3 Japanese Stocks Trading At Discounts Up To 48.9% Below Intrinsic Value Estimates

Japan's stock markets have experienced a rise recently, with the Nikkei 225 Index gaining 2.45% and the broader TOPIX Index up 0.45%, as yen weakness has improved the profit outlook for exporters. In this environment, identifying stocks trading below their intrinsic value can offer potential opportunities for investors seeking to capitalize on market inefficiencies and favorable conditions in Japan’s economy.

Top 10 Undervalued Stocks Based On Cash Flows In Japan

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Hagiwara Electric Holdings (TSE:7467) | ¥3460.00 | ¥6702.94 | 48.4% |

| Akatsuki (TSE:3932) | ¥2009.00 | ¥3738.51 | 46.3% |

| Eternal Hospitality GroupLtd (TSE:3193) | ¥4095.00 | ¥7746.58 | 47.1% |

| Management SolutionsLtd (TSE:7033) | ¥1921.00 | ¥3836.08 | 49.9% |

| Pilot (TSE:7846) | ¥4575.00 | ¥8896.09 | 48.6% |

| Appier Group (TSE:4180) | ¥1745.00 | ¥3469.94 | 49.7% |

| Hibino (TSE:2469) | ¥3495.00 | ¥6915.69 | 49.5% |

| S-Pool (TSE:2471) | ¥372.00 | ¥694.41 | 46.4% |

| Gift Holdings (TSE:9279) | ¥3335.00 | ¥6526.24 | 48.9% |

| freee K.K (TSE:4478) | ¥3115.00 | ¥6060.07 | 48.6% |

We'll examine a selection from our screener results.

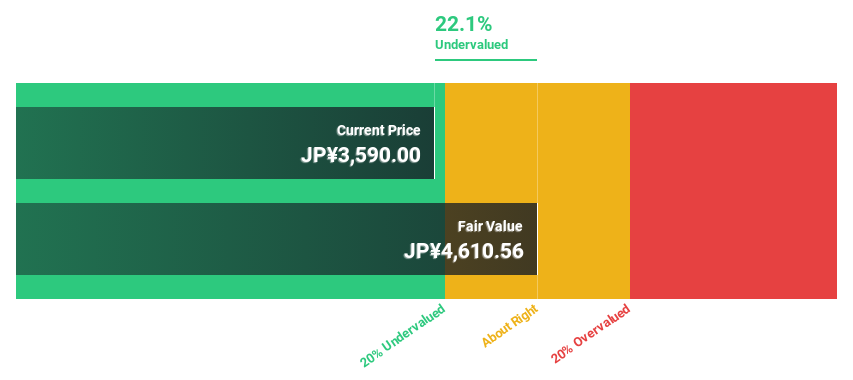

Union Tool (TSE:6278)

Overview: Union Tool Co. specializes in manufacturing and selling cutting tools, linear motion products, and metal machining equipment both in Japan and globally, with a market cap of ¥117.13 billion.

Operations: Union Tool Co.'s revenue is derived from several regions, with ¥19.84 billion from Japan, ¥15.05 billion from Asia, ¥2.17 billion from Europe, and ¥1.84 billion from North America.

Estimated Discount To Fair Value: 14.2%

Union Tool Co. is trading at approximately 14.2% below its estimated fair value of ¥7,902.42, suggesting it may be undervalued based on cash flows. Despite recent share price volatility, the company's earnings are forecast to grow significantly at 21.45% annually, outpacing the Japanese market's growth rate of 8.8%. Recent guidance projects net sales of ¥30 billion and operating profit of ¥6.4 billion for fiscal year 2024, supporting a stable financial outlook amidst dividend increases.

- In light of our recent growth report, it seems possible that Union Tool's financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in Union Tool's balance sheet health report.

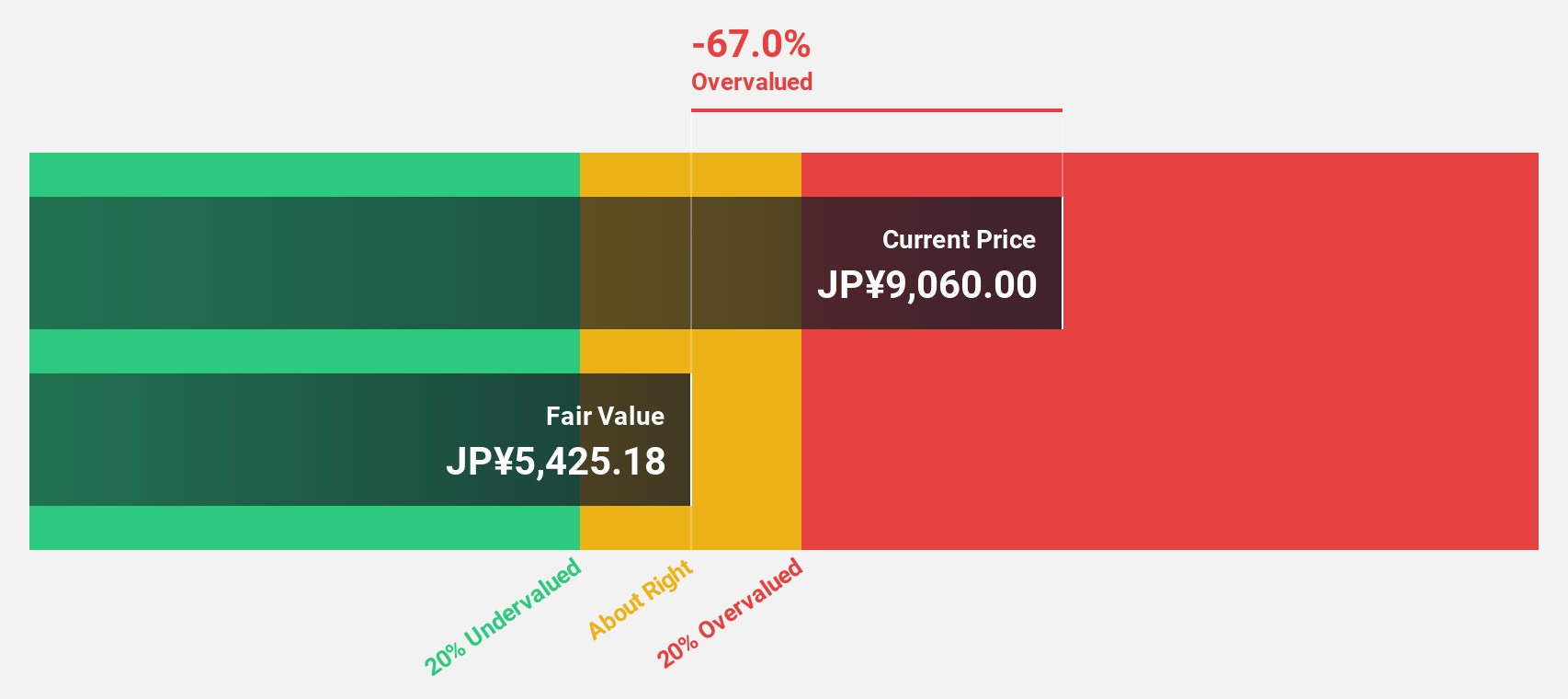

Premium Group (TSE:7199)

Overview: Premium Group Co., Ltd. is a global provider of financing and services, with a market cap of ¥86.42 billion.

Operations: The company's revenue is primarily derived from Finance, contributing ¥19.20 billion, Failure Warranty at ¥8.15 billion, and Auto Mobility Service (including Car Premium Business) generating ¥7.51 billion.

Estimated Discount To Fair Value: 30%

Premium Group is trading at ¥2,281, more than 20% below its estimated fair value of ¥3,257.15, highlighting potential undervaluation based on cash flows. The company's earnings grew by 13.5% last year and are expected to rise significantly over the next three years at a rate of 20% annually—outpacing the Japanese market's growth rate of 8.8%. However, debt coverage by operating cash flow remains a concern despite strong profit forecasts.

- Upon reviewing our latest growth report, Premium Group's projected financial performance appears quite optimistic.

- Take a closer look at Premium Group's balance sheet health here in our report.

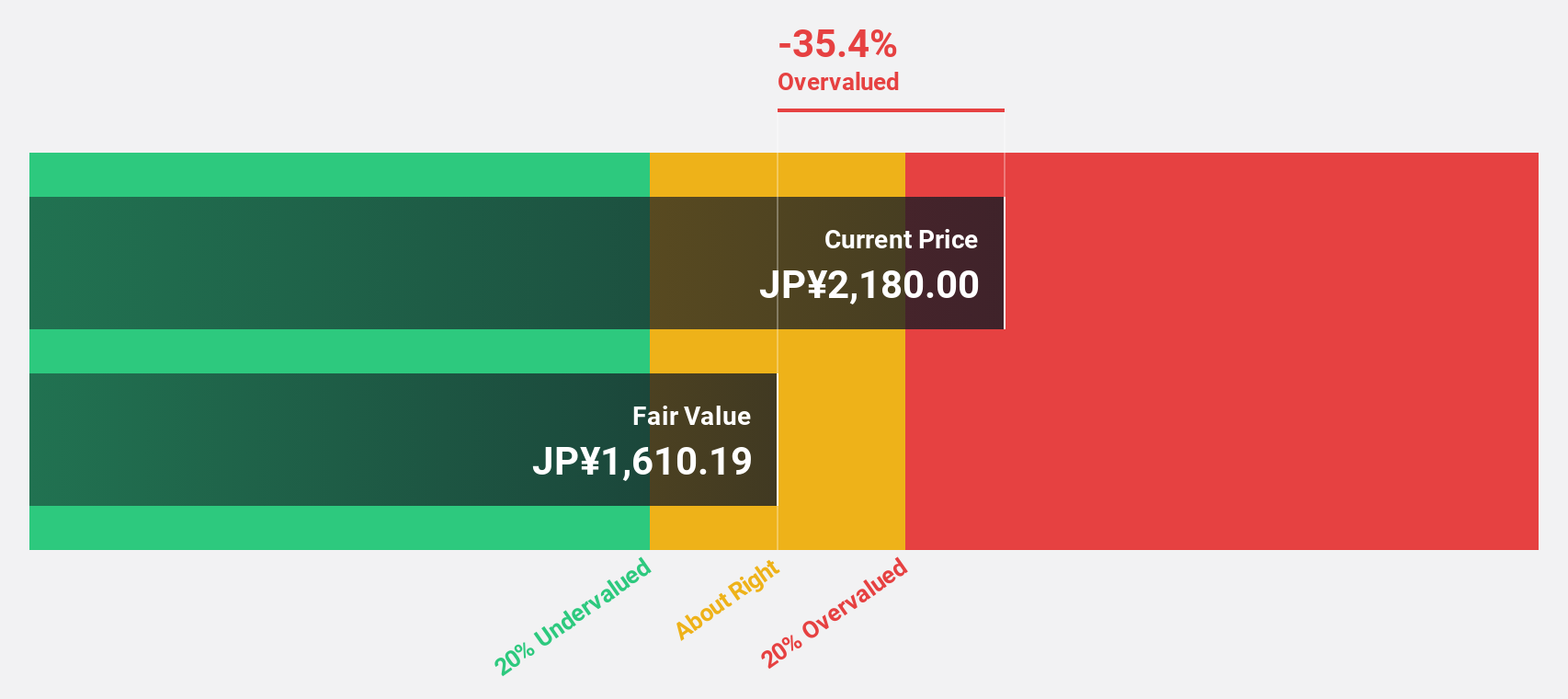

Gift Holdings (TSE:9279)

Overview: Gift Holdings Inc. operates restaurants in Japan, the Republic of South Korea, and internationally, with a market cap of ¥63.89 billion.

Operations: The company generates revenue primarily from its Food and Beverage Business, amounting to ¥26.94 billion.

Estimated Discount To Fair Value: 48.9%

Gift Holdings is trading at ¥3,335, significantly below its fair value estimate of ¥6,526.24, indicating potential undervaluation based on cash flows. Earnings are projected to grow at 26.46% annually over the next three years—surpassing the Japanese market's growth rate of 8.8%. Recent expansion into Shanghai with a new store aligns with their ambitious goal of opening 1,000 stores domestically and overseas, supporting future revenue prospects despite slower monthly sales growth compared to last year.

- According our earnings growth report, there's an indication that Gift Holdings might be ready to expand.

- Click here and access our complete balance sheet health report to understand the dynamics of Gift Holdings.

Key Takeaways

- Unlock our comprehensive list of 81 Undervalued Japanese Stocks Based On Cash Flows by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal