Undiscovered Gems in Japan for October 2024

Japan's stock markets have shown resilience, with the Nikkei 225 Index rising by 2.45% and the broader TOPIX Index gaining 0.45% over the week, supported by yen weakness which has enhanced the profit outlook for exporters. In this environment, identifying promising stocks involves looking for companies that can capitalize on favorable currency conditions while navigating potential challenges such as wage declines and economic policy shifts.

Top 10 Undiscovered Gems With Strong Fundamentals In Japan

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| NJS | NA | 4.97% | 5.30% | ★★★★★★ |

| ITOCHU-SHOKUHIN | NA | -0.08% | 12.04% | ★★★★★★ |

| Ad-Sol Nissin | NA | 4.02% | 7.90% | ★★★★★★ |

| Maezawa Kasei Industries | 0.81% | 2.01% | 18.42% | ★★★★★★ |

| Nikko | 31.99% | 4.24% | -8.75% | ★★★★★☆ |

| AJIS | 0.69% | 0.07% | -12.44% | ★★★★★☆ |

| Pharma Foods International | 145.80% | 30.07% | 22.61% | ★★★★★☆ |

| Techno Ryowa | 1.77% | 2.06% | 5.32% | ★★★★★☆ |

| Kappa Create | 74.42% | -0.45% | 3.62% | ★★★★★☆ |

| Toyo Kanetsu K.K | 47.92% | 2.34% | 15.44% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Koshidaka Holdings (TSE:2157)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Koshidaka Holdings Co., Ltd. is engaged in the karaoke and bath house industries both in Japan and internationally, with a market capitalization of approximately ¥95.51 billion.

Operations: Koshidaka Holdings generates significant revenue from its karaoke segment, amounting to ¥61.25 billion, while its real estate management contributes ¥1.59 billion.

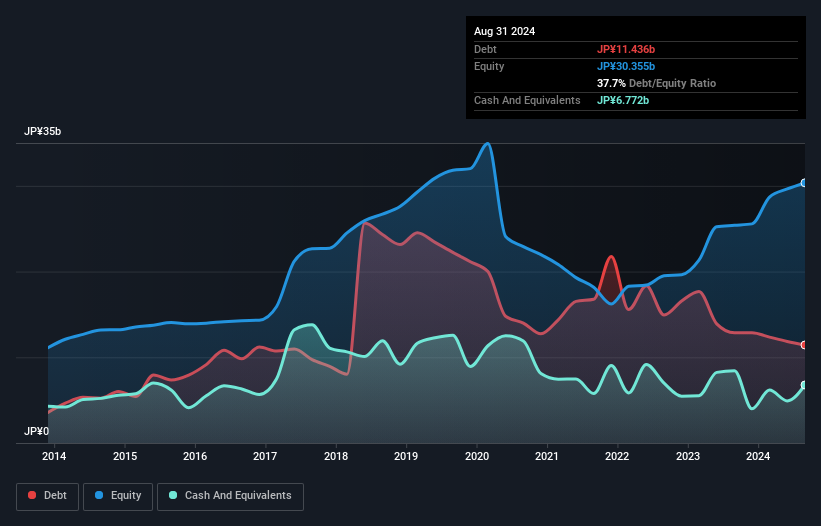

Koshidaka Holdings, a promising player in Japan's hospitality sector, showcases robust financial health with well-covered interest payments at 1626.5x EBIT and a satisfactory net debt to equity ratio of 15.4%. Despite recent negative earnings growth of -5.2%, the company is trading at a favorable P/E ratio of 14.2x compared to the industry average of 22.3x, hinting at potential undervaluation. Recent dividend hikes and positive earnings forecasts reflect confidence in future performance, with expected net sales reaching ¥71 billion for fiscal year ending August 2025.

- Click here to discover the nuances of Koshidaka Holdings with our detailed analytical health report.

Gain insights into Koshidaka Holdings' past trends and performance with our Past report.

Bic Camera (TSE:3048)

Simply Wall St Value Rating: ★★★★★☆

Overview: Bic Camera Inc., along with its subsidiaries, operates in Japan focusing on the manufacture and sale of audiovisual products, with a market capitalization of ¥294.78 billion.

Operations: Bic Camera generates revenue primarily through the sale of audiovisual products. The company's financial performance is reflected in its market capitalization of ¥294.78 billion.

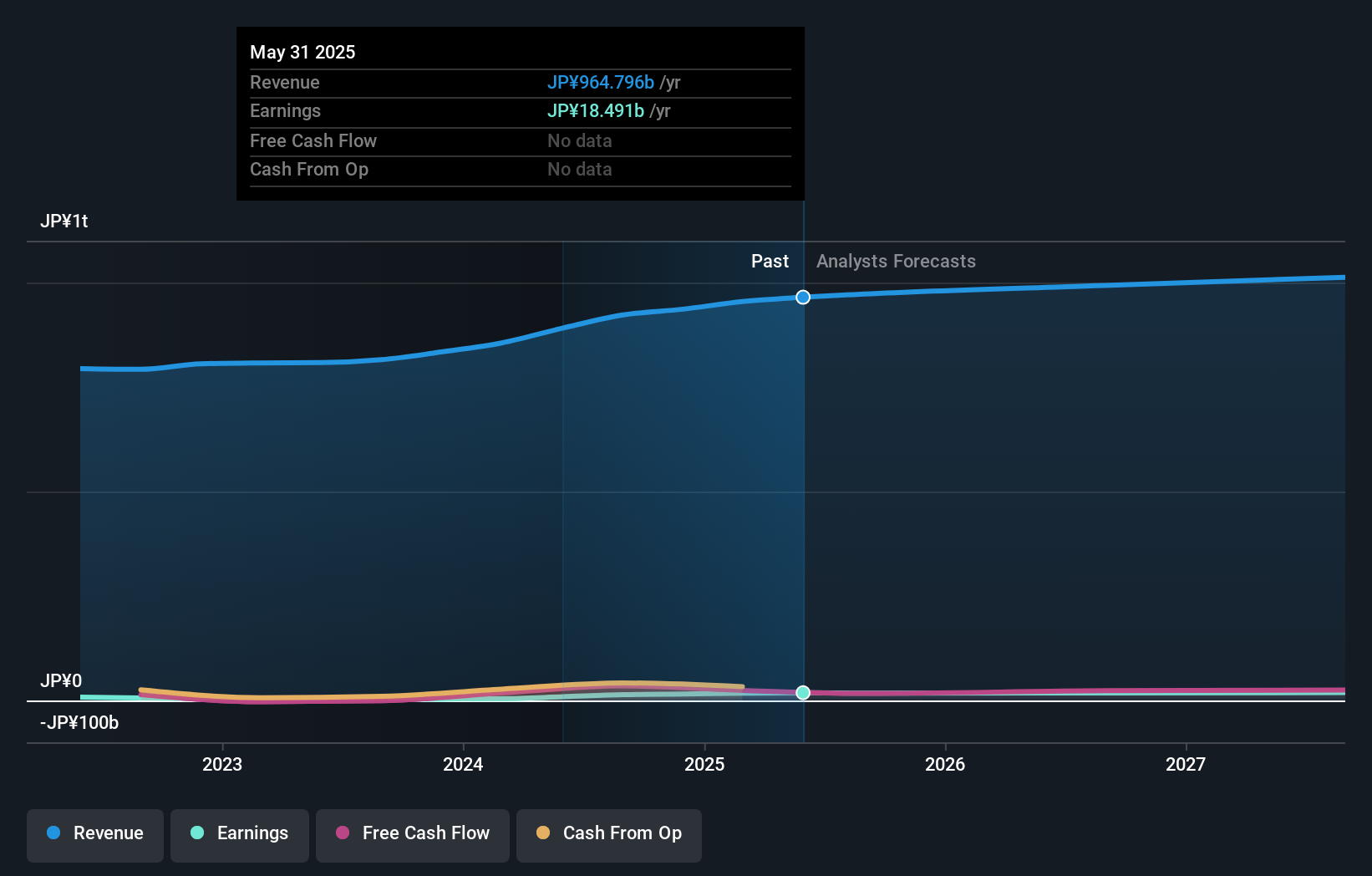

Bic Camera, a noteworthy player in Japan's retail scene, experienced a significant ¥5.4 billion one-off loss affecting its financials for the year ending May 2024. Despite this setback, the company's earnings surged by 299%, outpacing the Specialty Retail industry growth of 5%. With an anticipated annual earnings growth of 13.74%, Bic Camera seems poised for continued expansion. The debt-to-equity ratio rose from 61% to 69% over five years, yet remains satisfactory at a net ratio of 27%.

- Unlock comprehensive insights into our analysis of Bic Camera stock in this health report.

Evaluate Bic Camera's historical performance by accessing our past performance report.

Furuno Electric (TSE:6814)

Simply Wall St Value Rating: ★★★★★☆

Overview: Furuno Electric Co., Ltd. manufactures and sells marine and industrial electronics equipment, wireless LAN systems, and handy terminals across Japan, the Americas, Europe, Asia, and internationally with a market cap of ¥66.50 billion.

Operations: Furuno Electric generates revenue primarily from its Marine Business, which accounts for ¥102.10 billion, followed by the Industrial Business at ¥13.32 billion and the Wireless LAN Handy Terminal Business at ¥3.81 billion.

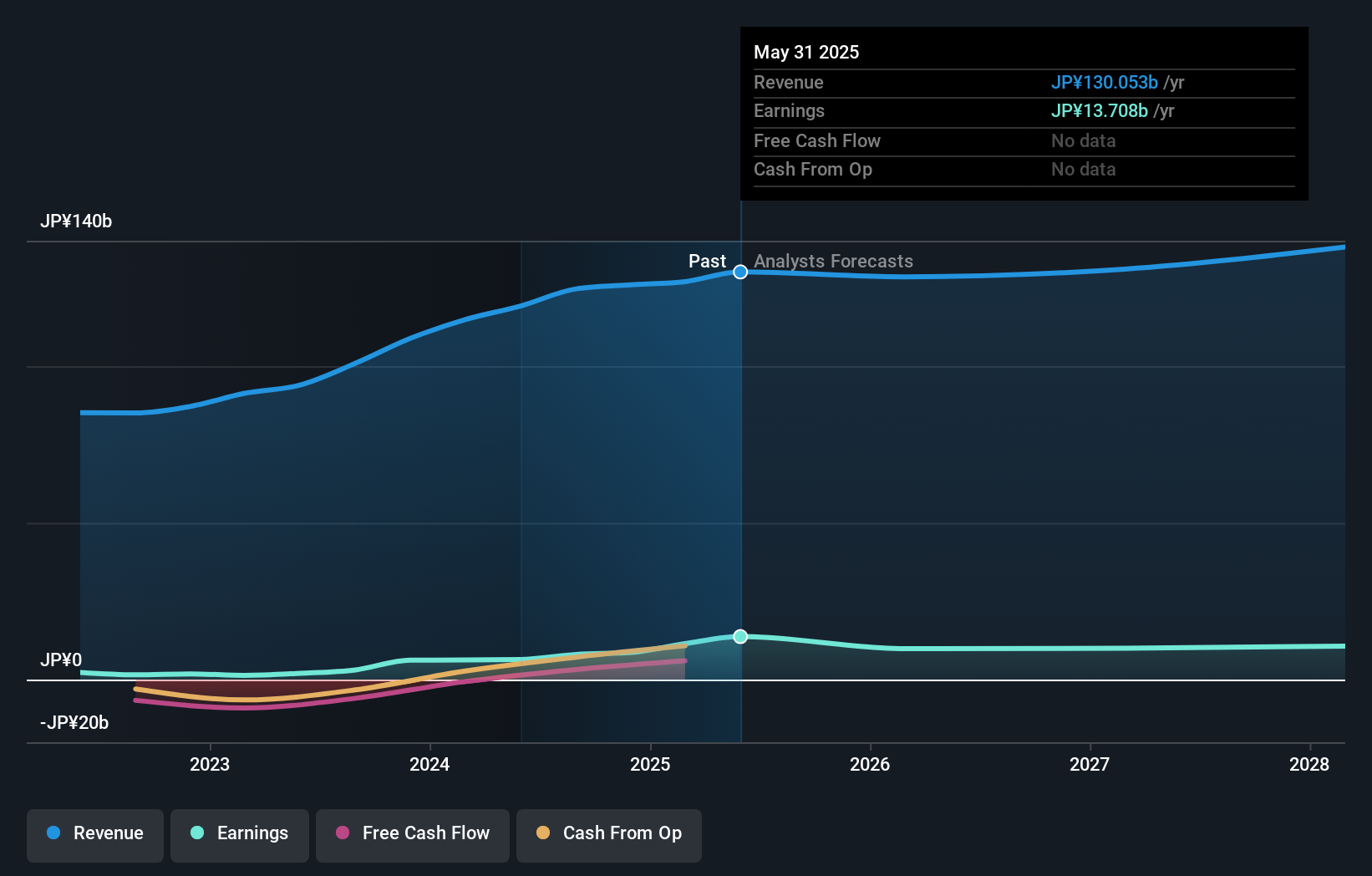

Furuno Electric, a player in the electronics sector, has shown impressive earnings growth of 218% over the past year, outpacing the industry average of 7%. The company sports a price-to-earnings ratio of 10.4x, which is favorable compared to Japan's market average of 13.6x. Despite having high-quality past earnings and satisfactory net debt to equity at 10%, its share price has been highly volatile recently, indicating potential risk for investors.

- Click here and access our complete health analysis report to understand the dynamics of Furuno Electric.

Review our historical performance report to gain insights into Furuno Electric's's past performance.

Next Steps

- Click here to access our complete index of 729 Japanese Undiscovered Gems With Strong Fundamentals.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal