Market Might Still Lack Some Conviction On The Agency Group Australia Limited (ASX:AU1) Even After 30% Share Price Boost

The Agency Group Australia Limited (ASX:AU1) shareholders would be excited to see that the share price has had a great month, posting a 30% gain and recovering from prior weakness. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 10% over that time.

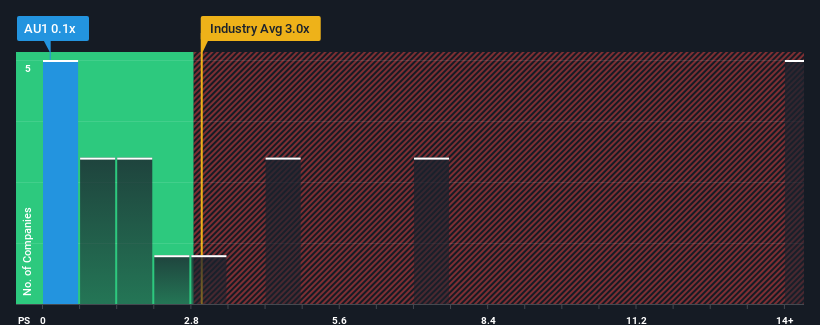

In spite of the firm bounce in price, Agency Group Australia's price-to-sales (or "P/S") ratio of 0.1x might still make it look like a strong buy right now compared to the wider Real Estate industry in Australia, where around half of the companies have P/S ratios above 2.9x and even P/S above 8x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

View our latest analysis for Agency Group Australia

How Agency Group Australia Has Been Performing

Revenue has risen firmly for Agency Group Australia recently, which is pleasing to see. One possibility is that the P/S is low because investors think this respectable revenue growth might actually underperform the broader industry in the near future. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Agency Group Australia's earnings, revenue and cash flow.How Is Agency Group Australia's Revenue Growth Trending?

In order to justify its P/S ratio, Agency Group Australia would need to produce anemic growth that's substantially trailing the industry.

Retrospectively, the last year delivered a decent 14% gain to the company's revenues. This was backed up an excellent period prior to see revenue up by 51% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenues over that time.

Comparing that to the industry, which is predicted to shrink 2.4% in the next 12 months, the company's positive momentum based on recent medium-term revenue results is a bright spot for the moment.

In light of this, it's quite peculiar that Agency Group Australia's P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can maintain its recent positive growth rate in the face of a shrinking broader industry.

The Key Takeaway

Agency Group Australia's recent share price jump still sees fails to bring its P/S alongside the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Looking at the figures, it's surprising to see Agency Group Australia currently trades on a much lower than expected P/S since its recent three-year revenue growth is beating forecasts for a struggling industry. There could be some major unobserved threats to revenue preventing the P/S ratio from matching this positive performance. Perhaps there is some hesitation about the company's ability to stay its recent course and swim against the current of the broader industry turmoil. While the chance of the share price dropping sharply is fairly remote, investors do seem to be anticipating future revenue instability.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Agency Group Australia (1 is a bit concerning!) that you need to be mindful of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal