Exploring Three Undiscovered Gems in Hong Kong with Strong Potential

As global markets experience fluctuations, with Chinese equities recently declining and the Hong Kong Hang Seng Index falling significantly, investors are increasingly looking for opportunities in less volatile sectors. In this environment, identifying stocks with strong fundamentals and growth potential becomes crucial for those seeking to navigate the complexities of the market.

Top 10 Undiscovered Gems With Strong Fundamentals In Hong Kong

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| E-Commodities Holdings | 21.33% | 9.04% | 28.46% | ★★★★★★ |

| C&D Property Management Group | 1.32% | 37.15% | 41.55% | ★★★★★★ |

| Changjiu Holdings | NA | 11.84% | 2.46% | ★★★★★★ |

| ManpowerGroup Greater China | NA | 14.56% | 1.58% | ★★★★★★ |

| Sundart Holdings | 0.92% | -2.32% | -3.94% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Xin Point Holdings | 1.77% | 10.88% | 22.83% | ★★★★★☆ |

| S.A.S. Dragon Holdings | 60.96% | 4.62% | 10.02% | ★★★★★☆ |

| Carote | 2.36% | 85.09% | 92.12% | ★★★★★☆ |

| Billion Industrial Holdings | 3.63% | 18.00% | -11.38% | ★★★★★☆ |

Let's uncover some gems from our specialized screener.

Kinetic Development Group (SEHK:1277)

Simply Wall St Value Rating: ★★★★★☆

Overview: Kinetic Development Group Limited is an investment holding company involved in the extraction and sale of coal products in the People's Republic of China, with a market capitalization of HK$14.16 billion.

Operations: Kinetic Development Group generates revenue primarily through the extraction and sale of coal products in China. The company's financial performance is characterized by its focus on these core activities within the coal industry.

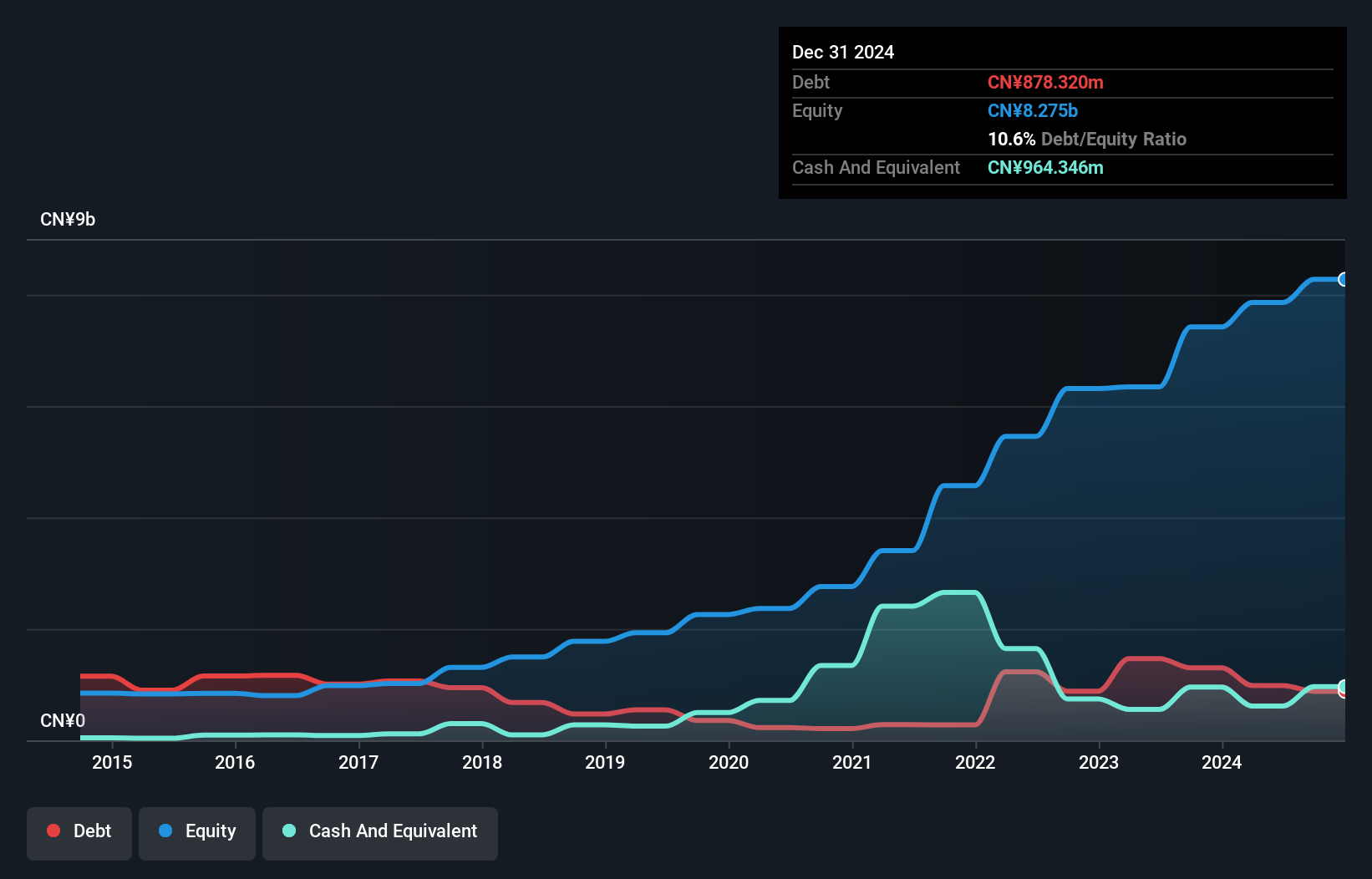

Kinetic Development Group, a smaller player in the market, has shown impressive financial health with a net debt to equity ratio of 4.7%, which is satisfactory. Their earnings grew by 39% over the past year, surpassing industry growth of 4.6%. The company reported half-year sales of CNY 2.53 billion and net income of CNY 1.10 billion, up from last year's figures. Additionally, they declared both interim and special dividends recently, reflecting strong cash flow management and shareholder returns.

- Navigate through the intricacies of Kinetic Development Group with our comprehensive health report here.

Gain insights into Kinetic Development Group's past trends and performance with our Past report.

Sprocomm Intelligence (SEHK:1401)

Simply Wall St Value Rating: ★★★★★☆

Overview: Sprocomm Intelligence Limited is an investment holding company that focuses on the research and development, design, manufacture, and sale of mobile phones across various international markets including China, India, Algeria, and Bangladesh with a market capitalization of HK$5.53 billion.

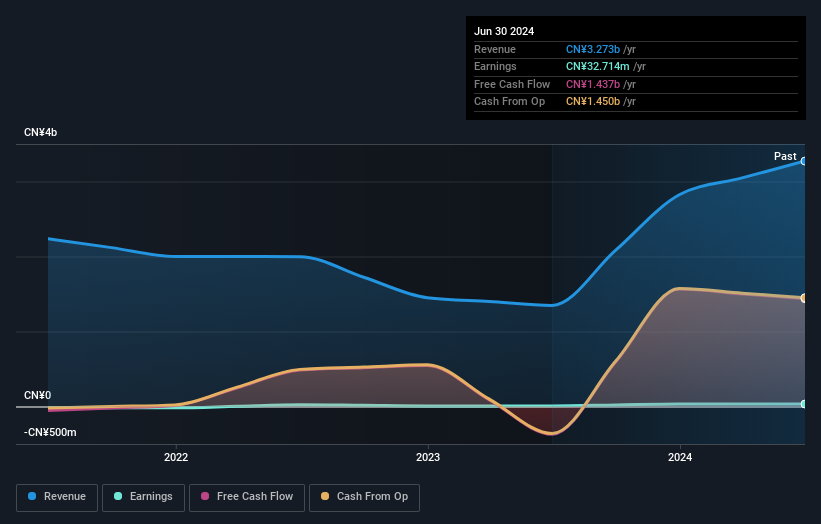

Operations: The primary revenue stream for Sprocomm Intelligence comes from its wireless communications equipment segment, generating CN¥3.27 billion.

Sprocomm Intelligence, a tech player in Hong Kong's market, has shown impressive earnings growth of 301% over the past year, outpacing the broader industry. Despite this surge, its earnings have decreased by 5.5% annually over five years. A notable one-off gain of CN¥18 million influenced recent financial results. The company's debt-to-equity ratio improved from 73.8% to 37.6% in five years and it trades at a significant discount to estimated fair value by 93%. Recent M&A activity saw a combined acquisition of a 33% stake for HK$200 million by undisclosed buyers, signaling potential strategic interest in Sprocomm's future trajectory.

- Get an in-depth perspective on Sprocomm Intelligence's performance by reading our health report here.

Understand Sprocomm Intelligence's track record by examining our Past report.

Sinopec Kantons Holdings (SEHK:934)

Simply Wall St Value Rating: ★★★★★★

Overview: Sinopec Kantons Holdings Limited is an investment holding company that offers crude oil jetty services, with a market capitalization of approximately HK$11.78 billion.

Operations: The primary revenue stream for Sinopec Kantons Holdings comes from crude oil jetty and storage services, generating HK$632.38 million.

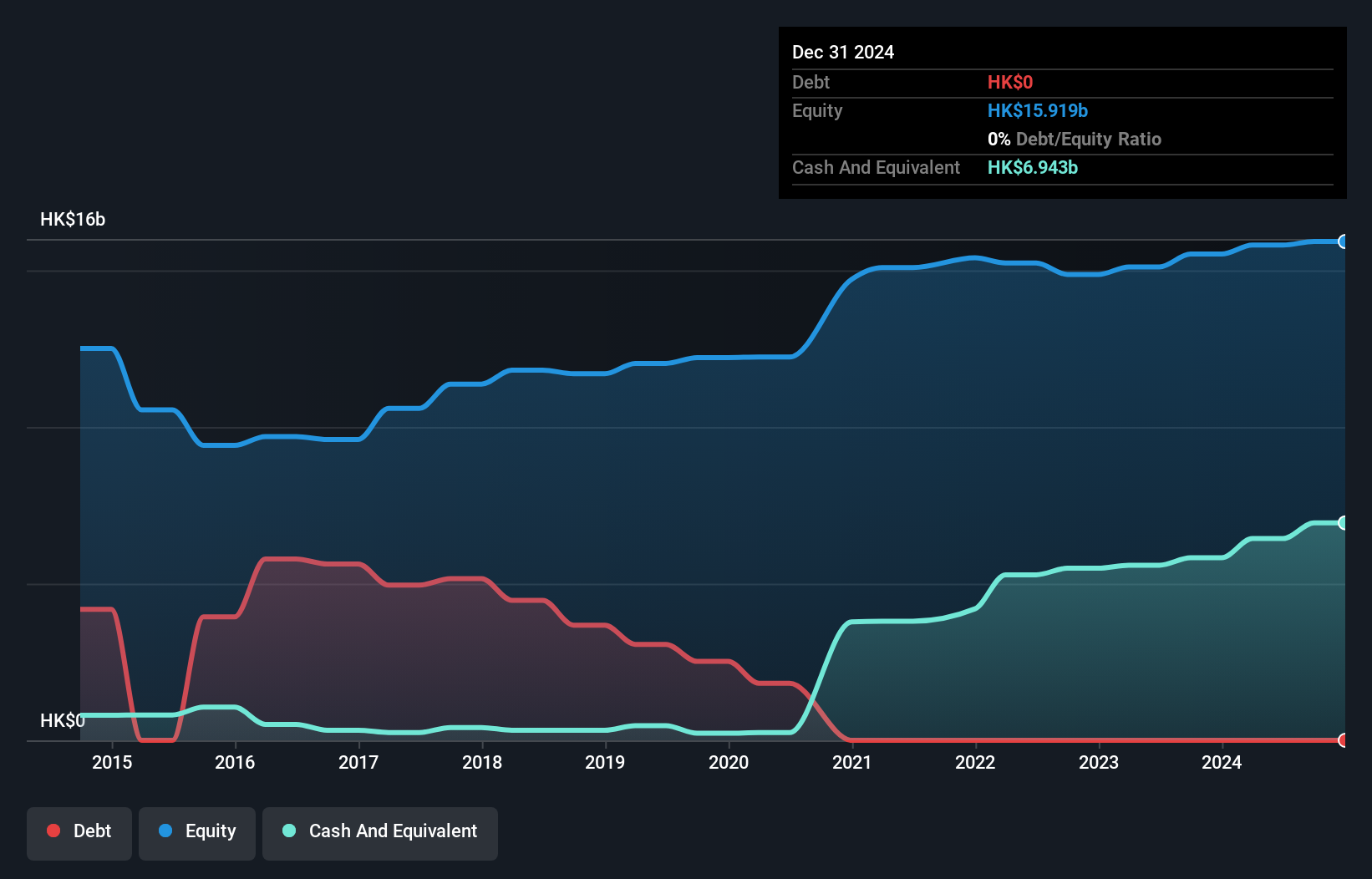

Sinopec Kantons Holdings, a smaller player in the energy sector, shows promising characteristics with its debt-free status compared to five years ago when it had a 25.5% debt-to-equity ratio. Trading at 59% below its estimated fair value, it seems undervalued. The company reported half-year sales of HK$331 million and net income of HK$685 million, reflecting a drop from the previous year’s HK$744 million. Recent leadership changes might influence future strategic directions.

- Take a closer look at Sinopec Kantons Holdings' potential here in our health report.

Evaluate Sinopec Kantons Holdings' historical performance by accessing our past performance report.

Summing It All Up

- Unlock more gems! Our SEHK Undiscovered Gems With Strong Fundamentals screener has unearthed 165 more companies for you to explore.Click here to unveil our expertly curated list of 168 SEHK Undiscovered Gems With Strong Fundamentals.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal