Market Participants Recognise Ganesha Ecosphere Limited's (NSE:GANECOS) Revenues Pushing Shares 25% Higher

Despite an already strong run, Ganesha Ecosphere Limited (NSE:GANECOS) shares have been powering on, with a gain of 25% in the last thirty days. The annual gain comes to 155% following the latest surge, making investors sit up and take notice.

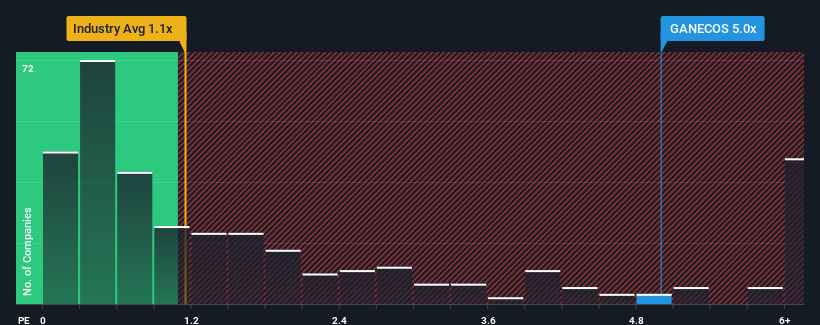

Since its price has surged higher, when almost half of the companies in India's Luxury industry have price-to-sales ratios (or "P/S") below 1.1x, you may consider Ganesha Ecosphere as a stock not worth researching with its 5x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for Ganesha Ecosphere

What Does Ganesha Ecosphere's Recent Performance Look Like?

Ganesha Ecosphere could be doing better as it's been growing revenue less than most other companies lately. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Ganesha Ecosphere will help you uncover what's on the horizon.How Is Ganesha Ecosphere's Revenue Growth Trending?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Ganesha Ecosphere's to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 5.6% last year. Pleasingly, revenue has also lifted 37% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 28% per year during the coming three years according to the sole analyst following the company. Meanwhile, the rest of the industry is forecast to only expand by 14% each year, which is noticeably less attractive.

With this information, we can see why Ganesha Ecosphere is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

Shares in Ganesha Ecosphere have seen a strong upwards swing lately, which has really helped boost its P/S figure. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our look into Ganesha Ecosphere shows that its P/S ratio remains high on the merit of its strong future revenues. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Ganesha Ecosphere that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal