Investors Still Aren't Entirely Convinced By Chengdu Xiling Power Science & Technology Incorporated Company's (SZSE:300733) Revenues Despite 39% Price Jump

The Chengdu Xiling Power Science & Technology Incorporated Company (SZSE:300733) share price has done very well over the last month, posting an excellent gain of 39%. Unfortunately, despite the strong performance over the last month, the full year gain of 7.7% isn't as attractive.

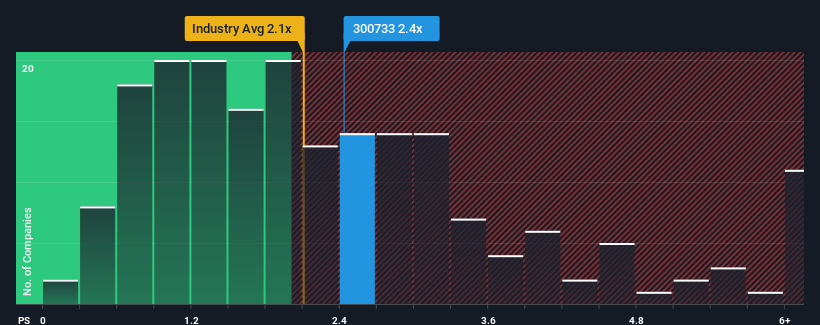

Although its price has surged higher, you could still be forgiven for feeling indifferent about Chengdu Xiling Power Science & Technology's P/S ratio of 2.4x, since the median price-to-sales (or "P/S") ratio for the Auto Components industry in China is also close to 2.1x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Chengdu Xiling Power Science & Technology

What Does Chengdu Xiling Power Science & Technology's Recent Performance Look Like?

Recent times have been advantageous for Chengdu Xiling Power Science & Technology as its revenues have been rising faster than most other companies. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Chengdu Xiling Power Science & Technology.What Are Revenue Growth Metrics Telling Us About The P/S?

Chengdu Xiling Power Science & Technology's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered an exceptional 22% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 143% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue should grow by 67% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 23%, which is noticeably less attractive.

With this information, we find it interesting that Chengdu Xiling Power Science & Technology is trading at a fairly similar P/S compared to the industry. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Final Word

Its shares have lifted substantially and now Chengdu Xiling Power Science & Technology's P/S is back within range of the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Chengdu Xiling Power Science & Technology currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Before you take the next step, you should know about the 1 warning sign for Chengdu Xiling Power Science & Technology that we have uncovered.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal