3 SGX Stocks That May Be Undervalued In October 2024

As the Singapore market navigates a period of cautious optimism, investors are keenly observing opportunities that may arise from undervalued stocks amidst broader economic developments. In this context, identifying stocks with strong fundamentals and potential for growth becomes crucial for those looking to capitalize on current market conditions.

Top 3 Undervalued Stocks Based On Cash Flows In Singapore

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Singapore Technologies Engineering (SGX:S63) | SGD4.62 | SGD7.29 | 36.6% |

| Digital Core REIT (SGX:DCRU) | US$0.58 | US$0.82 | 28.9% |

| Nanofilm Technologies International (SGX:MZH) | SGD0.84 | SGD1.43 | 41.1% |

| Seatrium (SGX:5E2) | SGD2.01 | SGD3.05 | 34.1% |

Here's a peek at a few of the choices from the screener.

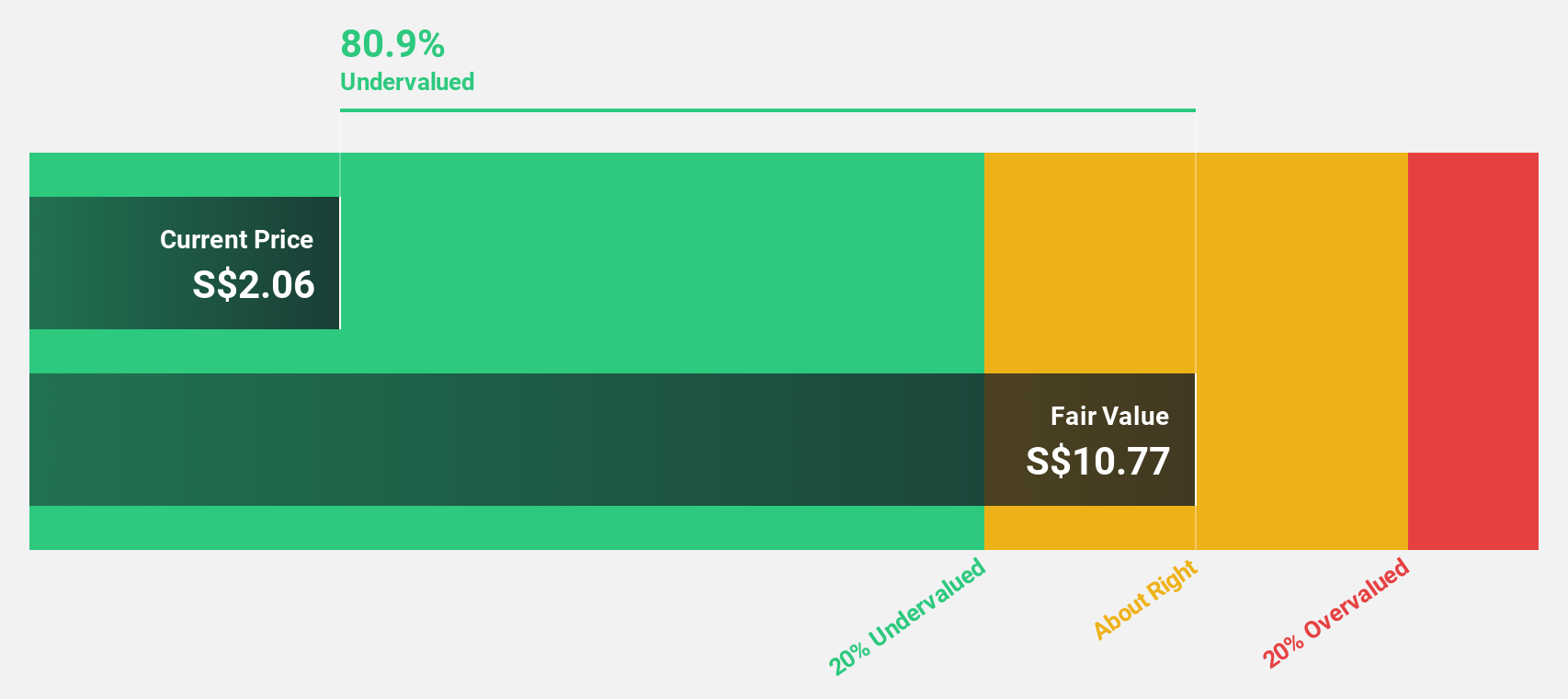

Seatrium (SGX:5E2)

Overview: Seatrium Limited offers engineering solutions to the offshore, marine, and energy industries with a market cap of SGD6.82 billion.

Operations: The company's revenue primarily comes from its Rigs & Floaters, Repairs & Upgrades, Offshore Platforms, and Specialised Shipbuilding segment, which generated SGD8.39 billion, while the Ship Chartering segment contributed SGD24.71 million.

Estimated Discount To Fair Value: 34.1%

Seatrium is trading at 34.1% below its estimated fair value of S$3.05, indicating potential undervaluation based on discounted cash flow analysis. The company has achieved profitability with net income of S$35.97 million for H1 2024, a significant turnaround from a loss last year. Despite lower forecasted revenue growth compared to the market, Seatrium's successful project deliveries and share buybacks underscore its operational efficiency and shareholder value focus.

- The growth report we've compiled suggests that Seatrium's future prospects could be on the up.

- Unlock comprehensive insights into our analysis of Seatrium stock in this financial health report.

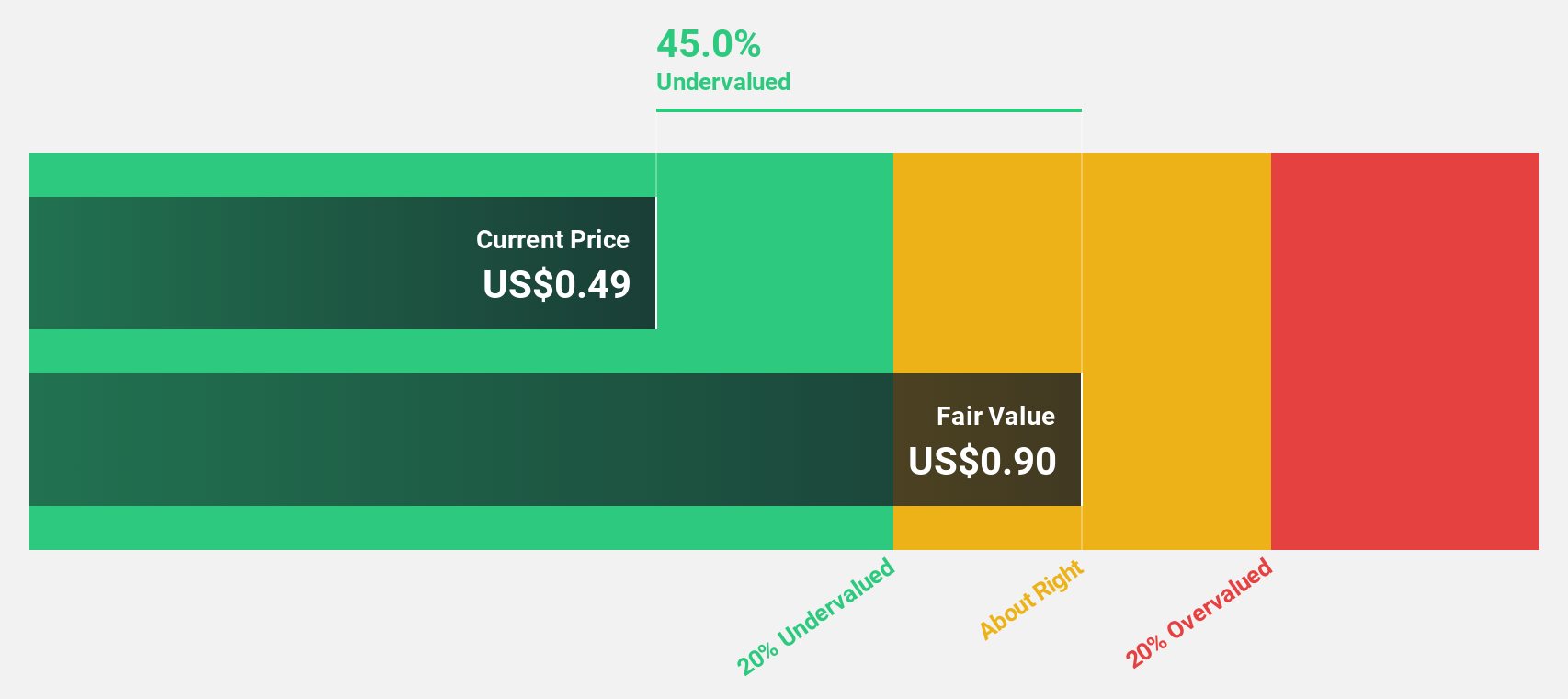

Digital Core REIT (SGX:DCRU)

Overview: Digital Core REIT (SGX: DCRU) is a Singapore-listed pure-play data centre real estate investment trust sponsored by Digital Realty, with a market cap of $753.43 million.

Operations: The company's revenue is derived entirely from its REIT - Commercial segment, amounting to $70.76 million.

Estimated Discount To Fair Value: 28.9%

Digital Core REIT is trading at 28.9% below its estimated fair value of US$0.82, highlighting potential undervaluation based on discounted cash flow analysis. Despite a recent decrease in revenue to US$48.26 million for the first half of 2024, net income improved significantly to US$18.63 million from the previous year. While dividends have been unstable and diluted shares are a concern, analysts project strong profit growth over the next three years, outpacing market averages.

- Our growth report here indicates Digital Core REIT may be poised for an improving outlook.

- Delve into the full analysis health report here for a deeper understanding of Digital Core REIT.

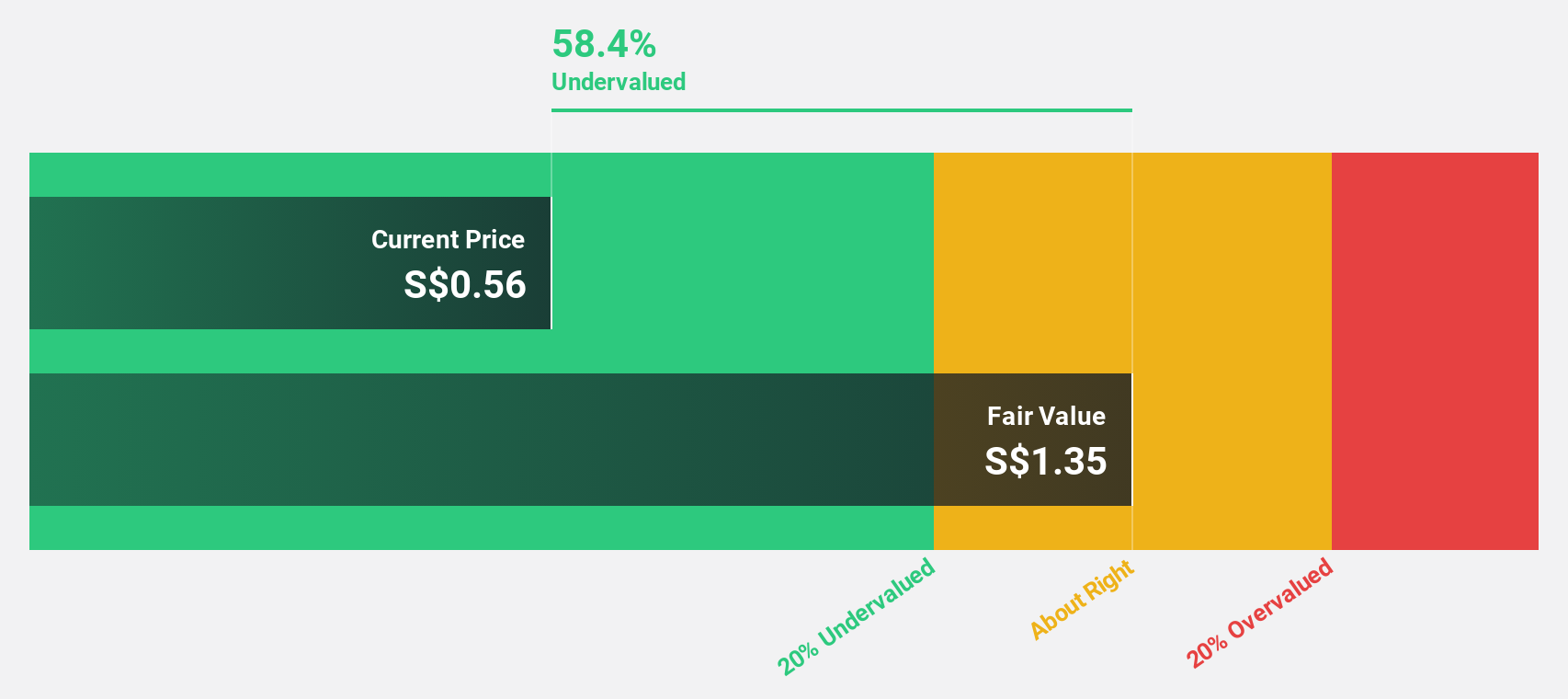

Nanofilm Technologies International (SGX:MZH)

Overview: Nanofilm Technologies International Limited, with a market cap of SGD546.91 million, offers nanotechnology solutions across Singapore, China, Japan, and Vietnam.

Operations: The company's revenue segments include Advanced Materials at SGD153.32 million, Nanofabrication at SGD18.37 million, Industrial Equipment at SGD28.71 million, and Sydrogen at SGD1.40 million.

Estimated Discount To Fair Value: 41.1%

Nanofilm Technologies International is trading at 41.1% below its estimated fair value of SGD 1.43, suggesting potential undervaluation based on cash flow analysis. While revenue is expected to grow faster than the Singapore market, profit margins have decreased from last year. Despite a net loss in the first half of 2024, earnings are forecast to grow significantly over the next three years, outpacing market averages and indicating strong future prospects amidst recent leadership changes.

- According our earnings growth report, there's an indication that Nanofilm Technologies International might be ready to expand.

- Click here and access our complete balance sheet health report to understand the dynamics of Nanofilm Technologies International.

Seize The Opportunity

- Click here to access our complete index of 4 Undervalued SGX Stocks Based On Cash Flows.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal