Discover Knowit And 2 Other Top Dividend Stocks On Swedish

As the global markets experience fluctuations, with European indices like the STOXX Europe 600 Index seeing modest gains amid hopes for economic stimulus, Sweden's stock market remains a focal point for investors looking to capitalize on dividend stocks. In this context, understanding what constitutes a strong dividend stock is crucial; factors such as consistent earnings performance and robust cash flow are key indicators of a company's ability to sustain and grow its dividend payouts.

Top 10 Dividend Stocks In Sweden

| Name | Dividend Yield | Dividend Rating |

| Bredband2 i Skandinavien (OM:BRE2) | 4.68% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 3.95% | ★★★★★☆ |

| Zinzino (OM:ZZ B) | 3.33% | ★★★★★☆ |

| Axfood (OM:AXFO) | 3.03% | ★★★★★☆ |

| Skandinaviska Enskilda Banken (OM:SEB A) | 5.60% | ★★★★★☆ |

| Duni (OM:DUNI) | 4.87% | ★★★★★☆ |

| Avanza Bank Holding (OM:AZA) | 5.02% | ★★★★★☆ |

| Loomis (OM:LOOMIS) | 3.97% | ★★★★☆☆ |

| Afry (OM:AFRY) | 3.12% | ★★★★☆☆ |

| Bahnhof (OM:BAHN B) | 3.75% | ★★★★☆☆ |

Click here to see the full list of 23 stocks from our Top Swedish Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Knowit (OM:KNOW)

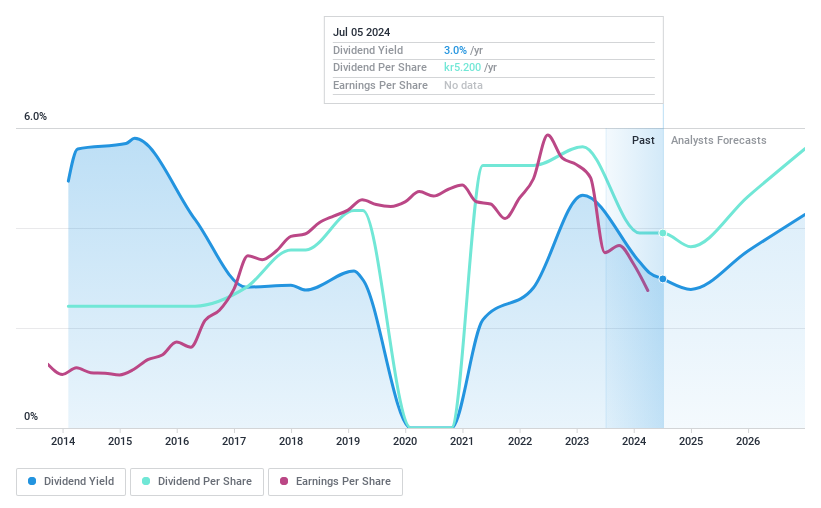

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Knowit AB (publ) is a consultancy company focused on developing digital solutions, with a market capitalization of approximately SEK4.18 billion.

Operations: Knowit AB (publ) generates revenue from several segments: Insight (SEK898.95 million), Solutions (SEK3.90 billion), Experience (SEK1.44 billion), and Connectivity (SEK1.02 billion).

Dividend Yield: 3.4%

Knowit's dividend sustainability is supported by a payout ratio of 77.3%, indicating earnings coverage, and a cash payout ratio of 41.6%, showing strong cash flow backing. However, its dividend history has been volatile over the past decade despite some growth in payments. Recent financials reveal declining net income and revenue, with second-quarter net income at SEK 3 million compared to SEK 19.5 million the previous year, which may affect future payouts.

- Take a closer look at Knowit's potential here in our dividend report.

- Upon reviewing our latest valuation report, Knowit's share price might be too pessimistic.

Loomis (OM:LOOMIS)

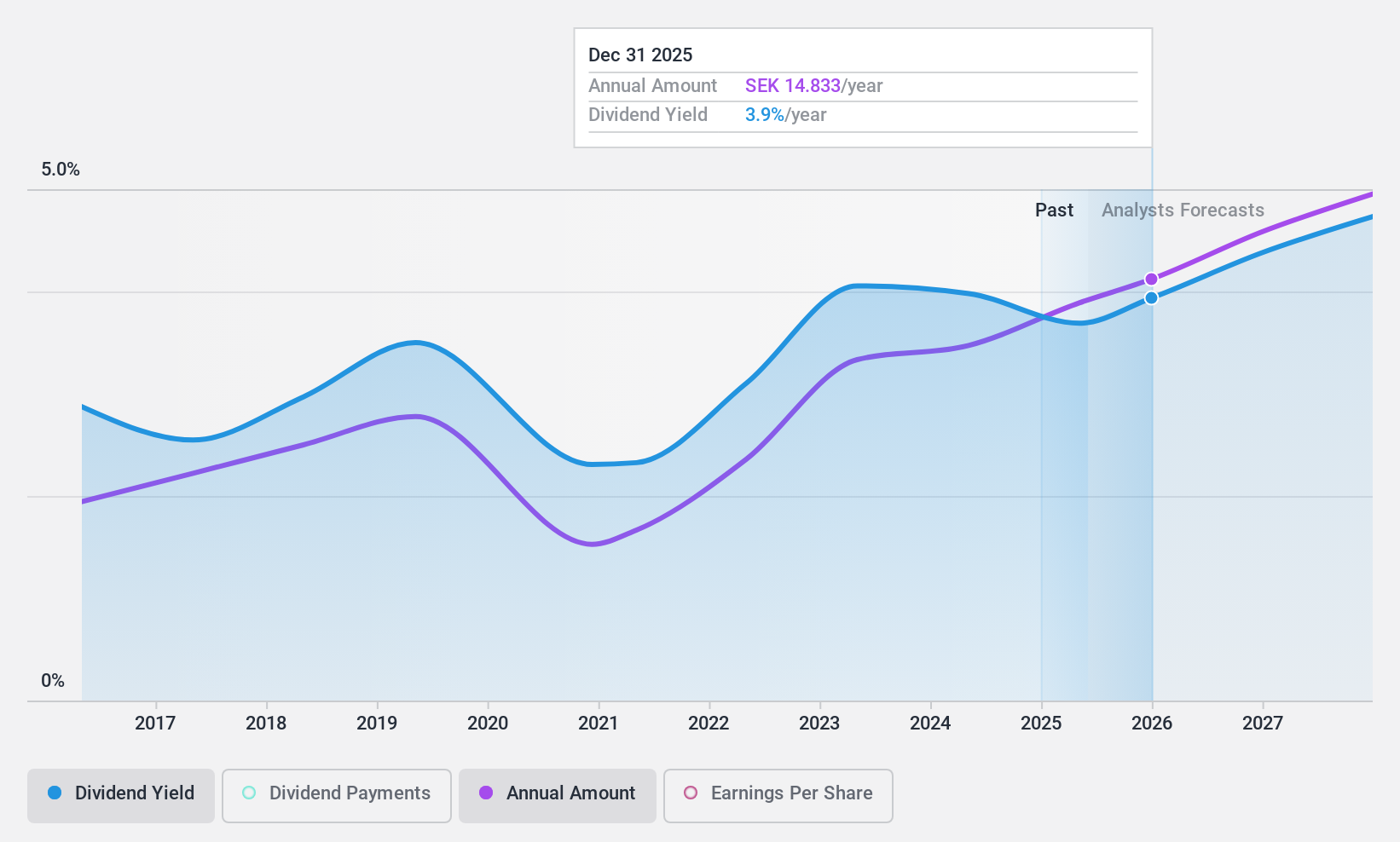

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Loomis AB (publ) offers solutions for the distribution, payments, handling, storage, and recycling of cash and other valuables with a market cap of SEK21.92 billion.

Operations: Loomis AB (publ) generates revenue primarily from its operations in Europe and Latin America, which contribute SEK14.32 billion, and the United States of America, which adds SEK15.45 billion, along with its Loomis Pay segment contributing SEK77 million.

Dividend Yield: 4%

Loomis's dividend payments are supported by a payout ratio of 59.4% and a cash payout ratio of 26.3%, indicating strong coverage from both earnings and cash flows. Despite past volatility, dividends have grown over the last decade. Recent financials show growth, with second-quarter sales rising to SEK 7.64 billion from SEK 7.07 billion year-on-year, though net income slightly decreased over six months compared to last year. Loomis also completed significant share buybacks totaling SEK 199.75 million recently, potentially impacting future dividend policies positively or negatively depending on strategic priorities and market conditions.

- Click here to discover the nuances of Loomis with our detailed analytical dividend report.

- According our valuation report, there's an indication that Loomis' share price might be on the cheaper side.

Softronic (OM:SOF B)

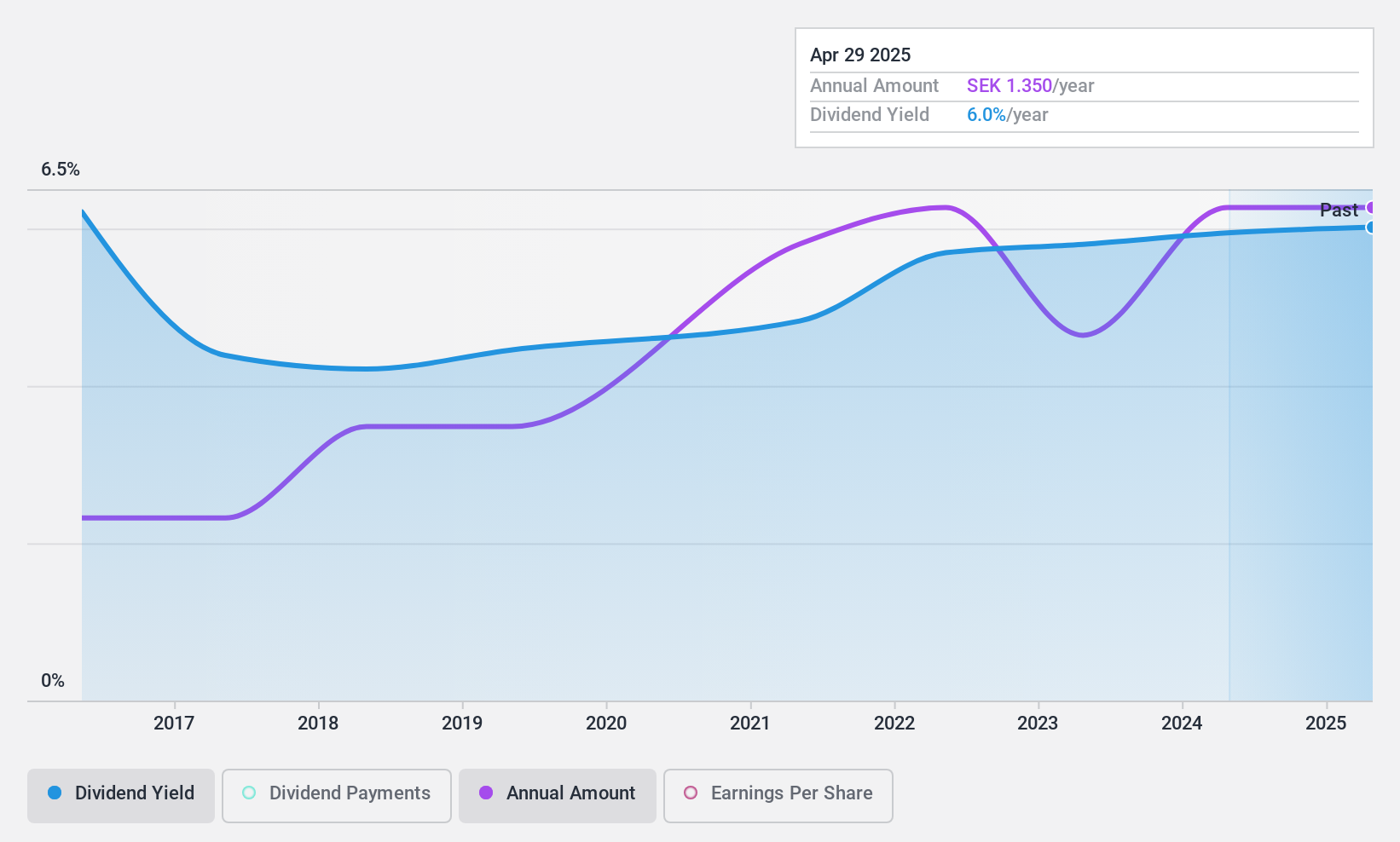

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Softronic AB (publ) is a company that offers IT and management services mainly in Sweden, with a market cap of SEK1.21 billion.

Operations: Softronic AB (publ) generates revenue from its Computer Services segment, amounting to SEK838.92 million.

Dividend Yield: 5.9%

Softronic's dividend yield of 5.87% ranks in the top 25% of Swedish dividend payers, but sustainability is a concern due to an 85.5% payout ratio and a high cash payout ratio of 94.5%, indicating dividends are not well covered by earnings or cash flows. Despite past volatility, dividends have grown over the last decade. Recent earnings show modest growth with Q2 sales at SEK 206.8 million and net income increasing to SEK 14.6 million year-on-year.

- Dive into the specifics of Softronic here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that Softronic is priced higher than what may be justified by its financials.

Taking Advantage

- Investigate our full lineup of 23 Top Swedish Dividend Stocks right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal