High Growth Tech Stocks In Sweden Including Telefonaktiebolaget LM Ericsson

Amidst a backdrop of rising indices in Europe, with the pan-European STOXX Europe 600 Index seeing gains and hopes for quicker interest rate cuts by the European Central Bank, Sweden's tech sector is drawing attention for its potential high growth opportunities. In this context, understanding what makes a good stock involves examining factors such as innovation capacity and market adaptability, especially pertinent to companies like Telefonaktiebolaget LM Ericsson that are navigating these dynamic economic conditions.

Top 10 High Growth Tech Companies In Sweden

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Truecaller | 20.40% | 21.73% | ★★★★★★ |

| Xbrane Biopharma | 53.90% | 118.02% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| Hemnet Group | 20.10% | 25.39% | ★★★★★★ |

| BioArctic | 42.38% | 98.40% | ★★★★★★ |

| Biovica International | 81.67% | 78.55% | ★★★★★★ |

| Yubico | 20.52% | 42.18% | ★★★★★★ |

| Bonesupport Holding | 33.76% | 31.20% | ★★★★★★ |

| KebNi | 34.75% | 86.11% | ★★★★★★ |

| Skolon | 32.63% | 122.14% | ★★★★★★ |

We're going to check out a few of the best picks from our screener tool.

Telefonaktiebolaget LM Ericsson (OM:ERIC B)

Simply Wall St Growth Rating: ★★★★★☆

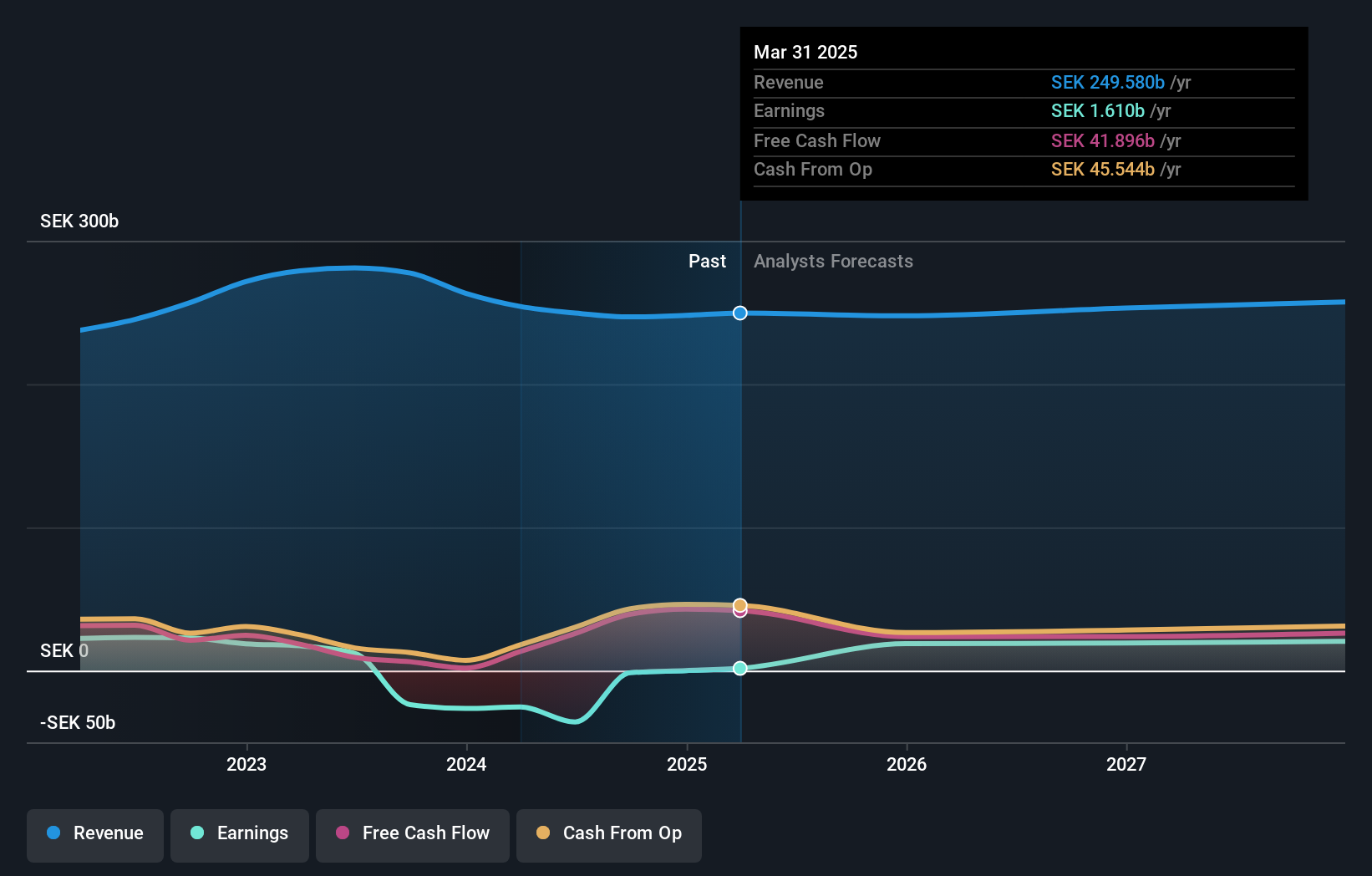

Overview: Telefonaktiebolaget LM Ericsson (publ) offers mobile connectivity solutions for telecom operators and enterprise customers across multiple regions, with a market cap of approximately SEK294.48 billion.

Operations: Ericsson generates revenue primarily through providing mobile connectivity solutions to telecom operators and enterprise customers across diverse regions, including North America, Europe, and Asia. The company's business model focuses on leveraging its extensive network infrastructure expertise to support the telecommunications industry.

Telefonaktiebolaget LM Ericsson (Ericsson) has shown a promising turnaround in its recent financial performance, with a significant reduction in net loss from SEK 30,670 million to SEK 3,814 million year-over-year for Q3. This improvement is mirrored by its robust R&D investment strategy, which remains central to its operational ethos. The company's commitment to innovation is evident from its R&D expenses, crucial for sustaining long-term growth in the competitive tech landscape. Furthermore, Ericsson's strategic alliances and client relationships underscore its industry influence and potential for future growth; notably, the expansion of its 5G network capabilities across Vietnam with Viettel highlights both market penetration and technological advancement prospects.

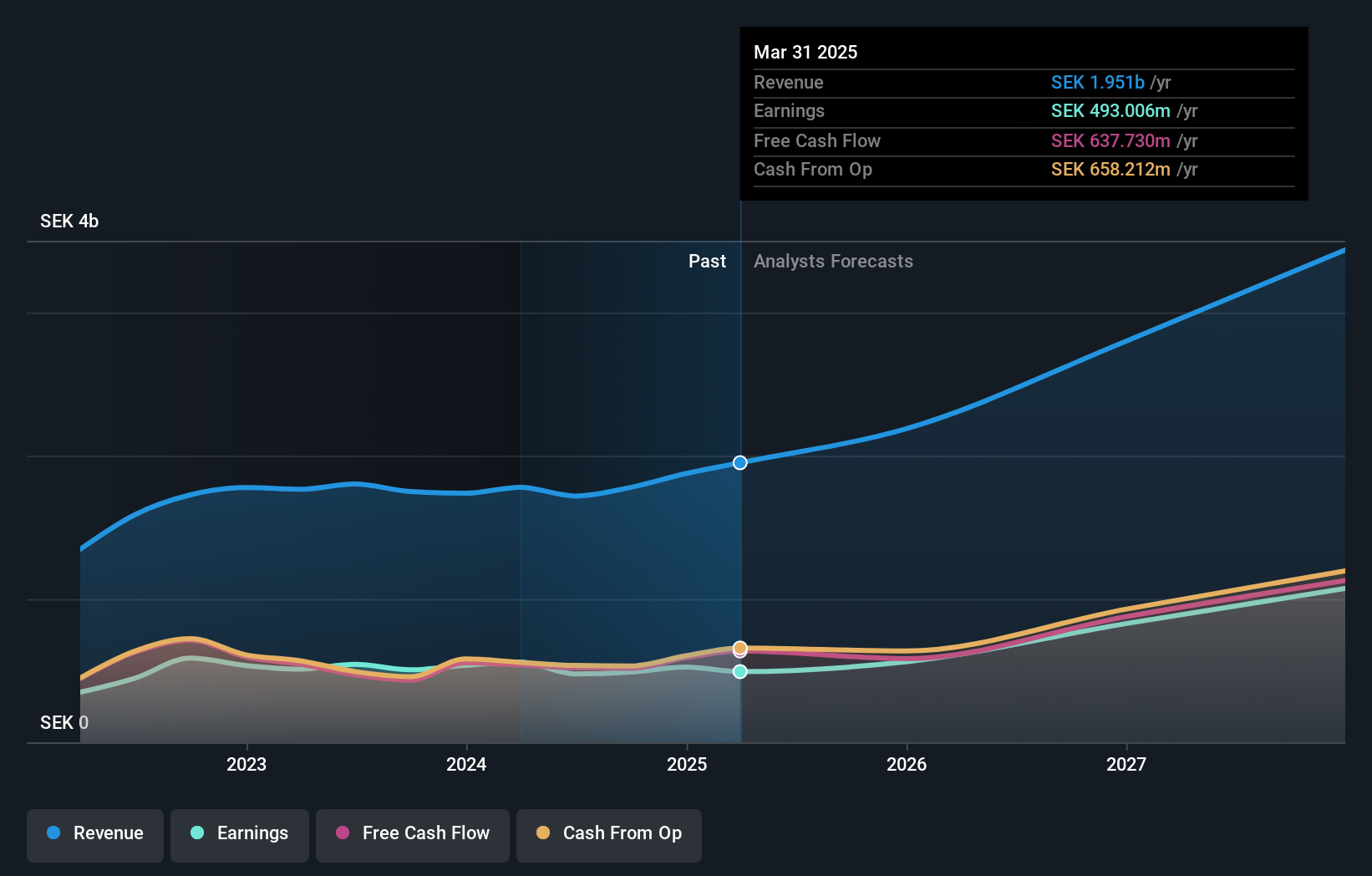

Sectra (OM:SECT B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sectra AB (publ) offers medical IT and cybersecurity solutions across Sweden, the United Kingdom, the Netherlands, and other parts of Europe with a market capitalization of SEK 55.95 billion.

Operations: Sectra generates revenue primarily through its Imaging IT Solutions and Secure Communications segments, with SEK 2.67 billion and SEK 388.55 million respectively. The company's focus on these sectors highlights its commitment to providing specialized technology solutions in medical IT and cybersecurity across Europe.

Sectra stands out in the Swedish tech landscape, not just for its solid financial performance but also for its strategic innovations in healthcare technology. Recently, Sectra reported a robust first-quarter revenue increase to SEK 739.48 million from SEK 603.03 million year-over-year, underpinned by a net income rise to SEK 80.4 million from SEK 61.56 million, reflecting a growth trajectory that significantly outpaces the average market projections with an earnings forecast growth rate of 21.2% per annum. Moreover, the company's recent deal with MaineGeneral Health to provide cloud-based imaging services exemplifies Sectra’s commitment to expanding its technological footprint and enhancing service scalability, ensuring it remains at the forefront of digital healthcare solutions while projecting future revenue growth at an impressive rate of 14.2% annually.

- Dive into the specifics of Sectra here with our thorough health report.

Examine Sectra's past performance report to understand how it has performed in the past.

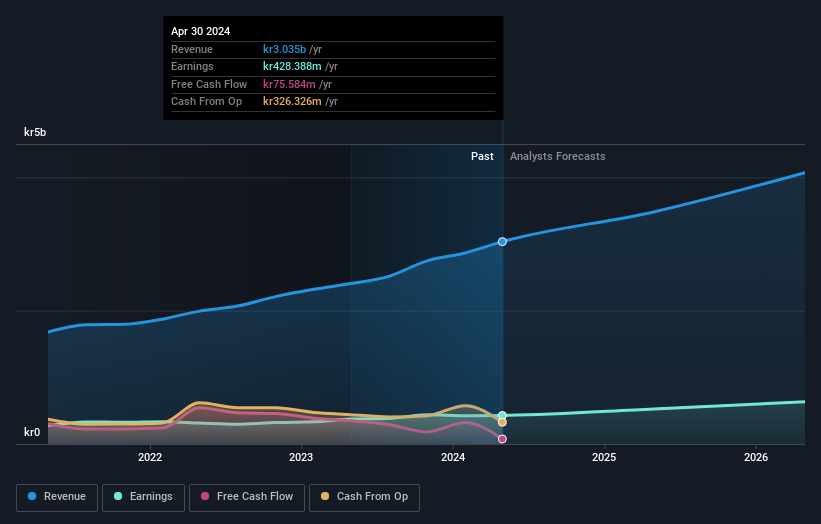

Truecaller (OM:TRUE B)

Simply Wall St Growth Rating: ★★★★★★

Overview: Truecaller AB (publ) is a company that develops and publishes mobile caller ID applications for individuals and businesses across India, the Middle East, Africa, and other international markets, with a market capitalization of approximately SEK15.63 billion.

Operations: The company generates revenue primarily from its communications software segment, amounting to SEK1.72 billion. Its operations focus on providing mobile caller ID applications across various international markets.

Truecaller, a key player in Sweden's tech sector, is navigating through a transformative phase with strategic personnel additions and partnerships aimed at enhancing its service offerings. The recent appointment of Seema Jindal as Head of Public Affairs underscores Truecaller’s commitment to fortify its regulatory framework, especially in critical markets like India. This move complements the company's collaboration with Halan to integrate Verified Business Caller ID solutions, which bolsters user trust and safety by authenticating business communications. Financially, Truecaller has demonstrated resilience despite a challenging environment; it reported revenues of SEK 457.87 million for Q2 2024 but saw a dip in net income to SEK 123.01 million from the previous year's SEK 205.95 million. Looking ahead, Truecaller is poised for robust growth with revenue and earnings projected to increase by 20.4% and 21.7% annually, outpacing broader market trends significantly.

- Click here and access our complete health analysis report to understand the dynamics of Truecaller.

Evaluate Truecaller's historical performance by accessing our past performance report.

Where To Now?

- Click here to access our complete index of 80 Swedish High Growth Tech and AI Stocks.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal