Exploring 3 Undiscovered German Gems with Promising Potential

As the German economy faces a forecasted contraction for the second consecutive year, with factory orders plunging and industrial production showing mixed signals, investors are increasingly on the lookout for opportunities within this challenging landscape. Amidst these economic headwinds, identifying stocks that demonstrate resilience through strong fundamentals or unique market positions can be particularly appealing.

Top 10 Undiscovered Gems With Strong Fundamentals In Germany

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Mineralbrunnen Überkingen-Teinach GmbH KGaA | 19.91% | 0.96% | -5.02% | ★★★★★★ |

| FRoSTA | 8.18% | 4.36% | 16.00% | ★★★★★★ |

| Westag | NA | -1.56% | -21.68% | ★★★★★★ |

| Paul Hartmann | 26.29% | 1.12% | -17.65% | ★★★★★☆ |

| Südwestdeutsche Salzwerke | 0.30% | 4.57% | 25.01% | ★★★★★☆ |

| EnviTec Biogas | 48.48% | 20.85% | 46.34% | ★★★★★☆ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| Baader Bank | 91.28% | 12.42% | -8.00% | ★★★★★☆ |

| DFV Deutsche Familienversicherung | NA | 19.63% | 62.92% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Paul Hartmann (DB:PHH2)

Simply Wall St Value Rating: ★★★★★☆

Overview: Paul Hartmann AG is a company that manufactures and sells medical and care products across Germany, the rest of Europe, the Middle East, Africa, Asia-Pacific, and the Americas with a market cap of approximately €777.83 million.

Operations: The company's primary revenue streams include Wound Care (€597.39 million), Infection Management (€516.66 million), Incontinence Management (€769.70 million), and Complementary divisions of the group (€499.70 million).

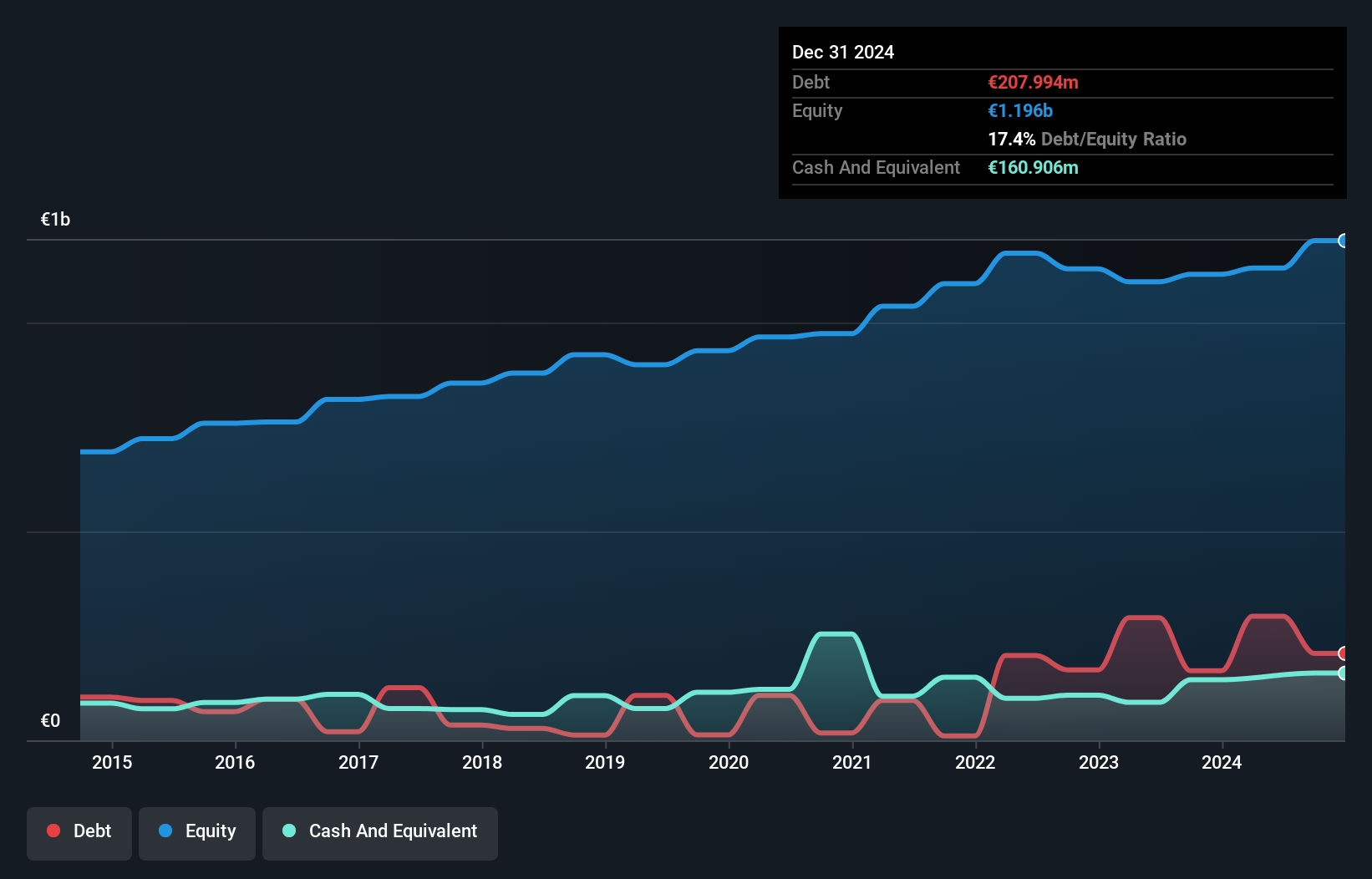

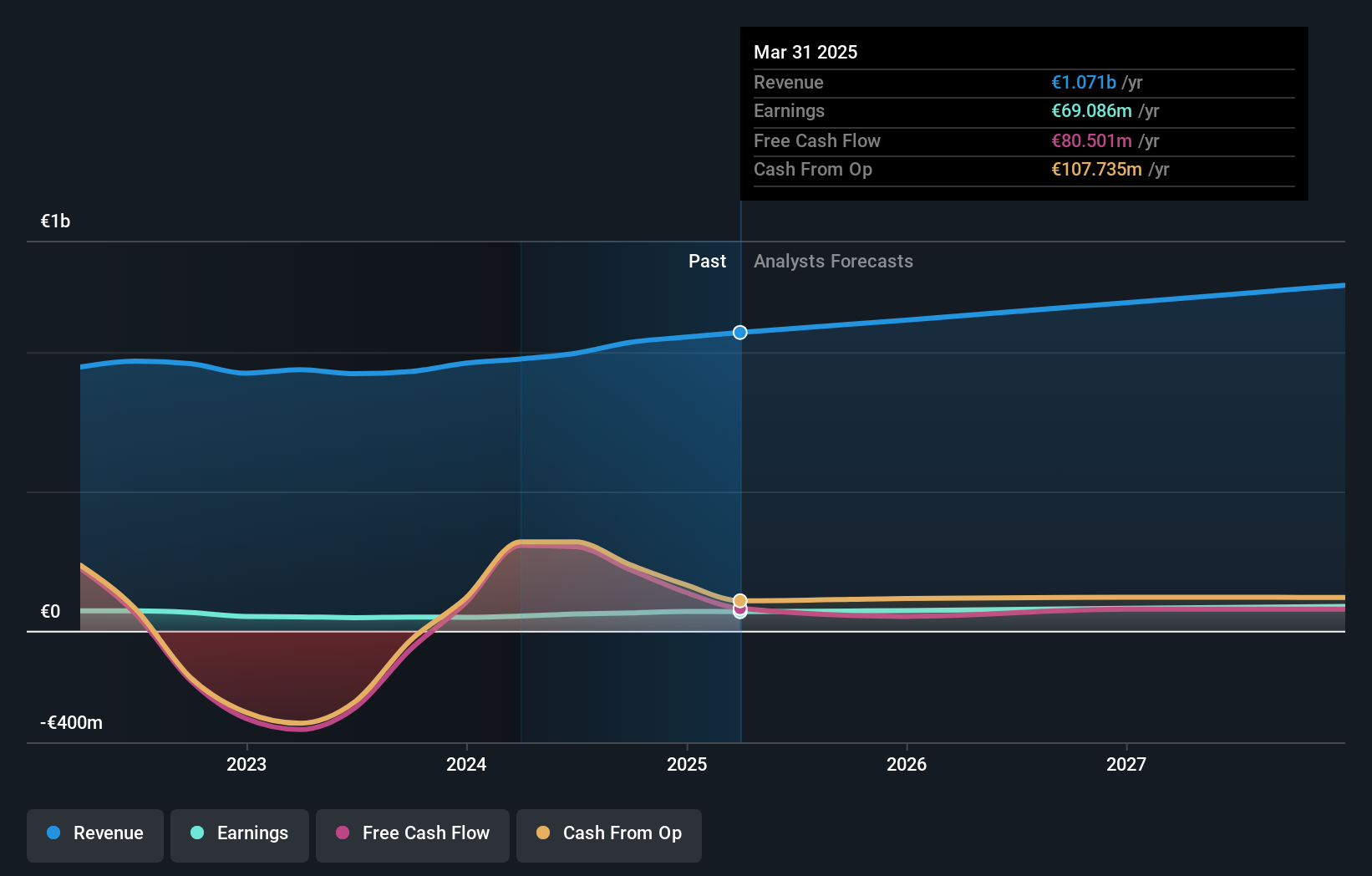

Paul Hartmann, a notable player in the medical equipment sector, recently reported impressive half-year earnings with sales of €1.2 billion and net income soaring to €42.8 million from €11.69 million last year. The company's earnings growth of 156% outpaces the industry's 16%, reflecting robust performance despite a debt-to-equity increase to 26% over five years. Trading at nearly 97% below estimated fair value, it seems undervalued with well-covered interest payments and high-quality past earnings bolstering its profile.

MLP (XTRA:MLP)

Simply Wall St Value Rating: ★★★★★★

Overview: MLP SE, along with its subsidiaries, offers a range of financial services to private, corporate, and institutional clients in Germany and has a market capitalization of approximately €677.65 million.

Operations: MLP SE generates revenue primarily from Financial Consulting (€429.61 million), FERI (€231.23 million), and Banking (€206.97 million) segments, with additional contributions from DOMCURA and Deutschland.Immobilien. The company's revenue model includes a segment adjustment of €16.17 million and is affected by consolidation adjustments of -€86.32 million, reflecting internal financial reconciliations across its operations in Germany.

MLP, a financial services firm in Germany, showcases promising potential with its recent performance. Over the past year, earnings grew by 28%, outpacing the Capital Markets industry at 19%. The company is trading at 40% below its estimated fair value and remains debt-free. Recent guidance suggests an EBIT for 2024 between €85 million and €95 million, reflecting a positive outlook. For H1 2024, net income reached €38 million compared to last year's €26 million.

- Click to explore a detailed breakdown of our findings in MLP's health report.

Explore historical data to track MLP's performance over time in our Past section.

Friedrich Vorwerk Group (XTRA:VH2)

Simply Wall St Value Rating: ★★★★★☆

Overview: Friedrich Vorwerk Group SE specializes in solutions for the transformation and transportation of energy across Germany and Europe, with a market capitalization of €527 million.

Operations: The group's revenue is primarily derived from Natural Gas (€160.89 million) and Electricity (€95.30 million), with additional contributions from Adjacent Opportunities (€117.28 million) and Clean Hydrogen (€28.38 million).

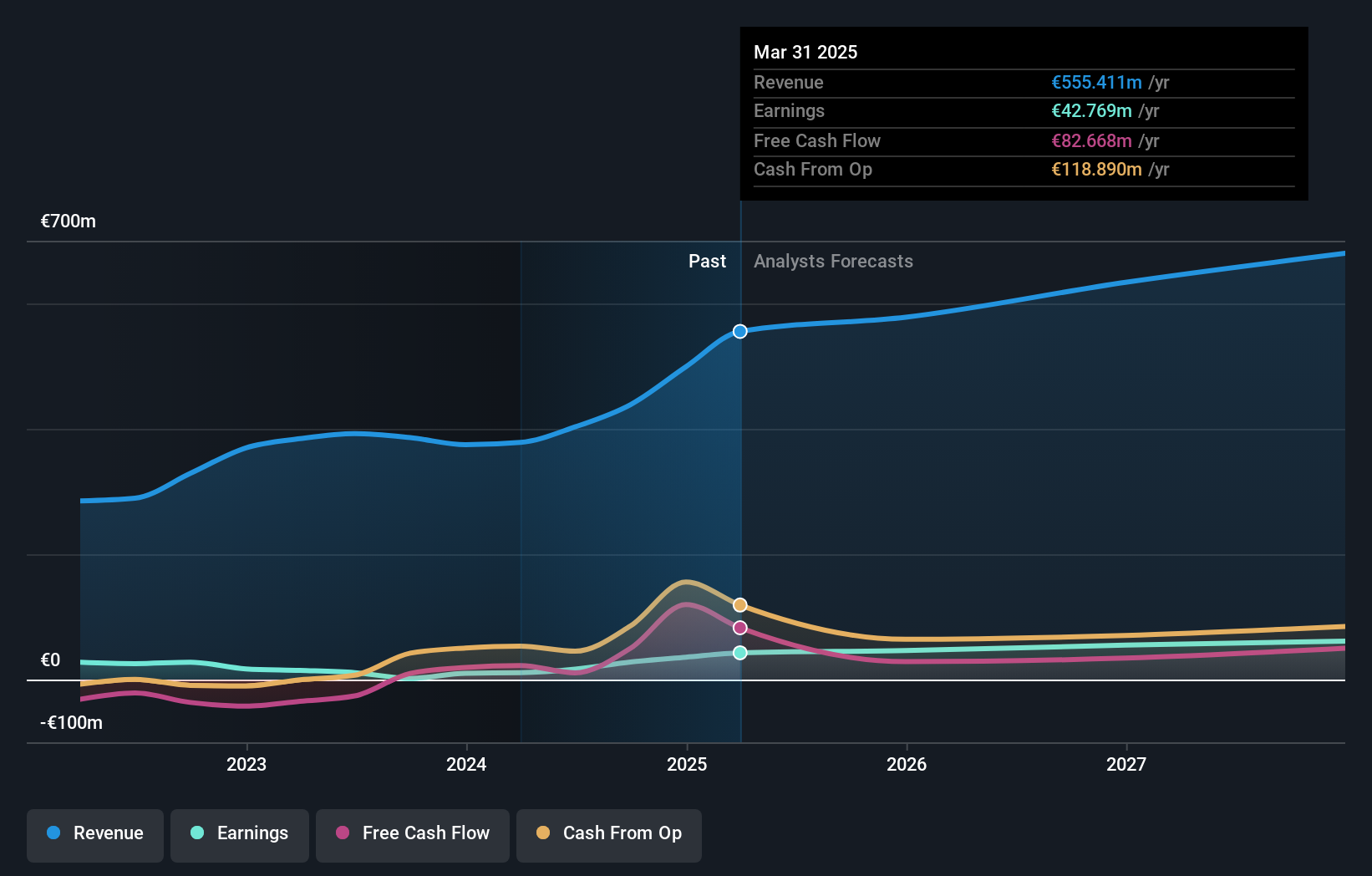

Friedrich Vorwerk Group, a promising player in the German market, has shown robust performance with net income climbing to €7.96 million in Q2 2024 from €2.38 million last year, and earnings per share increasing to €0.4 from €0.12. Revenue for the same quarter was up at €121.04 million compared to €96.41 million previously, indicating strong growth momentum. The company forecasts over 10% revenue growth for fiscal year 2024, projecting more than €410 million in sales, supported by satisfactory debt management with a net debt-to-equity ratio of 12%.

Make It Happen

- Click this link to deep-dive into the 54 companies within our German Undiscovered Gems With Strong Fundamentals screener.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal