Undervalued Small Caps With Insider Action In Australia For October 2024

Over the last 7 days, the Australian market has risen by 1.7%, contributing to an impressive 18% increase over the past year, with earnings forecasted to grow by 12% annually. In this dynamic environment, identifying small-cap stocks that show potential for growth and have insider activity can be a strategic approach for investors looking to capitalize on current market conditions.

Top 10 Undervalued Small Caps With Insider Buying In Australia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Magellan Financial Group | 8.1x | 5.1x | 33.30% | ★★★★★☆ |

| GWA Group | 16.9x | 1.6x | 40.15% | ★★★★★☆ |

| SHAPE Australia | 14.5x | 0.3x | 33.12% | ★★★★☆☆ |

| Collins Foods | 18.1x | 0.7x | 7.53% | ★★★★☆☆ |

| Eagers Automotive | 10.9x | 0.3x | 37.50% | ★★★★☆☆ |

| Tabcorp Holdings | NA | 0.5x | 19.99% | ★★★★☆☆ |

| Mader Group | 22.3x | 1.5x | 46.59% | ★★★☆☆☆ |

| Dicker Data | 20.9x | 0.7x | -72.33% | ★★★☆☆☆ |

| Coventry Group | 239.6x | 0.4x | -18.55% | ★★★☆☆☆ |

| Abacus Storage King | 12.1x | 7.6x | -29.66% | ★★★☆☆☆ |

Here's a peek at a few of the choices from the screener.

Mader Group (ASX:MAD)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Mader Group is a company that provides staffing and outsourcing services, with a market capitalization of A$1.03 billion.

Operations: The primary revenue stream for the company is from Staffing & Outsourcing Services, with recent figures reaching A$774.47 million. The gross profit margin has shown a trend of increase over time, peaking at 22.99% by the end of June 2024. Operating expenses and non-operating expenses are significant cost components, with general and administrative expenses forming a substantial part of operating costs.

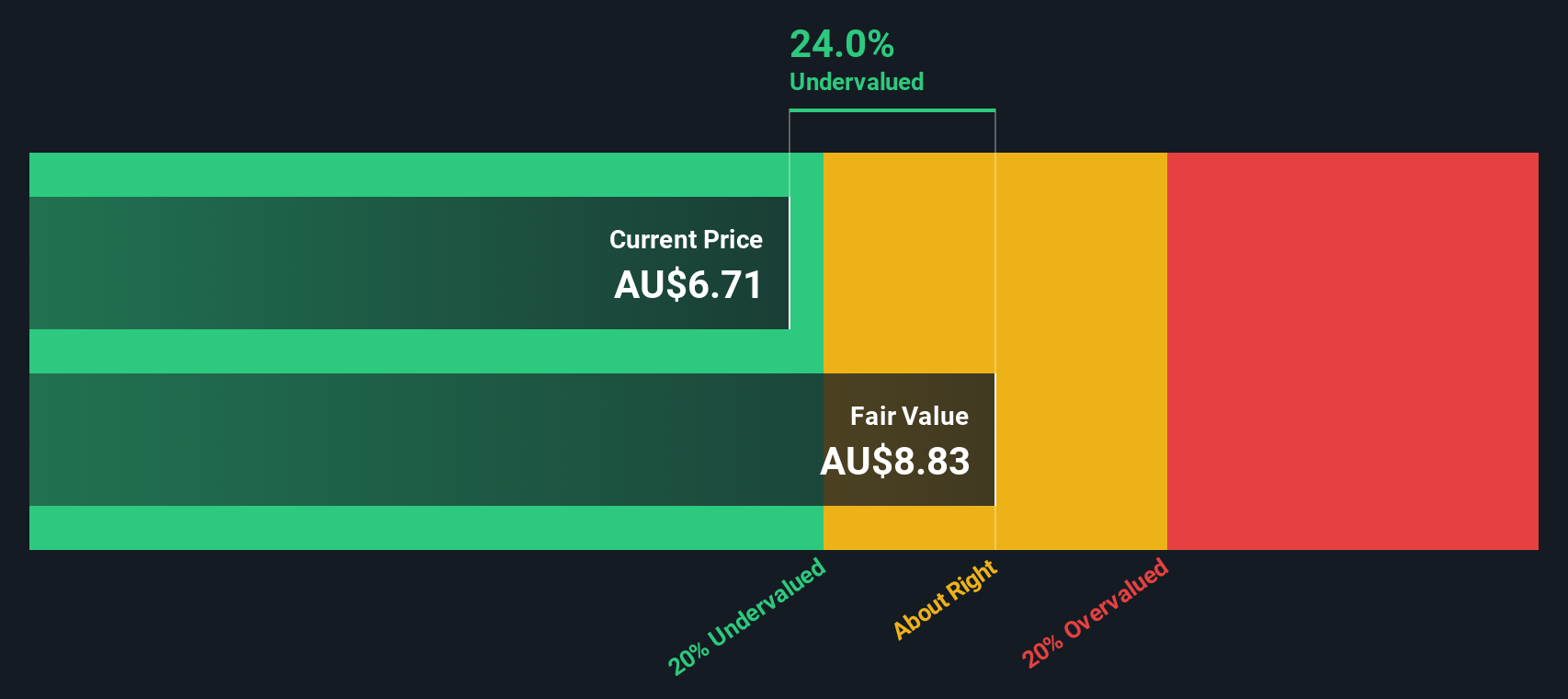

PE: 22.3x

Mader Group, a standout among Australia's smaller stocks, is capturing attention with its forecasted annual earnings growth of 13.47%. Despite relying entirely on external borrowing for funding, the company has shown strong financial performance. For fiscal 2024, it reported A$774.5 million in sales and A$50.42 million net income, marking significant year-on-year increases. Insider confidence is evident as they purchased shares recently. As Mader joins the S&P Global BMI Index and projects further revenue growth to at least A$870 million in 2025, potential investors may find this promising amidst its current valuation challenges.

- Click here and access our complete valuation analysis report to understand the dynamics of Mader Group.

Review our historical performance report to gain insights into Mader Group's's past performance.

MFF Capital Investments (ASX:MFF)

Simply Wall St Value Rating: ★★★★☆☆

Overview: MFF Capital Investments is an investment company focused on managing a portfolio of international and domestic equities, with a market capitalization of A$2.03 billion.

Operations: MFF Capital Investments generates revenue primarily through equity investments, with recent figures showing A$659.96 million in revenue. The company consistently achieves a gross profit margin of 100%, indicating no cost of goods sold is recorded. Operating expenses are relatively low compared to revenue, with the most recent period reporting A$3.89 million in operating expenses and a net income of A$447.36 million, resulting in a net income margin of 67.78%.

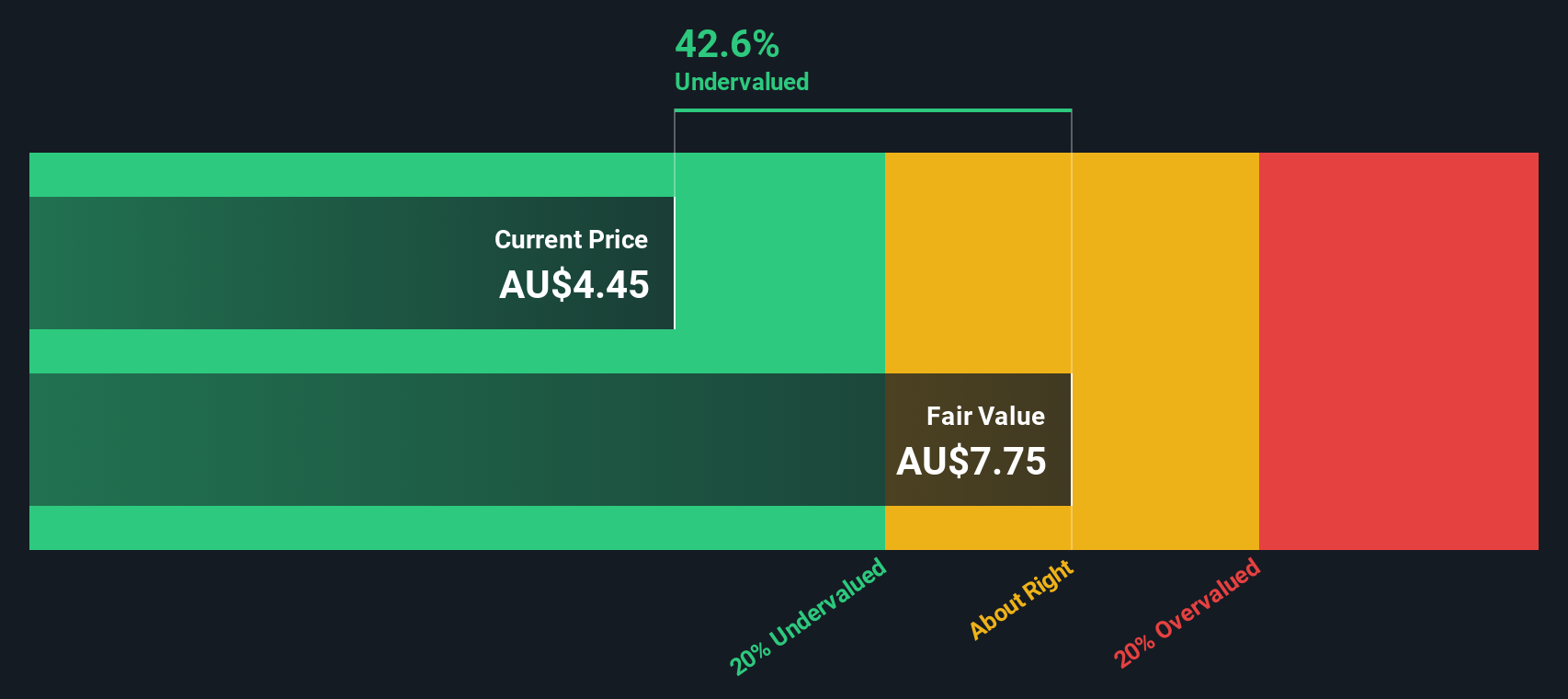

PE: 5.1x

MFF Capital Investments, a small player in Australia, has shown promising financial growth with revenues of A$666.59 million and net income of A$447.36 million for the year ending June 30, 2024. Basic earnings per share rose to A$0.77 from A$0.55 the previous year, reflecting improved profitability despite reliance on external borrowing for funding. Insider confidence is evident as Christopher MacKay purchased nearly 1.3 million shares worth over A$5 million recently, indicating potential value recognition within the company’s stock amidst its dividend increase announcement to 7 cents per share payable November 2024.

- Take a closer look at MFF Capital Investments' potential here in our valuation report.

Gain insights into MFF Capital Investments' past trends and performance with our Past report.

Magellan Financial Group (ASX:MFG)

Simply Wall St Value Rating: ★★★★★☆

Overview: Magellan Financial Group is an Australian-based investment management firm specializing in global equities and infrastructure strategies, with a market capitalization of A$4.45 billion.

Operations: Magellan Financial Group generates revenue primarily from investment management services, contributing A$279.83 million, and fund investments at A$81.65 million. The company has experienced fluctuations in its net income margin, reaching a peak of 69.63% in June 2022 before declining to 42.40% by June 2023, reflecting changes in operational efficiency and cost structures over time.

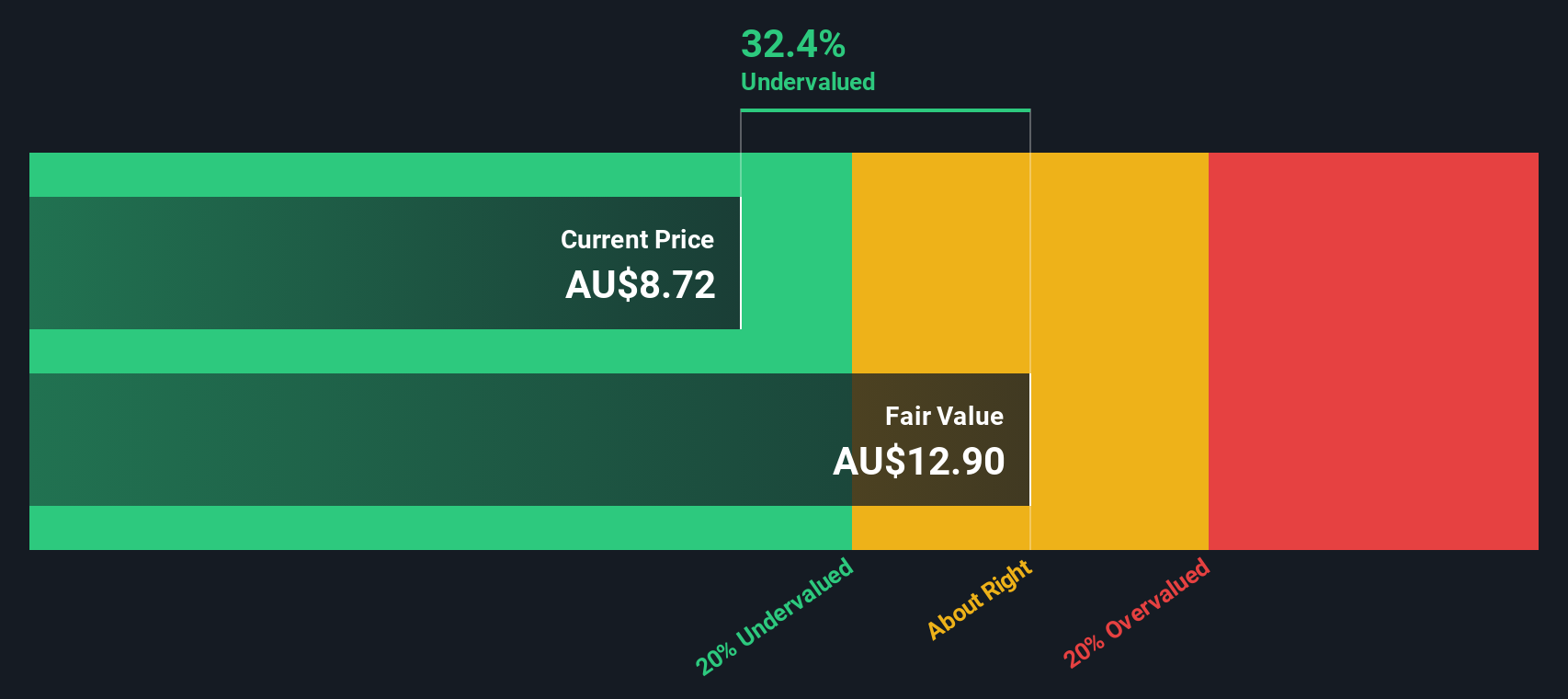

PE: 8.1x

Magellan Financial Group, a smaller player in the Australian market, has caught attention with its recent financials and strategic moves. The company reported A$378.63 million in revenue for the year ending June 30, 2024, down from A$431.65 million the previous year, yet net income rose to A$238.76 million from A$182.66 million. This suggests efficient cost management despite declining revenues. Insider confidence is evident as they have been purchasing shares over time, indicating belief in future potential amidst forecasted earnings decline of 9.2% annually over three years. The company completed a share buyback of nearly five million shares worth A$52.47 million by June 2024 and extended its plan till April 2025—moves that could potentially enhance shareholder value despite high-risk funding through external borrowing rather than customer deposits.

- Unlock comprehensive insights into our analysis of Magellan Financial Group stock in this valuation report.

Learn about Magellan Financial Group's historical performance.

Key Takeaways

- Click here to access our complete index of 22 Undervalued ASX Small Caps With Insider Buying.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal