City Chic Collective Limited (ASX:CCX) Stocks Shoot Up 26% But Its P/S Still Looks Reasonable

City Chic Collective Limited (ASX:CCX) shareholders would be excited to see that the share price has had a great month, posting a 26% gain and recovering from prior weakness. But the last month did very little to improve the 56% share price decline over the last year.

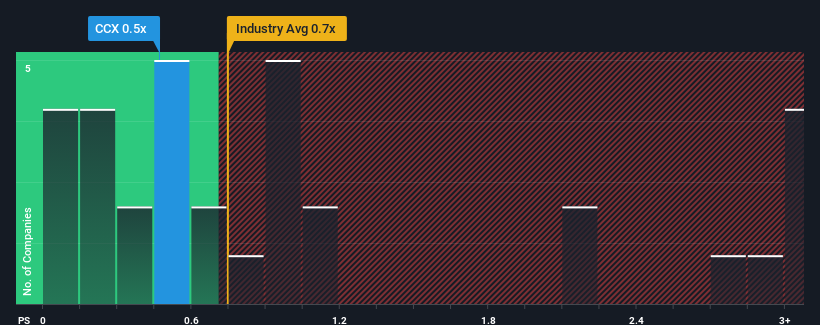

In spite of the firm bounce in price, there still wouldn't be many who think City Chic Collective's price-to-sales (or "P/S") ratio of 0.5x is worth a mention when the median P/S in Australia's Specialty Retail industry is similar at about 0.7x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for City Chic Collective

How City Chic Collective Has Been Performing

City Chic Collective could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on City Chic Collective will help you uncover what's on the horizon.How Is City Chic Collective's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like City Chic Collective's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 29% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 51% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 8.6% per year over the next three years. With the industry predicted to deliver 7.8% growth per year, the company is positioned for a comparable revenue result.

With this in mind, it makes sense that City Chic Collective's P/S is closely matching its industry peers. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Key Takeaway

City Chic Collective's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've seen that City Chic Collective maintains an adequate P/S seeing as its revenue growth figures match the rest of the industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. If all things remain constant, the possibility of a drastic share price movement remains fairly remote.

Before you take the next step, you should know about the 3 warning signs for City Chic Collective (2 are significant!) that we have uncovered.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal