Chengdu Tangyuan Electric Co.,Ltd.'s (SZSE:300789) Share Price Boosted 39% But Its Business Prospects Need A Lift Too

The Chengdu Tangyuan Electric Co.,Ltd. (SZSE:300789) share price has done very well over the last month, posting an excellent gain of 39%. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 6.0% over the last year.

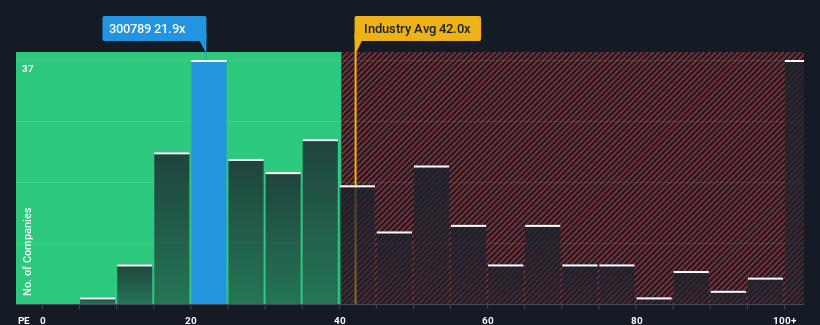

In spite of the firm bounce in price, given about half the companies in China have price-to-earnings ratios (or "P/E's") above 32x, you may still consider Chengdu Tangyuan ElectricLtd as an attractive investment with its 21.9x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

It looks like earnings growth has deserted Chengdu Tangyuan ElectricLtd recently, which is not something to boast about. One possibility is that the P/E is low because investors think this benign earnings growth rate will likely underperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for Chengdu Tangyuan ElectricLtd

What Are Growth Metrics Telling Us About The Low P/E?

Chengdu Tangyuan ElectricLtd's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Retrospectively, the last year delivered virtually the same number to the company's bottom line as the year before. Still, the latest three year period has seen an excellent 62% overall rise in EPS, in spite of its uninspiring short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

This is in contrast to the rest of the market, which is expected to grow by 37% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we can see why Chengdu Tangyuan ElectricLtd is trading at a P/E lower than the market. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

The Final Word

Chengdu Tangyuan ElectricLtd's stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Chengdu Tangyuan ElectricLtd revealed its three-year earnings trends are contributing to its low P/E, given they look worse than current market expectations. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. If recent medium-term earnings trends continue, it's hard to see the share price rising strongly in the near future under these circumstances.

Plus, you should also learn about this 1 warning sign we've spotted with Chengdu Tangyuan ElectricLtd.

You might be able to find a better investment than Chengdu Tangyuan ElectricLtd. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal