KRX Stocks That Might Be Trading Below Estimated Value In October 2024

The South Korean market has shown positive momentum, rising 1.1% over the past week and 4.9% over the last year, with earnings projected to grow significantly in the coming years. In this environment, identifying stocks that might be trading below their estimated value can provide investors with opportunities to capitalize on potential growth while maintaining a strategic approach to market participation.

Top 10 Undervalued Stocks Based On Cash Flows In South Korea

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| PharmaResearch (KOSDAQ:A214450) | ₩224000.00 | ₩423578.11 | 47.1% |

| T'Way Air (KOSE:A091810) | ₩3010.00 | ₩5564.42 | 45.9% |

| Sejin Heavy Industries (KOSE:A075580) | ₩7430.00 | ₩14829.58 | 49.9% |

| Cosmecca Korea (KOSDAQ:A241710) | ₩76000.00 | ₩149201.39 | 49.1% |

| TSE (KOSDAQ:A131290) | ₩53300.00 | ₩99890.63 | 46.6% |

| Lutronic (KOSDAQ:A085370) | ₩36700.00 | ₩63217.94 | 41.9% |

| Intellian Technologies (KOSDAQ:A189300) | ₩54200.00 | ₩91200.83 | 40.6% |

| Shinsung E&GLtd (KOSE:A011930) | ₩1580.00 | ₩2932.41 | 46.1% |

| Global Tax Free (KOSDAQ:A204620) | ₩3820.00 | ₩6408.40 | 40.4% |

| Hotel ShillaLtd (KOSE:A008770) | ₩45050.00 | ₩75491.67 | 40.3% |

Below we spotlight a couple of our favorites from our exclusive screener.

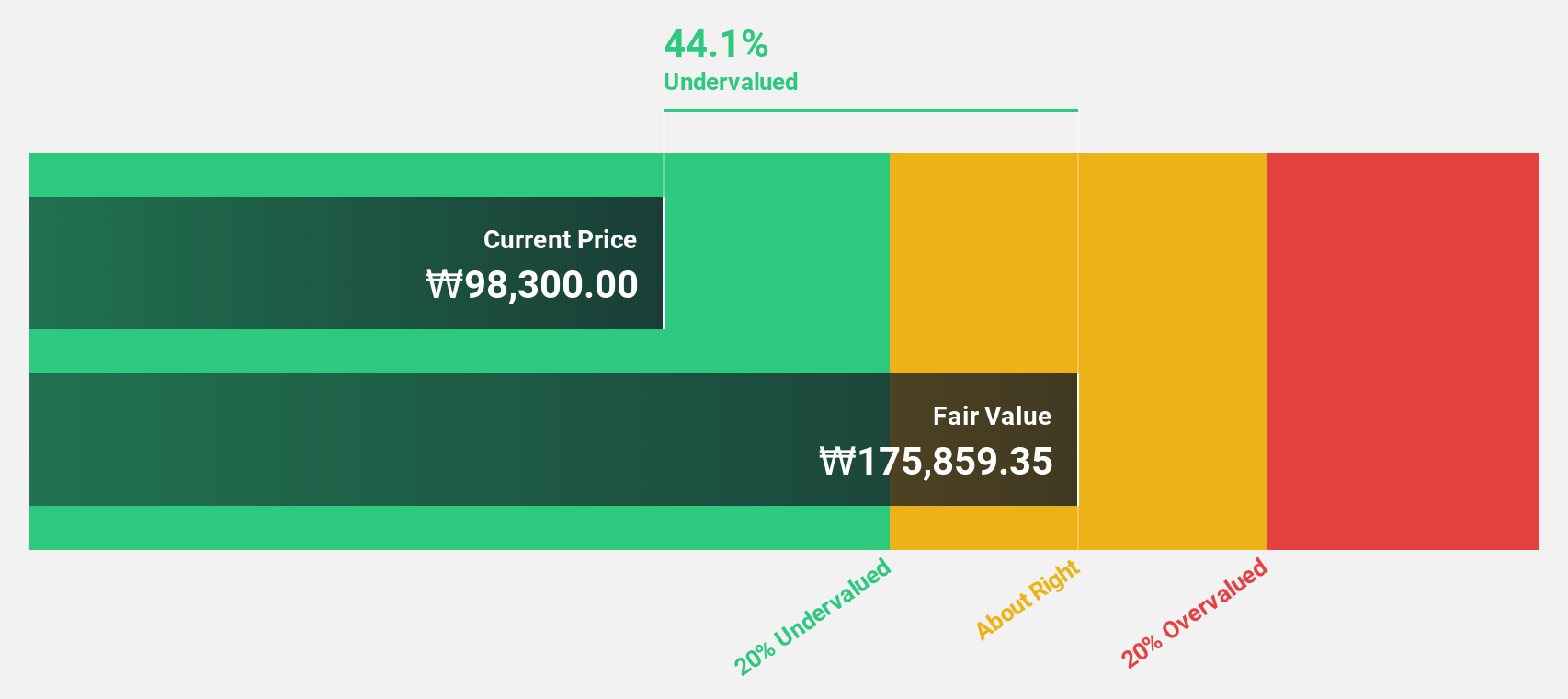

SK hynix (KOSE:A000660)

Overview: SK hynix Inc., along with its subsidiaries, is involved in the manufacture, distribution, and sale of semiconductor products across Korea, China, other parts of Asia, the United States, and Europe, with a market capitalization of approximately ₩129.94 trillion.

Operations: The company's revenue primarily comes from the manufacture and sale of semiconductor products, amounting to approximately ₩49.22 billion.

Estimated Discount To Fair Value: 12.9%

SK hynix's recent return to profitability, with a net income of ₩4.12 trillion for Q2 2024, highlights its potential as an undervalued stock based on cash flows. Despite high share price volatility and large one-off items affecting earnings quality, the stock trades at ₩188,700—below its estimated fair value of ₩216,703.8. Revenue and earnings are forecasted to grow significantly faster than the market average, driven by innovations like GDDR7 memory products targeting AI applications.

- The growth report we've compiled suggests that SK hynix's future prospects could be on the up.

- Unlock comprehensive insights into our analysis of SK hynix stock in this financial health report.

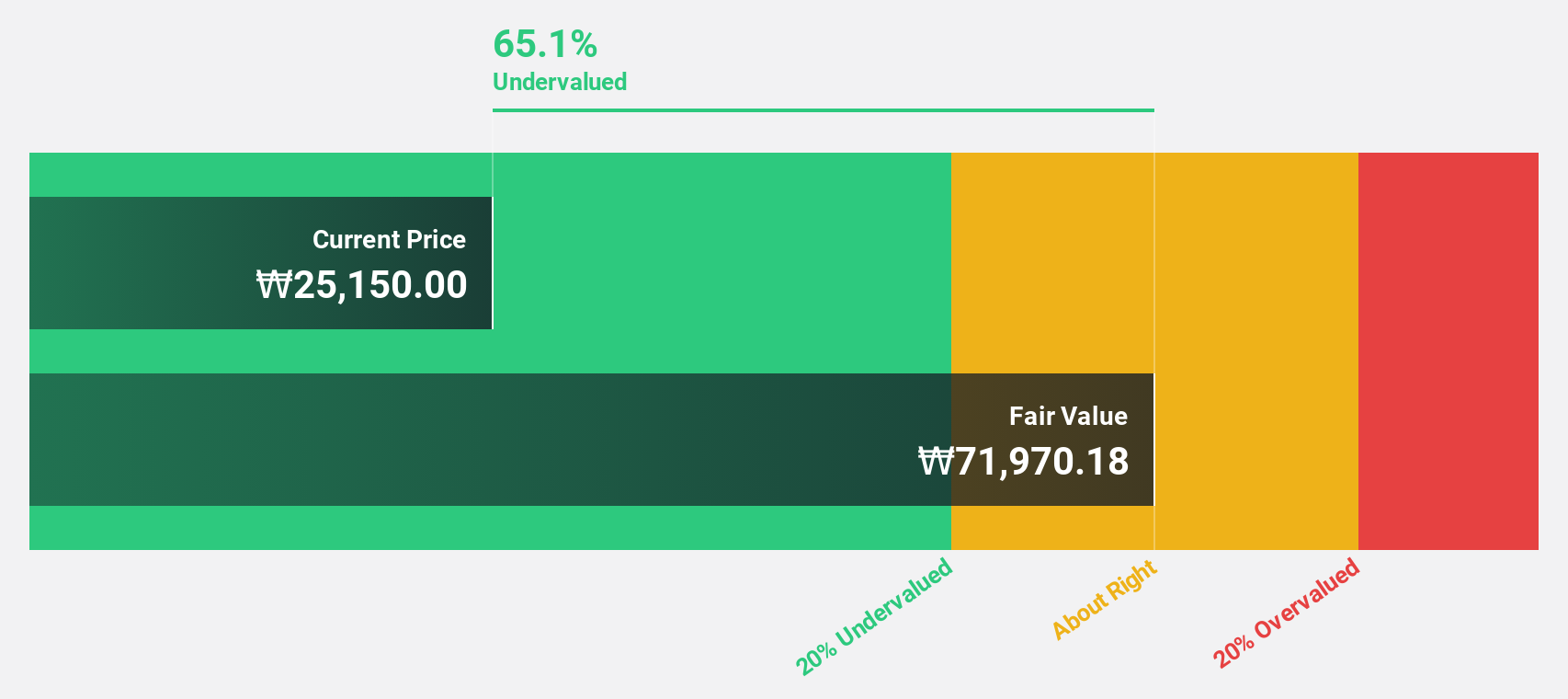

Hanall Biopharma (KOSE:A009420)

Overview: Hanall Biopharma Co., Ltd. is a pharmaceutical company that manufactures and sells pharmaceutical products in South Korea and internationally, with a market cap of ₩2.29 trillion.

Operations: The company's revenue segment is primarily derived from the manufacture and sale of pharmaceuticals, totaling ₩130.37 billion.

Estimated Discount To Fair Value: 16.7%

Hanall Biopharma is trading at ₩45,150, below its estimated fair value of ₩54,198.01. Despite a challenging recent performance with a net loss for Q2 2024 and declining sales year-over-year, the company is expected to achieve profitability within three years. Revenue growth is forecasted at 16% annually, outpacing the South Korean market average of 10.4%. However, its return on equity remains low compared to benchmarks in the near term.

- Our earnings growth report unveils the potential for significant increases in Hanall Biopharma's future results.

- Take a closer look at Hanall Biopharma's balance sheet health here in our report.

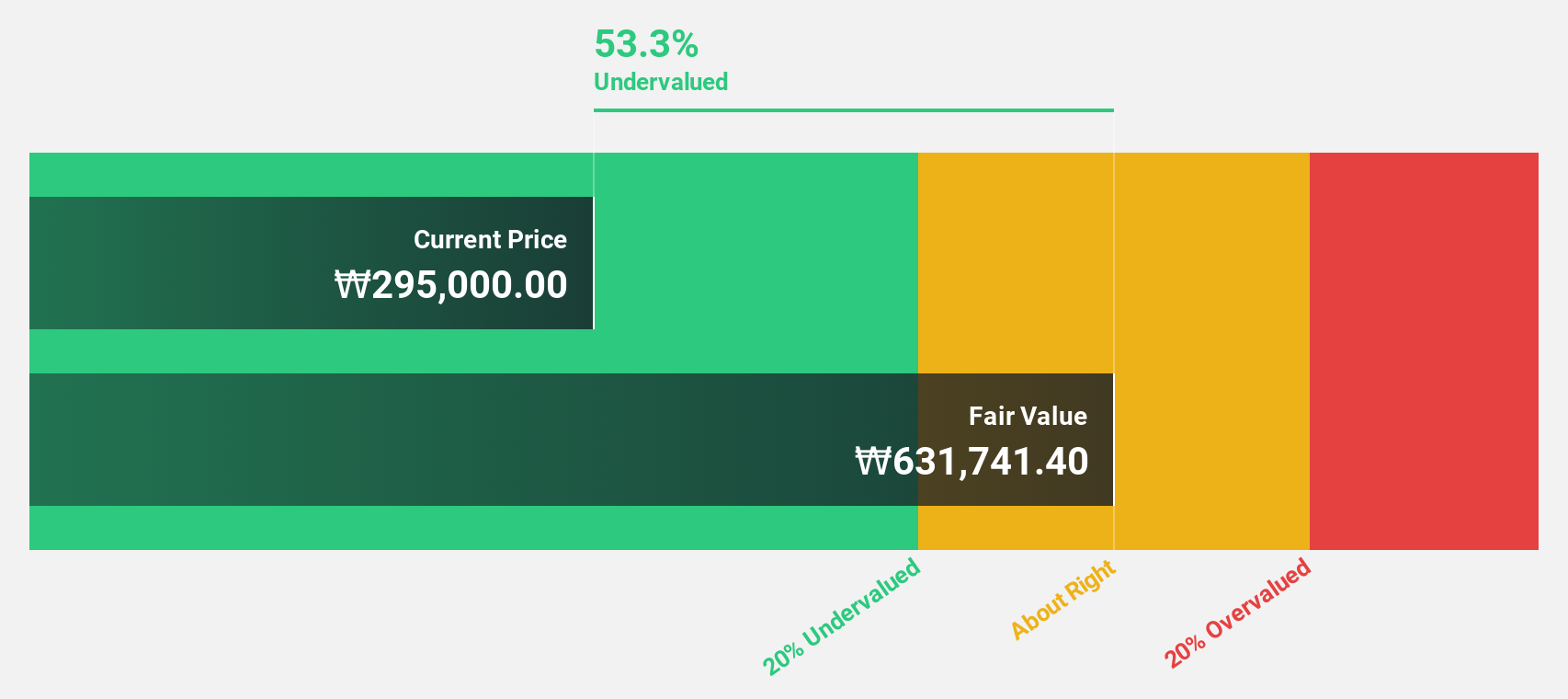

SK Biopharmaceuticals (KOSE:A326030)

Overview: SK Biopharmaceuticals Co., Ltd. is a pharmaceutical company focused on researching and developing drugs for central nervous system disorders, with a market cap of ₩9.86 trillion.

Operations: The company's revenue primarily stems from its new drug development segment, generating approximately ₩465.06 million.

Estimated Discount To Fair Value: 34.2%

SK Biopharmaceuticals is trading at ₩125,800, significantly below its fair value estimate of ₩191,127.72. The company's revenue is projected to grow 22.7% annually, surpassing the South Korean market's average growth rate of 10.4%. Earnings are expected to increase substantially by 70.18% per year over the next three years, well above the market's 29.6%. Recently profitable, SK Biopharmaceuticals shows strong potential for future financial performance despite current undervaluation.

- Upon reviewing our latest growth report, SK Biopharmaceuticals' projected financial performance appears quite optimistic.

- Get an in-depth perspective on SK Biopharmaceuticals' balance sheet by reading our health report here.

Key Takeaways

- Reveal the 34 hidden gems among our Undervalued KRX Stocks Based On Cash Flows screener with a single click here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal