Risks Still Elevated At These Prices As Universal Technologies Holdings Limited (HKG:1026) Shares Dive 26%

The Universal Technologies Holdings Limited (HKG:1026) share price has fared very poorly over the last month, falling by a substantial 26%. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 35% share price drop.

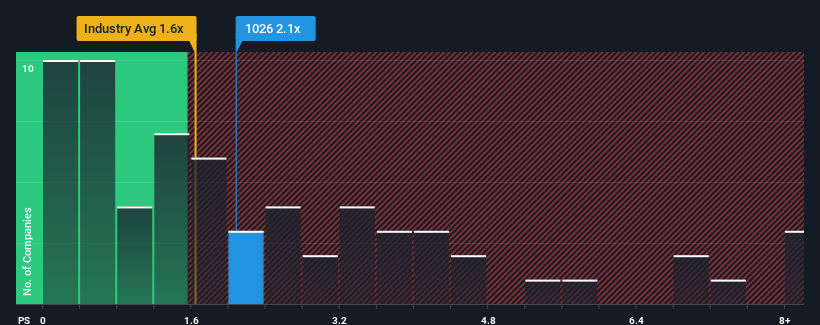

Although its price has dipped substantially, you could still be forgiven for thinking Universal Technologies Holdings is a stock not worth researching with a price-to-sales ratios (or "P/S") of 2.1x, considering almost half the companies in Hong Kong's Water Utilities industry have P/S ratios below 0.6x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

Check out our latest analysis for Universal Technologies Holdings

How Universal Technologies Holdings Has Been Performing

For example, consider that Universal Technologies Holdings' financial performance has been poor lately as its revenue has been in decline. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, which is keeping the P/S ratio high. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Although there are no analyst estimates available for Universal Technologies Holdings, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Universal Technologies Holdings' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 6.0% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 17% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 18% shows it's an unpleasant look.

With this in mind, we find it worrying that Universal Technologies Holdings' P/S exceeds that of its industry peers. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

What We Can Learn From Universal Technologies Holdings' P/S?

Despite the recent share price weakness, Universal Technologies Holdings' P/S remains higher than most other companies in the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Universal Technologies Holdings revealed its shrinking revenue over the medium-term isn't resulting in a P/S as low as we expected, given the industry is set to grow. Right now we aren't comfortable with the high P/S as this revenue performance is highly unlikely to support such positive sentiment for long. Unless the recent medium-term conditions improve markedly, investors will have a hard time accepting the share price as fair value.

It is also worth noting that we have found 3 warning signs for Universal Technologies Holdings (1 makes us a bit uncomfortable!) that you need to take into consideration.

If these risks are making you reconsider your opinion on Universal Technologies Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal