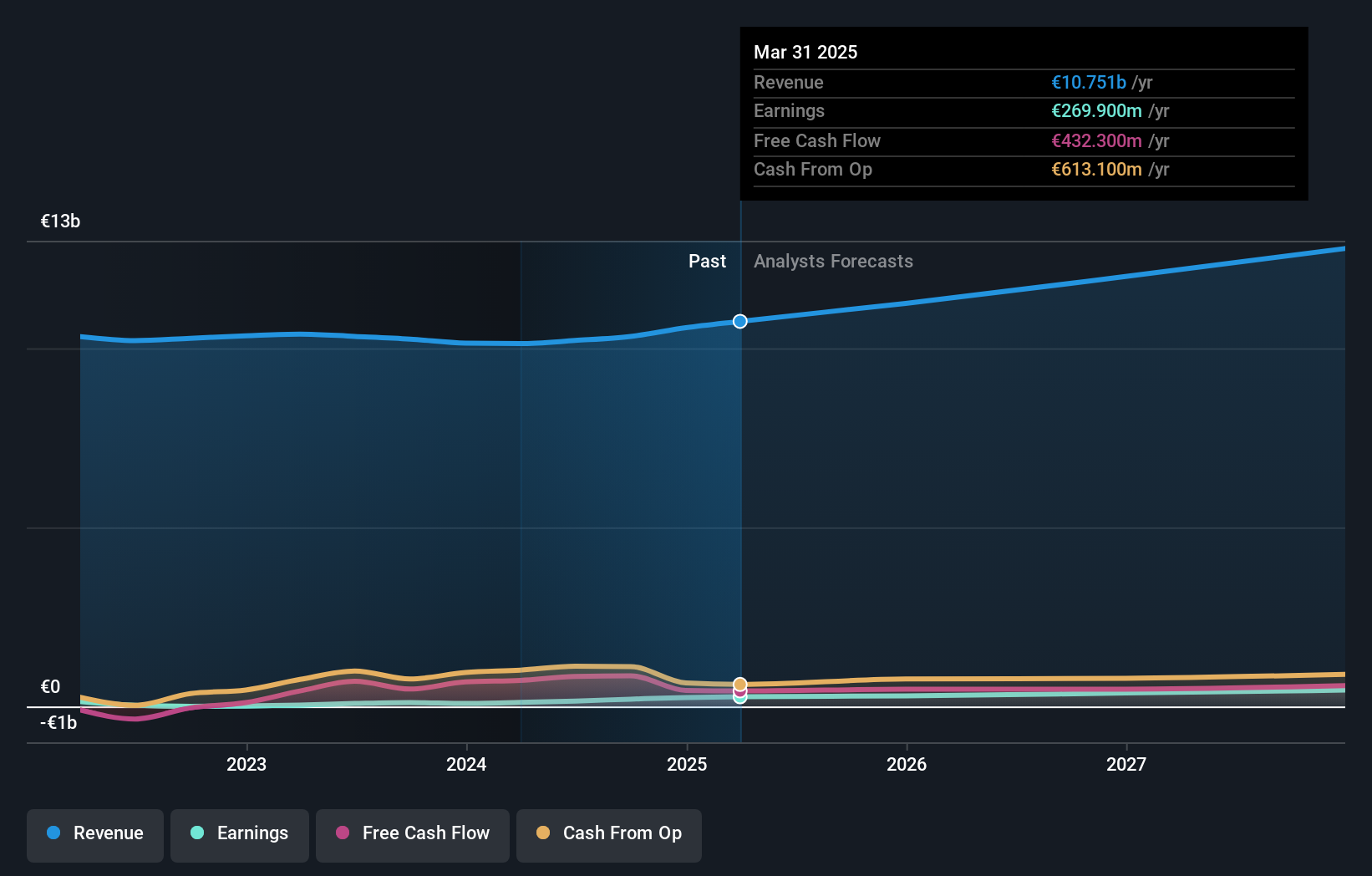

Zalando (XTRA:ZAL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Zalando SE operates an online platform for fashion and lifestyle products, with a market capitalization of approximately €7.81 billion.

Operations: The company generates revenue primarily from its online platform for fashion and lifestyle products, with segment adjustments amounting to €10.49 billion.

Insider Ownership: 10.4%

Earnings Growth Forecast: 24.4% p.a.

Zalando, with substantial insider ownership, reported a strong increase in earnings for the second quarter of 2024, with net income rising to €95.7 million from €56.6 million a year ago. The company's earnings are forecast to grow significantly at 24.4% annually over the next three years, outpacing the German market's growth rate. Despite this positive outlook, its Return on Equity is expected to remain low at 12.8%, and there has been no significant insider trading activity recently.

- Click here and access our complete growth analysis report to understand the dynamics of Zalando.

- Upon reviewing our latest valuation report, Zalando's share price might be too optimistic.

Seize The Opportunity

- Unlock our comprehensive list of 22 Fast Growing German Companies With High Insider Ownership by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal