Declining Stock and Solid Fundamentals: Is The Market Wrong About Samsung Electronics Co., Ltd. (KRX:005930)?

Samsung Electronics (KRX:005930) has had a rough three months with its share price down 32%. However, a closer look at its sound financials might cause you to think again. Given that fundamentals usually drive long-term market outcomes, the company is worth looking at. Specifically, we decided to study Samsung Electronics' ROE in this article.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. In other words, it is a profitability ratio which measures the rate of return on the capital provided by the company's shareholders.

Check out our latest analysis for Samsung Electronics

How To Calculate Return On Equity?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Samsung Electronics is:

7.5% = ₩29t ÷ ₩384t (Based on the trailing twelve months to June 2024).

The 'return' is the amount earned after tax over the last twelve months. So, this means that for every ₩1 of its shareholder's investments, the company generates a profit of ₩0.08.

Why Is ROE Important For Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

A Side By Side comparison of Samsung Electronics' Earnings Growth And 7.5% ROE

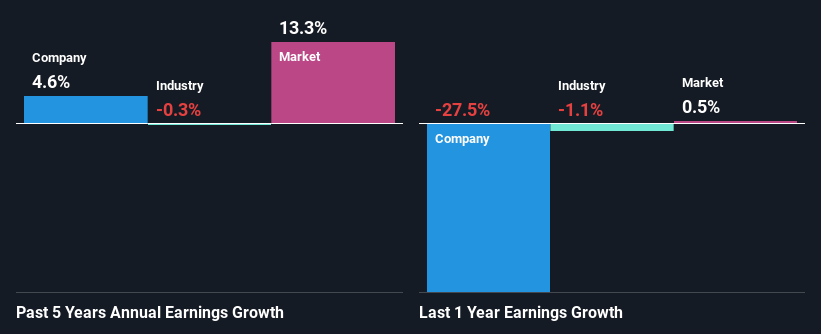

At first glance, Samsung Electronics' ROE doesn't look very promising. Although a closer study shows that the company's ROE is higher than the industry average of 5.4% which we definitely can't overlook. Yet, Samsung Electronics has posted measly growth of 4.6% over the past five years. Remember, the company's ROE is quite low to begin with, just that it is higher than the industry average. Hence, this goes some way in explaining the low earnings growth.

Given that the industry shrunk its earnings at a rate of 0.3% over the last few years, the net income growth of the company is quite impressive.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. Doing so will help them establish if the stock's future looks promising or ominous. Is A005930 fairly valued? This infographic on the company's intrinsic value has everything you need to know.

Is Samsung Electronics Using Its Retained Earnings Effectively?

Despite having a normal three-year median payout ratio of 28% (or a retention ratio of 72% over the past three years, Samsung Electronics has seen very little growth in earnings as we saw above. So there might be other factors at play here which could potentially be hampering growth. For example, the business has faced some headwinds.

Additionally, Samsung Electronics has paid dividends over a period of at least ten years, which means that the company's management is determined to pay dividends even if it means little to no earnings growth. Our latest analyst data shows that the future payout ratio of the company is expected to drop to 21% over the next three years. The fact that the company's ROE is expected to rise to 10% over the same period is explained by the drop in the payout ratio.

Summary

Overall, we are quite pleased with Samsung Electronics' performance. Particularly, we like that the company is reinvesting heavily into its business at a moderate rate of return. Unsurprisingly, this has led to an impressive earnings growth. That being so, the latest analyst forecasts show that the company will continue to see an expansion in its earnings. To know more about the latest analysts predictions for the company, check out this visualization of analyst forecasts for the company.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal