Yoshimura Food Holdings K.K (TSE:2884) Seems To Use Debt Quite Sensibly

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that Yoshimura Food Holdings K.K. (TSE:2884) does have debt on its balance sheet. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Yoshimura Food Holdings K.K

What Is Yoshimura Food Holdings K.K's Net Debt?

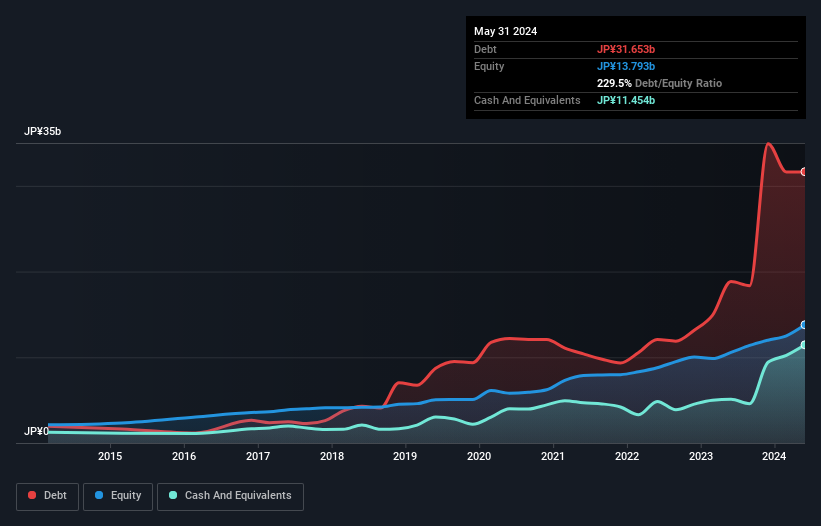

The image below, which you can click on for greater detail, shows that at May 2024 Yoshimura Food Holdings K.K had debt of JP¥31.7b, up from JP¥18.8b in one year. On the flip side, it has JP¥11.5b in cash leading to net debt of about JP¥20.2b.

How Strong Is Yoshimura Food Holdings K.K's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Yoshimura Food Holdings K.K had liabilities of JP¥25.7b due within 12 months and liabilities of JP¥14.8b due beyond that. Offsetting these obligations, it had cash of JP¥11.5b as well as receivables valued at JP¥7.36b due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by JP¥21.7b.

This deficit isn't so bad because Yoshimura Food Holdings K.K is worth JP¥38.5b, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. But it's clear that we should definitely closely examine whether it can manage its debt without dilution.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Yoshimura Food Holdings K.K's net debt is 4.1 times its EBITDA, which is a significant but still reasonable amount of leverage. However, its interest coverage of 14.6 is very high, suggesting that the interest expense on the debt is currently quite low. Pleasingly, Yoshimura Food Holdings K.K is growing its EBIT faster than former Australian PM Bob Hawke downs a yard glass, boasting a 196% gain in the last twelve months. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Yoshimura Food Holdings K.K can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Happily for any shareholders, Yoshimura Food Holdings K.K actually produced more free cash flow than EBIT over the last three years. That sort of strong cash conversion gets us as excited as the crowd when the beat drops at a Daft Punk concert.

Our View

Happily, Yoshimura Food Holdings K.K's impressive interest cover implies it has the upper hand on its debt. But we must concede we find its net debt to EBITDA has the opposite effect. Taking all this data into account, it seems to us that Yoshimura Food Holdings K.K takes a pretty sensible approach to debt. That means they are taking on a bit more risk, in the hope of boosting shareholder returns. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. For instance, we've identified 3 warning signs for Yoshimura Food Holdings K.K (2 shouldn't be ignored) you should be aware of.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal