Further Upside For Adairs Limited (ASX:ADH) Shares Could Introduce Price Risks After 37% Bounce

Adairs Limited (ASX:ADH) shares have had a really impressive month, gaining 37% after a shaky period beforehand. Looking back a bit further, it's encouraging to see the stock is up 80% in the last year.

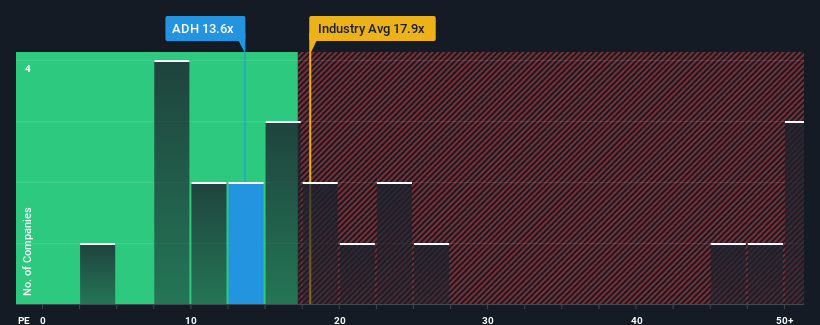

In spite of the firm bounce in price, given about half the companies in Australia have price-to-earnings ratios (or "P/E's") above 20x, you may still consider Adairs as an attractive investment with its 13.6x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

While the market has experienced earnings growth lately, Adairs' earnings have gone into reverse gear, which is not great. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Adairs

How Is Adairs' Growth Trending?

There's an inherent assumption that a company should underperform the market for P/E ratios like Adairs' to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 18%. As a result, earnings from three years ago have also fallen 53% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 16% per year during the coming three years according to the nine analysts following the company. Meanwhile, the rest of the market is forecast to expand by 18% per annum, which is not materially different.

With this information, we find it odd that Adairs is trading at a P/E lower than the market. It may be that most investors are not convinced the company can achieve future growth expectations.

The Final Word

The latest share price surge wasn't enough to lift Adairs' P/E close to the market median. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Adairs currently trades on a lower than expected P/E since its forecast growth is in line with the wider market. There could be some unobserved threats to earnings preventing the P/E ratio from matching the outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

You always need to take note of risks, for example - Adairs has 1 warning sign we think you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal