Sichuan Newsnet Media (Group) Co.,Ltd. (SZSE:300987) Stock Rockets 40% As Investors Are Less Pessimistic Than Expected

The Sichuan Newsnet Media (Group) Co.,Ltd. (SZSE:300987) share price has done very well over the last month, posting an excellent gain of 40%. Unfortunately, despite the strong performance over the last month, the full year gain of 3.0% isn't as attractive.

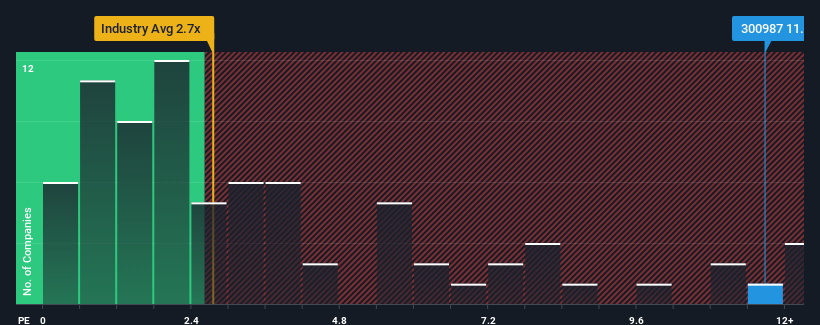

After such a large jump in price, you could be forgiven for thinking Sichuan Newsnet Media (Group)Ltd is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 11.7x, considering almost half the companies in China's Media industry have P/S ratios below 2.7x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Sichuan Newsnet Media (Group)Ltd

What Does Sichuan Newsnet Media (Group)Ltd's P/S Mean For Shareholders?

Revenue has risen firmly for Sichuan Newsnet Media (Group)Ltd recently, which is pleasing to see. One possibility is that the P/S ratio is high because investors think this respectable revenue growth will be enough to outperform the broader industry in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Sichuan Newsnet Media (Group)Ltd's earnings, revenue and cash flow.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as steep as Sichuan Newsnet Media (Group)Ltd's is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered an exceptional 16% gain to the company's top line. The latest three year period has also seen an excellent 34% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 13% shows it's noticeably less attractive.

With this in mind, we find it worrying that Sichuan Newsnet Media (Group)Ltd's P/S exceeds that of its industry peers. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

The Final Word

Sichuan Newsnet Media (Group)Ltd's P/S has grown nicely over the last month thanks to a handy boost in the share price. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

The fact that Sichuan Newsnet Media (Group)Ltd currently trades on a higher P/S relative to the industry is an oddity, since its recent three-year growth is lower than the wider industry forecast. Right now we aren't comfortable with the high P/S as this revenue performance isn't likely to support such positive sentiment for long. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with Sichuan Newsnet Media (Group)Ltd (at least 2 which make us uncomfortable), and understanding them should be part of your investment process.

If these risks are making you reconsider your opinion on Sichuan Newsnet Media (Group)Ltd, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal